- Home

- »

- Plastics, Polymers & Resins

- »

-

Global Beverage Cans Market Size & Growth Report, 2030GVR Report cover

![Beverage Cans Market Size, Share & Trends Report]()

Beverage Cans Market Size, Share & Trends Analysis Report By Material (Aluminum, Steel), By Application (Carbonated Soft Drinks, Alcoholic Beverages, Fruits & Vegetable Juices), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-298-3

- Number of Pages: 208

- Format: Electronic (PDF)

- Historical Range: 2018 - 2020

- Industry: Bulk Chemicals

Report Overview

The global beverage cans market size was estimated at USD 39,207.7 million in 2022 and is expected to expand at a compounded annual growth rate (CAGR) of 5.3% from 2023 to 2030.The market is expected to witness growth owing to the increasing consumption of beverages such as carbonated soft drinks, beer, and cider. Additionally, the increasing ban on plastic products owing to sustainability concerns is likely to drive demand for alternative packaging solutions, benefitting the growth of the market. The superior physical properties of metal over its alternatives include the high malleability of aluminum and steel, easy labeling and printing on the metal surface, and design innovations that appeal to the young population. These benefits associated with the beverage cans for the manufacturers and end users are supporting the growth of the market. Thus the manufacturers are designing solutions that are meeting the requirements of consumers.

For instance, in March 2021, Font Pincészet, a Hungarian winery, collaborated with CANPACK, a manufacturer of beverage cans to launch its white and rose FONT SECCO wines in design and matt finished cans to offer high customization in labeling, increasing customer engagement.

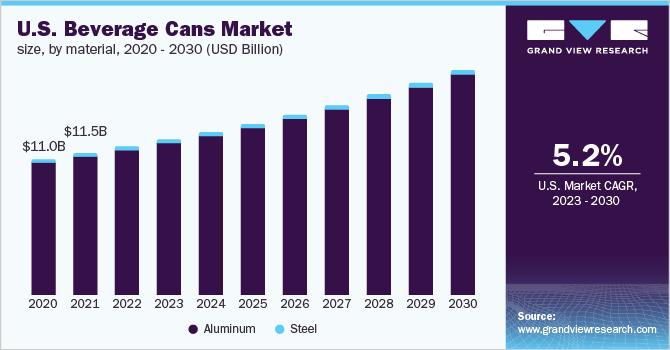

The U.S. is the prominent market for metal beverage cans with the highest per capita can consumption across the globe. The demand is influenced by the high consumption of soft drinks and beer, which are increasingly made available in metal cans. The U.S. market is characterized by the high consumption of beverages such as cold coffee, fruit juices, frappes, iced teas, and flavored sodas by the American population.

The global market is expected to witness substantial growth owing to the increasing recycling of used beverage cans. The growing demand for optimum utilization of natural resources has driven the demand for the recycling of metals for reuse. Metal recycling has garnered great support from government agencies such as the European Commission and the U.S. government who mandated the exchange of used cans. Furthermore, the metal recycling market is also expected to be benefitted from the municipal recycling programs initiated in countries such as the U.S., Italy, Brazil, Indonesia, and the U.K.

According to the International Aluminium Institute, aluminum’s economic scrap value and ability to be recycled continuously make the aluminum beverage cans the most recycled container in the world. These cans have an average of 60% global recycling rate, however, in some countries, the recycling rate is over 90%. This cost-effective recycling of aluminum coupled with the sustainability associated with it is projected to support the market growth over the forecast period from 2023 to 2030.

According to the American Aluminum Association, in the U.S. and Canada, the aluminum industry recycles more than 5 million tons of aluminum annually, much of which is returned directly to North American markets. This is 92% more energy efficient than making new aluminum, which lowers the environmental impact of the production process. Thus, the market of metal beverage cans is experiencing growth in the global market.

The packaging industry experienced a significant impact from the COVID-19 pandemic owing to supply chain disruption. The shutdown in China, which is one of the key raw material producers, has impacted packaging manufacturers globally. The shortage in supply of raw materials like aluminum, steel, and others from Chinese manufacturers resulted in a demand-supply gap. Additionally, the decreased demand for beverages due to temporary lockdowns and restrictions on retail operations has also negatively impacted the market growth.

Material Insights

The aluminum segment is leading the market with a maximum volume share of 95.1% in 2021 and the segment is projected to maintain its dominance throughout the forecast timeframe from 2023 to 2030. The segment is also projected to maintain its fastest revenue growth with a CAGR of 5.4% over the forecast period owing to the benefits associated with aluminum.

According to a study by ICF International, aluminum cans emit fewer greenhouse gases (GHGs) during transportation and refrigeration compared to beverages in glass or plastic bottles under the same conditions. Thus, the benefits of aluminum cans such as high-energy conservation and low-carbon emission compared to their counterparts also contribute to the growth of the metal beverage cans market.

The usage of aluminum as a raw material for packaging beverages has increased as it can be easily cooled and heated for sterilization, along with its property of maintaining the structure and integrity of packaged products.For instance, in September 2021, CANPACK partnered with RUSAL, a producer of low-carbon aluminum, and ELVAL, an aluminum rolling expert, to launch a pilot to produce a can with the lowest-ever carbon footprint for AB InBev beer can in Europe. This experimental pilot scheme will use inert anode aluminum technology to produce five million ultra-low carbon Budweiser 440 ml cans using renewable electricity.

The recyclability offered by aluminum cans has led the key beverage manufacturers to shift toward sustainability by reducing their carbon footprint. Moreover, these cans can be customized in terms of colors and 3D prints, as well can be embossed, making them aesthetically appealing to consumers. However, the price of aluminum is higher than that of PET or polyester raw materials, thus increasing its usage for making cans to package high-value beverages such as beer and carbonated drinks.

Application Insights

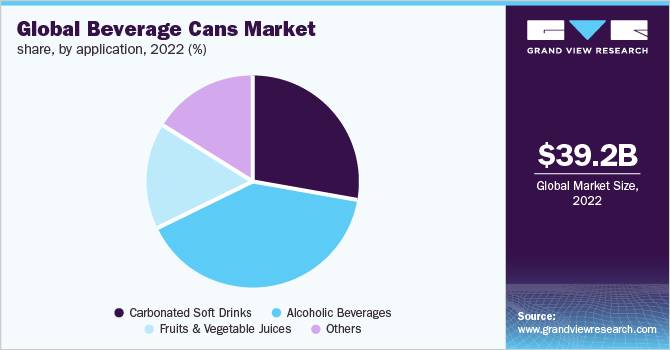

The alcoholic beverages segment dominated the market in terms of both value and volume and the segment is also projected to continue with its dominance throughout the forecast timeframe from 2023 to 2030. The increasing demand for alcoholic beverages among the millennial population especially across developing economies, coupled with rapid urbanization, increasing disposable income, and increasing consumer demand for premium or high-end products is further contributing to the market growth.

Beverage cans are used for packaging various alcoholic beverages including beer, cider, and ready-to-drink alcoholic preparations.Additionally, the demand for beverage cans for craft beer is expected to emerge as a major market driver over the forecast period because it offersmore health benefits compared to normal beer.Moreover,the consumption of beer has been witnessing positive volumetric growth in countries such as India, China, and Indonesia owing to sustained economic growth over the past few years.

Innovation and advancements in the production of vodka, flavored wine, beer, and cocktail products, coupled with changes in consumer lifestyles and the rise in breweries and wineries across the globe are driving the growth of this market. A continuously growing trend in socializing and mid-week/weekend parties among young professionals is bolstering the consumption of alcoholic beverages has increased drastically.

The fruits and vegetable segment is projected to exhibit the fastest growth over the forecast period with maximum CAGR in terms of both volume and value. Fruit & vegetable juices are expected to witness growth in demand owing to increased emphasis on health and wellness among consumers. The emergence of Covid-19 has boosted the demand for 100% real fruit juices by the young population. Additionally, the increasing consumption of vegetable juices such as tomato juice in the U.S. is expected to drive the demand for fruit and vegetable juices, which will support the demand for favorable beverage cans.

Regional Insights

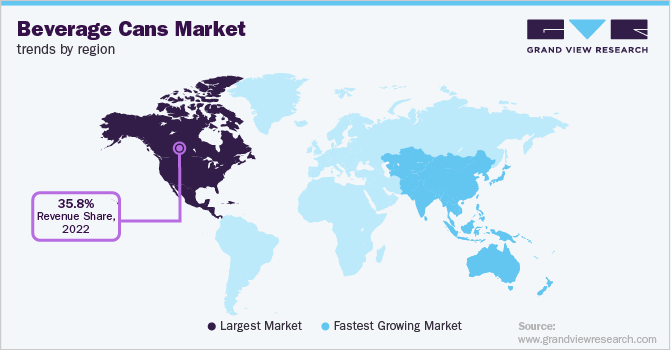

North America dominated the market in terms of both volume and value in 2022 and the region is also projected to maintain its dominance throughout the forecast period from 2023 to 2030. In terms of volume, the region accounted for a share of 35.8% in 2022 and is estimated to dominate the market in 2030 with a volume share of 35.1%. Countries such as the U.S. and Canada have made progressive commitments to reduce the use of plastic by introducing campaigns such as The Clean Seas. Such types of initiatives are projected to support the growth of the regional market over the forecast timeframe from 2023 to 2030.

The U.S. accounted for the maximum revenue share of 83.6% in 2021 and the country is also projected to maintain its dominance over the forecast period from 2022 to 2030. The U.S. market has witnessed continuous product innovations for metal beverage cans with major companies such as Ball Corporation, Crown Holdings, Inc., and Envases Group operating their manufacturing plants and distribution centers in the country.

The expanding production capacities of manufacturers headquartered in the country such as Ardagh Group S.A., Orora Packaging Australia Pty. Ltd., and CANPACK owing to the increasing demand for sustainable packaging solutions in the country. In May 2021, Ardagh Group S.A. invested USD 195.0 million for the expansion of its metal beverage cans manufacturing facility in Forsyth County, North Carolina, U.S. The investment is expected to be utilized to install two new high-speed can manufacturing lines in the facility along with additional building improvements for increasing the production capacity of the plant.

Asia Pacific is projected to exhibit the fastest growth with a revenue CAGR of 6.7% over the forecast timeframe from 2023 to 2030. The region is one of the leading consumers of alcoholic and non-alcoholic carbonated beverages. The growing millennial population propelling demand for customized packaging with high aesthetic appeal is projected to support the fastest growth of the regional market. Moreover, the major economies of the region including China and India are major contributors to the regional market growth.

Key Companies & Market Share Insights

The beverage cans industry is highly fragmented with the presence of several global companies such as Ball Corporation, CANPACK, Crown Holdings, Inc., and Ardagh Group S.A. These companies have implemented numerous strategies to enhance their market position in the global as well as regional markets. For instance, they carried out the expansion of their production facilities through partnerships and collaborations, as well as through the addition of new production lines to their existing facilities to enhance their market share and fulfill the rising demand for beverage cans from developed economies.

Manufacturers operating in the market are constantly innovating ways of sourcing raw materials and producing products in the most sustainable way to attract a large number of customers, along with enhancing their product portfolios by incorporating new design elements. For instance, Crown Holdings Inc. offers augmented reality packaging solutions that enable brand owners to directly engage with consumers by providing tailored content on beverage cans through AR codes. Experiences are offered to consumers using these codes in the form of anti-counterfeiting technology. Some of the prominent players in the beverage cans market include:

-

Mahmood Saeed Beverage Cans & Ends Industry Company Limited

-

Kian Joo Can Factory Berhad

-

SWAN Industries (Thailand) Company Limited

-

GZ Industries Limited

-

Toyo Seikan Co., Ltd.

-

Ball Corporation

-

Orora Packaging Australia Pty Ltd.

-

The Olayan Group

-

Crown Holdings, Inc.

-

Bangkok Can Manufacturing

-

CPMC Holdings Limited

-

CANPACK

-

Nampak Ltd.

-

Ardagh Group S.A.

-

Envases Group

Beverage Cans Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 41,136.3 million

Revenue forecast in 2030

USD 59.6 billion

Growth rate

CAGR of 5.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2020

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Key companies profiled

Mahmood Saeed Beverage Cans & Ends Industry Company Limited; Kian Joo Can Factory Berhad; SWAN Industries (Thailand) Company Limited, GZ Industries Limited; Toyo Seikan Co., Ltd.; Ball Corporation; Orora Packaging Australia Pty Ltd.; The Olayan Group; Crown Holdings, Inc.; Bangkok Can Manufacturing; CPMC Holdings Limited; CANPACK; Nampak Ltd.; Ardagh Group S.A.; Envases Group.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Beverage Cans Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global beverage cans market report based on material, application, and region:

-

Material Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Aluminum

-

Steel

-

-

Application Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Carbonated Soft Drinks

-

Alcoholic Beverages

-

Fruits & Vegetable Juices

-

Others

-

-

Regional Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

Belarus

-

Bulgaria

-

Czech Republic

-

Poland

-

Hungary

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Kazakhstan

-

Uzbekistan

-

Tajikastan

-

-

Central & South America (CSA)

-

Brazil

-

Argentina

-

Peru

-

Chile

-

Colombia

-

-

Middle East & Africa (MEA)

-

Saudi Arabia

-

South Africa

-

Ghana

-

Nigeria

-

Kenya

-

Mauritius

-

Egypt

-

Iran

-

Kuwait

-

Israel

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global beverage cans market was estimated at USD 39,207.7 million in the year 2022 and is expected to reach USD 41,136.3 million in 2023.

b. The global beverage cans market is expected to grow at a compound annual growth rate of 5.3% from 2022 to 2030 to reach USD 59.6 billion by 2030.

b. Aluminum segment by material emerged as a dominating region with a revenue share of 96.1% in the year 2022 owing to the presence of major companies and introduction of new & innovative packaging solutions for the application segment.

b. The key market player in the global beverage cans market includes Mahmood Saeed Beverage Cans & Ends Industry Company Limited, Kian Joo Can Factory Berhad, SWAN Industries (Thailand) Company Limited, GZ Industries Limited, Toyo Seikan Co., Ltd, Ball Corporation, Orora Packaging Australia Pty Ltd, The Olayan Group, Crown Holdings, Inc., Bangkok Can Manufacturing, CPMC Holdings Limited, CANPACK, Nampak Ltd., Ardagh Group S.A., and Envases Group.

b. Increasing consumption of alcoholic beverages, increasing ban on plastic packaging, and increasing government initiatives for recycling of aluminum material is expected to drive the beverage can market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."