- Home

- »

- Communications Infrastructure

- »

-

C4ISR Market Size, Share, Growth & Trends Report, 2030GVR Report cover

![C4ISR Market Size, Share & Trends Report]()

C4ISR Market Size, Share & Trends Analysis Report By Component, By Application, By End-use, By Vertical (Defense & Military, Government, Commercial), By Type, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-255-9

- Number of Pages: 125

- Format: Electronic (PDF)

- Historical Range: 2018 - 2023

- Industry: Technology

C4ISR Market Size & Trends

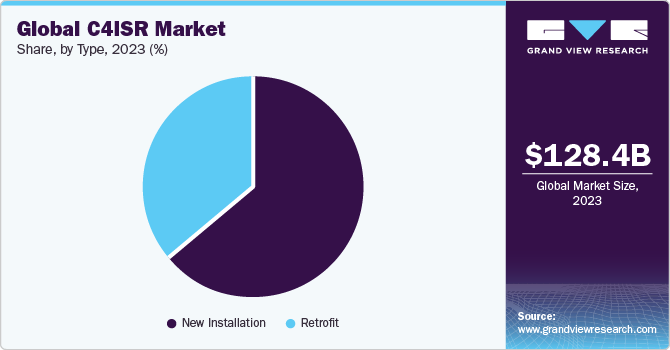

The global C4ISR market size was estimated at USD 128.39 billion in 2023 and is expected to grow at a CAGR of 3.7% from 2024 to 2030. The C4ISR (Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance) market stands at the forefront of technological innovation in defense systems. With an increasing focus on modernizing military operations, the market is witnessing a dynamic landscape shaped by the integration of advanced technologies. Artificial intelligence (AI) and machine learning (ML) play pivotal roles in data analysis, providing rapid and accurate insights for informed decision-making. The adoption of Internet of Things (IoT) devices enhances real-time data collection and connectivity, bolstering interoperability among C4ISR components.

AI and ML have emerged as transformative forces within the market. In the field of C4ISR, where vast amounts of data are generated from diverse sources, such as sensors, satellites, and communication networks, AI and ML technologies play a crucial role in processing and analyzing this information with unprecedented speed and accuracy. AI algorithms enable real-time pattern recognition, anomaly detection, and predictive analytics, contributing significantly to enhanced situational awareness for military operations. Machine learning, in particular, enables C4ISR systems to learn from historical data and adapt to evolving threats, providing decision-makers with valuable insights into potential risks and opportunities. These technologies are instrumental in automating tedious tasks, allowing military personnel to focus on strategic decision-making and mission-critical activities.

Moreover, AI-driven predictive modeling enhances mission planning and resource allocation, optimizing the overall efficiency and effectiveness of defense operations. Cybersecurity remains a paramount concern, with a growing emphasis on cyber resilience and secure communication to safeguard critical information. Satellite communication advancements, particularly in high-bandwidth capabilities, are addressing the need for global connectivity in military operations. Recognizing the inherent vulnerabilities, defense organizations worldwide are investing heavily in robust cybersecurity measures to safeguard sensitive information and ensure the uninterrupted functioning of critical communication channels. Encryption techniques are being implemented to secure data transmission, and secure communication protocols are employed to prevent unauthorized access.

Cyber resilience has become a cornerstone of C4ISR strategies, acknowledging that cyber threats are not only persistent but also adaptive. Furthermore, collaboration with cybersecurity experts and the development of innovative solutions are paramount in staying ahead of evolving cyber threats. Moreover, the industry is witnessing a shift towards cloud computing solutions, enabling the storage and processing of large datasets while facilitating remote access to critical information. Open architecture systems enhance interoperability, and sensor fusion technologies contribute to enhanced situational awareness. As international collaboration expands and defense budgets face constraints, the market continues to evolve, offering cost-effective solutions to meet the evolving demands of modern defense strategies.

Market Concentration & Characteristics

Market growth stage is high, and pace of the market growth is accelerating. The market is characterized by a high degree of innovation owing to the rapid technological advancements driven by factors, such as advancements in ML algorithms, application of AI, and increasing computing power. Subsequently, the Internet of Things (IoT) is increasingly being leveraged to enhance connectivity and interoperability within C4ISR systems. The deployment of IoT devices facilitates real-time data collection, sharing, and communication, contributing to a more responsive and agile defense infrastructure.

The market is also characterized by a significant level of merger and acquisition activity by the leading companies. As the industry undergoes rapid technological advancements and strives to meet evolving defense needs, major companies are strategically aligning through mergers and acquisitions. This trend aims to enhance overall capabilities, foster innovation, and consolidate market share, allowing companies to offer comprehensive C4ISR solutions and maintain a competitive edge in the dynamic defense sector.

The market is also subject to increasing regulatory scrutiny as governments and defense agencies recognize the critical importance of ensuring the security and compliance of these advanced systems. Heightened regulatory oversight aims to address concerns related to data privacy, cybersecurity, and the ethical use of emerging technologies within C4ISR frameworks. This regulatory focus features the need for industry stakeholders to adhere to stringent standards, fostering transparency and accountability in the development and deployment of these sophisticated command and control systems.

There are a limited number of direct product substitutes for C4ISR. However, several technologies can be used to achieve similar outcomes to C4ISR, such as advanced communication systems, surveillance technologies, and intelligence platforms developed by different manufacturers. These substitutes aim to provide comprehensive situational awareness and operational control in diverse environments. The choice of a substitute depends on specific mission requirements, technology capabilities, and the operational context.

End-user concentration is a significant factor in the market. A limited number of major end-users, often government entities, exert considerable influence on demand and procurement trends. This concentration can lead to market fluctuations and impact suppliers' strategies, pricing models, and innovation efforts. Understanding and navigating the preferences and requirements of these key end-users becomes crucial for companies operating in the C4ISR sector to maintain competitiveness and foster successful long-term partnerships.

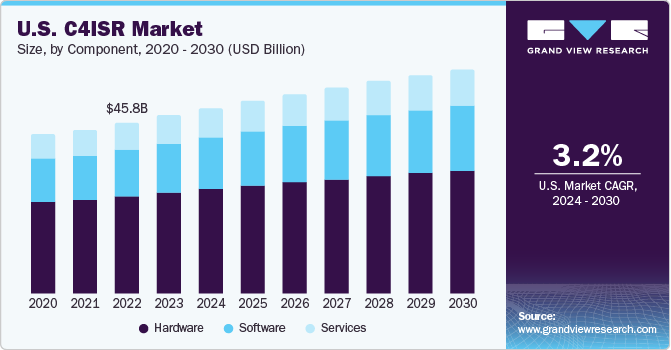

Component Insights

The hardware segment accounted for the largest share of 58% in 2023. Hardware components encompass a diverse range of equipment, including communication devices, sensors, computing systems, and networking infrastructure, all of which are integral to the seamless functioning of C4ISR systems. The robust demand for advanced hardware solutions stems from the critical need for reliable and high-performance equipment in military operations. Modern defense environments demand cutting-edge technology to support real-time data processing, secure communication, and the integration of diverse sensor data. As defense agencies worldwide continue to prioritize technological modernization, the hardware segment is expected to maintain its lead, driven by ongoing advancements in sensor technologies, communication equipment, and computing systems, reinforcing its pivotal role in enhancing military command and control capabilities.

The service segment is expected to register the fastest CAGR from 2024 to 2030. As technology continues to advance rapidly, the need for ongoing support, maintenance, and upgrades becomes increasingly critical. C4ISR systems are intricate, involving a blend of hardware, software, and communication components. Consequently, the demand for services such as system integration, training, consulting, and maintenance is anticipated to surge. Service providers play a pivotal role in ensuring the optimal functioning, cybersecurity, and adaptability of C4ISR systems. With the continuous evolution of threats and the imperative for real-time response capabilities, end-users are placing greater emphasis on services that enhance the operational efficiency and longevity of their C4ISR investments.

Application Insights

The intelligence, surveillance, and reconnaissance (ISR) segment accounted for the largest revenue share in 2023. The growing complexity of security challenges, coupled with the need for real-time, actionable intelligence, has propelled the demand for advanced ISR technologies. These technologies encompass a spectrum of sophisticated sensors, Unmanned Aerial Vehicles (UAVs), satellite systems, and ground-based surveillance tools. ISR capabilities enable defense forces to gather, analyze, and disseminate information swiftly, enhancing situational awareness and decision-making processes. As military strategies increasingly emphasize preventive and proactive approaches, the significance of ISR in providing a comprehensive understanding of the operational environment becomes paramount.

The computer segment is expected to register the fastest CAGR of over 3.7% from 2024 to 2030. This growth can be attributed to rising demand for advanced computing capabilities, data processing efficiency, and seamless connectivity in defense applications. As military operations increasingly rely on sophisticated technologies, the role of computers in C4ISR systems becomes pivotal. The evolving nature of modern warfare, characterized by information-centric approaches, necessitates powerful computing solutions to handle complex algorithms, artificial intelligence applications, and real-time data analysis.

End-use Insights

The air segment led the market in 2023. The increasing complexity of air operations, coupled with the rising adoption of UAVs and sophisticated airborne platforms, has propelled the demand for advanced C4ISR systems. These systems play a pivotal role in enhancing situational awareness, communication, and intelligence gathering within the aerospace domain. This segment contains a broad spectrum of applications, including manned and unmanned aircraft, helicopters, and other airborne platforms, each requiring seamless integration of C4ISR technologies. The need for real-time data exchange, target identification, and mission coordination has driven the deployment of advanced C4ISR solutions, consolidating the air segment's dominance.

The naval segment is expected to register the fastest CAGR from 2024 to 2030. This augmented growth can be attributed to the increasing emphasis on naval modernization and the integration of advanced technologies to bolster maritime capabilities. Naval forces worldwide are investing significantly in C4ISR systems to enhance their situational awareness, command and control capabilities, and overall operational effectiveness. The rising complexities in maritime security challenges, coupled with the need for real-time information in naval operations, are driving the demand for sophisticated C4ISR solutions.

Vertical Insights

The defense & military segment led the market in 2023. Investments in advanced technologies for situational awareness, communication, and data analysis have surged within the defense sector, as nations globally prioritize strengthening their defense capabilities. C4ISR systems enable seamless coordination of military activities, ensuring real-time information flow, strategic decision-making, and enhanced operational efficiency. The growing complexity of modern warfare, characterized by diverse threats and evolving challenges, has spurred the demand for sophisticated C4ISR solutions.

The government segment is expected to register the fastest CAGR from 2024 to 2030. Governments worldwide are increasingly recognizing the critical role of advanced command, control, and surveillance systems in addressing evolving security challenges. With rising geopolitical tensions and the need for enhanced situational awareness, there is a growing emphasis on modernizing defense and intelligence capabilities. Governments are allocating substantial budgets for the development and acquisition of C4ISR technologies to bolster national security.

Type Insights

The new installation type led the market in 2023. This installation type represents the implementation of fresh C4ISR systems, reflecting the increasing demand for cutting-edge technologies and modernization within the defense and security sectors. The new installation type encompasses the deployment of advanced sensor networks, communication systems, and integrated technologies to enhance situational awareness and decision-making. The emphasis on new installations signifies a commitment to staying ahead of technological curves, ensuring that defense forces are equipped with the latest tools to address modern security challenges effectively.

The retrofit type segment is projected to witness the highest CAGR of over 4% from 2024 to 2030. Retrofitting, the process of upgrading or enhancing existing systems with advanced technologies, gains prominence due to its cost-effectiveness and efficiency in modernizing legacy C4ISR infrastructure. As technological advancements progress at a rapid pace, retrofit solutions offer a strategic advantage, allowing defense organizations to leverage new capabilities without entirely replacing their current systems.

Regional Insights

The C4ISR market in North America accounted for the largest share of 39.0% in 2023. The U.S. military is strategically investing significant resources to bolster its C4ISR capabilities, aiming to secure a decisive edge in the ongoing technological competition with adversaries. This substantial commitment reflects a key priority in the nation's warfare strategy, with substantial funds dedicated to the development of advanced C4ISR solutions. In addition, the U.S. government is actively engaged in expanding and modernizing its current fleet of land, air, and sea platforms by integrating cutting-edge communication and situational awareness systems.

U.S. C4ISR Market Trends

The U.S. C4ISR market is expected to grow at a CAGR of 3% from 2024 to 2030 due to increasing demand for C4ISR across various industries, the market has witnessed significant growth in terms of both revenue and sales volume. This growth can be attributed to several factors, including technological advancements, rising consumer awareness, and increasing adoption of C4ISR in diverse applications.

Europe C4ISR Market Trends

The C4ISR market in Europe is anticipated to grow at a CAGR of 3.3% from 2024 to 2030 owing to the increasing adoption of C4ISR in various applications, rising demand for energy-efficient solutions, stringent government regulations, and increasing focus on reducing carbon emissions. Moreover, technological advancements and product innovations have also played a significant role in driving market growth in Europe.

The Germany C4ISR market is expected to witness a CAGR of 3.5% from 2024 to 2030. The German government has set ambitious targets for reducing greenhouse gas (GHG) emissions, which has led to increased demand for C4ISR products and solutions across various sectors. In addition, there has been a growing interest in energy storage solutions, which has further fueled the demand for C4ISR in Germany.

The C4ISR market in the UK is anticipated to grow at a CAGR of over 3.0% from 2024 to 2030. The demand for advanced C4ISR systems has been rising due to the changing nature of military operations and the need for real-time data analysis and decision-making. The market growth has also been supported by the increasing adoption of cloud-based solutions, big data analytics, and artificial intelligence in defense applications.

The France C4ISR market is expected to witness growth at a CAGR of 3.3% from 2024 to 2030. The growth of the France C4ISR market can be attributed to the increasing adoption of C4ISR technology in various industries, including energy, transportation, and critical infrastructure protection, for different applications, such as monitoring, surveillance, and disaster response, among others.

Asia Pacific C4ISR Market Trends

The C4ISR market in Asia Pacific is anticipated to witness significant growth at a CAGR of over 4.5% from 2024 to 2030. The rising defense budget of the major Asian economies primarily drives the growth. The growth is further fueled by advancements in battlefield communications and enhanced efficiency in surveillance and reconnaissance operations within the region. China, India, and Japan are projected to boost their demand for electronic warfare, demonstrating a significant commitment to refining their C4ISR capabilities for the future. This substantial investment is anticipated to have a positive impact on the overall market growth.

The China C4ISR market is expected to register a CAGR of over 4.6% from 2024 to 2030. The increasing demand for real-time data analysis and decision-making has further fueled the demand for advanced C4ISR systems in the country. Many companies in China are now focusing on developing innovative and efficient C4ISR products to meet the evolving needs of the defense sector.

The C4ISR market in Japan is expected to witness a CAGR of nearly 5% from 2024 to 2030. The growth is due to increased defense spending by the Japanese government on upgrading capabilities, adoption of advanced technologies due to rising regional security threats, deployment of new military communication infrastructure, etc.

The India C4ISR market is expected to witness high growth from 2024 to 2030. The market is driven by increased defense spending and modernization initiatives, the adoption of network-centric warfare doctrines, 'Make in India' policies boosting domestic manufacturing, and collaborations between Indian and global tech leaders.

Middle East & Africa (MEA) C4ISR Market Trends

The C4ISR market in MEA is anticipated to reach a value of USD 6.2 billion by 2030. Key factors driving its growth include rising defense spending in countries like Saudi Arabia, UAE, Egypt, etc., conflicts and security issues in the region fueling demand for advanced C4ISR capabilities, investments in border surveillance systems, strategic partnerships, and localization efforts boosting technology transfer.

The Saudi Arabia C4ISR market is the largest defense spender in the Middle East and has an active military modernization program, with C4ISR systems being a major area of investment. The KSA C4ISR market is expected to grow at a CAGR of 4.4% from 2024 to 2030. Major ongoing and planned defense spending includes the upgradation of command-and-control systems, airborne early warning & control aircraft, radar systems, satellites, establishing cyber defense centers, etc.

Key C4ISR Company Insights

Some of the key companies operating in the market include RTX Corporation, L3Harris Technologies, Inc., and Northrop Grumman among others.

-

RTX Corp. (Raytheon Technologies Corp.) is a technology company that provides communication systems, electronic warfare solutions, target acquisition, command & control solutions, and Intelligence, Surveillance, and Reconnaissance (ISR) systems. The company operates in the defense and homeland security arena. In April 2020, the company merged with United Technologies Corporation to form Raytheon Technologies and since July 2023, is known as RTX Corporation

-

L3Harris Technologies, Inc. is a technology company that designs communication systems; wireless equipment; avionics & electronic systems; and intelligence, surveillance, target acquisition, and reconnaissance (ISR) systems. The company caters to the defense and homeland security arena

Kratos Defense & Security Solutions, Inc., Saab AB, and CACI International Inc. are some of the emerging market participants in the C4ISR market.

-

Kratos Defense & Security Solutions, Inc., is a technology company specializing in directed-energy weapons, unmanned systems, satellite communications, cyber security/warfare, microwave electronics, missile defense, training, and combat systems

-

CACI International Inc. provides solutions and services for intelligence, defense, and federal civilian customers in support of government transformation and national security missions

Key C4ISR Companies:

The following are the leading companies in the C4ISR market. These companies collectively hold the largest market share and dictate industry trends.

- BAE Systems, Inc.

- CACI International Inc.

- Elbit Systems Ltd.

- General Dynamics

- Kratos Defense & Security Solutions, Inc.

- L3Harris Technologies, Inc.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Northrop Grumman

- Rheinmetall AG

- RTX Corporation (Raytheon Technologies Corporation)

- Saab AB

- Thales

Recent Developments

-

In July 2023, L3Harris Technologies, Inc and Leidos announced their collaboration today as they join forces for the U.S. Army's Theater Level High-Altitude Expeditionary Next Airborne - Signals Intelligence (ATHENA-S) proposal. This collaboration aims to provide two upgraded intelligence, surveillance, and reconnaissance (ISR) aircraft in alignment with the program's objectives

-

In April 2023, The U.S. Naval Information Warfare Systems Command, San Diego, awarded a contract of USD 537 million to BAE Systems plc, to design, command, control, and intelligence (C4I) services on surface ships. Under this contract, the company will provide C4I services and data transfer during the five phases of shipboard integration

-

In March 2022, the Qatari Emiri Naval Forces (QENF) chose Leonardo to provide a Naval Operation Centre (NOC) for overseeing command, control, and coordination of activities in territorial waters, the Exclusive Economic Zone (EEZ), and neighboring waters concurrently. This initiative aims to strengthen collaboration with diverse national agencies responsible for maritime security

-

In January 2021, Northrop Grumman announced the collaboration with Fujitsu and AT&T, to demonstrate 5G-enabled ISR capabilities in Northrop’s 5G lab. The demonstration integrates AT&T's private 5G network, radios with Northrop Grumman Corporation's tactical data links, and Fujitsu's O-RAN to deliver ISR video and data

C4ISR Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 134.29 billion

Revenue forecast in 2030

USD 166.75 billion

Growth rate

CAGR of 3.7% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, application, end-use, vertical, type, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Russia; China; Japan; India; South Korea; Australia; Brazil; Mexico; Saudi Arabia; UAE; South Africa

Key companies profiled

BAE Systems, Inc.; CACI International Inc.; Elbit Systems Ltd.; General Dynamics; Kratos Defense & Security Solutions, Inc.; L3Harris Technologies, Inc.; Leonardo S.p.A.; Lockheed Martin Corp.; Northrop Grumman; Rheinmetall AG; RTX Corp. (Raytheon Technologies Corp.); Saab AB; Thales

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global C4ISR Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global C4ISR market report based on component, application, end-use, vertical, type, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Command & Control

-

Communications

-

Computers

-

Intelligence, Surveillance and Reconnaissance (ISR)

-

Electronic Warfare

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Ground

-

Naval

-

Air

-

Space

-

-

Vertical Outlook (Revenue, USD Billion, 2018 - 2030)

-

Defense & Military

-

Government

-

Commercial

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

New Installation

-

Retrofit

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa (MEA)

-

Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global C4ISR market size was estimated at USD 128.39 billion in 2023 and is expected to reach USD 134.29 billion in 2024.

b. The global C4ISR market is expected to grow at a compound annual growth rate of 3.7% from 2024 to 2030 to reach USD 166.75 billion by 2030.

b. North America dominated the market and accounted for a 39.1% share in 2023. The U.S. military is strategically investing significant resources to bolster its C4ISR capabilities, aiming to secure a decisive edge in the ongoing technological competition with adversaries. This substantial commitment reflects a key priority in the nation's warfare strategy, with substantial funds dedicated to the development of advanced C4ISR solutions.

b. Some key players operating in the C4ISR market include BAE Systems, Inc., CACI International Inc, Elbit Systems Ltd, General Dynamics, Kratos Defense & Security Solutions, Inc., L3Harris Technologies, Inc., and Leonardo S.p.A., among others.

b. The market's growth can be credited to the rapid technological advancements driven by factors such as advancements in machine learning algorithms, the application of artificial intelligence, and increasing computing power. Subsequently, the IoT is increasingly being leveraged to enhance connectivity and interoperability within C4ISR systems.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."