- Home

- »

- Petrochemicals

- »

-

Crude Oil Flow Improvers Market Size & Share, Industry Report, 2025GVR Report cover

![Crude Oil Flow Improvers Market Size, Share & Trends Report]()

Crude Oil Flow Improvers Market Size, Share & Trends Analysis Report By Product (Paraffin Inhibitors, Asphaltene Inhibitors, Scale Inhibitors, Hydrate Inhibitors), By Application, By Region, And Segment Forecasts, 2018 - 2025

- Report ID: GVR-1-68038-669-1

- Number of Pages: 104

- Format: Electronic (PDF)

- Historical Range: 2014 - 2015

- Industry: Bulk Chemicals

Report Overview

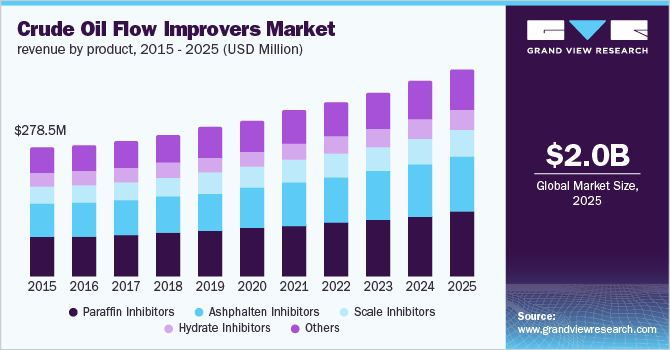

The global crude oil flow improvers market size to be valued at USD 2.03 billion by 2025. The rising acceptance of hydraulic fracturing and horizontal drilling techniques is projected to drive the demand for these products. The market is also actively driven by the high demand for these specialty products to enhance fluid drift in various stages of the petroleum value chain. The U.S. was the leading consumer market in North America. North America observed the maximum demand for these products, owing to the upsurge in the implementation of unconventional petroleum extraction techniques, such as hydraulic fracturing and horizontal drilling, the necessity for drift improvement additives to decrease the viscosity of petroleum liquids and to improve the movement through pipes has increased.

The oversupply of crude oil worldwide along with various geopolitical issues have led to the slump in average spot prices globally. The U.S. has made considerable amounts of investments in unconventional forms of drilling. Thus, it cannot afford to cut down their production as it would lead to a decline in the price of the finished products.

Owing to exploration activities, Europe holds huge opportunities for growth. The crude oil flow improvers market is also anticipated to gain profitability from ongoing activities in the Middle East to tap tight reserves, which will improve the declining rate of production.

The product manufacturing companies have high priority for minimizing rig time, improving the overall productivity of oil wells, and ensuring environmental amenability. New joint ventures, acquisitions, and mergers between the existing players in the market are likely to create new opportunities in the global industry.

Regulatory standards play a vital role in this industry. Frequently changing regulatory framework is a matter of concern for the industry players across the entire value chain. Several guidelines need to be followed during the utilization and disposal of these chemicals concerning environmental factors associated with it. This offers guidance to market players regarding the licenses, sanctions, guidelines, or orders to be followed during the utilization of these products.

Crude Oil Flow Improvers Market Trends

One of the primary reasons driving the market expansion is the increase in oil and gas exploration operations around the world as a result of rising energy demand. Furthermore, as oil and gas reserves deplete, hydraulic fracturing is gaining popularity as a way to access previously inaccessible oil and gas resources. Many governments are promoting hydraulic fracturing through financial aid, investment provisions, and tax advantages in order to facilitate the development of oil and gas resources. This is another component that contributes to the market's expansion. Aside from that, some businesses are working on low-dose hydrate inhibitors that will reduce the requirement for chemical additions significantly. This reduces the chance of hydrate plugs and line blockages, which is propelling the sector forward.

Heavy crude oil consists of high viscosity which makes its transport even more difficult. Therefore, it is essential to manage its viscosity so that it can be transported over long distances without compromising the state or quality of the crude oil. In addition, in cold regions, it is quite a challenge to transport oil owing to the cold temperature that results in the thickening of oil as it travels long distances. Furthermore, expanding output from renewable resources and increasing research activities, on the other hand, are expected to generate new and adequate chances for the market to flourish throughout the forecast period.

However, fluctuating crude oil costs, along with increasing environmental concerns for the expansion of automotive carbon thermoplastic, and the use of drag-reducing agents (DRA) to improve the flow of oil which affects the quality of the oil likely act as market restraints. The greatest impediment to market growth is the global recession.

Product Insights

The paraffin inhibitors was the largest product segment in 2016 and is expected to reach a net worth exceeding USD 620 million by 2025. Paraffin inhibitors are polymers with a high-molecular-weight. They interact with paraffins in petroleum liquids to restrict the formation of wax crystal, size, shape, and adhesion characteristics. These agents inhibit the paraffin deposition in the system by establishing repulsion between paraffin particles as well as between paraffin particles and the pipe surface.

Asphaltene inhibitors is projected to observe the fastest growth over the prediction period. The segment is expected to grow at a CAGR of 6.3% over the forecast period. The growth in this segment is attributed to its increasing utilization in the upstream and offshore petroleum operations. They are used to maximize the production capacity by inhibiting the blockages in the flow lines. They preserve the integrity of subsea assets like flow lines and wells and manage the throughput time and minimizing downtime. The other product categories include scale inhibitors, drag-reducing agents, and hydrate inhibitors.

Companies have started focusing on developing low-dose hydrate inhibitors owing to their environmental benefits when compared with glycol or methanol. The advantages associated with the use of these products are that they substantially decrease the need to use other chemical additives along with it. The need for other additives was very prevalent in the case of conventional hydrate inhibitors. This eliminates the risk associated with hydrate plugs and line blockages thereby driving the demand for crude oil flow improving products.

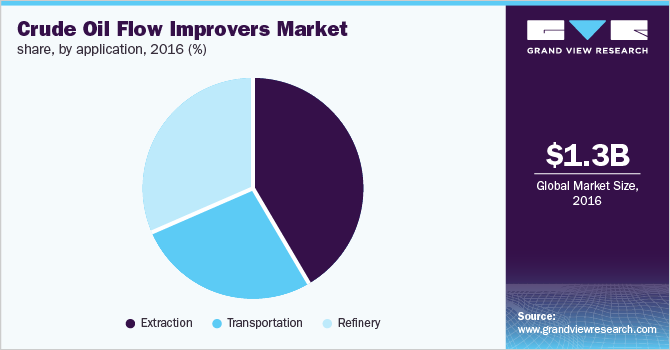

Application Insights

Extraction emerged as the largest and fastest-growing application and accounted for over 42% of the total revenue in 2016. The crude oil flow improvers (COFI) market is poised to witness growth owing to its capability to maximize the extraction of hydrocarbons in a cost-effective manner and assist in minimizing its influence on the environment. Increasing global hydrocarbon production and hydraulic fracturing operations from eccentric sources are driving the market.

The refinery application segment accounted for over 31% of the total revenue in 2016. The need to protect the integrity of the assets and the increasing refined petroleum products demand such as diesel, gasoline, naphtha, and lube-base stock to steer the product utilization in the refinery sector over the prediction period.

Various stages of petroleum production require the addition of huge quantities of these flow improvers. Some of the major OPEC countries including Saudi Arabia, Iraq, and Iran have amplified their production capacities to sustain the existing market position.

The drag-reducing agents are the chemical additives used in the pipelines to minimize the level of turbulence and reduces the possibilities of corrosion. The additive interacts with the fluids and the pipeline walls thereby reducing the contact with the oil and the walls of the pipelines. This enables crude oil to flow through low-pressure areas in a cost-effective and energy-efficient manner.

Regional Insights

Most of the investments are intended to penetrate the evolving markets in Asia Pacific, Middle East & Africa, and North America. The major multinational companies intend to enhance their global footprints in extremely lucrative regions and exploit factors such as low labor costs and resource availability along with liberal environmental norms.

Asia Pacific crude oil flow improvers industry is the fastest-growing market in terms of revenue. The regional market is estimated to grow at a CAGR of over 6% during the forecast period. The growth of the market is specifically attributed to the increasing number of exploration activities in this region.

The Middle East & Africa is poised to grow at moderate rates over the forecast period owing to its constant demand in the upstream sector of this region. There have been various upcoming offshore contracts in this region which will require the utilization of products such as hydrate inhibitors, paraffin inhibitors, and pour point depressants to deal with the fluid flow issues associated with offshore hydrocarbon extraction processes. For this purpose, the COFI market has established a strong-hold and is expected to further grow in this region.

Owing to the removal of sanctions on Iran, various multinational energy companies have shown an inclination towards investing in this region which is offering approximately 50 onshore and offshore projects and around 18 energy and power blocks valued over USD 185 billion by 2025. The existing geopolitical disturbances in countries such as Libya and Nigeria are expected to ease in the years to come. This is likely to result in increased hydrocarbon production and trade from these regions.

Key Companies & Market Share Insights

Major industry participants include BASF, Halliburton, Schlumberger, Nalco, The Lubrizol Company, Clariant, and Evonik. The global COFI market is extremely competitive owing to the presence of various well-established multinationals who pioneer in the manufacturing and supply of several oilfield chemicals across the industry value chain and have multiple channels for procurement of raw materials and distribution of finished goods globally.

The companies adopt integration across the value chain by supplying raw materials, manufacturing, and distributing the finished products which enable these companies to reduce the overall costs of procuring raw materials from small scale firms. Integration across the value chain enables the companies to achieve a higher profit margin and achieve optimum economies of scale to ensure the sustainability of the products in the industry.

The increasing requirement for flow improvers in operations such as extraction, transportation, and refining has provoked the major players to enhance their product portfolio and global footprint by undertaking mergers and acquisitions to serve a broader industry segment and acquire a larger market share

Recent Developments

-

In March 2022, Baker Hughes an American energy services firm announced the signing of an agreement to acquire Altus Intervention, an international facility with more than 40 years of industry experience in down-hole oil & gas technology and well intervention services.

-

In March 2022, Baker Hughes announced a joint venture with Dussur a Saudi Arabian Industrial Investments Company. The joint venture is signed to focus on providing oilfield and industrial chemicals in The Kingdom of Saudi Arabia (KSA).

-

In September 2020, Baker Hughes signed an agreement with private equity fund Pelican Energy to sell its SPC Flow (surface pressure control flow) business unit assets.

-

In November 2020, Evonik one of the world leaders in specialty chemicals announced the acquisition of Porocel Group, Houston (USA). Porocel is a global innovative leader in catalyst services and a leading producer of specialty adsorbents, activated alumina, and support media.

Crude Oil Flow Improvers Market Report Scope

Report Attribute

Details

Revenue forecast in 2025

USD 2.03 billion

Base year for estimation

2016

Historical data

2014 - 2015

Forecast period

2017 - 2025

Quantitative units

Revenue in USD million/billion and CAGR from 2017 to 2025

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; CSA; MEA

Country scope

U.S.; Canada; Mexico; UK; Russia; Norway; China; India; Indonesia; Brazil; Argentina; Venezuela; Saudi Arabia; UAE; Algeria.

Key companies profiled

BASF; Halliburton; Schlumberger; Nalco; The Lubrizol Company; Clariant; Evonik.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Crude Oil Flow Improvers Market Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the global crude oil flow improvers market on the basis of product, application, and region:

-

Product Outlook (Revenue, USD Million, 2014 - 2025)

-

Paraffin Inhibitors

-

Asphaltene Inhibitors

-

Scale Inhibitors

-

Hydrate Inhibitors

-

-

Application Outlook (Revenue, USD Million, 2014 - 2025)

-

Extraction

-

Transportation

-

Refinery

-

-

Regional Outlook (Revenue, USD Million, 2014 - 2025)

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

The U.K.

-

Russia

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Indonesia

-

-

Central & South America (CSA)

-

Brazil

-

Argentina

-

Venezuela

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

Algeria

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."