- Home

- »

- Catalysts & Enzymes

- »

-

Agricultural Enzymes Market Size And Share Report, 2025GVR Report cover

![Agricultural Enzymes Market Size, Share & Trends Report]()

Agricultural Enzymes Market Size, Share & Trends Analysis Report By Type (Phosphatases, Dehydrogenase, Sulfatases), By Crop Type (Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables), By Product Type, By Region, And Segment Forecasts, 2018 - 2025

- Report ID: GVR-1-68038-533-5

- Number of Pages: 95

- Format: Electronic (PDF)

- Historical Range: 2014 - 2015

- Industry: Specialty & Chemicals

Report Overview

The global agricultural enzymes market size was valued at USD 246.9 million in 2016. Growing demand for the consumption of organic food coupled with various competitive strategies adopted by the key industry participants is expected to propel market growth.

Agricultural enzymes are bioactive proteins, which are used instead of chemicals for food production and protection. They are also used for crop fertility and protection against various pests & diseases. These factors improve crop efficiency and enhance crop growth. In addition, the increasing population and rising disposable income in developing countries will propel market growth in the future.

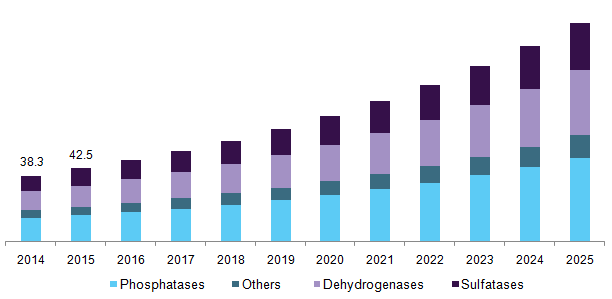

U.S. agricultural enzymes market revenue by type, 2014 - 2025 (USD Millions)

Some of the major types of enzymes used for soil fertility and crop growth are phosphatases, dehydrogenases, and sulfatases. The market for phosphatase enzymes is expected to grow at the fastest growth rate over the forecast period.

The key market players have developed technologies for producing these enzymes from microorganism. The microorganism used for production, grow in closed steel tanks, which contain nutrients such as sugar, starch, soy, and corn. These microorganisms increase crop yields and decrease the use of pesticides in food production. Some of the players also used gene technology for making the enzyme more efficient.

The U.S. market demand is expected to grow at an anticipated CAGR of 11.7% over the forecast period. Organic food is being used on a wide scale in the country, on account of growing healthy eating habits among people. According to The Food and Drug Administration (FDA) of the U.S., if the identified biological product problem is not recovered within a time period, the manufacturing of the respective product should be stopped. This regulation by FDA for biological or organic products is expected to be a major drawback for the market.

Enzyme Type Insights

The global phosphatases demand dominated the market in 2016. The market is expected to grow at a CAGR of 12.6% from 2017 to 2025. In soil ecosystems, phosphatases play a major role in the phosphorus cycle (P cycle), which correlates to plant growth and P stress (Phosphorus Stress). Phosphatase is an indicator of fertility and it also indicates the phosphorus deficiency in the soil.

Dehydrogenase is an important enzyme used for the biological oxidation of soil. They also indicate microbiological activities in soil. These processes performed by dehydrogenase are related to the respiration of microorganisms. In addition, they also indicate any disruption caused by pesticides.

Some of the other agricultural enzymes are beta-glucosidase and urease. Beta-glucosidase is also a soil fertility enzyme, involved in catalyzing the hydrolysis and biodegradation of various other beta-glucosidase present in plant debris, and is used for indicating soil quality.

Urease is used for hydrolyzing urea fertilizers, which are applied to the soil. These enzymes hydrolysis urea into NH3 and CO2 along with a rise in soil pH value. Urease is found in extra & intra-cellular enzymes of both plants and microorganisms. Urease extracted from plants and microorganisms degrade rapidly in soil with the help of proteolytic enzymes

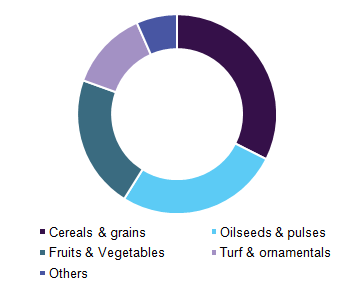

Crop Type Insights

Cereals and grains are cultivated almost in all countries this factor is expected to drive the agricultural enzymes industry. Enzymes play an important role in the processing of cereals as they enhance the quality and prevent crop diseases. The enzymes added to cereals and grains have the ability to remove bran and germs from the crop.

The increase in health consciousness among consumers owing to the use of chemicals in agriculture is altering the taste and preferences towards organic fruits and vegetables. Pesticides used in crop production harm living organisms and also contribute to the degradation of the environment. There are various government regulations for controlling the sale and use of pesticides which is expected to have a positive impact on the agriculture industry.

Organic food such as apples, bananas, and strawberries consists of medical benefits such as enhancement of immunity, prevention of cancer, and reducing inflammation. These factors are projected to drive the demand for agricultural enzymes over the forecast period.

Global agricultural enzymes market by Crop Type, 2016 (%)

The oilseed and pulses segment is projected to witness a growth in production owing to the growing demand for biofuel and vegetable oil. The consumption of the oilseed in palm kernel, rapeseed, and cottonseed is also anticipated to fuel the segment growth.

Product Type Insights

The fertility product type market is expected to grow at a CAGR of 12.4% over the forecast period. The soil is the major source of nutrients for plants, it helps in the biological processes and provides protection to groundwater and plants. Soil enzymes are the major indicator of fertility and they respond to climatic changes, industrial waste, and agriculture chemicals.

Growth-enhancing products are expected to grow at an anticipated CAGR of 11.7% from 2017 to 2025. These products when used on crops induce effects such as proper flowering and enhanced cell division, thus contributing to proper plant growth. Such factors are expected to aid segment growth.

Farmers across the globe are concerned about crop losses due to factors such as rodents and pests. Control products are helpful in reducing this damage as they inhibit the growth as well as the movement of pests in fields. Decreasing arable land has put a strain on the overall crop production worldwide.

Control products aid in increasing crop productivity and decreasing losses caused due to pests.

Control products are used to decrease harmful microorganisms such as soil-borne and pathogenic fungi. This control activity results in the stabilization of soil structure and improves water infiltration in it.

Regional Insights

North America dominated the global agricultural enzymes market in 2016 and is expected to continue its dominance over the next eight years. North America and Europe are mature markets, owing to the presence of major key players and huge investment in technology advancement. The U.S. and Mexico are investing a huge amount in technology to develop chemical-free products for the agricultural industry. These are some of the major factors, which are expected to propel the growth of the agricultural enzymes business of the region.

Asia Pacific is the fastest-growing region, owing to the presence of developing economies such as India and China. China is expected to be the major market over the forecast period owing to its huge investment in agriculture. Globally, the maximum increase in agricultural land has been in China, over the past few years. The nation is significantly investing in chemical-free products used in the agricultural industry. The region is expected to grow at a CAGR of 12.9% from 2017 to 2025.

Key Companies & Market Share Insights

The global industry is characterized by the presence of industry participants who are adopting various competitive strategies to gain market share. Companies have developed new microbial products for agriculture, which are used to produce crops in a sustainable way. Manufacturers such as Novozymes have established BioAg Alliance along with Monsanto to develop and sell microbial solutions which can increase the crop yield. The alliance benefits the agriculture, the environment, and consumer

Companies are using advanced technology and products for manufacturing the product by saving water and energy. In addition, these products are reducing waste and making the product more sustainable. Some of the major industry participants include Novozymes, Syngenta, BASF, Creative Enzyme, Enzyme India Pvt. Ltd., Aum Enzyme, Cypher Environmental, Afrizymes, Specialty Enzymes & Biotechnologies, and American Biosystems, Inc.

Recent Developments

-

In December 2021, BASF launched the new enzyme product Natupulse® TS for animal feed. The product increased the digestibility of nutrients and supported a more sustainable production of animal protein.

-

In February 2021, Novozymes collaborated with FMC, a leading global agricultural science company. This collaboration elevated Novozymes’ enzyme biocontrol technology and commercialized enzyme-based crop protection solutions for farmers.

Agricultural Enzymes Market Report Scope

Attribute

Details

Base year for estimation

2016

Actual estimates/Historical data

2014 - 2015

Forecast period

2017 - 2025

Market representation

Revenue in USD Million, and CAGR from 2017 to 2025

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S., Mexico, Canada, France, UK, Germany, China, India, Brazil

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

15% free customization scope (equivalent to 5 analyst working days)

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments Covered in the ReportThis report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the global agricultural enzymes market on the basis of enzyme type, crop type, product type, and region:

-

Enzyme Type Outlook (Revenue, USD Million; 2014 - 2025)

-

Phosphatases

-

Dehydrogenases

-

Sulfatases

-

Others

-

-

Crop Type Outlook (Revenue, USD Million; 2014 - 2025)

-

Cereals & Grains

-

Oilseeds & Pulses

-

Fruits & Vegetables

-

Turf & Ornamentals

-

Others

-

-

Product Type Outlook (Revenue, USD Million; 2014 - 2025)

-

Fertility Products

-

Growth Enhancing Products

-

Control Products

-

-

Regional Outlook (Revenue, USD Million; 2014 - 2025)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

U.K

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."