- Home

- »

- Medical Devices

- »

-

Biomedical Refrigerators And Freezers Market Report, 2024GVR Report cover

![Biomedical Refrigerators And Freezers Market By Type (Blood Bank Refrigerators, Shock, Plasma, Ultra Low Temperature Freezers, Laboratory/ Pharmacy / Medical Refrigerators, Laboratory/ Pharmacy / Medical Freezers), End-User (Hospitals, Research Laboratories, Pharmacies, Diagnostic Centers, Blood Banks), And Segment Forecast 2018 - 2024Report]()

Biomedical Refrigerators And Freezers Market By Type (Blood Bank Refrigerators, Shock, Plasma, Ultra Low Temperature Freezers, Laboratory/ Pharmacy / Medical Refrigerators, Laboratory/ Pharmacy / Medical Freezers), End-User (Hospitals, Research Laboratories, Pharmacies, Diagnostic Centers, Blood Banks), And Segment Forecast 2018 - 2024

- Report ID: GVR-1-68038-179-5

- Number of Pages: 0

- Format: Electronic (PDF)

- Historical Data: 2010-2012

- Industry: Healthcare

Report Overview

Growing demand for storage of DNA samples, vaccines are expected to boost the market over the forecast period

The global biomedical refrigerators and freezers market was valued at USD 2.85 billion in 2015 and is expected to grow at a compound annual growth rate (CAGR) of 4.9% from 2018 to 2024. Key factors driving the growth include the growing prevalence of chronic diseases, rising demand for storing biological products, blood samples, blood reagents, vaccines, DNA samples, and other chemicals. In addition, the need to provide thermal insulation and avoid product degradation is a critical factor boosting the usage rates.

These biomedical freezers are available in different specifications to suit specific commercial needs. For instance, the plasma once is used for storage of blood and plasma products at -30 °C to 40 °C and the ultra-low temperature freezers are used for long term storage of DNA and RNA samples products at a range of 70 °C to 80 °C.

Based on the estimates of the American Society of Health System Pharmacists, hospitals spend nearly 70-75% of their budget on their pharmacy department. Moreover, as per the Institutes for Safety Medication Practices, more than 20% of the healthcare practitioners have reported adverse patient effects due to deficiencies in storage and inventory management practices

Increasing support from government and industry participants to provide technical and financial assistance in the improvement of healthcare infrastructure, and procurement of biomedical refrigerators and freezers is a positive trend witnessed in the market.

In 2015 plasma freezers accounted for the largest share of the biomedical refrigerators market

Based on the product type, the market is segmented as blood bank refrigerators, shock, plasma, ultra-low temperature freezers, and laboratory/pharmacy refrigerators and freezers The plasma freezers segment accounted for the maximum share of over 28% in 2015, mainly on account of rising demand for collection and storage of several blood components such as platelets, plasma, and others.

The laboratory/pharmacy freezers are expected to emerge as the fastest-growing segment with a CAGR of nearly 5.4% over the forecast period. High wastage of laboratory chemicals, vaccines, and other biological products due to improper storage conditions is a key factor impacting the profitability and operational efficiency of laboratories and pharmacies. Moreover, increasing government scrutiny in the implementation of quality management and GLP practices is also a key factor boosting the segment's growth.

Blood banks account for the majority biomedical refrigerators and freezers market in 2015

The risk of blood transfusion errors is increasing rapidly due to unscientific inventory management practices. The presence of stringent regulations for the storage of blood components is a key factor driving the segment's growth. For instance, in the U.S., the Center for biologics evaluation and research (CBER) actively regulates the collection and storage of blood and blood components, which may be used for blood transfusion or for the manufacturing of pharmaceutical products.

However, the pharmacies are expected to emerge as the fastest-growing category over the forecast period. The growing number of adverse reactions and increasing wastage of vaccines due to thermal shock is a major factor boosting the growth

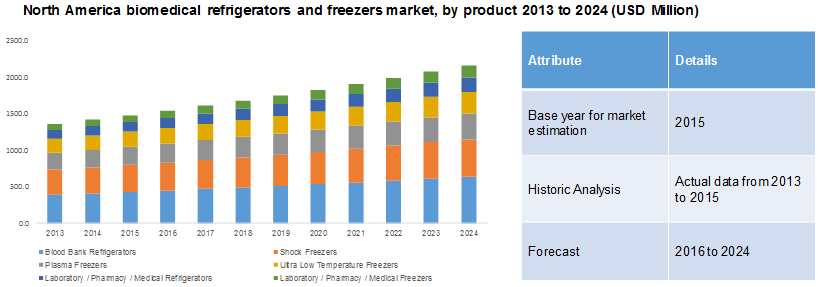

In 2015, North America accounted for a share of over 51% of the biomedical refrigerators and freezers market in 2015

In 2015, North America held the maximum share of over 51%, presence of stringent guidelines in the U.S., high-quality standards, and high expenditure on hospital and healthcare infrastructure is a key factors for the dominance of the region. The U.S. spends nearly 17.1% of its GDP on healthcare, and it is a priority to improve patient care and reduce the wastage of pharmaceutical and biological components. The growing prevalence of chronic diseases coupled with the rising geriatric population is significantly driving the number of blood transfusion procedures, and consumption of various pharmaceutical products. This factor is boosting the demand for use of biomedical refrigerators across all the end-use segments.

The U.S. is the most important sector and has captured a majority share of North America. The increase in the prevalence of various chronic disorders among both the pediatric and elderly population is one of the factors indicating the growing number of patients being admitted, which is thereby increasing pressure on the traditional pharmaceutical system. The awareness regarding the presently available, technologically-advanced systems gaining prominence, and the lack of low-cost skilled professionals are some of the crucial factors expected to boost the market.

Asia Pacific is anticipated to grow with a lucrative growth rate over the forecast period. By 2024, this share of this region is expected to reach over 18%. High economic development in countries such as India, China, Indonesia, and others is a key factor boosting the expenditure on healthcare infrastructure and medical services. This region is emerging as a key medical tourism destination, and the government and private sector are investing significant resources to reach the service quality standards adopted in the western regions. Moreover, increasing the patient pool suffering from chronic diseases is also boosting the demand for various blood components and pharmaceutical products.

The biomedical refrigerators and freezers market is fragmented with high competition among key players

The leading players operating in the market include Philipp Kirsch GmbH, Haier Biomedical, Panasonic Healthcare Co., Thermo Fisher Scientific Inc., Helmer Scientific, and Eppendorf AG. The key success factors in the market include technological factors, product pricing, service quality, and distribution network.

Recent Developments

-

In February 2023, PHC Corporation launched the VIP ECO® SMART Ultra-Low Temperature Freezer that offers industry-leading energy efficiency with enhanced security and usability.

-

In February 2021, PHC collaborated with Follett Products to market and sell PHCbi ultra-low temperature freezers, pharmaceutical-grade refrigerators, and biomedical freezers to Follett's healthcare customers.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."