- Home

- »

- Medical Devices

- »

-

3D Medical Imaging Devices Market Size Report, 2030GVR Report cover

![3D Medical Imaging Devices Market Size, Share & Trends Report]()

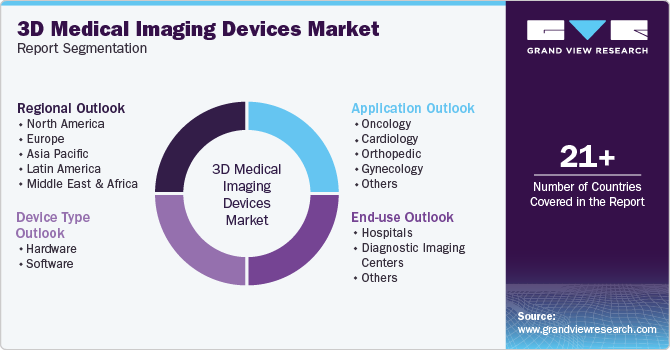

3D Medical Imaging Devices Market Size, Share & Trends Analysis Report By Device Type (Hardware, Software), By Application (Oncology, Cardiology), By End-use (Hospitals, Diagnostic Imaging Centers), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-782-7

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

3D Medical Imaging Devices Market Size & Trends

The global 3D medical imaging devices market size was estimated at USD 10.95 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 8.04% from 2023 to 2030. The market is driven by factors such as the increasing global geriatric population coupled with the increase in cases of road traffic accidents. Moreover, advancements in 3D imaging technology and investments by government and private organizations are other prime factors propelling the market growth. Furthermore, the increasing prevalence of chronic diseases, such as cancer and cardiovascular disorders, is also contributing to market growth.

According to the data published by the American Cancer Society, approximately 1,958,310 new cancer cases are to be registered in the U.S. and an estimated 609,820 cancer-related deaths would occur in 2023. These conditions often require precise and detailed imaging for early detection, diagnosis, and treatment planning. Medical 3D imaging technologies, such as MRI and CT scans, offer healthcare professionals the ability to visualize anatomical structures and abnormalities in three dimensions, enabling them to make more informed decisions and improve patient care.

The growing elderly global population is fueling the demand for 3D medical imaging devices, as these people become more susceptible to various health issues, such as musculoskeletal problems and neurodegenerative diseases. 3D imaging provides better insights into these conditions, facilitating early intervention and personalized treatment plans. Moreover, the elderly population often requires ongoing monitoring, making 3D imaging a crucial tool for disease management and tracking progression.

The continuous technological advancements are also driving innovation in 3D medical imaging devices. The development of high-resolution imaging sensors, improved image reconstruction algorithms, and the integration of artificial intelligence (AI) are enhancing the capabilities of these devices. AI plays an important role in automating image analysis, reducing interpretation errors, and expediting the diagnostic process. These advancements not only improve the accuracy of diagnoses but also increase the efficiency of healthcare delivery.

The increasing demand for minimally invasive procedures is boosting the adoption of 3D imaging technologies in surgical and interventional settings. Surgeons and interventional radiologists can use 3D images to plan procedures, navigate complex anatomical structures, and precisely target treatment areas. This leads to shorter recovery times, reduced complications, and improved patient outcomes. As healthcare providers increasingly recognize the benefits of minimally invasive techniques, the demand for 3D medical imaging devices will continue to rise.

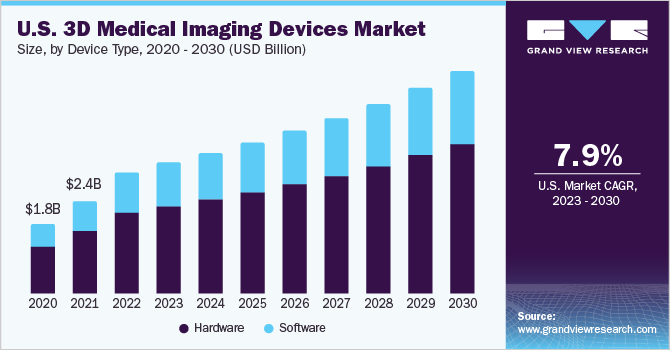

Device Type Insights

In terms of device type, the hardware segment dominated the market in 2022 with the largest revenue share of over 67.52%. Hardware components are an important infrastructure of any medical imaging device. These components include the actual imaging equipment, such as MRI machines, CT scanners, and ultrasound devices, which form the base of medical imaging. Healthcare institutions are hugely investing in hardware to ensure the best patient outcomes. These factors would further expand the segment’s growth. An increase in usage of 3D imaging, coupled with several advantages, and the presence of several market players is anticipated to drive the segment over the forecast period. For instance, companies such as Koninklijke Philips N.V., Siemens Healthcare GmbH, GE Healthcare, and Shenzhen Mindray Bio-Medical Electronics Co., Ltd have a large portfolio of such devices. Moreover, these market players are actively operating in most of the major economies, which further drives the adoption of these hardware.

The software segment is projected to witness the fastest CAGR of 8.3% during the forecast period. Software plays a crucial role in enhancing the quality and utility of images obtained from hardware devices like MRI, CT, and ultrasound. These software solutions employ sophisticated algorithms and image processing techniques to create detailed 3D reconstructions, enhance image contrast, and remove noise. With the rising demand for more accurate and detailed diagnostics, healthcare providers increasingly rely on these software tools to extract meaningful insights from imaging data, driving the demand for advanced software solutions. The growth of this segment can be attributed to the presence of several major players in the market, such as GE Healthcare. For instance, Innova 3D from GE Healthcare provides 3D images from angiography, which helps visualize complex vasculature in the lab. Similarly, Philips provides quantification software, such as QLAB general imaging analysis. Such factors are expected to help the software segment hold a considerable market share over the forecast period.

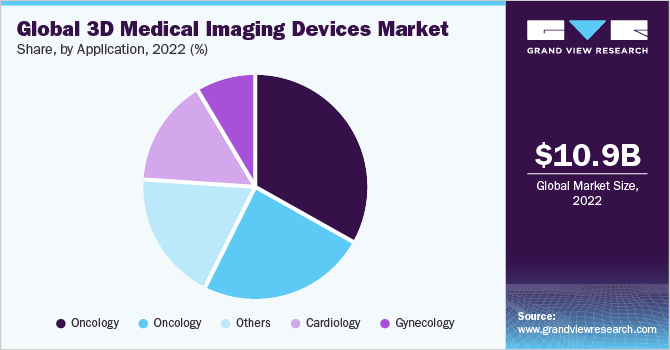

Application Insights

In terms of application, the oncology segment dominated the market in 2022 with a revenue share of 33.09% owing to the increasing incidence of cancer globally, which has led to a higher demand for advanced diagnostic and treatment tools. 3D medical imaging devices, such as CT, MRI, and PET-CT scanners, play a crucial role in oncology by providing detailed and accurate images of tumors and their surrounding tissues. These devices are essential for cancer diagnosis, staging, treatment planning, and monitoring, making them a cornerstone in the management of cancer patients. As per data published by WHO, cancer was the leading cause of death globally, accounting for around 10 million deaths in 2020. WHO estimated 2.26 million breast cancer cases, 2.21 million lung cancer cases, 1.93 million colon & rectum cancer cases, 1.41 million prostate cancer cases, 1.20 million skin cancer cases, and 1.09 million stomach cancer cases in 2020.

The cardiology segment is projected to witness the fastest CAGR of 8.3% during the forecast period. Cardiac interventions, such as catheter-based procedures, minimally invasive surgeries, and structural heart interventions, have become increasingly complex. Cardiologists require detailed 3D images of the heart and its vasculature to plan and guide these procedures effectively. 3D medical imaging devices, such as 3D echocardiography and cardiac CT/MRI, provide the necessary anatomical information, improving the precision and safety of these interventions. An increase in the incidence of cardiac disorders, such as cardiac arrest, heart attack, and other cardiovascular diseases is expected to drive the usage of 3D imaging. For instance, as per the American Heart Association, more than 356,000 cases of total cardiac arrest cases are reported in the U.S. annually. Similarly, according to American research, there is an increase in approximately 13.0% of cases of sudden cardiac arrest.

End-use Insights

In terms of end-use, the hospitals segment dominated the market in 2022 with a revenue share of 48.35% as it offers a wide range of diagnostic, therapeutic, and surgical services, which makes them the primary users of 3D medical imaging devices. These devices are essential for diagnosing and monitoring various medical conditions, from cancer and cardiovascular diseases to orthopedic and neurological disorders, allowing hospitals to offer a complete spectrum of healthcare services. Moreover, the hospitals segment is expected to witness growth due to several factors such as high adoption of image-guided therapy systems in hospitals, high volume of surgeries undertaken at hospitals, and hospitals being considered as primary health systems in several countries. Moreover, the installation of image-guided therapy systems at hospitals has demonstrated several positive results in terms of cost-effectiveness and optimization of clinical workflows. Furthermore, large hospitals usually have in-house medical imaging facilities, which is estimated to propel segment growth.

The diagnostic imaging centers segment is projected to witness the fastest CAGR of 8.3% during the forecast period. These centers offer quicker appointments and reduced wait times for patients compared to hospitals. This speedy access to diagnostic services is particularly appealing for individuals who require non-emergent imaging, such as routine screenings, preventive check-ups, and follow-up studies. As healthcare trends increasingly emphasize efficiency and convenience, diagnostic imaging centers meet these expectations. Diagnostic imaging centers can act as disease detection centers in many cases and provide physicians with results that aid in further diagnosis and treatment. Thus, an increase in awareness, along with technological advancements, is likely to contribute to the segment’s growth.

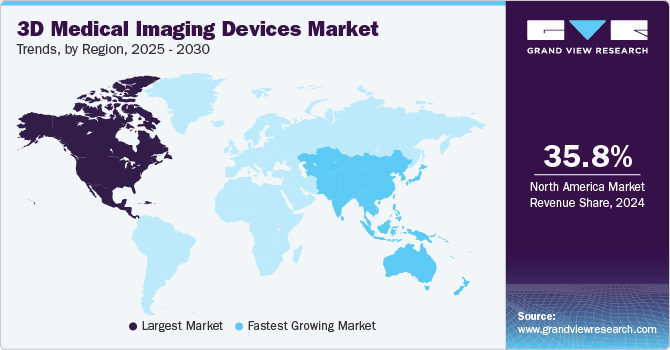

Regional Insights

Based on region, North America held the largest market share in 2022 at about 35.94%. The growth of the region is attributed to the higher purchasing power of healthcare settings, such as hospitals, long-term care centers, and advanced specialty centers. The North America market is driven by various strategic initiatives undertaken by key manufacturers targeting niche patient subsets in this space. Leading players in the market are Bayer, GE Healthcare, Guerbet, Lantheus, and Bracco Diagnostics. The presence of well-established healthcare facilities, easy availability of advanced technologies, and high demand for diagnostic procedures owing to disease screening & management initiatives in this region are expected to boost the number of screenings. In addition, the large geriatric population, increase in lifestyle-induced disease, and growing awareness about early diagnosis of chronic diseases have increased the demand for 3D medical imaging devices.

The Asia Pacific region is estimated to grow at the fastest CAGR of more than 8.46% from 2023 to 2030. The growth is driven by improved healthcare infrastructure and rising medical tourism. Moreover, lifestyle changes, urbanization, and dietary habits have contributed to a rise in chronic diseases such as diabetes, cardiovascular diseases, and cancer in the APAC region. The diagnosis and management of these conditions often necessitate advanced medical imaging technologies, leading to higher demand. Moreover, economic development in countries, such as India and China, is expected to facilitate market growth. The presence of a large population with low per capita income in the Asia Pacific region has led to a high demand for affordable treatment options. Multinational companies are keen to invest in developing economies of the APAC region, such as India & China. Thus, many market players are entering into collaborative partnerships and strategic alliances with local players. The region’s market is growing due to the rising geriatric population and its susceptibility to chronic diseases and the increasing overall prevalence of chronic diseases.

Key Companies & Market Share Insights

The market is captured by several dominant players such as Siemens Healthineers, GE HealthCare, and Koninklijke Philips N.V. These players have more than 60% of the global market holdings in 2022. Companies are continually investing in research and development to enhance 3D medical imaging devices. Many key players are expanding their geographical presence to tap into emerging markets, such as the Asia Pacific region. Expanding operations in these regions allows companies to capitalize on the growing demand for these devices. In July 2023, Siemens Healthineers announced a collaborative agreement with Atrium Health to introduce new ideas and progress in surgical training wherein the U.S. Siemens Healthineers will offer advanced medical imaging technology, assist in developing educational programs, and elevate the overall learning experience for visiting surgeons and their teams at the newly established medical learning center of excellence. Some prominent players in the global 3D medical imaging devices market include:

-

Siemens Healthineers

-

Esaote SpA

-

Koninklijke Philips N.V.

-

GE Healthcare Ltd.

-

Canon Medical Systems

-

Hitachi Medical Systems

-

Shimadzu Corporation

-

DigiRad Corporation

-

Del Medical Systems Inc.

3D Medical Imaging Devices Market Report Scope

Report Attribute

Details

The market size value in 2023

USD 11.82 billion

The revenue forecast in 2030

USD 20.31 billion

Growth rate

CAGR of 8.04% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion & CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Device type, application, end-use, region

Regions covered

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; UK; Germany; Italy; France; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand, Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Siemens Healthineers; Esaote SpA; Koninklijke Philips N.V.; GE Healthcare Ltd.; Canon Medical Systems; Hitachi Medical Systems; Shimadzu Corporation; DigiRad Corporation; Del Medical Systems Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global 3D Medical Imaging Devices Market Report Segmentation

This report forecasts revenue growth at the regional & country level and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global 3D medical imaging devices market report based on device type, application, end-use, and region:

-

Device Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

X-ray Devices

-

CT Devices

-

Ultrasound Systems

-

MRI Equipment

-

-

Software

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Cardiology

-

Orthopedic

-

Gynecology

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostic Imaging Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Norway

-

Sweden

-

Rest of Europe

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Rest of Latin America

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

Rest of MEA

-

-

Frequently Asked Questions About This Report

b. The global 3D medical imaging devices market size was estimated at USD 10.95 billion in 2022 and is expected to reach USD 11.82 billion in 2023.

b. The global 3D medical imaging devices market is expected to grow at a compound annual growth rate of 8.04% from 2023 to 2030 to reach USD 20.31 billion by 2030.

b. Hardware segment dominated the 3D medical imaging devices type market with a share of 67.5% in 2022. This is attributable to high demand for imaging devices globally.

b. Some key players operating in the 3D medical imaging devices market include GE Healthcare; Siemens Healthineers AG; Philips Healthcare; Canon Medical Systems Corporation; Mindray; FUJIFILM SonoSite, Inc.; Esaote; ContextVision; EOS imaging; Intelerad; Able Software Corp.; and Axial3D

b. Key factors that are driving the market growth include growing incidence of chronic disorders and technological advancements.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."