- Home

- »

- Next Generation Technologies

- »

-

Advanced Analytics Market Size, Share, Growth Report, 2030GVR Report cover

![Advanced Analytics Market Size, Share & Trends Report]()

Advanced Analytics Market Size, Share & Trends Analysis Report By Type, By Deployment (On-premise, Cloud), By Enterprise Size, By End Use, By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68038-997-5

- Number of Pages: 170

- Format: Electronic (PDF)

- Historical Range: 2017 – 2020

- Industry: Technology

Report Overview

The global advanced analytics market size was valued at USD 34.56 billion in 2021 and is expected to grow at a compound annual growth rate (CAGR) of 21.1% from 2022 to 2030. The major factors driving the growth of the market are the advent of machine learning and Artificial Intelligence (AI) to offer personalized customer experiences, the increasing popularity of online shopping, and the rising penetration of social networking platforms.

Many companies have adopted advanced analytics and AI solutions amid the COVID-19 pandemic to engage customers through digital channels and manage large and complex supply chains. Furthermore, the pandemic has augmented the use of advanced technologies such as data mining, artificial neural networks, and semantic analysis across several businesses.

In recent years, there has been exponential growth in the volume of data generated by businesses worldwide. Several businesses derive insights from the gathered data to make better, real-time, and fact-based decisions. This has particularly translated into the rising demand for advanced analytics solutions for data management and strategic decision-making.

Moreover, developments in the field of big data have helped improve the assessment capabilities of data science experts. By leveraging big data analytics, enterprises can bring improvements in vital business functions, processes, and objectives. As a result, organizations can meet stakeholder demands, manage data volumes, manage risks, improve process controls, and boost administrative performance by turning information into intelligence.

The growing adoption of advanced analytics tools for applications such as predicting and forecasting electricity consumption, trade market, and traffic trend predictions is expected to drive the market growth. The use of advanced analytics in demand forecasting can help organizations make informed decisions and augment their profitability. Government agencies and various industries, such as banking, manufacturing, and professional services, have been investing aggressively in big data analytics in recent years.

For instance, global banks are optimizing information, such as the data gathered from social media feeds, customer transactions, and service inquiries, to create data-driven Business-Intelligence (BI) models and implement advanced predictive analytics to make their data sets informative and stay competitive in the market. The continued integration of advanced analytics into Geographical Information Systems (GIS) and improvements in location-based services for optimal data management are driving the market.

Moreover, several healthcare consultants and government decision-makers are collaborating to generate real-time data on COVID-19 patients and share geographical information of COVID-19-prone areas amid the pandemic. For instance, in June 2021, Novartis International AG announced a collaboration with Hewlett Packard Enterprise (U.S.) to accelerate the use of health data sources and advance the applications of AI, machine learning, and geospatial analytics, and expand access to technology in remote and underserved locations.

Several healthcare institutes are extensively using advanced analytical tools to derive clinically meaningful outcomes through the investigational mining of Electronic Health Records (EHRs) of patients. This could aid in improving patient care outcomes, such as patient functional status and patient safety while curbing expenses.

Furthermore, AI-integrated data analytics solutions are being used in healthcare data mining to design customized treatment plans. For instance, in February 2021, IBM announced a partnership with Palantir Technologies, a software company that specializes in big data analytics, to provide consistent datasets for healthcare providers, researchers, and institutions to analyze and generate outcomes for their business and patients.

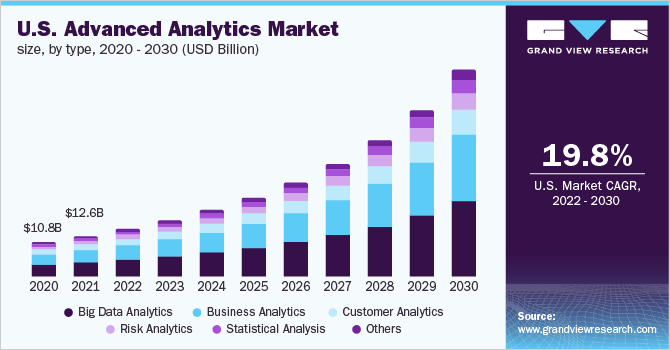

Type Insights

The big data analytics segment accounted for a market share of over 35% in 2021. The growth of the segment can be attributed to the increasing popularity of social media platforms and the growing number of virtual offices that produce large data volumes. Moreover, the emergence of SaaS-based big data analytics has made the implementation of automation easier and allowed advanced analytical models to be built in a self-service model. The rising demand for big data analytics solutions has encouraged big data service providers to increase their investments in cloud technology and gain a competitive edge.

The customer analytics segment is expected to register a notable CAGR of 20.1%, in line with the increasing demand for improved lead management, customer retention, and customer experience management. Customer analytics is highly used in the retail industry to develop personalized communications and marketing programs.

The increasing demand for omnichannel experience among customers of the retail industry has propelled the segment growth. Prominent retailers, such as Amazon and Walmart, have successfully managed to harness the benefits of different social media platforms, such as Facebook and YouTube. The growing focus of an increasing number of retail companies on offering omnichannel services to their customers is anticipated to drive the growth of the segment.

Deployment Insights

The on-premise segment accounted for a market share of over 45% in 2021. On-premise deployments offer organizations more flexibility and control to customize their IT infrastructure while also reducing their dependency on the internet and protecting business data from potential losses and frauds. These benefits are anticipated to encourage large organizations to opt for on-premise deployment.

Furthermore, organizations operating in the BFSI sector prefer the on-premise model owing to the growing concerns about frauds such as new account frauds and account takeovers. Organizations utilizing the on-premise model are more immune to these frauds, which bodes well for segment growth.

The cloud segment is expected to witness significant growth over the forecast period. The increased penetration of IoT and cloud computing is expected to boost the demand for cloud solutions. Advanced cloud analytics solutions continue to influence how organizations run, organize, and use data generated by their digital channels.

Additionally, key players such as International Business Machines Corporation, SAP SE, and Microsoft Corporation are focusing on developing customized solutions that can enable companies to smoothen their multi-cloud journeys. For instance, Microsoft Corporation offers its big data analytics software through the Microsoft Azure cloud service.

Enterprise Size Insights

The large enterprises segment held the largest market share of over 60% in 2021. The segment’s growth can be attributed to the growing adoption of advanced analytics solutions such as customer analytics and business analytics for efficiently managing the vast databases of customers and assets in large enterprises.

Moreover, several key companies are adopting big data analytics to increase their profits, enhance analytics skills, and support risk management capabilities. Furthermore, big data analytics assists companies in better understanding the data and providing important information to the concerned people.

The Small & Medium Enterprises (SMEs) segment held a market share of over 35% in 2021. The rising demand for dashboards for data visualization is anticipated to drive the demand for advanced analytics solutions by SMEs. Furthermore, SMEs opt for advanced analytics solutions to provide enhanced customer services and make better decisions in line with inherent risks.

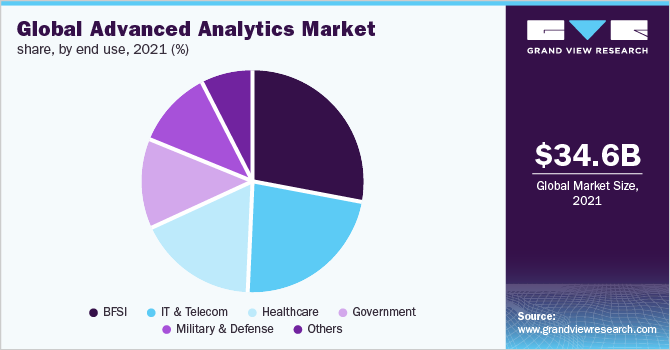

End-use Insights

The BFSI segment accounted for the largest market share of over 25% in 2021. The segment growth can be attributed to the continuous adoption of advanced analytics for identifying fraudulent transactions, optimizing processes, and handling data risks. Furthermore, the increased deployment of BI software to enable constant access to client databases, secure transactions, and enhance the client experience is also expected to drive the growth of the segment over the forecast period.

These solutions allow financial institutions to ensure better operational efficiency and enhanced customer experiences while also helping them sort unstructured data while ensuring regulatory compliance.

The IT & telecom segment held a market share of over 20% in 2021. The segment growth can be attributed to the growing demand for collaboration tools such as web conferencing and video conferencing. Furthermore, companies in this sector are adopting advanced analytical tools for the prevention of fraud, such as illegal access, authorization, or cloning.

Moreover, big data analytics enables telecom companies to build micro-segmentations for the large number of customers they serve. This, in turn, could allow these companies to personalize their offerings according to every customer’s needs and determine the most valuable customers.

Regional Insights

North America held a major market share of over 45% of the global advanced analytics market in 2021. This can be attributed to the presence of supporting infrastructure for the implementation of cutting-edge analytics and an increase in the adoption of advanced technologies, such as AI and machine learning.

For instance, in December 2021, Microsoft Corporation announced a collaboration with Consumer Value Store (CVS) Health, a healthcare solutions provider, to develop innovative solutions to help consumers improve their health. CVS Health would leverage Azure cognitive services like Computer Vision and Text Analytics for Health for automating tasks. The Azure services would accelerate CVS Health’s digital transformation by expanding the company’s multi-cloud presence to over 1,500 new and existing business applications on its cloud.

The Asia Pacific market is anticipated to exhibit a notable CAGR of 23.5% over the forecast period. The growth of the regional market is driven by the widespread adoption of big data analytics tools and solutions in the region. Furthermore, various enterprises in the region are investing heavily in customer analytics to improve business efficiency and productivity. Moreover, travel companies in the region, including China Ways LLC, TNT Korea Travel, and Trafalgar, are adopting analytical solutions for applications such as tracking buses, train schedules, breakdowns, and traffic management.

Key Companies & Market Share Insights

The market is dominated by a few large players. However, the emergence of niche players offering industry-specific solutions has changed the market dynamics in recent years. Companies can be seen engaging in mergers, acquisitions, and partnerships to further upgrade their products and gain a competitive advantage in the market.

Companies are working on new product development and the enhancement of existing products to acquire new customers and capture a larger market. For instance, in February 2021, RapidMiner, Inc. announced a partnership with Hivecell, an Edge-as-a-Service company. The collaboration is aimed at allowing users to rapidly create and operate models with streaming data from the edge. Through the integration, Hivecell’s users would be able to use models built with the RapidMiner platform to enable AI-optimized decision-making wherever needed. Some prominent players in the global advanced analytics market include:

-

Altair Engineering, Inc.

-

Fair Isaac Corporation (FICO)

-

International Business Machines Corporation

-

KNIME

-

Microsoft Corporation

-

Oracle Corporation

-

RapidMiner, Inc.

-

SAP SE

-

SAS Institute Inc.

-

Trianz

Recent Developments

-

In 2022, Altair Engineering, Inc., a global leader in AI, announced to acquire RapidMiner to expand its Broad Data Analytics portfolio.

-

In June 2023, Microsoft and Moody’s, announced of developing enhanced risk, data, analytics ,and collaborative solutions powered by AI that created innovative insights into corporate intelligence and risk management.

Advanced Analytics Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 40.88 billion

Revenue forecast in 2030

USD 189.56 billion

Growth rate

CAGR of 21.1% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Type, deployment, enterprise size, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil

Key companies profiled

Altair Engineering, Inc.; Fair Isaac Corporation (FICO); International Business Machines Corporation; KNIME; Microsoft Corporation; Oracle Corporation; RapidMiner, Inc.; SAP SE; SAS Institute Inc.; Trianz

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global advanced analytics market report based on type, deployment, enterprise size, end use, and region:

-

Type Outlook (Revenue, USD Million, 2017 – 2030)

-

Big Data Analytics

-

Business Analytics

-

Customer Analytics

-

Risk Analytics

-

Statistical Analysis

-

Others (Predictive Analytics, Text Analytics, and Prescriptive Analytics)

-

-

Deployment Outlook (Revenue, USD Million, 2017 – 2030)

-

On-premise

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Million, 2017 – 2030)

-

Large Enterprises

-

Small & Medium Enterprises (SMEs)

-

-

End-use Outlook (Revenue, USD Million, 2017 – 2030)

-

BFSI

-

Government

-

Healthcare

-

IT & Telecom

-

Military & Defense

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 – 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

- Middle East & Africa

-

Frequently Asked Questions About This Report

b. The major factors driving the growth of the advanced analytics market are the advent of machine learning and Artificial Intelligence (AI) to offer personalized customer experiences, the increasing popularity of online shopping, and rising social network penetration.

b. The global advanced analytics market size was estimated at USD 34.56 billion in 2021 and is expected to reach USD 40.88 billion in 2022.

b. The global advanced analytics market is expected to grow at a compound annual growth rate of 21.1% from 2022 to 2030 to reach USD 189.56 billion by 2030.

b. The big data analytics segment accounted for the largest share of over 35% in 2021 in the advanced analytics market.

b. Some key players operating in the advanced analytics market include Altair Engineering, Inc.; Fair Isaac Corporation; IBM Corporation; KNIME; Microsoft Corporation; Oracle Corporation; RapidMiner, Inc.; SAP SE; SAS Institute Inc.; and Trianz.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."