- Home

- »

- Sensors & Controls

- »

-

Burner Management System Market Size, Share, Industry Report, 2025GVR Report cover

![Burner Management System Market Size, Share & Trends Report]()

Burner Management System Market Size, Share & Trends Analysis Report By Platform, By Fuel Type, By End-Use, By Component, By System Size, By Application, By Region And Segment Forecasts, 2015 - 2025

- Report ID: GVR-3-68038-755-1

- Number of Pages: 148

- Format: Electronic (PDF)

- Historical Range: 2015 - 2017

- Industry: Semiconductors & Electronics

Industry Insights

The global burner management system market size was valued at USD 5.05 billion in 2018 and is anticipated to register a CAGR of 6.1% from 2019 to 2025. BMS is a safety system used for ensuring that process burners safely start-up, operate, and shut down. Burner management systems are being increasingly adopted across a wide range of industries to improve plant operations by providing reliable and safe burner operations, thus reducing maintenance costs, ensuring improved safety, and a safer work environment for plant operators. These factors are expected to continue to drive the growth of the BMS market.

The growing rate of development of the industrial sector worldwide is expected to drive the applications of BMS in boiler processes. The rise in government regulations and legislations supporting the installation of safety systems have increased the installation of BMS in new as well as existing fired equipment. The adoption of BMS has also increased as companies face an increasing number of litigations for workplace accidents. The demand for burner management systems has also substantially increased across a wide range of end-use industries such as chemicals, oil & gas, and power generation.

Key companies operating in the BMS market are focusing on manufacturing systems compliant with industry standards to ensure increased safety, system availability, enhanced operations, and easy maintenance of process boilers across a variety of industries. Investment in R&D activities has also increased over the years and advanced BMS are being introduced. Increased awareness about the benefits associated with the installation of the advanced burner management system, such as improvement in burner status monitoring and damage detection through immediate diagnostic failure identification, is also expected to positively influence the sales of BMS over the forecast period.

The increased proliferation of BMS has resulted in the development of an advanced burner management system that monitors multiple aspects of boiler control, including stack temperature, hours of use, fuel usage, and boiler efficiency. The demand for advanced burner control systems, which include operator displays and alarm management features, is increasing as such systems help simplify unit operations and reduce the start-up time. The advanced diagnostics and operator messaging features in such advanced systems enable companies to minimize critical troubleshooting time.

Platform Insights

In terms of platform, the report segments the market for BMS into a Distributed Control System (DCS), and Programmable Logic Controller (PLC). The PLC segment dominated the market in 2018 and is anticipated to retain its dominance over the forecast period. The segment is projected to register a CAGR of approximately 5% over the forecast period. The PLC BMS platform is popular among end-use industries as it provides enhanced versatility and reliability. Its faster response time also makes the PLC BMS platform a preferred choice among consumers for performing numerous operations such as firing control and safety shutdown.

The market for the distributed control system BMS platform segment is expected to register the fastest CAGR over the forecast period. This can be attributed to a wide application base of DCS burner management system platform spanning several industries such as chemicals, water & wastewater, power generation, oil and gas, pharmaceuticals, and paper and pulp. The cost-effectiveness of a DCS-based burner management system, development of open source DCS, and advanced process control capabilities of the DCS BMS platform is expected to be the major factors driving the growth of the segment.

Fuel Type Insights

Based on fuel type, the market for burner management systems has been segmented into oil, gas, and others. Presently, BMS for gas-powered burners witness higher demand across several industries as they are environmentally friendly as compared to oil and coal-powered ones. Industries are also increasingly utilizing gas-fired burners owing to their higher operating efficiencies and easy the availability of natural gas. In 2018, the gas segment accounted for over 50% share of the overall market. The segment is expected to dominate the global market for the burner management system over the forecast period.

Governments worldwide are enforcing stringent environment norms to minimize pollution levels. These norms are expected to drive the adoption of gas-fired burners as combustion of natural gas releases meager amounts of Nitrogen Oxides (NOx), Sulfur Dioxide (SO2), Carbon Dioxide (CO2), Carbon Monoxide (CO), and other reactive hydrocarbons and virtually no particulate matter. Coal and oil are composed of complex molecules, which, when combusted, release higher levels of harmful emissions. These factors are expected to encourage the growth of the gas segment over the forecast period.

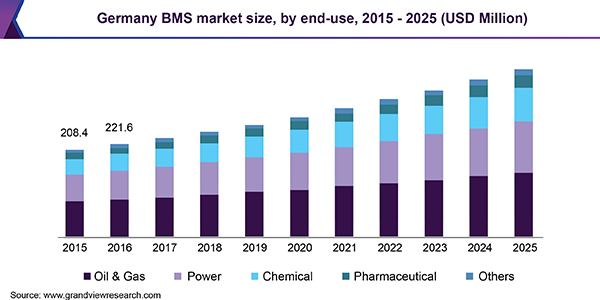

End-Use Insights

Based on end-use, the burner management system market has been segmented into oil & gas, power, chemical, pharmaceutical, and others. The oil & gas segment dominated the market in 2018. Various applications in the oil and gas sector, such as heaters, line heaters, dehydrators, separators, and re-boilers, require burner (heat) and BMS to facilitate the proper functioning of the equipment. The demand for BMS is notably rising across the oil & gas sector as companies look for ways of optimizing their efficiency, maintain a safe work environment, and ensure compliance with standards and norms.

Several industry verticals have faced major accidents involving fired equipment in the past. However, with the proliferation in burner management technology and the adoption of enhanced engineering practices, the rate of such accidents has reduced significantly. Various nonprofit organizations, such as the National Fire Protection Association (NFPA), have developed numerous standards and codes to prevent losses due to hazards at the workplace, thus driving the adoption of BMS in industries such as chemical and pharmaceutical. In the chemical industry, the market for BMS is likely to witness a CAGR of over 7% over the forecast period.

Component Insights

The two key components of a typical BMS analyzed in the study include hardware and software. The hardware segment is estimated to emerge as the largest revenue-generating segment over the forecast period. The segment comprises flame detectors, actuators & controllers, shut-off valves, ignition units, and alarms & shutdowns. Of these, the alarms & shutdowns sub-segment is expected to register the highest CAGR of more than 7% over the forecast period. In an attempt to effectively address the need for safety during various operational modes of a BMS, organizations are increasingly using alarms & shutdowns for improved safety and risk reduction.

The software segment is projected to register the highest CAGR of nearly 7% over the forecast period. Typically a BMS is provided with an independent logic solving hardware, separate power supplies, and independent input/output systems. Customers prefer to install it as an autonomous system in such a way that it is physically and functionally separate from other logic solvers. As a result, the hardware component accounts for the lion’s share in the market for BMS and the trend is likely to remain strong over the forecast period as well.

Application Insights

In terms of application, the report segments the market for the burner management system into single-burner and multiple-burner. BMS for a single-burner with a single fuel is generally a simple system equipped with monitoring and control functions. In most of the applications involving single burner, off-the-shelf products meet the customer's needs. However, in the case where two or more burners are used to fire into a common chamber and where multiple fuels are burned simultaneously, a customized approach is preferred to design the burner management system (using PLC) as it is more flexible and economical.

The increasing complexity of the multiple-burner environment is expected to create the demand for safety systems over the forecast period. Multiple-burners systems are typically used in dryers, incinerators, and in almost all chemical heating applications. The multiple-burner segment accounted for the largest revenue share of the overall market in 2018 and is anticipated to continue to lead over the forecast period. The segment is projected to register the highest CAGR of more than 7% over the forecast period.

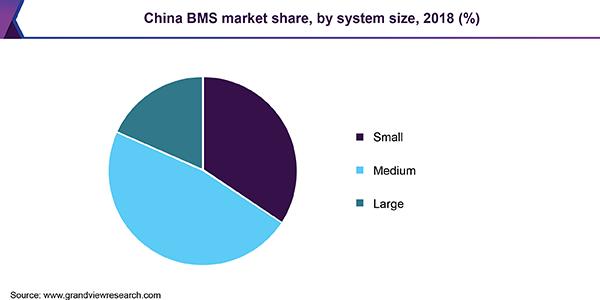

System Size Insights

Based on technology, the market for burner management systems has been categorized into small, medium, and large systems. Small burner management systems support an I/O range of approximately 20-50 I/Os, medium burner management systems support an I/O range of approximately 50-100 I/Os, and large burner management systems support an I/O range of approximately 100-200 I/Os. The medium burner management systems segment is expected to account for approximately 44% of the overall market share by 2025. The segment accounted for the dominant share of the market in 2018 as well.

The market for the large burner management system segment is expected to register the highest CAGR of nearly 7% over the forecast period. The start-up of a large industrial burner typically takes a lengthy purge time before ignition. After the purge time, the BMS ignites the burner or sometimes ignites the pilot (smaller burner), which, in turn, lights the main burner. Many industrial burners are usually managed by analog electronic control systems or electromechanical relay. The recent trend is toward microprocessor-based digital electronic controls.

Regional Insights

The North American regional market is expected to remain the leading contributor to the market for the burner management system over the next six years. The region accounted for approximately 33% of the overall market share in 2018. Steady growth in the regional oil & gas industry, coupled with the high technology adoption rate, is expected to drive the regional market over the forecast period.

The Middle East & Africa regional market for the burner management system is likely to witness the fastest growth over the forecast period. The growing demand for industrial boilers in the region is expected to drive the popularity of the burner management system significantly. Moreover, the region is witnessing a substantial increase in activities associated with the development and expansion of ultra-mega power projects, thereby resulting in the increased adoption of burner safety systems across the energy sector. The region accounted for more than 12% of the overall market share in 2018 and is expected to register a CAGR of nearly 8% from 2019 to 2025.

Burner Management System Market Share Insights

Leading players in this market include Siemens, Emerson Electric Co., Schneider Electric, ABB, Rockwell Automation, Inc., and Honeywell. Companies are focusing their efforts toward means to reduce the overall cost of BMS. Some of the top companies have started providing advanced systems that offer benefits such as redundancy management, built-in diagnostics, and error checking. Moreover, focus on the research and development of new technologies is expected to rise with the increasing need to enhance existing combustion safety systems.

Most system integrators in the market for a burner management system outsource the software and assemble the hardware parts locally. This enables them to supply new varieties of the burner management systems at low prices without compromising on specifications or project requirements. Industry players are also striving to develop low-emission burners without sacrificing on their product’s combustion efficiency. Many companies are developing new-age systems to reduce emissions and meet rigorous environmental regulations. For instance, in October 2017, Honeywell launched the XPO PAK System - a customized burner system in China to reduce NOx emissions of commercial and industrial boilers in the country.

Report Scope

Attribute

Details

The base year for estimation

2018

Actual estimates/Historical data

2015 - 2017

Forecast period

2019 - 2025

Market representation

Revenue in USD Million and CAGR from 2019 to 2025

Regional scope

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa (MEA)

Country scope

U.S., Canada, U.K., Germany, China, India, Japan, Brazil, and Mexico

Report coverage

Revenue forecasts, company market share, competitive landscape, growth factors, and trends

15% free customization scope (equivalent to 5 analyst working days)

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

Segments Covered in the reportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2015 to 2025. For this study, Grand View Research has segmented the global burner management system market report based on platform, fuel type, end-use, component, system size, application, and region:

-

Platform Outlook (Revenue, USD Million, 2015 - 2025)

-

Distributed Control System (DCS)

-

Programmable Logic Controller (PLC)

-

-

Fuel Type Outlook (Revenue, USD Million, 2015 - 2025)

-

Oil

-

Gas

-

Others

-

-

End-Use Outlook (Revenue, USD Million, 2015 - 2025)

-

Oil & Gas

-

Power

-

Chemical

-

Pharmaceutical

-

Others

-

-

Component Outlook (Revenue, USD Million, 2015 - 2025)

-

Hardware

-

Actuators & Controllers

-

Flame Detectors

-

Shut-Off Valves

-

Ignition Units

-

Alarms & Shutdowns

-

-

Software

-

-

System Size Outlook (Revenue, USD Million, 2015 - 2025)

-

Small

-

Medium

-

Large

-

-

Application Outlook (Revenue, USD Million, 2015 - 2025)

-

Single-Burner

-

Multiple-Burner

-

-

Regional Outlook (Revenue, USD Million, 2015 - 2025)

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."