- Home

- »

- Petrochemicals

- »

-

Carbon Black Market Size, Share And Growth Report, 2030GVR Report cover

![Carbon Black Market Size, Share & Trends Report]()

Carbon Black Market Size, Share & Trends Analysis Report By Type, By Application (Tire, Non- Tire Rubber, Plastics, Inks & Coatings, Other), By Grade, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-802-2

- Number of Pages: 92

- Format: Electronic (PDF)

- Historical Range: 2018 - 2023

- Industry: Bulk Chemicals

Carbon Black Market Size & Trends

The global carbon black market size was valued at USD 22.35 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 4.8% from 2024 to 2030. Rising product usage in the production of plastics is anticipated to drive growth. Moreover, the rising usage of these plastics in electrical and electronic components will boost product demand. It is produced either by thermal decomposition or partial combustion method, which includes oil or natural gas as a feedstock. It is produced by four different processes, which are the furnace black process, channel process, acetylene black process, and Lampblack process.

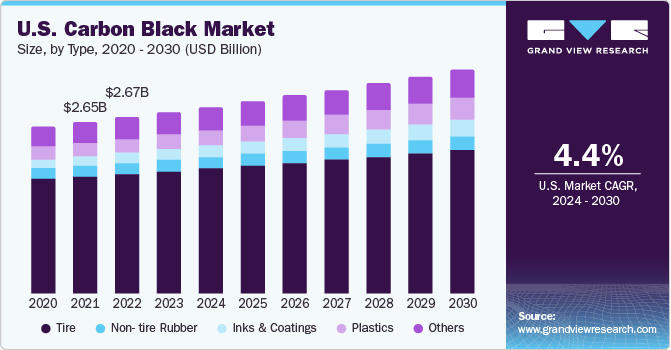

Growing environmental concerns coupled with the developing automotive industry is expected to drive the growth of the U.S. market. The refurbishing trend has resulted in increased demand for high-performance coatings in automotive as well as other industries, such as marine, aerospace, and industrial.

The product helps improve the strength and longevity of tires by providing better abrasion resistance and tensile strength. Also, growing construction and manufacturing sectors utilizing industrial rubber and equipment are anticipated to positively impact the demand over the forecast period.

Carbon black market prices are mainly based on raw materials, auxiliary materials, and utilities. The crude oil price fluctuation has a major impact on the pricing of carbon black. Some other macro-level factors influencing the price include working capital and pre-operational costs. The installation and setup, capitalized interests, project engineering and management, and commissioning costs are included under the pre-occupational costs.

Carbon black is formed by incomplete combustion of different petroleum-based constituents. It is an essential component for a range of end-use applications such as consumer goods, automobiles, appliances, electronics, and others. Since it is a petroleum-derived product the manufacturers rely on sourcing their key raw materials at the right prices with no supply hindrance. Raw materials are critically selected by the manufacturers depending on their product quality, offering price, product portfolio holding, and market accessibility.

Market Concentration & Characteristics

The carbon black market is fragmented in nature with the presence of large number of domestic and global players operating in the market. Market players are adopting the product differentiation strategy that insulates them from price wars. The merger and acquisition activity in the market has been high for the past few years. Tokai Carbon has been leading the way as it has acquired a majority stake in 3 companies in the past 3 years. Growing automotive sales together with the implementation of progressive technologies in tire manufacturing are further estimated to fuel market progress in the region. Mounting high-performance coatings consumption in the aerospace and defense industry is anticipated to remain a key growth driving factor. Carbon blacks are cautiously aimed to transmute electrical characteristics from insulating to conductive in goods such as safety applications, and automotive parts. Carbon black for packaging market is used for electronic packaging.

The market dynamics are largely dependent on the usage of rubber, electronic discharge compounds, and inks along with several regulations formulated for manufacturing technologies and raw materials used. The market is also influenced by the regulatory laws put in place by major North American and European government bodies. Within this industry, transportation is poised to be the dominant segment over the next seven years owing to the increasing demand for tires and rubber.

For instance, in November 2022, OCI announced the approval of the spin-off of the organization’s primary business in the chemical & carbon chemical sectors and the development of a new organization. In the sector of carbon chemicals, the new firm plans to fabricate a portfolio of high-value-added carbon products, and execute new businesses, including highly conductive carbon black deployed for conductive additives for rechargeable batteries and high-voltage cables.

Grade Insights

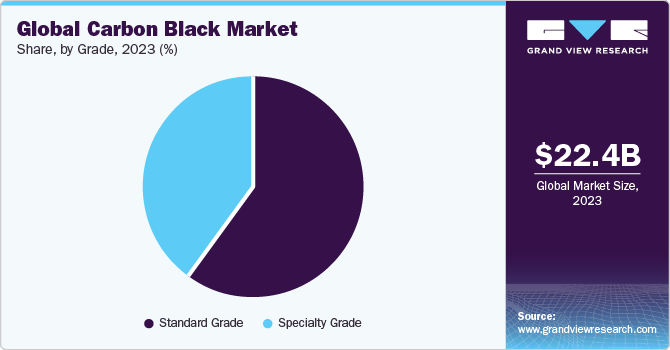

There are two grades: standard grade, and specialty grade carbon black. The standard grade segment dominated the market and accounted for the largest revenue share of over 60% in 2023. The segment is projected to grow owing to increasing demand for rubber and plastics across various industries, coupled with technological advancements and quest sustainable solutions. Standard grade is expected to grow due to standard grades wide range of applications in tire rubber, non-tire rubber, inks and coatings and plastics. Specialty grade carbon black market also held the significant share in the market.

Type Insights

Furnace Black dominated the market and accounted for a share of over 40% in 2023. Furnace black is the most commonly used method owing to its maximum production capacity. Industrially, it is produced by the combustion of heavy petroleum products, such as coal tar and Fluid Catalytic Cracking (FCC) tar, with vegetable oil. The U.S. tire industry is expected to witness a surge in demand owing to increasing automotive sales in the country. Tire manufacturers in the region are establishing new units in the vicinity of automobile production centers. Moreover, the quick adoption of advanced technologies in tire production is further expected to fuel market growth.

Application Insights

Tires emerged as a dominant application segment accounting for 68.8% of the overall revenue share in 2023. The product is widely used in tire manufacturing by adding rubber as a strengthening agent and as a filler. It is used in carcasses, inner liners, treads, and sidewalls utilizing different types based on specific performance requirements.

The plastics segment emerged as the fastest-growing segment in 2023. Carbon blacks are widely used for films, conductive packaging, moldings, fibers, semi-conductive cable compounds, and pipes in products, such as industrial bags, refuse sacks, stretch wraps, agriculture mulch film, and photographic containers. It is used in the production of conductive plastics as it exhibits antistatic and electrical conductivity properties.

Regional Insights

Asia Pacific carbon black market led the global market with a revenue share of 63.3% in 2023 followed by Europe and North America. Stringent environmental regulation may harm the North America and European markets. However, the high demand for tire manufacturing is expected to support the market. High economic growth along with rapid industrialization and urbanization in the emerging regions of Asia Pacific has boosted the regional demand. Rising foreign investments and favorable regulatory policies are also contributing to market growth. The region is rapidly transforming into a manufacturing hub, which has increased the demand for the material over the past few years.

India carbon black market

Major manufacturers are shifting their manufacturing facilities to countries like India, and Vietnam, as they have lower labor costs and support from the respective governments.

China carbon black market

Rising automotive production is also expected to drive product demand over the forecast period. Initially, the chemical was exported to developing countries like China, but with a rise in their production capacities, the exports have reduced.

U.S. carbon black market

North America carbon black market is dominated by the U.S., both in terms of product consumption and production. The demand for tires in North America has increased with a rise in the number of tires being replaced every year. Moreover, the constant recovery of ongoing construction and automobile industries giving rise to the demand for paints, coatings, and non-tire rubber will drive the market further. Plastics manufactured from carbon black are lightweight and thus help reduce carbon emissions and fuel consumption. North America is expected to witness significant demand over the forecast period over the forecast period owing to increasing tire, rubber, and high-performance coatings demand from end-use industries.

Europe carbon black market

Europe is characterized by favorable regulatory policies regarding plastics usage in automotive component applications. Additionally, automotive OEMs in the region are actively incorporating thermoplastics as a substitute for metals to provide automobiles with better performance and fuel efficiency while reducing the overall curb weight of the vehicle. These factors are expected to drive demand for carbon black in automotive applications.

Key Companies & Market Share Insights

Key companies are adopting several organic and inorganic growth strategies, such as capacity expansion, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

-

In June 2023, Bridgestone Corporation announced the commencement of the development of tire-derived oil and recovered carbon black via pyrolysis of worn tires with the help of test units established at the Bridgestone Innovation Park in Tokyo. This is aimed at encouraging the social deployment of chemical recycling technologies that allow the efficient pyrolysis of worn tires.

-

In April 2023, Orion Engineered Carbons announced the implementation of its new cogeneration technology producing renewable energy in its Ivanhoe plant (Louisiana, U.S.). The system comprises a steam turbine generator, which ingests the waste steam from the production process of the carbon black plant and alters it to electricity.

-

In March 2023, Tokai Carbon Co., Ltd. entered into a strategic partnership with Sekisui Chemical Co., Ltd., for the real-world application of the Carbon Capture and Utilization (CCU) technology. This deal was aimed at manufacturing varied carbon products and materials for the capture and storage of carbon dioxide (CO2) as solid carbon.

Key Carbon Black Companies:

- Orion Engineered Carbons Holdings GmbH

- OMSK Carbon Group

- Sid Richardson Carbon & Energy Co.

- Tokai Carbon Co. Ltd.

- Asahi Carbon Co. Ltd.

- Ralson Goodluck Carbon

- Atlas Organic Pvt. Ltd.

- Continental Carbon Co.

- OCI Company Ltd.

- Birla Carbon

- Bridgestone Corp.

- Cabot Corp.

- China Synthetic Rubber Corporation (CSRC)

- Himadri Companies & Industries Ltd. (HCIL)

- Mitsubishi Chemicals

- Nippon Steel & Sumikin Chemical Co. Ltd.

- Jiangxi Black Cat Carbon Black Inc.

Carbon Black Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 23.39 billion

Revenue forecast in 2030

USD 31.04 billion

Growth rate

CAGR of 4.8% from 2024 to 2030

Base year of estimation

2023

Historical data

2018 - 2023

Forecast period

2024 - 2030

Report updated

January 2024

Quantitative Units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, application, grade, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; Russia; China; India; Japan; Indonesia; Malaysia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Orion Engineered Carbons Holding GmbH; OMSK Carbon Group; Tokai Carbon Co. Ltd.; Bridgestone Corp.; Atlas Organic Pvt. Ltd.; Birla Carbon

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Carbon Black Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides a carbon black market analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global carbon black market report based on type, application, grade, and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Furnace Black

-

Channel Black

-

Thermal Black

-

Acetylene Black

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Tire

-

Non- tire Rubber

-

Plastics

-

Inks & Coatings

-

Others

-

-

Grade Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Standard Grade

-

Specialty Grade

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Indonesia

-

Malaysia

-

Thailand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global carbon black market size was estimated at USD 21.36 billion in 2022 and is expected to reach USD 22.34 billion in 2023.

b. The global carbon black market is expected to grow at a compound annual growth rate of 4.8% from 2023 to 2030 to reach USD 31.04 billion by 2030.

b. Tires emerged as a dominant application segment accounting for 68.8% of the overall revenue in 2022. The product is widely used in tire manufacturing by adding it to rubber as a strengthening agent and as a filler

b. Some of the key players in the carbon black market include Orion Engineered Carbons Holdings GmbH, OMSK Carbon Group, Sid Richardson Carbon & Energy Co., Tokai Carbon Co. Ltd., Asahi Carbon Co. Ltd., Ralson Goodluck Carbon, Atlas Organic Pvt. Ltd., Continental Carbon Co., OCI Company Ltd.

b. Rising usage of carbon black in the production of plastics is anticipated to drive the global market over the forecast period. Moreover, the rising usage of these plastics in electrical and electronic components will boost the product demand further

Table of Contents

Chapter 1. Carbon Black Market: Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Market Definition

1.3. Information Procurement

1.3.1. Purchased Database

1.3.2. GVR’s Internal Database

1.3.3. Secondary Sources & Third-Party Perspectives

1.3.4. Primary Research

1.4. Information Analysis

1.4.1. Data Analysis Models

1.5. Market Formulation & Data Visualization

1.6. Data Validation & Publishing

Chapter 2. Carbon Black Market: Executive Summary

2.1. Market Insights

2.2. Segmental Outlook

2.3. Competitive Outlook

Chapter 3. Carbon Black Market: Variables, Trends & Scope

3.1. Global Carbon Black Market Outlook

3.2. Industry Value Chain Analysis

3.2.1. Raw Material Trends

3.2.2. Manufacturing/Technology Trends

3.2.3. Sales Channel Analysis

3.3. Regulatory Framework

3.4. Market Dynamics

3.4.1. Market Driver Analysis

3.4.2. Market Restraint Analysis

3.4.3. Industry Challenges

3.4.4. Industry Opportunity

3.5. Porter’s Five Forces Analysis

3.5.1. Supplier Power

3.5.2. Buyer Power

3.5.3. Substitution Threat

3.5.4. Threat from New Entrant

3.5.5. Competitive Rivalry

3.6. PESTEL Analysis

3.6.1. Political Landscape

3.6.2. Economic Landscape

3.6.3. Social Landscape

3.6.4. Technological Landscape

3.6.5. Environmental Landscape

3.6.6. Legal Landscape

Chapter 4. Carbon Black Market: Supplier Portfolio Analysis

4.1. List of Key Raw Material Suppliers

4.2. Raw Material Trends

4.3. Portfolio Analysis/Kraljic Matrix

4.4. Engagement Model

4.5. Negotiation Strategies

4.6. Sourcing Best Practices

Chapter 5. Carbon Black Market: Type Outlook Estimates & Forecasts

5.1. Carbon Black Market: Type Movement Analysis, 2023 & 2030

5.2. Furnace Black

5.2.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

5.3. Channel Black

5.3.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

5.4. Thermal Black

5.4.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

5.5. Acetylene Black

5.5.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

5.6. Others

5.6.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

Chapter 6. Carbon Black Market: Application Outlook Estimates & Forecasts

6.1. Carbon Black Market: Application Movement Analysis, 2023 & 2030

6.2. Tire

6.2.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

6.3. Non-Tire Rubber

6.3.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

6.4. Plastics

6.4.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

6.5. Inks & Coatings

6.5.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

6.6. Others

6.6.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

Chapter 7. Carbon Black Market: Grade Outlook Estimates & Forecasts

7.1. Carbon Black Market: Grade Movement Analysis, 2023 & 2030

7.2. Standard Grade

7.2.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

7.3. Specialty Grade

7.3.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

Chapter 8. Carbon Black Market Regional Outlook Estimates & Forecasts

8.1. Regional Snapshot

8.2. Carbon Black Market: Regional Movement Analysis, 2023 & 2030

8.3. North America

8.3.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.3.2. Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

8.3.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

8.3.4. Market estimates and forecast, by grade, 2018 - 2030 (USD Million) (Kilotons)

8.3.5. U.S.

8.3.5.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.3.5.2. Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

8.3.5.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

8.3.5.4. Market estimates and forecast, by grade, 2018 - 2030 (USD Million) (Kilotons)

8.3.6. Canada

8.3.6.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.3.6.2. Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

8.3.6.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

8.3.6.4. Market estimates and forecast, by grade, 2018 - 2030 (USD Million) (Kilotons)

8.3.7. Mexico

8.3.7.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.3.7.2. Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

8.3.7.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

8.3.7.4. Market estimates and forecast, by grade, 2018 - 2030 (USD Million) (Kilotons)

8.4. Europe

8.4.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.4.2. Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

8.4.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

8.4.4. Market estimates and forecast, by grade, 2018 - 2030 (USD Million) (Kilotons)

8.4.5. Germany

8.4.5.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.4.5.2. Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

8.4.5.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

8.4.5.4. Market estimates and forecast, by grade, 2018 - 2030 (USD Million) (Kilotons)

8.4.6. France

8.4.6.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.4.6.2. Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

8.4.6.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

8.4.6.4. Market estimates and forecast, by grade, 2018 - 2030 (USD Million) (Kilotons)

8.4.7. UK

8.4.7.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.4.7.2. Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

8.4.7.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

8.4.7.4. Market estimates and forecast, by grade, 2018 - 2030 (USD Million) (Kilotons)

8.4.8. Russia

8.4.8.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.4.8.2. Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

8.4.8.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

8.4.8.4. Market estimates and forecast, by grade, 2018 - 2030 (USD Million) (Kilotons)

8.4.9. Italy

8.4.9.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.4.9.2. Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

8.4.9.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

8.4.9.4. Market estimates and forecast, by grade, 2018 - 2030 (USD Million) (Kilotons)

8.4.10. Spain

8.4.10.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.4.10.2. Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

8.4.10.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

8.4.10.4. Market estimates and forecast, by grade, 2018 - 2030 (USD Million) (Kilotons)

8.5. Asia Pacific

8.5.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.5.2. Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

8.5.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

8.5.4. Market estimates and forecast, by grade, 2018 - 2030 (USD Million) (Kilotons)

8.5.5. China

8.5.5.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.5.5.2. Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

8.5.5.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

8.5.5.4. Market estimates and forecast, by grade, 2018 - 2030 (USD Million) (Kilotons)

8.5.6. India

8.5.6.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.5.6.2. Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

8.5.6.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

8.5.6.4. Market estimates and forecast, by grade, 2018 - 2030 (USD Million) (Kilotons)

8.5.7. Japan

8.5.7.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.5.7.2. Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

8.5.7.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

8.5.7.4. Market estimates and forecast, by grade, 2018 - 2030 (USD Million) (Kilotons)

8.5.8. Indonesia

8.5.8.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.5.8.2. Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

8.5.8.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

8.5.8.4. Market estimates and forecast, by grade, 2018 - 2030 (USD Million) (Kilotons)

8.5.9. Malaysia

8.5.9.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.5.9.2. Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

8.5.9.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

8.5.9.4. Market estimates and forecast, by grade, 2018 - 2030 (USD Million) (Kilotons)

8.5.10. Thailand

8.5.10.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.5.10.2. Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

8.5.10.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

8.5.10.4. Market estimates and forecast, by grade, 2018 - 2030 (USD Million) (Kilotons)

8.6. Central & South America

8.6.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.6.2. Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

8.6.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

8.6.4. Market estimates and forecast, by grade, 2018 - 2030 (USD Million) (Kilotons)

8.6.5. Brazil

8.6.5.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.6.5.2. Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

8.6.5.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

8.6.5.4. Market estimates and forecast, by grade, 2018 - 2030 (USD Million) (Kilotons)

8.6.6. Argentina

8.6.6.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.6.6.2. Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

8.6.6.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

8.6.6.4. Market estimates and forecast, by grade, 2018 - 2030 (USD Million) (Kilotons)

8.7. Middle East & Africa

8.7.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.7.2. Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

8.7.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

8.7.4. Market estimates and forecast, by grade, 2018 - 2030 (USD Million) (Kilotons)

8.7.5. South Africa

8.7.5.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.7.5.2. Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

8.7.5.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

8.7.5.4. Market estimates and forecast, by grade, 2018 - 2030 (USD Million) (Kilotons)

8.7.6. Saudi Arabia

8.7.6.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.7.6.2. Market estimates and forecast, by type, 2018 - 2030 (USD Million) (Kilotons)

8.7.6.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

8.7.6.4. Market estimates and forecast, by grade, 2018 - 2030 (USD Million) (Kilotons)

Chapter 9. Competitive Landscape

9.1. Recent Developments & Impact Analysis, By Key Market Participants

9.2. Company Categorization

9.3. Company Market Share Analysis, 2023

9.4. Company Heat Map Analysis

9.5. Vendor Landscape

9.5.1. List of channel partners and distributors

9.5.2. List of potential end-users

9.6. Strategy Mapping

9.7. Company Profiles/Listing

9.7.1. Orion Engineered Carbons Holdings GmbH

9.7.1.1. Company Overview

9.7.1.2. Financial Performance

9.7.1.3. Product Benchmarking

9.7.2. OMSK Carbon Group

9.7.2.1. Company Overview

9.7.2.2. Financial Performance

9.7.2.3. Product Benchmarking

9.7.3. Sid Richardson Carbon & Energy Co.

9.7.3.1. Company Overview

9.7.3.2. Financial Performance

9.7.3.3. Product Benchmarking

9.7.4. Tokai Carbon Co. Ltd.

9.7.4.1. Company Overview

9.7.4.2. Financial Performance

9.7.4.3. Product Benchmarking

9.7.5. Asahi Carbon Co. Ltd.

9.7.5.1. Company Overview

9.7.5.2. Financial Performance

9.7.5.3. Product Benchmarking

9.7.6. Ralson Goodluck Carbon

9.7.6.1. Company Overview

9.7.6.2. Financial Performance

9.7.6.3. Product Benchmarking

9.7.7. Atlas Organic Pvt. Ltd.

9.7.7.1. Company Overview

9.7.7.2. Financial Performance

9.7.7.3. Product Benchmarking

9.7.8. Continental Carbon Co.

9.7.8.1. Company Overview

9.7.8.2. Financial Performance

9.7.8.3. Product Benchmarking

9.7.9. OCI Company Ltd.

9.7.9.1. Company Overview

9.7.9.2. Financial Performance

9.7.9.3. Product Benchmarking

9.7.10. Birla Carbon

9.7.10.1. Company Overview

9.7.10.2. Financial Performance

9.7.10.3. Product Benchmarking

9.7.11. Bridgestone Corp.

9.7.11.1. Company Overview

9.7.11.2. Financial Performance

9.7.11.3. Product Benchmarking

9.7.12. Cabot Corp.

9.7.12.1. Company Overview

9.7.12.2. Financial Performance

9.7.12.3. Product Benchmarking

9.7.13. China Synthetic Rubber Corporation (CSRC)

9.7.13.1. Company Overview

9.7.13.2. Financial Performance

9.7.13.3. Product Benchmarking

9.7.14. Himadri Companies & Industries Ltd. (HCIL)

9.7.14.1. Company Overview

9.7.14.2. Financial Performance

9.7.14.3. Product Benchmarking

9.7.15. Mitsubishi Chemicals

9.7.15.1. Company Overview

9.7.15.2. Financial Performance

9.7.15.3. Product Benchmarking

9.7.16. Nippon Steel & Sumikin Chemical Co. Ltd.

9.7.16.1. Company Overview

9.7.16.2. Financial Performance

9.7.16.3. Product Benchmarking

9.7.17. Jiangxi Black Cat Carbon Black Inc.

9.7.17.1. Company Overview

9.7.17.2. Financial Performance

9.7.17.3. Product Benchmarking

List of Tables

Table 1 Carbon Black market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 2 Carbon Black market estimates and forecasts, by furnace black, 2018 - 2030 (USD Million) (Kilotons)

Table 3 Carbon Black market estimates and forecasts, by channel black, 2018 - 2030 (USD Million) (Kilotons)

Table 4 Carbon Black market estimates and forecasts, by thermal black, 2018 - 2030 (USD Million) (Kilotons)

Table 5 Carbon Black market estimates and forecasts, acetylene black, 2018 - 2030 (USD Million) (Kilotons)

Table 6 Carbon Black market estimates and forecasts, in tire, 2018 - 2030 (USD Million) (Kilotons)

Table 7 Carbon Black market estimates and forecasts, in non-tire rubber, 2018 - 2030 (USD Million) (Kilotons)

Table 8 Carbon Black market estimates and forecasts, in plastics, 2018 - 2030 (USD Million) (Kilotons)

Table 9 Carbon Black market estimates and forecasts, in inks & coatings, 2018–2030 (USD Million) (Kilotons)

Table 10 Carbon Black market estimates and forecasts, in others, 2018–2030 (USD Million) (Kilotons)

Table 11 Standard grade Carbon Black market estimates and forecasts, 2018–2030 (USD Million) (Kilotons)

Table 12 Specialty Grade Carbon Black market estimates and forecasts, 2018–2030 (USD Million) (Kilotons)

Table 13 North America Carbon Black market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 14 North America Carbon Black market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 15 North America Carbon Black market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 16 North America Carbon Black market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 17 North America Carbon Black market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 18 North America Carbon Black market estimates and forecasts, by grade, 2018 - 2030 (USD Million)

Table 19 North America Carbon Black market estimates and forecasts, by grade, 2018 - 2030 (Kilotons)

Table 20 U.S. Carbon Black market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 21 U.S. Carbon Black market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 22 U.S. Carbon Black market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 23 U.S. Carbon Black market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 24 U.S. Carbon Black market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 25 U.S. Carbon Black market estimates and forecasts, by grade, 2018 - 2030 (USD Million)

Table 26 U.S. Carbon Black market estimates and forecasts, by grade, 2018 - 2030 (Kilotons)

Table 27 Canada Carbon Black market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 28 Canada Carbon Black market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 29 Canada Carbon Black market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 30 Canada Carbon Black market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 31 Canada Carbon Black market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 32 Canada Carbon Black market estimates and forecasts, by grade, 2018 - 2030 (USD Million)

Table 33 Canada Carbon Black market estimates and forecasts, by grade, 2018 - 2030 (Kilotons)

Table 34 Mexico Carbon Black market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 35 Mexico Carbon Black market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 36 Mexico Carbon Black market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 37 Mexico Carbon Black market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 38 Mexico Carbon Black market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 39 Mexico Carbon Black market estimates and forecasts, by grade, 2018 - 2030 (USD Million)

Table 40 Mexico Carbon Black market estimates and forecasts, by grade, 2018 - 2030 (Kilotons)

Table 41 Europe Carbon Black market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 42 Europe Carbon Black market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 43 Europe Carbon Black market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 44 Europe Carbon Black market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 45 Europe Carbon Black market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 46 Europe Carbon Black market estimates and forecasts, by grade, 2018 - 2030 (USD Million)

Table 47 Europe Carbon Black market estimates and forecasts, by grade, 2018 - 2030 (Kilotons)

Table 48 Germany Carbon Black market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 49 Germany Carbon Black market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 50 Germany Carbon Black market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 51 Germany Carbon Black market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 52 Germany Carbon Black market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 53 Germany Carbon Black market estimates and forecasts, by grade, 2018 - 2030 (USD Million)

Table 54 Germany Carbon Black market estimates and forecasts, by grade, 2018 - 2030 (Kilotons)

Table 55 France Carbon Black market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 56 France Carbon Black market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 57 France Carbon Black market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 58 France Carbon Black market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 59 France Carbon Black market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 60 France Carbon Black market estimates and forecasts, by grade, 2018 - 2030 (USD Million)

Table 61 France Carbon Black market estimates and forecasts, by grade, 2018 - 2030 (Kilotons)

Table 62 UK Carbon Black market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 63 UK Carbon Black market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 64 UK Carbon Black market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 65 UK Carbon Black market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 66 UK Carbon Black market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 67 UK Carbon Black market estimates and forecasts, by grade, 2018 - 2030 (USD Million)

Table 68 UK Carbon Black market estimates and forecasts, by grade, 2018 - 2030 (Kilotons)

Table 69 Russia Carbon Black market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 70 Russia Carbon Black market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 71 Russia Carbon Black market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 72 Russia Carbon Black market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 73 Russia Carbon Black market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 74 Russia Carbon Black market estimates and forecasts, by grade, 2018 - 2030 (USD Million)

Table 75 Russia Carbon Black market estimates and forecasts, by grade, 2018 - 2030 (Kilotons)

Table 76 Italy Carbon Black market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 77 Italy Carbon Black market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 78 Italy Carbon Black market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 79 Italy Carbon Black market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 80 Italy Carbon Black market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 81 Italy Carbon Black market estimates and forecasts, by grade, 2018 - 2030 (USD Million)

Table 82 Italy Carbon Black market estimates and forecasts, by grade, 2018 - 2030 (Kilotons)

Table 83 Spain Carbon Black market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 84 Spain Carbon Black market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 85 Spain Carbon Black market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 86 Spain Carbon Black market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 87 Spain Carbon Black market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 88 Spain Carbon Black market estimates and forecasts, by grade, 2018 - 2030 (USD Million)

Table 89 Spain Carbon Black market estimates and forecasts, by grade, 2018 - 2030 (Kilotons)

Table 90 Asia Pacific Carbon Black market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 91 Asia Pacific Carbon Black market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 92 Asia Pacific Carbon Black market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 93 Asia Pacific Carbon Black market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 94 Asia Pacific Carbon Black market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 95 Asia Pacific Carbon Black market estimates and forecasts, by grade, 2018 - 2030 (USD Million)

Table 96 Asia Pacific Carbon Black market estimates and forecasts, by grade, 2018 - 2030 (Kilotons)

Table 97 China Carbon Black market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 98 China Carbon Black market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 99 China Carbon Black market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 100 China Carbon Black market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 101 China Carbon Black market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 102 China Carbon Black market estimates and forecasts, by grade, 2018 - 2030 (USD Million)

Table 103 China Carbon Black market estimates and forecasts, by grade, 2018 - 2030 (Kilotons)

Table 104 Japan Carbon Black market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 105 Japan Carbon Black market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 106 Japan Carbon Black market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 107 Japan Carbon Black market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 108 Japan Carbon Black market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 109 Japan Carbon Black market estimates and forecasts, by grade, 2018 - 2030 (USD Million)

Table 110 Japan Carbon Black market estimates and forecasts, by grade, 2018 - 2030 (Kilotons)

Table 111 Malaysia Carbon Black market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 112 Malaysia Carbon Black market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 113 Malaysia Carbon Black market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 114 Malaysia Carbon Black market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 115 Malaysia Carbon Black market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 116 Malaysia Carbon Black market estimates and forecasts, by grade, 2018 - 2030 (USD Million)

Table 117 Malaysia Carbon Black market estimates and forecasts, by grade, 2018 - 2030 (Kilotons)

Table 118 India Carbon Black market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 119 India Carbon Black market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 120 India Carbon Black market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 121 India Carbon Black market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 122 India Carbon Black market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 123 India Carbon Black market estimates and forecasts, by grade, 2018 - 2030 (USD Million)

Table 124 India Carbon Black market estimates and forecasts, by grade, 2018 - 2030 (USD Kilotons)

Table 125 Indonesia Carbon Black market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 126 Indonesia Carbon Black market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 127 Indonesia Carbon Black market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 128 Indonesia Carbon Black market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 129 Indonesia Carbon Black market estimates and forecasts, by grade, 2018 - 2030 (Kilotons)

Table 130 Indonesia Carbon Black market estimates and forecasts, by grade, 2018 - 2030 (USD Million)

Table 131 Thailand Carbon Black market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 132 Thailand Carbon Black market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 133 Thailand Carbon Black market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 134 Thailand Carbon Black market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 135 Thailand Carbon Black market estimates and forecasts, by grade, 2018 - 2030 (Kilotons)

Table 136 Thailand Carbon Black market estimates and forecasts, by grade, 2018 - 2030 (USD Million)

Table 137 Central & South America Carbon Black market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 138 Central & South America Carbon Black market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 139 Central & South America Carbon Black market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 140 Central & South America Carbon Black market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 141 Central & South America Carbon Black market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 142 Central & South America Carbon Black market estimates and forecasts, by grade, 2018 - 2030 (USD Million)

Table 143 Central & South America Carbon Black market estimates and forecasts, by grade, 2018 - 2030 (Kilotons)

Table 144 Brazil Carbon Black market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 145 Brazil Carbon Black market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 146 Brazil Carbon Black market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 147 Brazil Carbon Black market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 148 Brazil Carbon Black market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 149 Brazil Carbon Black market estimates and forecasts, by grade, 2018 - 2030 (USD Million)

Table 150 Argentina Carbon Black market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 151 Argentina Carbon Black market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 152 Argentina Carbon Black market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 153 Argentina Carbon Black market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 154 Indonesia Carbon Black market estimates and forecasts, by grade, 2018 - 2030 (Kilotons)

Table 155 Argentina Carbon Black market estimates and forecasts, by grade, 2018 - 2030 (USD Million)

Table 156 Middle East & Africa Carbon Black market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 157 Middle East & Africa Carbon Black market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 158 Middle East & Africa Carbon Black market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 159 Middle East & Africa Carbon Black market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 160 Middle East & Africa Carbon Black market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 161 Middle East & Africa Carbon Black market estimates and forecasts, by grade, 2018 - 2030 (USD Million)

Table 162 Middle East & Africa Carbon Black market estimates and forecasts, by grade, 2018 - 2030 (Kilotons)

Table 163 Saudi Arabia Carbon Black market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 164 Saudi Arabia Carbon Black market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 165 Saudi Arabia Carbon Black market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 166 Saudi Arabia Carbon Black market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 167 Saudi Arabia Carbon Black market estimates and forecasts, by grade, 2018 - 2030 (Kilotons)

Table 168 Saudi Arabia Carbon Black market estimates and forecasts, by grade, 2018 - 2030 (USD Million)

Table 169 South Africa Carbon Black market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 170 South Africa Carbon Black market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 171 South Africa Carbon Black market estimates and forecasts, by type, 2018 - 2030 (Kilotons)

Table 172 South Africa Carbon Black market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 173 South Africa Carbon Black market estimates and forecasts, by grade, 2018 - 2030 (Kilotons)

Table 174 South Africa Carbon Black market estimates and forecasts, by grade, 2018 - 2030 (USD Million)

List of Figures

Fig. 1 Market segmentation

Fig. 2 Information procurement

Fig. 3 Data Analysis Models

Fig. 4 Market Formulation and Validation

Fig. 5 Market Snapshot

Fig. 6 Segmental outlook- Type, grade, and application

Fig. 7 Competitive outlook

Fig. 8 Carbon Black market, 2018-2030 (USD Million) (Kilotons)

Fig. 9 Value chain analysis

Fig. 10 Market dynamics

Fig. 11 Porter’s Analysis

Fig. 12 PESTEL Analysis

Fig. 13 Carbon Black market, by type: Key takeaways

Fig. 14 Carbon Black market, by type: Market share, 2023 & 2030

Fig. 15 Carbon Black market, by application: Key takeaways

Fig. 16 Carbon Black market, by application: Market share, 2023 & 2030

Fig. 17 Carbon Black market, by grade: Key takeaways

Fig. 18 Carbon Black market, by grade: Market share, 2023 & 2030

Fig. 19 Carbon Black market, by region: Key takeaways

Fig. 20 Carbon Black market, by region: Market share, 2023 & 2030What questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Carbon Black Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- Furnace Black

- Channel Black

- Thermal Black

- Acetylene Black

- Others

- Carbon Black Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- Tire

- Non-Tire Rubber

- Plastics

- Inks & Coatings

- Others

- Carbon Black Grade Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- Standard Grade

- Specialty Grade

- Carbon Black Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- North America

- North America Carbon Black Market, By Type

- Furnace Black

- Channel Black

- Thermal Black

- Acetylene Black

- Others

- North America Carbon Black Market, By Application

- Tire

- Non-Tire Rubber

- Plastics

- Inks & Coatings

- Others

- North America Carbon Black Market, By Grade

- Standard Grade

- Specialty Grade

- U.S.

- U.S. Carbon Black Market, By Type

- Furnace Black

- Channel Black

- Thermal Black

- Acetylene Black

- Others

- U.S. Carbon Black Market, By Application

- Tire

- Non-Tire Rubber

- Plastics

- Inks & Coatings

- Others

- U.S. Carbon Black Market, By Grade

- Standard Grade

- Specialty Grade

- U.S. Carbon Black Market, By Type

- Canada

- Canada Carbon Black Market, By Type

- Furnace Black

- Channel Black

- Thermal Black

- Acetylene Black

- Others

- Canada Carbon Black Market, By Application

- Tire

- Non-Tire Rubber

- Plastics

- Inks & Coatings

- Others

- Canada Carbon Black Market, By Grade

- Standard Grade

- Specialty Grade

- Canada Carbon Black Market, By Type

- Mexico

- Mexico Carbon Black Market, By Type

- Furnace Black

- Channel Black

- Thermal Black

- Acetylene Black

- Others

- Mexico Carbon Black Market, By Application

- Tire

- Non-Tire Rubber

- Plastics

- Inks & Coatings

- Others

- Mexico Carbon Black Market, By Grade

- Standard Grade

- Specialty Grade

- Mexico Carbon Black Market, By Type

- North America Carbon Black Market, By Type

- Europe

- Europe Carbon Black Market, By Type

- Tire

- Non-Tire Rubber

- Plastics

- Inks & Coatings

- Others

- Europe Carbon Black Market, By Application

- Tire

- Non-Tire Rubber

- Plastics

- Inks & Coatings

- Others

- Europe Carbon Black Market, By Grade

- Standard Grade

- Specialty Grade

- Germany

- Germany Carbon Black Market, By Type

- Furnace Black

- Channel Black

- Thermal Black

- Acetylene Black

- Others

- Germany Carbon Black Market, By Application

- Tire

- Non-Tire Rubber

- Plastics

- Inks & Coatings

- Others

- Germany Carbon Black Market, By Grade

- Standard Grade

- Specialty Grade

- Germany Carbon Black Market, By Type

- France

- France Carbon Black Market, By Type

- Furnace Black

- Channel Black

- Thermal Black

- Acetylene Black

- Others

- France Carbon Black Market, By Application

- Tire

- Non-Tire Rubber

- Plastics

- Inks & Coatings

- Others

- France Carbon Black Market, By Grade

- Standard Grade

- Specialty Grade

- France Carbon Black Market, By Type

- U.K.

- U.K. Carbon Black Market, By Type

- Furnace Black

- Channel Black

- Thermal Black

- Acetylene Black

- Others

- U.K. Carbon Black Market, By Application

- Tire

- Non-Tire Rubber

- Plastics

- Inks & Coatings

- Others

- U.K. Carbon Black Market, By

- Standard Grade

- Specialty Graders

- U.K. Carbon Black Market, By Type

- Russia

- Russia Carbon Black Market, By Type

- Furnace Black

- Channel Black

- Thermal Black

- Acetylene Black

- Others

- Russia Carbon Black Market, By Application

- Flat

- Long

- Russia Carbon Black Market, By Application

- Standard Grade

- Specialty Grade

- Russia Carbon Black Market, By Type

- Italy

- Italy Carbon Black Market, By Type

- Furnace Black

- Channel Black

- Thermal Black

- Acetylene Black

- Others

- Italy Carbon Black Market, By Application

- Tire

- Non-Tire Rubber

- Plastics

- Inks & Coatings

- Others

- Italy Carbon Black Market, By Grade

- Standard Grade

- Specialty Grade

- Italy Carbon Black Market, By Type

- Spain

- Spain Carbon Black Market, By Type

- Furnace Black

- Channel Black

- Thermal Black

- Acetylene Black

- Others

- Spain Carbon Black Market, By Application

- Tire

- Non-Tire Rubber

- Plastics

- Inks & Coatings

- Others

- Spain Carbon Black Market, By Grade

- Standard Grade

- Specialty Grade

- Spain Carbon Black Market, By Type

- Europe Carbon Black Market, By Type

- Asia Pacific

- Asia Pacific Carbon Black Market, By Type

- Furnace Black

- Channel Black

- Thermal Black

- Acetylene Black

- Others

- Asia Pacific Carbon Black Market, By Application

- Furnace Black

- Channel Black

- Thermal Black

- Acetylene Black

- Others

- Asia Pacific Carbon Black Market, By Application

- Standard Grade

- Specialty Grade

- China

- China Carbon Black Market, By Type

- Furnace Black

- Channel Black

- Thermal Black

- Acetylene Black

- Others

- China Carbon Black Market, By Application

- Tire

- Non-Tire Rubber

- Plastics

- Inks & Coatings

- Others

- China Carbon Black Market, By Grade

- Standard Grade

- Specialty Grade

- China Carbon Black Market, By Type

- Malaysia

- Malaysia Carbon Black Market, By Type

- Furnace Black

- Channel Black

- Thermal Black

- Acetylene Black

- Others

- Malaysia Carbon Black Market, By Application

- Tire

- Non-Tire Rubber

- Plastics

- Inks & Coatings

- Others

- Malaysia Carbon Black Market, By Grade

- Standard Grade

- Specialty Grade

- Malaysia Carbon Black Market, By Type

- Japan

- Japan Carbon Black Market, By Type

- Furnace Black

- Channel Black

- Thermal Black

- Acetylene Black

- Others

- Japan Carbon Black Market, By Application

- Tire

- Non-Tire Rubber

- Plastics

- Inks & Coatings

- Others

- Japan Carbon Black Market, By Grade

- Standard Grade

- Specialty Grade

- Japan Carbon Black Market, By Type

- India

- India Carbon Black Market, By Type

- Furnace Black

- Channel Black

- Thermal Black

- Acetylene Black

- Others

- India Carbon Black Market, By Application

- Tire

- Non-Tire Rubber

- Plastics

- Inks & Coatings

- Others

- India Carbon Black Market, By Grade

- Standard Grade

- Specialty Grade

- India Carbon Black Market, By Type

- Indonesia

- Indonesia Carbon Black Market, By Type

- Furnace Black

- Channel Black

- Thermal Black

- Acetylene Black

- Others

- Indonesia Carbon Black Market, By Application

- Tire

- Non-Tire Rubber

- Plastics

- Inks & Coatings

- Others

- Indonesia Carbon Black Market, By Application

- Standard Grade

- Specialty Grade

- Indonesia Carbon Black Market, By Type

- Asia Pacific Carbon Black Market, By Type

- Central & South America

- Central & South America Carbon Black Market, By Type

- Furnace Black

- Channel Black

- Thermal Black

- Acetylene Black

- Others

- Central & South America Carbon Black Market, By Application

- Tire

- Non-Tire Rubber

- Plastics

- Inks & Coatings

- Others

- Central & South America Carbon Black Market, By Grade

- Standard Grade

- Specialty Grade

- Brazil

- Brazil Carbon Black Market, By Type

- Furnace Black

- Channel Black

- Thermal Black

- Acetylene Black

- Others

- Brazil Carbon Black Market, By Application

- Tire

- Non-Tire Rubber

- Plastics

- Inks & Coatings

- Others

- Brazil Carbon Black Market, By Grade

- Standard Grade

- Specialty Grade

- Brazil Carbon Black Market, By Type

- Argentina

- Argentina Carbon Black Market, By Type

- Furnace Black

- Channel Black

- Thermal Black

- Acetylene Black

- Others

- Argentina Carbon Black Market, By Application

- Tire

- Non-Tire Rubber

- Plastics

- Inks & Coatings

- Others

- Argentina Carbon Black Market, By Grade

- Standard Grade

- Specialty Grade

- Argentina Carbon Black Market, By Type

- Central & South America Carbon Black Market, By Type

- Middle East & Africa

- Middle East & Africa Carbon Black Market, By Type

- Furnace Black

- Channel Black

- Thermal Black

- Acetylene Black

- Others

- Middle East & Africa Carbon Black Market, By Application

- Tire

- Non-Tire Rubber

- Plastics

- Inks & Coatings

- Others

- Middle East & Africa Carbon Black Market, By Grade

- Standard Grade

- Specialty Grade

- Saudi Arabia

- Saudi Arabia Carbon Black Market, By Type

- Furnace Black

- Channel Black

- Thermal Black

- Acetylene Black

- Others

- Saudi Arabia Carbon Black Market, By Application

- Tire

- Non-Tire Rubber

- Plastics

- Inks & Coatings

- Others

- Saudi Arabia Carbon Black Market, By Grade

- Standard Grade

- Specialty Grade

- Saudi Arabia Carbon Black Market, By Type

- South Africa

- South Africa Carbon Black Market, By Type

- Furnace Black

- Channel Black

- Thermal Black

- Acetylene Black

- Others

- South Africa Carbon Black Market, By Application

- Tire

- Non-Tire Rubber

- Plastics

- Inks & Coatings

- Others

- South Africa Carbon Black Market, By Grade

- Standard Grade

- Specialty Grade

- South Africa Carbon Black Market, By Type

- Middle East & Africa Carbon Black Market, By Type

- North America

Carbon Black Market Dynamics

Driver: Increasing tire production

Rubber tires were originally white, but in the early 1900s, the Goodrich Tire Company discovered the benefits of using carbon black in tire production. By adding approximately 50% carbon black by weight, the durability and strength of the rubber increased significantly. This reinforcing filler increased the road-wear abrasion of the tires by up to 100-fold and improved their tensile strength. Additionally, carbon black helped dissipate heat from the belt and tread areas of the tire, reducing thermal damage and extending its lifespan. Carbon black is classified into two categories for tire applications: tread and carcass. Tread grades, identified by ASTM 100, 200, and 300 series, provide enhanced tread wear, traction, sidewall abrasion, and cut resistance. Carcass grades, identified by ASTM 500, 600, and 700 series, are semi-reinforcing and affect ply strength, air retention, and hysteresis in the tire's body. Furthermore, specialty grades have been developed for unique tire applications. The increasing demand for vehicles due to socio-economic growth and industrialization has led to a rise in tire production. In India, tire production increased from 976.08 thousand units in 2010 to 1,461.5 thousand units in 2015, while in China, it increased from 776.12 thousand units in 2010 to 1,133.68 thousand units in 2015.

Driver: High demand for plastics

Carbon black is a highly versatile component widely used by plastics compounders. It provides protection against UV degradation, adds color, enhances electrical conductivity, and improves opacity. The choice of carbon black depends entirely on the specific requirements of the end product. It is utilized in various important plastic segments, including molding, film pipe, fiber, and cable. Plastics have many applications in key industries such as construction, automotive, electrical & electronics, and packaging. This increasing application scope can be attributed to the numerous characteristics of plastics, including durability, cost-effectiveness, corrosion resistance, lightweight, flexibility, and low maintenance. Countries like China, India, Indonesia, Malaysia, Thailand, Vietnam, and Brazil have been witnessing a surge in construction activities due to rapid urbanization and rising disposable income. The growing awareness, demand for sustainable infrastructure, and increased construction spending by the government in these economies are expected to positively impact the demand for carbon black in the forecast period. Acrylic thermoplastics are used as a substitute for glass and find applications in various items such as aquariums, aircraft windows, lenses of exterior lights in automobiles, ports of submersibles, and helmet visors. Due to its chemical resistance, polyethylene is used to manufacture moving machine parts, gears, artificial joints, bearings, and bulletproof vests. These characteristics are expected to contribute to the growth of the plastic industry in the forecast period. The increasing demand and need for electrical and electronic components, such as microwaves, ovens, phones, tablets, laptops, computers, televisions, music players, and fax machines, are expected to drive the demand for plastics over the next seven years, thereby boosting the demand for carbon black.

Restraint: Stringent regulations

Several key bodies and their regulations influence the industry's dynamics. These bodies include the California Office of Environmental Health Hazard Assessment (OEHHA), the U.S. Environmental Protection Agency (EPA), the National Emission Standards for Hazardous Air Pollutants (NESHAP), the Occupational Safety and Health Association (OSHA), and the International Agency for Research on Cancer (IARC). According to IARC, carbon black is classified as a group 2B carcinogen based on sufficient evidence in animals. Initially, it was believed that the carcinogenicity of carbon black only affected specific species and had no impact on human health. However, recent studies have shown that regular exposure to carbon black and other poorly soluble particles may affect human lung capacity as measured by the forced expiratory volume in a second (FEV1). The EPA has proposed NESHAP regulations that will impact major sources of hazardous air pollutant (HAP) emissions in the carbon black manufacturing industry. The health effects identified by the EPA include chronic (long-term), acute (short-term), reproductive and developmental, and cancer effects. The severity of these effects depends on various factors, such as ambient concentrations in the area, frequency and duration of exposure, pollutant characteristics, and individual characteristics. Based on available data, the EPA has determined that a significant portion of HAP emissions from carbon black facilities come from process vents. Therefore, the EPA has mandated the use of control equipment to ensure compliance with the regulations.

What Does This Report Include?

This section will provide insights into the contents included in this carbon black market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

Carbon black market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

Carbon black market quantitative analysis

-

Market size, estimates, and forecast from 2018 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationResearch Methodology

A three-pronged approach was followed for deducing the carbon black market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below:

Information procurement: Information procurement is one of the most extensive and important stages in our research process, and quality data is critical for accurate analysis. We followed a multi-channel data collection process for carbon black market to gather the most reliable and current information possible.

- We buy access to paid databases such as Hoover’s and Factiva for company financials, industry information, white papers, industry journals, SME journals, and more.

- We tap into Grand View’s proprietary database of data points and insights from active and archived monitoring and reporting.

- We conduct primary research with industry experts through questionnaires and one-on-one phone interviews.

- We pull from reliable secondary sources such as white papers and government statistics, published by organizations like WHO, NGOs, World Bank, etc., Key Opinion Leaders (KoL) publications, company filings, investor documents, and more.

- We purchase and review investor analyst reports, broker reports, academic commentary, government quotes, and wealth management publications for insightful third-party perspectives.

Analysis: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilized different methods of carbon black market data depending on the type of information we’re trying to uncover in our research.

-

Market Research Efforts: Bottom-up Approach for estimating and forecasting demand size and opportunity, top-down Approach for new product forecasting and penetration, and combined approach of both Bottom-up and Top-down for full coverage analysis.

-

Value-Chain-Based Sizing & Forecasting: Supply-side estimates for understanding potential revenue through competitive benchmarking, forecasting, and penetration modeling.

-

Demand-side estimates for identifying parent and ancillary markets, segment modeling, and heuristic forecasting.

-

Qualitative Functional Deployment (QFD) Modelling for market share assessment.

Market formulation and validation: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilize different methods of data analysis depending on the type of information we’re trying to uncover in our research.

-

Market Formulation: This step involves the finalization of market numbers. This step on an internal level is designed to manage outputs from the Data Analysis step.

-

Data Normalization: The final market estimates and forecasts are then aligned and sent to industry experts, in-panel quality control managers for validation.

-

This step also entails the finalization of the report scope and data representation pattern.

-

Validation: The process entails multiple levels of validation. All these steps run in parallel, and the study is forwarded for publishing only if all three levels render validated results.

Carbon Black Market Categorization:

The carbon black market was categorized into four segments, namely type (Furnace Black, Channel Black, Thermal Black, Acetylene Black), application (Tire, Non- tire Rubber, Plastics, Inks & Coatings), grade (Standard Grade, Specialty Grade) and regions (North America, Europe, Asia Pacific, Central & South America, Middle East & Africa).

Segment Market Methodology:

The carbon black market was segmented into type, application, grade, and regions. The demand at a segment level was deduced using a funnel method. Concepts like the TAM, SAM, SOM, etc., were put into practice to understand the demand. We at GVR deploy three methods to deduce market estimates and determine forecasts. These methods are explained below:

Market research approaches: Bottom-up

-

Demand estimation of each product across countries/regions summed up to from the total market.

-

Variable analysis for demand forecast.

-

Demand estimation via analyzing paid database, and company financials either via annual reports or paid database.

-

Primary interviews for data revalidation and insight collection.

Market research approaches: Top-down

-

Used extensively for new product forecasting or analyzing penetration levels.

-

Tool used invoice product flow and penetration models Use of regression multi-variant analysis for forecasting Involves extensive use of paid and public databases.

-

Primary interviews and vendor-based primary research for variable impact analysis.

Market research approaches: Combined

- This is the most common method. We apply concepts from both the top-down and bottom-up approaches to arrive at a viable conclusion.

Regional Market Methodology:

The carbon black market was analyzed at a regional level. The globe was divided into North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa, keeping in focus variables like consumption patterns, export-import regulations, consumer expectations, etc. These regions were further divided into twenty countries, namely, the U.S.; Canada; Mexico; Germany; the UK.; France; Italy; Spain; Russia; China; India; Japan; Indonesia; Malaysia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia

All three above-mentioned market research methodologies were applied to arrive at regional-level conclusions. The regions were then summed up to form the global market.

Carbon black market companies & financials:

The carbon black market was analyzed via companies operating in the sector. Analyzing these companies and cross-referencing them to the demand equation helped us validate our assumptions and conclusions. Key market players analyzed include:

-

Orion Engineered Carbons GmbH - Orion Engineered Carbons Holdings GmbH, based in Frankfurt, Germany, is a leading producer and innovator of carbon black products. The company provides a wide range of carbon black products tailored to meet the specific requirements of different industries. These products serve as essential components and enhancers in manufacturing plastics, printing inks, and coatings and also play a crucial role in reinforcing rubber polymers. In a significant move in 2011, Orion Engineered Carbons Holdings GmbH acquired Evonik AG's carbon black business, further strengthening its position in the market.

-

Omsk Carbon Group - OMSK Carbon Group is a Russian company that specializes in the production of carbon black. With manufacturing facilities in Omsk and Volgograd, the company offers a wide range of carbon black grades, including tread grades, carcass grades, low dispersion grades, and specialty grades. OMSK has an annual production capacity of 525 kilotons, and they have made significant investments to increase this capacity to 585 kilotons by 2017. Regarding sales, OMSK has a strong presence across Western and Eastern Europe, Scandinavia, the Middle East, Asia, the CIS, and the Americas. The company has representative offices in Germany, Romania, Turkey, Canada, and the United States to support its global operations.

-

Tokai Carbon Co., Ltd. - Tokai Carbon Co., Ltd. is a carbon black manufacturer based in Japan. The company is involved in various business segments, including graphite electrodes, carbon black, fine carbon, smelting and lining, furnaces, friction materials, and anode materials. The company has established carbon black production plants in Ishinomaki, Shonan, Chita, Shiga, Hofu, Kyusyu Wakamatsu, and Tanoura to carry out its operations. Additionally, Tokai Carbon Co., Ltd. has research centers in Fuji, Chita, Hofu, Tanoura, and Chigasaki. In North America, the company's subsidiary, Tokai Carbon CB Ltd., focuses on the production and distribution of carbon black, boasting an impressive annual production capacity of 440,000 tons.

-

Asahi Carbon Co. Ltd. - Asahi Carbon Co. Ltd., a carbon black manufacturer based in Niigata, Japan, operates globally with divisions dedicated to manufacturing, research, sales, and distributing carbon black. The company provides carbon black products that adhere to ASTM standards.

-

Ralson - Ralson, an Indian-based company, specializes in the manufacturing and distribution of carbon black. The company's operations are divided into three distinct business units: carbon black, steel, and power. Each unit is equipped with customized technologies to cater to specific business requirements. Ralson boasts an impressive carbon black production capacity of 40,000 MT per annum. The company's manufacturing facilities and head offices are strategically located across various regions in India, including Punjab, New Delhi, Andhra Pradesh, Kerala, Karnataka, and Tamil Nadu. Additionally, Ralson extends its presence to the Middle East with operations in the United Arab Emirates (UAE).

-

Atlas Organics Private Limited - Atlas Organics Private Limited is an Indian company that specializes in the production, supply, and distribution of carbon black, organic wax, and other related products. These include carbon powder, microcrystalline wax, maleic hard resin, biodiesel oil, black softomer, car wax, and carbon black granules. The company primarily serves the tire, rubber goods, and plastics industries in the Indian subcontinent. The carbon black produced by Atlas Organics Private Limited is composed of amorphous carbons and is widely used as a reinforcing agent in various rubber applications. It is worth noting that all the products manufactured by the company have been TrustSEAL Verified.

-

Continental Carbon Company - Continental Carbon Company, a carbon black manufacturer based in the United States, has production plants in Texas, Ohio, and Oklahoma. The company's product range includes industrial rubber, carbon black, tire carbon black, and specialty carbon black. It operates as a subsidiary of CSRC USA Corp. In 2014, the company established its first overseas headquarters in Brussels, Belgium, to cater to the Middle East, Africa, and Asia Pacific regions. The company's manufacturing sites are in the U.S. (Texas, Sunray, Ponca City, Phenix City, Oklahoma, and Alabama) and Europe (Belgium). With an annual carbon black production capacity of 85,000 MT, the company holds certifications such as Phenix City ISO 9001, Ponca City ISO 9001, Sunray Conforming, and Phenix City ISO 14001.

-