- Home

- »

- Medical Devices

- »

-

Anti-infective Agents Market Size, Share, Growth Report 2030GVR Report cover

![Anti-infective Agents Market Size, Share & Trends Report]()

Anti-infective Agents Market Size, Share & Trends Analysis Report By Type/Drug Class (Antivirals, Antifungals), By Route Of Administration, By Distribution Channel, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-973-9

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

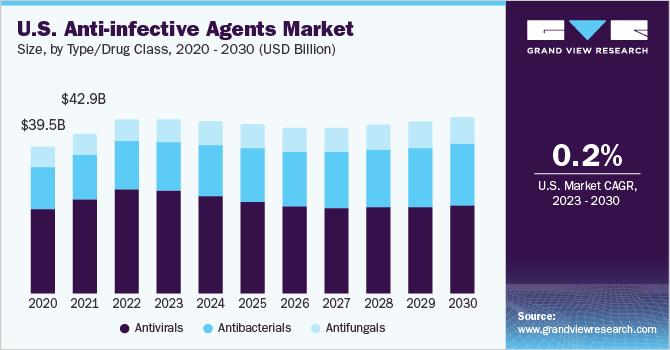

The global anti-infective agents market size was estimated at USD 136.9 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 1.2% from 2023 to 2030. Extensive R&D efforts for the development of new drugs with high efficacy and potency against multi-drug resistant micro-organisms are the major factors stimulating the market growth. Factors like increasing prevalence of infectious diseases and antimicrobial resistance to existing anti-infective agents are estimated to fuel the market growth. Moreover, rising health consciousness about the availability of diagnostics for infectious diseases and avoidable risks associated with early diagnosis are also projected to boost the market growth.

The global burden of infectious diseases, including bacterial, viral, and fungal infections, continues to rise. It has created a higher demand for effective anti-infective agents to combat these infections. The occurrence of new infectious diseases or the re-emergence of existing ones has boosted the need for effective anti-infective agents. Examples of such diseases include the outbreaks of Ebola, Zika, and, more recently, the COVID-19 pandemic. These events highlight the urgency of developing and deploying effective treatments to contain and treat such diseases. The COVID-19 pandemic had a significant impact on the market. One notable effect has been the heightened demand for antiviral drugs to combat the novel coronavirus.

This surge in demand has led to the repurposing of existing antiviral drugs and the accelerated development of new treatments, resulting in increased sales and production within the market. Pharmaceutical companies and research institutions invested substantially in developing novel drugs, therapies, and vaccines, thereby contributing to advancements in anti-infective agents. However, the pandemic also presented challenges, including disruptions to the supply chain. Restrictions on travel, lockdown measures, and labor limitations impeded the manufacturing and distribution processes, impacting the availability and pricing of these essential agents in certain regions.

Type/Drug Class Insights

The antiviral segment dominated the market with the highest revenue share of 53.2% in 2022. Advancements in antiviral drug development have contributed to the dominance of the antiviral segment. An improved understanding of viral replication mechanisms and host-virus interactions has led to the discovery of highly effective antiviral agents. Technologies like structure-based drug design and high-throughput screening have facilitated the identification and optimization of antiviral compounds. These advancements have resulted in newer generations of antiviral drugs with enhanced efficacy, improved safety profiles, and reduced side effects.

The global healthcare landscape has witnessed a surge in viral infections, such as influenza, HIV/AIDS, hepatitis, and respiratory viral diseases (including COVID-19). As a result, the demand for effective antiviral drugs to combat these infections has significantly increased in recent years. On the other hand, the antibacterial segment is expected to grow at the fastest CAGR of 4.2% over the forecast period. This is attributed to the increasing levels of resistance in bacteria. As per a December 2022 report by the WHO, there was a high level of resistance in bacteria leading to bloodstream infections in the hospitals. According to the CDC, around 13 billion Americans are expected to have a latent TB infection, with 8,300 cases of TB reported (provisional) in the U.S. in 2022 (at a rate of 2.5 cases per 100,000 people).

Route Of Administration Insights

Based on the route of administration, the market is categorized into topical, oral, and intravenous (IV). The oral route of administration held the largest market share in 2022 owing to new product development and a strong pipeline. Oral therapies minimize the use of central lines for intravenous drug administration and associated complications and reduce hospital stays.

The intravenous segment is estimated to exhibit a lucrative growth rate over the forecast period owing to high efficacy, better rate of bioavailability, and rapid delivery of drugs offered by this route of administration. It is widely used owing to the control it provides over the dosage and rapid delivery of drugs. Intravenous routes have a higher rate of bioavailability than other routes of administration.

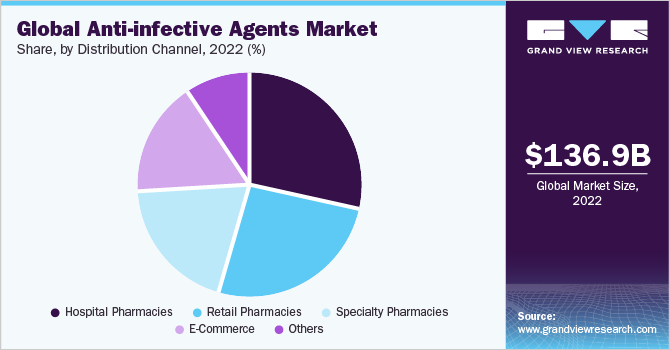

Distribution Channel Insights

The hospital pharmacies segment dominated the market with the highest revenue share of 28.8% in 2022 owing to the increased number of hospitalizations worldwide. Moreover, hospitals provide extensive patient treatment, care, quick reimbursement, and insurance policies owing to which patients opt for hospital pharmacies. Hospital pharmacies are typically associated with larger medical institutions equipped with advanced healthcare facilities. These hospitals often have specialized departments, such as infectious disease or intensive care units, where patients with severe infections are treated.

These departments require a constant supply of anti-infective agents to combat various infections. As a result, hospital pharmacies play a crucial role in meeting the high demand for anti-infective agents in such settings, leading to their dominance in this market segment. The e-commerce segment is expected to grow at the fastest CAGR of 2.1% over the forecast period owing to comfort, flexibility, and convenience as compared to other distribution channels. Various factors, such as the convenience of purchasing and improving healthcare infrastructure in developing regions, are likely to have a positive impact on the market growth.

Regional Insights

North America dominated the global industry in 2022 and accounted for the largest share of 37.0% of the overall revenue. The presence of sophisticated healthcare infrastructure and increasing awareness among healthcare professionals and clinicians are some of the key drivers for the regional market growth. Moreover, strong government emphasis on public health awareness & education with initiatives to promote infection prevention, vaccination programs, & appropriate antibiotic usage along with the presence of favorable reimbursement policies and high purchasing power for expensive drugs will have a positive impact on the market growth.

On the other hand, the Asia Pacific region is projected to expand at the fastest growth rate of 3.7% during the forecast period. The rapid growth can be attributed to the presence of generic companies, rising economic stability, and increasing disposable income levels. In addition, the growing aging population and their susceptibility to infections are projected to propel the regional market growth in the coming years.

Key Companies & Market Share Insights

Product launches, investment in R&D, and the expansion of product portfolios are strategies key players undertake to strengthen their market position. Advances in science, biotechnology, and pharmaceutical research have contributed to developing innovative anti-infective agents. It includes discovering new drug targets, developing novel drug delivery systems, and using advanced diagnostic techniques to identify infections more accurately. These advancements have expanded the possibilities for developing effective anti-infective agents.

For instance, in January 2022, Mankind Pharma reported to have launched Saviour Mankind, its division focused on developing injectable medications for life-saving purposes. Its product portfolio encompasses a wide range of therapeutic solutions, from anti-infective agents to therapies addressing stroke and trauma. Some of the prominent players operating in the global anti-infective agents market include:

-

Pfizer Inc.

-

Abbott.

-

Gilead Sciences, Inc.

-

Bristol-Myers Squibb Company

-

Merck & Co., Inc.

-

Sandoz International GmbH

-

B. Braun SE

-

Xellia Pharmaceuticals

-

Mankind Pharma

-

Bayer AG

-

AstraZeneca

-

Boehringer Ingelheim International GmbH

Anti-infective Agents Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 138.0 billion

Revenue forecast 2030

USD 150.6 billion

Growth rate

CAGR of 1.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type/drug class, route of administration, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Pfizer Inc.; Abbott; Gilead Sciences, Inc.; Bristol-Myers Squibb Company; Merck & Co., Inc.; Sandoz International GmbH; B. Braun SE; Xellia Pharmaceuticals; Mankind Pharma; Bayer AG; AstraZeneca; Boehringer Ingelheim International GmbH

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Anti-infective Agents Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global anti-infective agents market report on the basis of type/drug class, route of administration, distribution channel, and region:

-

Type/Drug Class Outlook (Revenue, USD Billion, 2018 - 2030)

-

Antibacterials

-

Cephalosporins

-

Penicillin

-

Fluoroquinolones

-

Macrolides

-

Carbapenem

-

Others

-

-

Antivirals

-

Antifungals

-

Azoles

-

Echinocandins

-

Polyenes

-

Others

-

-

-

Route of Administration Outlook (Revenue, USD Billion, 2018 - 2030)

-

Topical

-

Oral

-

IV

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Specialty Pharmacies

-

E-Commerce

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global anti-infective agents market size was estimated at USD 136.9 billion in 2022 and is expected to reach USD 138.0 billion in 2023.

b. The global anti-infective agents market is expected to grow at a compound annual growth rate of 1.2% from 2023 to 2030 to reach USD 150.60 billion by 2030.

b. Antiviral dominated the anti-infective agents market with a share of 53.2% in 2022. This is attributable to the introduction of novel drugs and the large patient population suffering from viral infections that require long treatment procedures.

b. Some key players operating in the global anti-infective agents market include GlaxoSmithKline plc.; Pfizer Inc.; Bayer AG; Sanofi; Merck & Co., Inc.; Bristol-Myers Squibb Company; Abbott; Novartis AG; Johnson & Johnson Services Inc.; Gilead Sciences, Inc.; and Astellas Pharma Inc.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."