- Home

- »

- Plastics, Polymers & Resins

- »

-

Agricultural Films Market Size & Share, Global Industry Report, 2024GVR Report cover

![Agricultural Films Market Size, Share & Trends Report]()

Agricultural Films Market Size, Share & Trends Analysis Report By Raw Material (LDPE, LLDPE, Reclaims), By Application (Green House, Mulching, Silage), By Region, And Segment Forecasts, 2016 - 2024

- Report ID: 978-1-68038-144-3

- Number of Pages: 92

- Format: Electronic (PDF)

- Historical Data: 2013-2015

- Industry: Bulk Chemicals

Industry Insights

The global agricultural films market size was USD 7.81 billion in 2016 and is expected to register a CAGR of 7.4% over the forecast period. Increasing food demand owing to population explosion coupled with rising requirement for optimum agricultural productivity is anticipated to drive the growth. Factors such as increasing high-quality crop requirement and declining arable land and are projected to further propel the product demand.

Agricultural films are used for covering greenhouses and are placed over soil or wrapped around fodder. These products aid in improving crop quality and increasing overall productivity. Rising need to increase agricultural productivity to fulfill the daily demand for food has led to commercialization of these specialty coverings.

Various innovations in the industry, including Ultra Violet (UV) blocking, fluorescent, NIR blocking, and ultra-thermic films are expected to positively impact the demand for agricultural films over the projected period. However, environmental concerns regarding product disposal are anticipated to hinder the growth in near future. Stringent government regulations regarding plastics and polythene use are anticipated to negatively affect the market growth. Having said that, introduction of biodegradable and bio-based polymer films is expected to create lucrative opportunities for industry participants over the next few years.

Biodegradable agricultural films are gaining popularity in mature regions owing to their eco-friendliness. Technological advancements in horticulture, coupled with the development of particle, multi-layer, and UV protection films to improve agricultural productivity is anticipated to drive the product demand over the foreseeable future.

However, volatile petrochemical prices owing to the unstable global demand-supply scenario is expected to restrain the market growth. Nevertheless, shifting consumer preference towards biodegradable polymer films, especially in mature economies of North America and Europe, is estimated to create lucrative opportunities for market participants over the forecast period.

Raw Material Insights

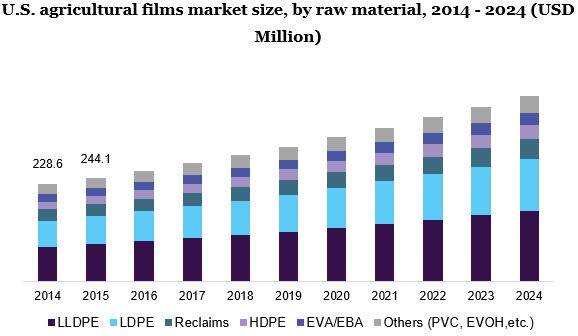

LLDPE was the leading raw material segment in 2016 and is anticipated to witness the fastest CAGR of 8.0% from 2017 to 2024. High-durability, the extended shelf life of finished products with high tensile strength, and improved thermal properties are expected to boost market penetration over the forecast period. Development of biodegradable products is also estimated to drive the growth.

LDPE accounted for over 21% of the market in 2016 owing to its increasing penetration in farming for areas with a limited water supply and harsh climatic conditions. LLDPE and LDPE are expected to witness high demand in the Asia Pacific, especially in China, due to the rising population coupled with rising regional demand for food.

The products manufactured using HDPE and EVA/EBA are used in agricultural applications, where rigidity is desired. HDPE products are mostly used in mulching and fumigation applications. Reclaims are recycled materials and have excellent tensile strength. However, the prices of these products are not competitive as compared to other conventional polymers.

Other agricultural films manufactured from PVC and EVOH have low market penetration owing to non-competitive prices and low durability of finished products coupled with their non-biodegradable nature. Development of bio-PVC films and other innovative products are expected to create immense opportunities for the industry over the forecast period.

Application Insights

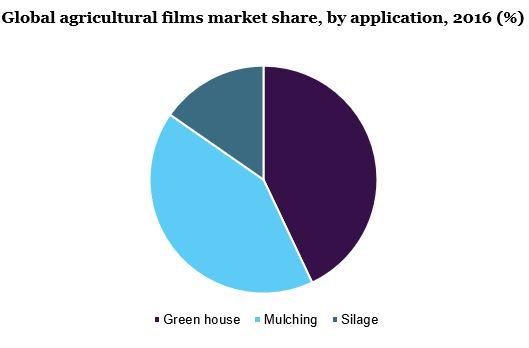

Mulching accounted for over 41.7% of total market revenue in 2016. Increasing demand for high-quality crop and rising disposable incomes are expected to drive the growth over the forecast period. Global application of agricultural films in mulching is projected to reach USD 5.75 billion by 2024 owing to its ability to maintain soil temperature, soil water retention, and inhibit the growth of weeds.

Mulch films are used in dry regions where sustaining of crops is important. Factors such as protection of crops from pests, limited supply, and judicious use of water and high agricultural productivity are anticipated to drive the growth. In addition, agricultural films aids in boosting the yield and quality of crops, along with the time required for the growth of crops.

Growing greenhouse agriculture in Asia, Middle East, and Western Europe are anticipated to have a positive impact on market growth. Factors such as increasing demand for floriculture and horticulture and uncertain climatic conditions are expected to boost the segment expansion. Furthermore, the product application in greenhouse aids in improving productivity and plant cultivation.

Furthermore, agricultural films used in silage applications increases the nutritional value of animal feed and enhances milk production. Rising product demand for fermentation of animal fodder obtained from forage plants is anticipated to drive the market in the forthcoming years. The properties associated with silage such as moisture retention in silage and facilitation of anaerobic fermentation is expected to further augment the market.

Regional Insights

Asia Pacific led the global agricultural films market and accounted for over 68.1% of global revenue in 2016. Over 80% of farmers in the region use mulch. Favorable government initiatives such as R&D of protected agriculture practices are anticipated to drive regional market. China is estimated to witness the fastest growth globally over the foreseeable future.

Europe is expected to witness stagnant growth in near future owing to stringent environmental regulations regarding film disposal and manufacturing. However, shifting consumer focus towards biodegradable materials is anticipated to drive the regional market.

The market in North America is mature, and hence the demand is anticipated to be sluggish over the forecast period. Furthermore, the high cost of the films along with the relocation of several polyethylene facilities to economies in from Asia Pacific and Middle East and Africa is likely to contribute to the regional growth.

Central and South America is estimated to witness average growth in demand. A large number of cultivable land along with advancements in agricultural technologies and implementation of effective horticulture techniques to increase crop yield may be attributed to increasing market penetration in economies including Brazil and Argentina.

Agricultural Films Market Share Insights

Global market is highly fragmented owing to the presence of several small-scale and regional players, particularly in China and India. Major companies operating in the industry include BP Industries (BPI), ExxonMobil, Trioplast, Group Barbier, Armando Alvarez, Britton Group, BASF, Novamont, Kuraray, and Ab Rani PlastOy.

Major companies have been investing heavily in R&D to introduce innovative products such as agricultural bags for grain storage to increase their market presence. Other strategies employed by companies include M&A, strategic collaborations with biotechnology firms, and enhancing supply chain efficiency.

Report Scope

Attribute

Details

Base year for estimation

2016

Actual estimates/Historical data

2014 - 2015

Forecast period

2017 - 2024

Market representation

Volume in Kilo Tons, Revenue in USD Million and CAGR from 2017 to 2024

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, Italy, France, Spain, UK, China, India, Japan, Brazil

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors and trends

15% free customization scope (equivalent to 5 analysts working days)

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."