- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Ceramic Coating Market Size & Share Report, 2030GVR Report cover

![Ceramic Coating Market Size, Share & Trends Report]()

Ceramic Coating Market Size, Share & Trends Analysis Report By Product (Oxide, Carbide, Nitride) By Technology, By Application (Automotive, Energy, Aerospace, Industrial Goods, Healthcare), And Segment Forecasts, 2022 - 2030

- Report ID: GVR-1-68038-589-2

- Number of Pages: 127

- Format: Electronic (PDF)

- Historical Range: 2017 - 2020

- Industry: Bulk Chemicals

Report Overview

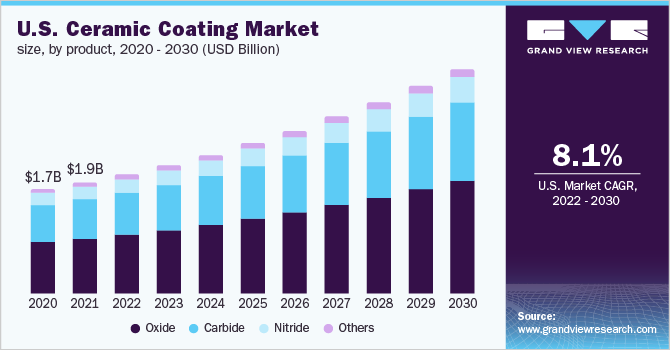

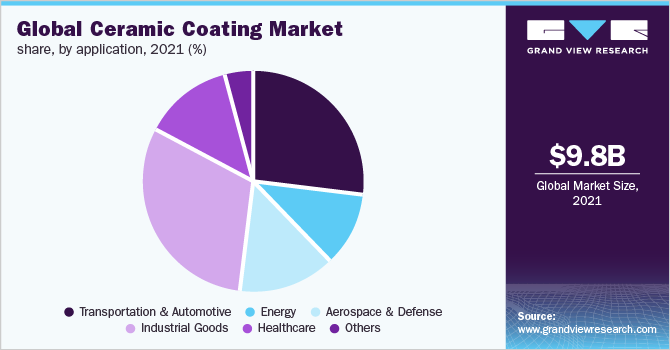

The global ceramic coating market size was valued at USD 9.75 billion in 2021 and is likely to expand at a compound annual growth rate (CAGR) of 7.8% from 2022 to 2030. The ceramic coating promotes increased heat resistance coupled with fewer emissions to the atmosphere. These factors are likely to augment the market growth during the forecast period. Moreover, these products are gradually finding applications on metal parts in vehicles owing to their suitable properties of abrasion and corrosion resistance along with it being an excellent thermal barrier. Furthermore, the aerospace & defense industry is exhibiting a trend of increasing consumption of oxide and carbide coatings. These coats are used exclusively in rocket exhaust cones, insulating tiles, space shuttles, and engine components, and are embedded into the windshield glass of many airplanes.

The COVID-19 pandemic impacted various industries. There were substantial disruptions in their respective supply-chain operations and manufacturing due to precautionary lockdowns and other constraints imposed by governing authorities around the world. The global ceramic coatings market witnessed a slow down in its year-on-year growth rate due to the reduced demand from key industries such as automotive, aerospace, and others and unexpected shutdowns of manufacturing plants, and temporary halts in production units.

However, in line with the current trend, there is an increased consumption of these coats in energy, healthcare, pharmaceutical, and different niche applications. These niche applications also include surgical instruments, prosthetic limbs & hips, and personal hygiene products.

At present, the majority of the product demand is derived from heavy industries, such as steel, cement, and power manufacturing plants, but is also observing increased demand from the automotive industry. These coats are also gradually replacing wax in automotive polishes. In April 2021, with the all-new Safari, Tata Motors unveiled one of the industry's first ceramic coating services. This is a cutting-edge hydrophilic formulation technology for renewing the appearance of Tata vehicles.

Rising demand for these coats in the defense, aerospace, energy, healthcare, and other industries is expected to push participants in the value chain to offer turnkey services along with providing engineering solutions. The cost depends on the type of product, i.e. oxide, carbide, or nitride, and the surface of application. The process is very much energy-intensive and, thus, the overheads form a major part of the overall cost.

The market witnesses a dispersed regional supply-demand trend. The North American region is the hub of superior grade coats and is likely to continue being the major supplier of coating services & products. The Asia Pacific region during the forecasted period is expected to account for the highest demand share as few manufacturers are situated in this geographic.

Asia-Pacific’s share of ceramic coating production is exported mainly to eastern Europe. Countries like China and India manufacture ceramic epoxy coatings that align with the material norms in that region. The coating solutions for the Asian countries are usually imported from North America as the products manufactured in that region are suitable for complying with the humidity effect in the Asia Pacific.

Product Insights

The oxide segment accounted for 57.2% of the global revenue share in 2021. Oxides are cheaper in comparison to other coatings such as carbide and nitride. This type of coating is used in the steel industry, where it is applied to refractory bricks, chimneys, guide bars, pumps, and bearings. Oxide & carbide coats are also heavily consumed in the oil & gas industries, where it is utilized in mud rotors, pump sleeves, MWD equipment, and valve components. Applying coatings on service components in this industry helps oil & gas exploring companies reduce exploration costs and increase production.

The carbide segment is expected to expand at a CAGR of 7.7% during the forecast period. Carbide coatings are expensive due to the high raw material and process costs. Carbide coatings are gradually venturing into the sports industry, where it is used on applications such as horse hooves, golf clubs, and bicycles. In October 2020, XPEL, Inc. revealed product line expansion for its FUSION PLUS automotive ceramic coating. The automotive ceramic coating line-up now includes unique materials created to protect brake calipers, glass, and wheels, along with trim surfaces, plastic, and upholstery.

Technology Insights

Thermal spray is the most popular means of deploying ceramic coatings on the surface. Thermal spray accounted for around 74% of the revenue share in the global market. This mode of application is the most popular choice among ceramic coating producers as it can be used for almost every material composition and has high density. In April 2020, Bodycote completed the acquisition of Ellison Surface Technologies. This acquisition led to the creation of the largest engineered coating surface technology and thermal spray services in the world. Physical Vapor Deposition or PVD is also likely to demonstrate significant growth in this segment. The primary factor associated with the increase in consumption is its cheaper cost.

Furthermore, along with the cost, this method is also more energy-efficient than the rest. However, PVD has some limitations, as the velocity of spraying of this method is low. Coatings applied through PVD have less resistance to high temperatures and surface pressures. Therefore, making them unsuitable for heavy industries and aerospace applications.

Application Insights

Ceramic coating is finding broad applications in transportation & automotive, energy, aerospace & defense, industrial goods, and healthcare. Global consumption was majorly derived from industrial goods. The Environmental Protection Agency (EPA) reported a rise in spending on anti-corrosion as well as efficiency enhancer coatings, which will further aggravate the demand. Ceramic coatings are also sprayed on industrial goods, such as refractory bricks, chimneys, and iron rods. Its properties of abrasion resistance and heat resistance, along with its added protective layer, will make it widely in demand in the steel and power generation industries in the near future.

Ceramic coatings in recent years are finding application scope in surgical instruments, where it is used to harden the tool. This is the final and essential form of a coating in prosthetic hips as it proportionately decreases the wear rates in prosthetic hips. In the U.S. alone, around 330,000 hip replacement surgery takes place each year. These coatings increase the efficiency of the gas turbine engines, which invariantly combats high operating temperatures. Ceramic coatings enable aircraft engines to operate at elevated temperatures, thus enhancing performance. Product demand is expected to witness an exponential increase owing to its extensive utilization in the aerospace and defense industry.

Regional Insights

Asia Pacific dominated the market with more than 40% of the global consumption in 2021, owing to the low cost in the region. Lower costs are mainly associated with inferior grade products and not lower operational costs. The local demand can be characterized by humongous consumption from developing countries, such as China, India, and Japan. In April 2021, Oerlikon Balzers opened its first customer center in Vietnam, expanding its coating operations in Asia. The company has made strategic investments to increase its footprint in the booming Asian market.

Increasing engineering component production in the region will probably trigger the regional demand during the forecast period. Most of the regional need comes from China, which is also a leading ceramic coating manufacturer. Japan accounts for around 25% of the regional consumption and is expected to maintain its dominance during the forecast period as well.

Europe and North America together are responsible for around half of the global needs. Well-established automobile and aerospace industries have helped the regions to achieve this level of ceramic coating consumption. The automotive and healthcare products sectors are expected to drive future market growth.

Key Companies & Market Share Insights

Key players are showing aggressiveness in establishing manufacturing plants in the Asia Pacific region as it is expected to emerge to be the epicenter of the demand. With moderate environmental laws coupled with a friendly business environment, ceramic coating capacities would see a rampant rise in this region. Some of the prominent players in the global ceramic coating market include:

-

Bodycote

-

Praxair Surface Technologies, Inc.

-

Aremco Products, Inc.

-

APS Materials, Inc.

-

Cetek Cermaic Technologies Ltd.

-

Keronite Group Ltd.

-

Saint-Gobain S.A.

-

Element 119

-

NanoShine Ltd.

-

Ultramet, Inc.

Ceramic Coating Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 10.42 billion

Revenue forecast in 2030

USD 19.19 billion

Growth Rate

CAGR of 7.8% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Volume in Kilo Tons, revenue in USD Million, and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, application, region

Regional Scope

North America, Europe, Asia Pacific, Central, & South America, Middle East & Africa

Country scope

U.S., Germany, U.K., France, China, Japan, India

Key companies profiled

Bodycote, Praxair Surface Technologies, Inc., Aremco Products, Inc., APS Materials, Inc., Cetek Cermaic Technologies Ltd., Keronite Group Ltd., Saint-Gobain S.A., Element 119, NanoShine Ltd., Ultramet, Inc.

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the ceramic coating market based on product, technology, application, and region:

-

Product Outlook (Volume, Kilo Tons, Revenue, USD Million, 2017 - 2030)

-

Oxide

-

Carbide

-

Nitride

-

Others

-

-

Technology Outlook (Volume, Kilo Tons, Revenue, USD Million, 2017 - 2030)

-

Thermal Spray

-

Physical Vapor Deposition

-

Chemical Vapor Deposition

-

Others

-

-

Application Outlook (Volume, Kilo Tons, Revenue, USD Million, 2017 - 2030)

-

Transportation & Automotive

-

Energy

-

Aerospace & Defense

-

Industrial Goods

-

Healthcare

-

Others

-

-

Regional Outlook (Volume, Kilo Tons, Revenue, USD Million, 2017 - 2030)

-

North America

-

The U.S.

-

-

Europe

-

Germany

-

France

-

UK

-

-

Asia-Pacific

-

China

-

India

-

Japan

-

-

Middle East & Africa (MEA)

-

Central & South America (CSA)

-

Frequently Asked Questions About This Report

b. The global ceramic coatings market size was estimated at USD 9.75 billion in 2021 and is expected to reach USD 10.42 billion in 2022.

b. The global ceramic coatings market is expected to grow at a compound annual growth rate of 7.8% from 2022 to 2030 to reach USD 19.19 billion by 2030.

b. The Asia Pacific dominated the ceramic coatings market with a share of more than 40% in 2021. This is attributable to rising demand from the automotive sector and industrial components owing to its properties of abrasion and heat resistance.

b. Some key players operating in the ceramic coatings market includeBodycote, Praxair Surface Technologies, Inc., Aremco Products, Inc., APS Materials, Inc., Cetek Cermaic Technologies Ltd., Keronite Group Ltd., Saint-Gobain S.A., Element 119, NanoShine Ltd., and Ultramet, Inc.

b. Key factors that are driving the ceramic coatings market growth include ceramic coatings application for surgical instruments, prosthetic limb & hip and personal hygiene products, and its application for abrasion and corrosion resistance in various end-use industries such as transportation & automotive, energy, and aerospace & defense.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."