- Home

- »

- Automotive & Transportation

- »

-

Global Catamaran Market Size & Share Report, 2022-2030GVR Report cover

![Catamaran Market Size, Share & Trends Report]()

Catamaran Market Size, Share & Trends Analysis Report By Product (Sailing Catamarans, Power Catamarans), By Size (Small, Medium, Large), By Application (Sport, Leisure, Transport), By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-965-7

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2017 - 2020

- Industry: Technology

Report Overview

The global catamaran market size was worth USD 1.35 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 5.8% from 2022 to 2030. The increased disposable income of citizens, as well as an increase in cruising and racing events, are some of the factors driving the industry’s expansion. Catamarans are highly comfortable. They have significantly more room than monohulls, and this means that the cockpit and living room between the two hulls provide enough space. This is especially critical while going from one lengthy destination to another. The market is expanding at a tremendous growth rate owing to the rising marine tourism and users’ inclination toward luxurious travels.

Catamarans have long been appealing because of their stability and size, and they make ideal live-aboard boats or bluewater cruising ships for long-distance voyages. By definition, a catamaran has a greater internal room than a monohull due to its two-hull construction. Modern cruising catamaran designs, on the other hand, have progressively evolved into their style, combining the sleek appearance of performance cats with the extra comfort of a luxury yacht.

Due to the advancements in design and technology, boat manufacturers are producing catamarans that are quicker and more fuel-efficient. As a result, a slew of devoted monohull owners has switched to catamaran ownership. In November 2021, The Martini 7.0, a 165-foot catamaran yacht with unique technology that gives passengers seasickness treatment, was introduced by Servo Yachts LLC.

Because of new technologies, the private, commercial, and military sectors of catamaran design are quickly advancing. Advanced materials and 3D printing will alter catamaran design and building methodologies, while new sustainable fuels will aid in decreasing or even eliminating emissions in the maritime sector.

Innovative hull designs, cutting-edge engine combinations, well-designed floor layouts, and improved power sources will define catamaran designs in the near future. These futuristic catamarans would be controlled by digital displays that included GPS, fish locating software, a 360-degree camera, an automatic docking system, and modern marine music systems. Catamaran production would revolutionize and become quite convenient for regular use with the help of:

-

Simplified control design,

-

Smartphone integration for better accessibility,

-

State-of-the-art technology that replaces steering wheels with intelligent screens and two throttles with a single joystick, and

-

Advanced HVAC systems

COVID-19 Impact

The COVID-19 pandemic had a negative impact on the sector, which was worsened by the worldwide lockdowns and limitations on travel and tourism. Lockdowns caused production facilities to close, labor shortages, and raw material shortages as a result of disruptions in the supply chain. Temporary firm closures placed a severe financial burden on industry members.

However, the catamaran business is expected to grow following the pandemic, owing to government attempts to boost maritime tourism and OEM investments in new product advancements. In the second half of 2020, growth in water sports and boating activities in Europe and North America raised the demand for smaller boats.

Customers cannot demand a refund during the Coronavirus pandemic period, but they can reschedule, according to a new regulation enforced by governments in various nations such as France and Italy, among others. For example, G Adventure, a Canada-based company, is offering future credits on canceled trips because it supports the global supply chain and also helps them by holding on to their customers through rebooking.

Most global charter companies and independent local charter operators are implementing their new booking and payment policies. This will include allowing a smaller down-payment (10-15 percent instead of 40-50 percent) for reserving the charter week and offering free changes to their charter guest bookings within 2020, as well as a minor charge for clients wishing to reschedule bookings to 2021.

Product Insights

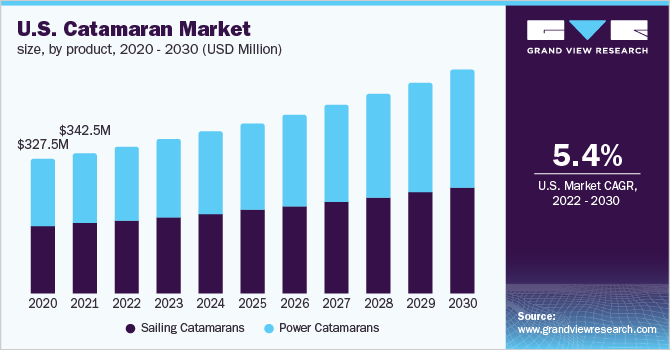

In terms of product, the market is bifurcated into sailing catamarans and power catamarans. Among these, the sailing catamaran segment held the largest revenue share of 54.21% in 2021. The power catamaran segment is expected to expand at a rapid CAGR of 6.2% through the forecast period. Sailing catamarans are often used by sailors or those who like sailing, and they are ideal for a long-distance cruise.

Sailboats may reach 9-10 knots with the right propeller and engine, and they are seaworthy, i.e., they provide comfort at sea. New designs and technological improvements have made sail handling on sailing catamarans easier now. Sailboats can accommodate several passengers at once, and that way, they encourage sociability and are calm. Sailing catamarans are also less expensive per cubic foot of volume.

Power catamarans have a lot of steadiness at anchor and underway and plush exterior living areas compared to that of monohulls. They have a vast, luxurious interior with excellent privacy for guests, as napping accommodations are well parted with en-suite closets and bathrooms and shallow draught. They have limited clearance, and in terms of speed and range, a professionally constructed, dedicated purpose catamaran powerboat surpasses an equivalent monohull powerboat.

Few power catamarans are less expensive to run than monohulls and can compete in economics with trawlers. The efficiency of the hull on power catamarans also allows for speedier movement when needed. For example, a sailing catamaran can reach 9-15 knots, whereas a power catamaran averages around 20-25 knots. The Freeman 47 power catamaran can reach up to 70 knots.

Size Insights

In terms of size, the industry is classified into small, medium, and large. Among these, the medium segment dominated in 2021, with a revenue share of 38.05%. The small segment is expected to advance at the fastest CAGR of 6.4% throughout the forecast period. A medium-sized catamaran is 30-50 feet long, and a boat of this size has adequate space for a cabin and can easily accommodate two to four persons.

The average ocean-crossing catamaran is 40 to 45 feet long. Designers can put a tremendous number of more amenities in the hulls by adding 10 feet in length. This is because adding a little more size allows designers and boat builders to dramatically broaden each hull, allowing for amenities like private staterooms, several bathrooms, and entirely separate eating and cooking areas.

A large catamaran is longer than 50 feet, and a 50-foot catamaran often has a mirrored floor layout. Each hull of a typical catamaran has the same configuration, that is, if one hull has a toilet and shower in the stern and a private berth in the bow, the second hull will have the same configuration but in the opposite direction.

This is mainly because areas such as the galley and sitting area are retained in the center console, where there is considerably more room to walk around. Spaces used only at night or infrequently are preserved in the thin hulls since this has shown to be a more pleasant layout for personnel.

Application Insights

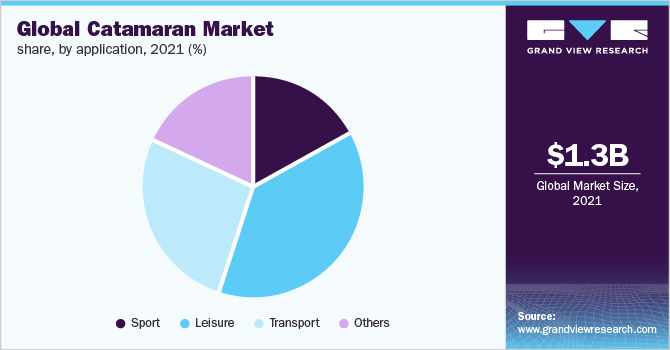

In terms of application, the industry is classified into sport, leisure, transport, and others. Among these, the leisure catamaran market dominated in 2021 with a revenue share of 37.79%. The sport segment is expected to expand at the fastest CAGR of 6.6% throughout the forecast period. A leisure catamaran is mainly used for water tourism and recreational pleasures. These vessels may have opulent infrastructures such as lodging, cabins, and other amenities.

Globally, as people’s disposable income has increased, there has been an apparent growth in tourism spending. The leisure catamaran market is expanding due to the increased popularity of water sports, improved boat infrastructure, technological advancements, and other water activities throughout the world.

The enhancing standards of living, as well as people's preference for luxury, comfort, and water body holiday houses, are driving the rise of the leisure catamaran market. Furthermore, several measures are undertaken by governments and private groups to encourage leisure boating, and the development of marine and coastal tourism is driving chances for the leisure catamaran industry to flourish.

Catamarans are a popular kind of transportation, and they are often employed as passenger boats and are pretty popular wherever they are deployed. A catamaran's main USP (Unique Selling Point) is its speed, and for this reason alone, a catamaran trip is popular among people of all ages. Stena Line, a shipping business based in Sweden and also a major ferry operator worldwide, operates one of the most well-known catamaran services.

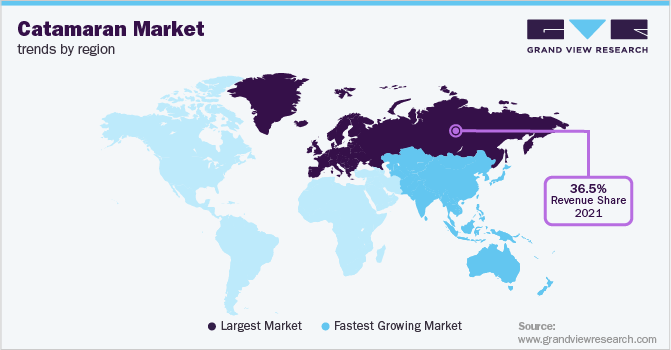

Regional Insights

Europe held the largest revenue share of 36.47% in 2021. Asia Pacific is expected to expand at the fastest CAGR of 7.1% throughout the forecast period. The rising number of High-Net-Worth Individuals (HNWI) and the adoption of technologically sophisticated catamarans are the primary drivers driving regional catamaran sales growth in Europe.

Furthermore, the increasing popularity of water sports and fishing activities in this area is boosting Europe's catamaran market share. Consumer spending on outdoor recreational activities is increasing, which is driving market revenue in North America. Consumers in the region are investing heavily in outdoor leisure activities, including fishing, cruise, and boating. The rise of many watersports activities such as kayaking, rafting, and canoeing is fueling a surge in demand for recreational boating throughout the region.

According to the Outdoor Industry Association 2020, the outdoor recreation sector generated USD 887 billion in yearly consumer spending, 7.6 million employments, and USD 125 billion in federal, state, and local tax revenues each year, consequently increasing market size.

One of the reasons for the expansion of the catamaran industry is the considerable initiatives taken by the governments of numerous nations in the Asia Pacific area to expand tourist activities. The availability of water resources in this region, such as the extensive coastline, interior lakes, and rivers, can be credited to the market's expansion.

There has been an increase in the number of people in China, India, South Korea, and Japan who are heavily investing in luxury boats and sports. This is going to create profitable opportunities for sales of powered catamarans. Enoshima Islands, Lake Biwa, and Hayama Port across Japan are becoming quite popular for sailing. Consumers are joining sailing schools which will also help in increasing the sales of the sailing catamaran.

Key Companies & Market Share Insights

The market is fragmented and is expected to witness an increase in competition owing to the presence of several players. The players are spending heavily on research and development activities to integrate cutting-edge technologies in catamarans used for leisure and sports, which has intensified the competition among these players. Some prominent players in the market include African Cats., Bavaria Catamarans, Groupe Beneteau, CATATHAI, Fountaine Pajot Catamarans, Leopard Catamarans, NAUTITECH, Outremer Yachting, Seawind, and Voyage, among others.

These players are going for mergers and acquisitions to gain a competitive edge over their peers and capture a significant market share. For example, in October 2021, Groupe Beneteau announced that it had acquired STARFISHER, a shipyard in Portugal, which became GB PORTUGAL, which will help them to strengthen the capacity of production for 25 to 35-foot powerboats by setting itself up in Portugal. Some prominent players in the global catamaran market include:

-

African Cats.

-

Bavaria Catamarans

-

Beneteau Group

-

CATATHAI

-

Fountaine Pajot Catamarans

-

Leopard Catamarans

-

NAUTITECH

-

Outremer Yachting

-

Seawind

-

Voyage

Catamaran Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 1.42 billion

Revenue forecast in 2030

USD 2.23 billion

Growth rate

CAGR of 5.8% from 2022 to 2030

Base year for estimation

2021

Historical year

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, size, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; China; Japan; India; Australia; Brazil; Mexico

Key companies profiled

African Cats; Bavaria Catamarans; Beneteau Group; CATATHAI; Fountaine Pajot Catamarans; Leopard Catamarans; NAUTITECH; Outremer Yachting; Seawind; Voyage

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Catamaran Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global catamaran market report based on product, size, application, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Sailing Catamarans

-

Sport

-

Leisure

-

Transport

-

Others

-

-

Power Catamarans

-

Sport

-

Leisure

-

Transport

-

Others

-

-

-

Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Small

-

Medium

-

Large

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Sport

-

Leisure

-

Transport

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia-Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global catamaran market size was estimated at USD 1.35 billion in 2021 and is expected to reach USD 1.42 billion in 2022.

b. The global catamaran market is expected to grow at a compound annual growth rate of 5.8% from 2022 to 2030 to reach USD 2.24 billion by 2030.

b. Europe dominated the catamaran market with a share of 36.5% in 2021. This is attributable to the rising number of High-Net-Worth Individuals (HNWI) and the adoption of technologically sophisticated catamarans.

b. Some key players operating in the catamaran market include African Cats., Bavaria Catamarans, Beneteau Group, CATATHAI, Fountaine Pajot Catamarans, Leopard Catamarans, NAUTITECH, Outremer Yachting, Seawind, Voyage.

b. Key factors that are driving catamaran market growth include increased disposable income of citizens, an increase in cruising &racing events, and the rising marine tourism coupled with users’ inclination toward luxurious travels

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."