- Home

- »

- Renewable Chemicals

- »

-

Chondroitin Sulfate Market Size & Share Analysis Report, 2030GVR Report cover

![Chondroitin Sulfate Market Size, Share & Trends Report]()

Chondroitin Sulfate Market Size, Share & Trends Analysis Report By Source (Bovine, Shark, Swine), By Application (Nutraceuticals, Pharmaceuticals), By Region (APAC, North America), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-501-4

- Number of Pages: 220

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Specialty & Chemicals

Report Overview

The global chondroitin sulfate market size was valued at USD 1.25 billion in 2022 and is anticipated to expand at a compound annual growth rate (CAGR) of 3.5% from 2023 to 2030. The demand for chondroitin sulfate is projected to be driven by the rising demand for nutraceutical goods and the growing incidences of osteoarthritis. Pharmaceutical-grade chondroitin sulfate is mostly used to treat Urinary Tract Infections (UTIs), cataracts, and osteoarthritis, which is expected to fuel the overall demand for the source. In addition, it is utilized in the form of medications to lower blood sugar levels, prevent tumor spread, and promote liver function. Moreover, the general market expansion is anticipated to be aided by the increasing demand for its use in the treatment of osteoarthritis and several other disorders.

A long chain of sugars, including glucuronic acid and N-acetylgalactosamine, make up chondroitin sulfate. Human connective tissues, cartilage, and joints all contain chondroitin sulfate in some form. Improved joint functioning results from regular chondroitin sulfate consumption. In addition, the product can be utilized in veterinary medicine and as an eye drop for dry eyes. Meat and the sector that produces it both have a significant impact on market demand. The market has grown as a result of the rising meat consumption and high demand for meat-based sources from the pet industry. Animals by sources, such as kidneys, spleen, liver, brains, and lungs, have significant nutritional value and are used in a variety of businesses.

For instance, several countries including Japan, China, and India use animal glands and organs for medical purposes. Animal intestines are used to make tallow, meat meal, fertilizer, and pet food. In addition, liver extract from pigs and cattle is used as a dietary supplement and a source of vitamin B12 for the treatment of different types of anemia. Fish waste that contains too many bones or has a high oil content is turned into industrial sources and feed. Moreover, cartilage is used as a source of the ingredients collagen and chondroitin sulfate, which are used in a variety of pharmaceutical, nutraceutical, cosmetic, and food sources.

The use of meat and meat sources is rising, which has resulted in more animals being killed. Given that the chondroitin source is made from cartilage collected after slaughter, this has benefited the makers of the substance tremendously. One of the most prevalent musculoskeletal conditions affecting the elderly is osteoarthritis. It has an impact on the joints, restricts motion, and causes pain. Osteoarthritis is treated with chondroitin sulfate to relieve pain, slow the progression of the condition, and alleviate osteoarthritis symptoms. It will likely become more popular as osteoarthritis becomes more common in industrialized nations like the U.S. and the U.K., among others.

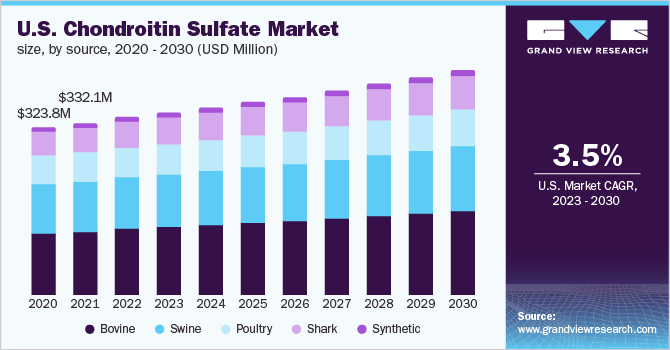

Source Insights

The bovine source segment dominated the global industry in 2022 and accounted for the maximum share of more than 37.80% of the overall revenue. This is attributed to the increased usage of the source in a variety of application industries, including pharmaceutical, personal care & cosmetics, and nutraceuticals globally. Pharmaceutical, nutraceutical, and animal feed industries are among the few sectors that use chondroitin sulfate made from sharks. Shark is currently regarded as an endangered species, which may impede the expansion of the sector.

The capacity to treat persons with HIV, arthritis and gut inflammation makes the shark-derived product the preferred form, and this preference is anticipated to further fuel demand during the projection period. Synthetic sodium chondroitin sulfate is produced utilizing a two-stage fermentation-based technique. Because animal cartilage is not used in the process, there is a low risk of contamination and adulteration. Low sourcing costs are also a result of the extraction process's simplicity. In addition, it can be used as an alternative by vegetarians and other people with dietary and religious limitations, and thus, its demand is anticipated to increase in Asian and Middle Eastern nations.

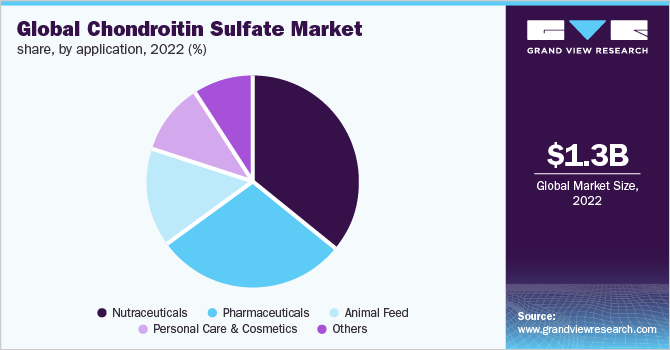

Application Insights

The nutraceutical segment dominated the industry in 2022 and accounted for the largest share of 36.1% of the overall revenue. Its high share is attributed to the rising investments in the sector on account of the need to develop new and more effective dietary supplements. In the nutraceutical sector, it is frequently used as a dietary supplement to treat osteoarthritis and joint discomfort. They are ingested to soothe arthritis pain and to fortify bones, cartilage, and joints. The source is classed considering the national laws of each nation.

It is prescribed as a dietary supplement and combined with glucosamine to relieve arthritic pain in the United States. In nations like the U.S., rising dietary supplement consumption is predicted to fuel market expansion. Furthermore, animal feed additives often contain glucosamine hydrochloride and chondroitin sulfate. To improve joint health and mobility, pet diets, particularly those for dogs and cats, contain chondroitin sulfate from bovine sources. The medicine is also used to treat hip dysplasia, osteoarthritis, intervertebral disc disease, and chronic discomfort from patellar luxation and intervertebral disc disease.

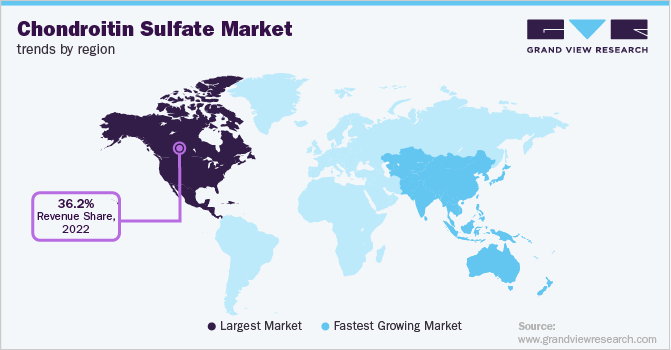

Regional Insights

North America dominated the industry with a revenue share of 36.2% in 2022. This is attributed to the rising pharmaceutical sector in the United States, along with the FDA’s approval for the use of goods containing sodium chondroitin sulfate. In addition, the demand is expected to be fueled by factors, such as the increasing prevalence of osteoarthritis, rising usage of cholesterol treatment, cataract surgery, and formulations for eye drops. The pharmaceutical, cosmetics, culinary, pet food, and veterinary industries are among the few industries in Europe that use chondroitin sulfate. In dietary supplements, chondroitin sulfate is used as an alternative therapy to treat osteoarthritis.

Over the projected period, it is anticipated that increased use of sodium chondroitin sulfate-infused pharmaceuticals and nutraceuticals will boost the market in Europe. Chondroitin sulfate is generally used to treat osteoarthritis, relieve joint pain, treat heart problems & excessive cholesterol, and prepare eye drops. The growing aging population in emerging nations like China and India has led to a high frequency of osteoarthritis and other joint health-related problems. The pharmaceutical industry in the Asia Pacific is expected to see increased demand for sources due to an increase in the prevalence of osteoarthritis and its growing inclusion in the treatment of various medical disorders.

Key Companies & Market Share Insights

Due to the presence of numerous manufacturers, particularly in China, the industry is highly fragmented. Due to the rising R&D expenditures for source innovation and improving source efficiency, there is intense competition in the industry. High competitive rivalry is indicated by high competitiveness in the source’s final prices and producers’ shifting priorities toward greater use of natural extracts. Sustainable raw material sourcing and effective sourcing techniques are the main areas of concern for manufacturers. To make the sources, companies are turning to cartilage with a high-purity concentration. For example, ZPD provides multiple grades that contain 20%, 40%, and 80% sodium chondroitin sulfate as well as other forms of sodium chondroitin sulfate components that are consistent with regulations for pet food makers. Some prominent players in the global chondroitin sulfate market include:

-

TSI Group Ltd.

-

Qingdao Wan Toulmin Biological Sources Co., Ltd.

-

Hebei SanXin Industrial Group

-

Bioiberica SAU

-

Sigma Aldrich, Inc.

-

ZPD

-

Sino Siam Biotechnique Company Ltd.

-

BRF

-

Bio-gen Extracts Pvt. Ltd.

-

Seikagaku Corp.

Chondroitin Sulfate Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.28 billion

Revenue forecast in 2030

USD 1.65 billion

Growth rate

CAGR of 3.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion, volume in tons, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; China; India; Japan; South Korea; Australia; Taiwan; Brazil; Argentina; Chile; Colombia; Saudi Arabia; South Africa

Key companies profiled

TSI Group Ltd.; Qingdao Wan Toulmin Biological Sources Co., Ltd.; Hebei SanXin Industrial Group; Bioiberica SAU; Sigma Aldrich, Inc.; ZPD; Sino Siam Biotechnique Company Ltd; BRF; Bio-gen Extracts Pvt. Ltd.; Seikagaku Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

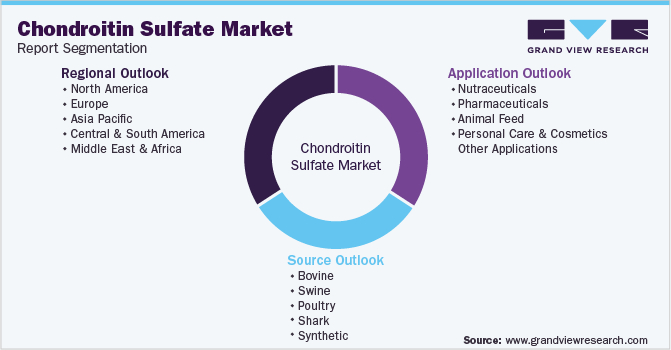

Global Chondroitin Sulfate Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global chondroitin sulfate market report on the basis of source, application, and region:

-

Source Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Bovine

-

Swine

-

Poultry

-

Shark

-

Synthetic

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Nutraceuticals

-

Pharmaceuticals

-

Animal Feed

-

Personal Care & Cosmetics

-

Other Applications

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Taiwan

-

-

Central & South America

-

Brazil

-

Argentina

-

Chile

-

Colombia

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global chondroitin sulfate market size was estimated at USD 1.25 billion in 2022 and is expected to reach USD 1.28 billion in 2023.

b. The global chondroitin sulfate market is expected to grow at a compound annual growth rate of 3.5% from 2023 to 2030 to reach USD 1.65 billion by 2030.

b. North America dominated the chondroitin sulfate market with a share of 36.2% in 2022. This is attributable to the booming pharmaceutical industry in the U.S. coupled with the FDA approval for using sodium chondroitin sulfate infused products.

b. Some key players operating in the chondroitin sulfate market include Bioiberica S.A.U., TSI Group Ltd., BRF, Seikagaku Corporation, Zeria Group, and Bio-gen Extracts Private Limited.

b. Key factors that are driving the market growth include increasing demand for joint health supplements along with prevalence of osteoarthritis among geriatric population.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."