- Home

- »

- Consumer F&B

- »

-

Camel Milk Products Market Size, Industry Report, 2020-2027GVR Report cover

![Camel Milk Products Market Size, Share & Trends Report]()

Camel Milk Products Market Size, Share & Trends Analysis Report By Product (Plain, Flavored, Powder, Ice Cream, Fermented), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68038-430-7

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2016 - 2018

- Industry: Consumer Goods

Report Overview

The global camel milk products market size to be valued at USD 18.3 billion by 2027 and is expected to grow at a compound annual growth rate (CAGR) of 6.8% during the forecast period. The increasing popularity of camel milk due to its easy-to-digest property among lactose-intolerant consumers is expected to have a positive impact on the industry. Aside from this, the milk is considered more nutritive as compared to cow milk as it contains higher quantities of copper, iron, sodium, potassium, magnesium, manganese, and vitamin A and C.

It is one of the most nutritious dairy beverages, which includes natural probiotic in it. Camel milk helps improve systemic immunity and gastrointestinal health. The drink has low-fat content, which is about only 2 to 3%, as compared to cow dairy, and thus, is expected to attract more health-conscious consumers who are checking their calorie intake. In addition, it aids infants and children, as it is the closest substitute for breastmilk. In various nations in the Middle East and Africa, it is used to feed undernourished children.

Camel milk is conventionally consumed in raw or fermented forms. However, with growing number of urban consumers, manufacturers are diversifying their offerings to cater to this population. Ice cream, flavored beverage, chocolate, and sweets are gaining popularity among nations including markets in Saudi Arabia, UAE, Kazakhstan, Morocco, Algeria, India, Egypt, Mauritania, and Australia. Thus, the market has a wide opportunity in terms of product innovation owing to increasing demand in the emerging and untapped markets.

Camel milk products are relatively expensive as compared to the traditional cattle dairy items due to high production costs. Camelicious sells milk for USD 13 per liter in Europe, whereas, the cow dairy drink costs around USD 0.40 per liter. Similarly, Desert Farms offers USD 35 per liter in the U.S., while cow milk is priced at around USD 0.80 per liter. The high price of camel milk products as compared to other counterparts is expected to hamper the market growth in the coming years.

Camel Milk Products Market Trends

The growing demand for pasteurized milk products, the adoption of camel milk products with unique flavors, and the increasing availability of quality powdered milk via online channels around the globe are all driving the development of the camel milk product market. Moreover, autistic patients are drinking more camel milk, and the demand from lactose-intolerant persons is rising.

Camel milk contains more iron and vitamin C than cow's milk. Additionally, camel milk is lower in cholesterol, fat, and protein. Camel milk products are continuously gaining popularity all over the world as a result of their nutrient-rich properties.

Camel milk is significantly more expensive than traditional cow milk as camel milk supply is lower than cow milk, and camel breeding costs are considerably greater than cow breeding costs. Thus, pricing factors restrict camel milk products' growth over cow's milk products.

Camel milk is usually consumed fresh or fermented. As the number of urban consumers increases, manufacturers are expanding their offers to respond to this market. The industry offers numerous opportunities for product innovation with increasing research activities for various applications of camel milk. Thus, it is expected to provide numerous opportunities leading to the camel milk product market over the forecast period.

Distribution Channel Insights

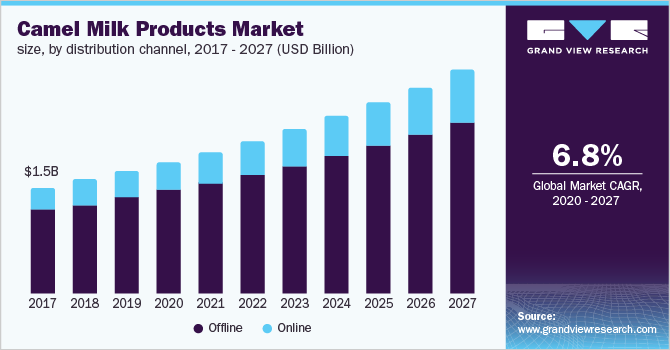

Offline distribution channel accounted for more than 80% of the global camel milk products market revenue. Consumers prefer to purchase dairy products owing to their short shelf life and daily requirement. Among the offline distribution channel, large retailers such as supermarkets & hypermarkets accounted for the major share owing to wide product range and attractive discounts. These stores, such as Whole Foods Market, has streamlined the distribution and expanded the reach of camel milk dairy products across the world.

On the other hand, the online distribution channel is anticipated to expand at the fastest CAGR of 8.6% from 2020 to 2027 on account of increasing familiarity and dependence of generation X, millennials, and generation Z on the internet and e-commerce. A variety of features including several value-added services such as discounted prices, cash-on-delivery, and paybacks offered by e-retailers as well as product return facilities are expected to promote the growth of online channels in the upcoming years.

Product Insights

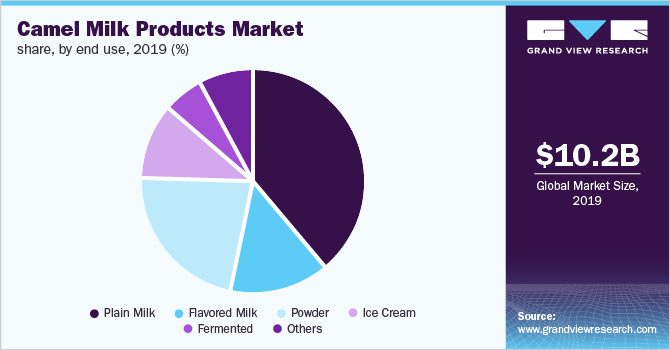

The plain and flavored milk segments together accounted for more than 55% of the total revenue in 2019. These products have been helping to sustain the nomadic societies and Bedouin for centuries. Plain milk is considered as a cultural and traditional drink of the Middle Eastern countries. Therefore, a large part of the product is consumed raw or plain. Over the past few years, the derivatives, including powder, yogurt, cheese, butter, ice creams, chocolates, infant formula, and even beauty products have been gaining popularity over the world.

Players in the industry are diversifying their product lines in order to secure their profit margins. The production of camel milk requires high investments and it has to compete with the well-established cattle’s milk market, thus diverse product portfolio is important for the industry players. Companies, including Camelicious, have their own in-house cheese production facility. In addition, camel infant formula is a close substitute for breastmilk as it has similar lactose content. For instance, Camelicious supplies the powdered form products of camel milk to a children’s hospital in Mexico for the lactose intolerant babies.

Regional Insights

Middle East and Africa dominated the market in 2019 with more than 60% share of the global revenue. Somalia, Kenya, Mali, Ethiopia, Saudi Arabia, and Niger are the major camel milk-producing countries in the world, where Somalia and Kenya accounted for over 60% of the production. Moreover, in terms of consumption, Saudi Arabia is the largest market in the world, where per capita consumption is around 33 liters per year. In addition, Somalia, Ethiopia, Sudan, and Kenya also have a high per capita consumption rate in the region.

North America is expected to expand at the fastest growth rate over the forecast period. The adoption of camel milk has been rising among the diabetic consumers of the U.S. and Canada owing to its low sugar content. As a result, companies of the industry are strengthening their supply in these nations through both offline and online retailers. The majority of these stores offer frozen drinks rather than fresh ones.

Key Companies & Market Share Insights

Key camel milk products manufacturers include Camelicious; Desert Farms, Inc.; The Camel Milk Co.; VITAL CAMEL MILK LTD; Camel Dairy Farm Smits; Al Ain Farms; Tiviski Pvt Ltd.; UK Camel Milk Ltd.; Aadvik Foods; and QCamel. The producers are expected to expand their production capacity in the upcoming years by increasing their herd size in order to meet the rising demand. Furthermore, emerging markets such as the U.S., China, India, and Russia are expected to widen the scope for the manufacturers in the upcoming years.

Moreover, companies have been expanding their portfolio in order to increase their consumer base. For instance, in November 2019, Aadvik Foods launched a powder form of camel milk. This powder is made using the freeze-drying process, which preserves the naturally occurring properties of the milk. The company is also planning to add sugar-free chocolates in its portfolio in the upcoming years.

Recent Development

In October 2020, Amul expanded its range of camel dairy products with the launch of camel milk ice cream and camel powder. Amul declares that its latest camel milk ice cream is made purely of camel milk. It contains no flavorings or colors, offering ice cream with a unique flavor of camel milk.

Camel Milk Products Market Report Scope

Report Attribute

Details

Revenue forecast in 2027

USD 18.3 billion

Growth rate

CAGR of 6.8% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD million/billion and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; U.K.; China; India; Saudi Arabia; Sudan

Key companies profiled

Camelicious; Desert Farms, Inc.; The Camel Milk Co.; VITAL CAMEL MILK LTD; Camel Dairy Farm Smits; Al Ain Farms; Tiviski Pvt Ltd.; UK Camel Milk Ltd.; Aadvik Foods; QCamel.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Camel Milk Products Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global camel milk products market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2016 - 2027)

-

Plain Milk

-

Flavored Milk

-

Powder

-

Ice Cream

-

Fermented

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2016 - 2027)

-

Offline

-

Online

-

-

Region Outlook (Revenue, USD Million, 2016 - 2027)

-

North America

-

The U.S.

-

-

Europe

-

Germany

-

The U.K.

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Middle East & Africa

-

Saudi Arabia

-

Sudan

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."