- Home

- »

- Medical Devices

- »

-

Bioelectric Medicine Market Size And Share Report, 2030GVR Report cover

![Bioelectric Medicine Market Size, Share & Trends Report]()

Bioelectric Medicine Market Size, Share & Trends Analysis Report By Type (Implantable Electroceutical Devices, Non-invasive Electroceutical Devices), By Product, By Application, By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-899-2

- Number of Pages: 96

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Bioelectric Medicine Market Size & Trends

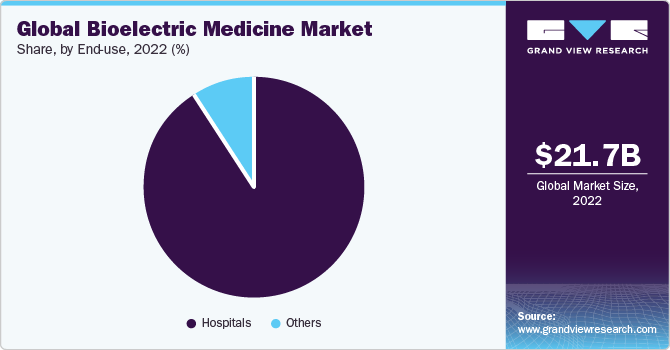

The global bioelectric medicine market size was valued at USD 21.67 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.1% from 2023 to 2030. The growing prevalence of chronic and acute conditions, increasing geriatric population, product advancements, and initiatives by key companies and organizations are major factors driving the market. In January 2022, the Alliance for Advancing Bioelectronic Medicine launched the first Bioelectronic Medicine Day, comprising a health awareness campaign. The campaign supported the efforts and advancements within the field of bioelectronic medicine.

Bioelectric medicine combines bioengineering, molecular medicine, and neuroscience to develop nerve-stimulating technologies for the regulation of biological processes during disease treatment. The rising prevalence of chronic diseases such as cardiac and neurological disorders is expected to be a major factor driving the market. As per the CDC, annually, around 610 thousand people die due to heart diseases in the U.S. Amongst them, over 370,000 deaths are caused by coronary heart disease. Thus, there is a high demand for advanced bioelectric medicine for treating these chronic disorders, which is expected to boost market growth.

As per the Centers for Disease Control and Prevention, cardiovascular diseases are responsible for the majority of deaths among men, women, and most racial and ethnic groups in the U.S. In 2021, approximately 695,000 individuals in the U.S. died from heart diseases, accounting for one in every five deaths. Furthermore, the global economic burden of CVDs is likely to be around USD 1,044 billion by 2030.

Increasing investments in R&D by manufacturers and the growth rate of regulatory approvals for new electroceuticals/bioelectric medicines are major factors contributing to the expansion of the market. For instance, in December 2018, Medtronic plc announced that the US FDA had provided approval to the InterStim smart programmer for use with the InterStim System deployed for sacral neuromodulation therapy. Medtronic has pioneered sacral neuromodulation and this product enhancement helped the company strengthen its market foothold.

However, stringent government rules and regulations regarding the development and manufacturing of medical devices, including implantable cardioverter defibrillators, cardiac pacemakers, and neuromodulation devices could hinder the growth of the market. These devices undergo rigorous clinical trials before a PMA (premarket approval), which causes a significant rise in the costs incurred by manufacturers. In addition, product recalls are a major challenge that could adversely affect market growth.

End-use Insights

The hospital segment held the largest revenue share of 91.3% in 2022, owing to the rising burden of chronic diseases, including arrhythmia, epilepsy, Alzheimer’s, retinitis pigmentosa, chronic pain, and depression, which require frequent or periodic hospitalization. For instance, as stated by the WHO, approximately 50 million people in the world suffer from epilepsy, and this number is expected to increase in the near future, owing to the rising number of car accidents and other traumatic injuries.

The increasing global population and rapidly developing healthcare infrastructure have spurred the demand for bioelectric medicines. Furthermore, increasing disposable income and the presence of advanced medical devices for the treatment of different debilitating diseases are expected to drive the application of electroceuticals in the hospital setting.

The other end-use segment includes research institutes and home care. This segment is projected to exhibit a significant CAGR over the forecast period due to the rising investments in R&D for new product developments. In addition, rising funding by governments globally for bioelectric medicine supports segment growth. For instance, in October 2016, the National Institutes of Health declared the funding of around USD 20 million for electroceutical research.

Product Insights

In 2022, the implantable cardioverter defibrillators segment held the largest revenue share of over 37.7% due to the high application of these products for arrhythmia. In addition, the increasing incidence rate of sudden cardiac arrests, the rising global geriatric population, and advanced product development are expected to boost market growth.

The deep brain stimulators segment is expected to witness lucrative growth over the forecast period, owing to the escalating prevalence of Parkinson's disease and lifestyle-induced disorders such as obesity and depression. According to the European Parkinson's Disease Association (EPDA), around 6.3 million patients suffer from Parkinson’s disease worldwide, of which 1.2 million patients are located in Europe. The sacral nerve stimulators segment accounted for a significant revenue share in 2022, owing to several product advancements and new product launches by companies in recent years.

On the other hand, the vagus nerve stimulators segment is expected to expand at the fastest CAGR of 8.1% during the forecast period. Factors such as the steadily aging global population, technological advancements in products, increasing demand for add-on therapy, growing prevalence of chronic diseases such as epilepsy and migraine, and significant unmet medical needs in these disease segments are expected to drive segment growth in the coming years.

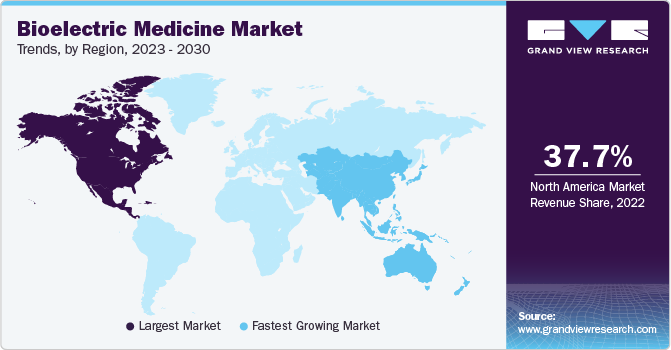

Regional Insights

North America led the market with a revenue share of 37.7% in 2022, due to the strong presence of medical device manufacturers such as Abbott and Boston Scientific Corporation. Moreover, the highly developed healthcare system and the availability of advanced products have fueled the growth of the regional market. North America was followed by Europe, owing to the rising demand for innovative medical devices for treatment procedures. The presence of major bioelectric medicine manufacturers and the well-developed healthcare infrastructure are growth drivers for the regional market.

The Asia Pacific region is projected to exhibit the highest CAGR of 8.6% during the forecast period, due to the rising geriatric population in Asian countries such as China and India. In addition, the growing prevalence of chronic diseases, including cardiac arrhythmias, Alzheimer's disease, Parkinson's disease, and epilepsy, is expected to drive the adoption of electroceuticals in the Asia Pacific.

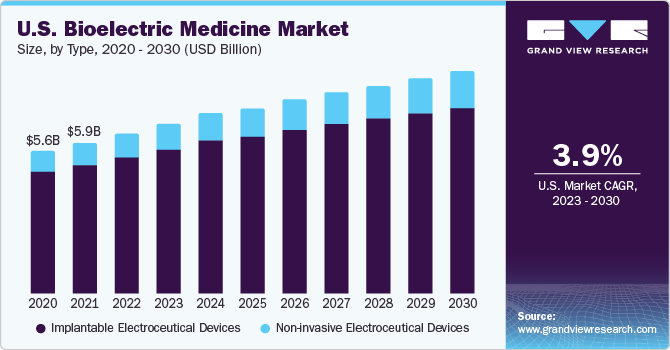

Type Insights

Implantable electroceutical devices held the dominant revenue share of 86.0% in 2022 owing to the extensive application of these products in the treatment of arrhythmia, chronic pain, ischemia, depression, tremor, and sensorineural hearing loss. Based on type, the market has been segmented into implantable and non-invasive electroceutical devices. Manufacturers are focusing on launching advanced products to cater to the unmet customer needs. In August 2018, Biotronik made a significant move in the space of arrhythmia detection and diagnosis with the MoMe cardiac monitor, designed to increase the rate of early detection and diagnosis of cardiac arrhythmias.

The non-invasive electroceutical devices segment is poised to witness the fastest CAGR of 7.8% during the projection period. This strong growth is due to technological advancements and rising investments in R&D by companies for innovative product developments. Moreover, the rapidly increasing healthcare awareness and popularity of electroceuticals in developing countries such as India, China, South Africa, and Argentina are expected to propel market growth.

Application Insights

The arrhythmia segment dominated the overall bioelectric medicine market with a revenue share of 65.6% in 2022. This is due to the rising prevalence of arrhythmia that involves the use of implantable cardioverter-defibrillators and cardiac pacemakers for the treatment. The epilepsy application segment is projected to register the fastest growth rate of 8.7% over the forecast period due to advancements in treatment options such as vagus nerve stimulators. Companies and research institutes are currently focusing on innovative product developments, driving industry growth.

In May 2023, a published study by the University of Pittsburgh Schools of the Health Sciences in the U.S. suggested that VNS (Vagus Nerve Stimulation) therapy could be more helpful to a wider range of patients than previously thought. The study's findings indicated that patients with focal seizures or motor seizures are more likely to respond positively to VNS treatment. This could mean that VNS therapy has the potential to benefit more patients than originally believed.

Sensorineural hearing loss is another major application segment, which accounted for a considerable revenue share in 2022. The rising number of patients suffering from hearing loss is the major growth driver of this segment. According to the NIH, in 2018, almost one in every three people in the age group of 65 to 74 suffered from hearing loss, while nearly half of the population older than 75 had hearing difficulties.

Key Companies & Market Share Insights

The market is highly fragmented, with the presence of a large number of manufacturers. Major names provide an extensive range of advanced electroceuticals through their strong global distribution channels. This has led to an intense competition among manufacturers and high pressure on the pricing strategies of vendors, which is expected to affect profit margins. Leading players are involved in new product developments, collaborations, mergers & acquisitions, and regional expansions to capture a greater revenue share. Such strategies help companies expand their existing product portfolio and geographical reach.

For instance, in November 2018, electroCore, Inc. received FDA Approval for its gammaCore therapy for the treatment of cluster headaches, making it the only FDA-approved pharmacological treatment for this disorder. Moreover, in June 2019, Boston Scientific Corporation acquired Vertiflex, Inc. The acquired company is focused on minimally invasive technology that helps alleviate pain and restore the physical function of lumbar spinal stenosis. The deal is anticipated to strengthen the spinal cord stimulation and radiofrequency ablation portfolio of Boston Scientific.

Key Bioelectric Medicine Companies:

- Medtronic

- Abbott

- Boston Scientific Corporation

- Cochlear Ltd.

- LivaNova PLC

- Biotronik SE & Co. KG

- electroCore, Inc.

- Sonova

- Nevro Corp.

- Stimwave LLC

Recent Developments

-

In July 2023, Boston Scientific Corporation obtained FDA approval for its Vercise Neural Navigator 5 software. This software is designed to be used alongside the Vercise Genus deep brain stimulation (DBS) systems, providing clinicians with straightforward and practical data for the treatment of individuals with Parkinson's disease or essential tremor. Clinicians can efficiently program the DBS system and deliver optimal treatment to patients with this software

-

In June 2023, BIOTRONIK announced the first successful worldwide implantation of its newest implantable cardiac monitor, BIOMONITOR IV. This device has been designed to increase the efficiency of monitoring for cardiac arrhythmias, using artificial intelligence technology. By pairing the company’s SmartECG technology with AI, the device is able to reduce false positive detections by 86%, while preserving 98% of true episodes. The BIOMONITOR IV is the only implantable cardiac monitor available that can accurately differentiate between premature atrial contractions (PACs) and premature ventricular contractions (PVCs)

-

In February 2023, LivaNova launched a new device called SenTiva DUO, an implantable pulse generator that aims to treat epilepsy in patients resistant to drug therapy. The device is specifically intended to deliver Vagus Nerve Stimulation (VNS) therapy and has a dual-pin header. The latest technology treats and offers benefits to patients who have been embedded with a dual-pin lead and IPG

-

In November 2022, electroCore, Inc. announced that Joerns Healthcare, LLC had been selected as the exclusive distributor and biller for the FDA-approved gammaCore Sapphire non-invasive device for the treatment and prevention of various types of headache pain through the vagus nerve. The device is set to be distributed and billed only within certain managed care health systems

-

In June 2020, Medtronic announced that its Percept PC Deep Brain Stimulation (DBS) system had received approval from the U.S. FDA. The system is equipped with the BrainSense technology, which enables continuous monitoring and recording of brain activity. It can capture and record brain signals while providing treatment to patients who suffer from neurological disorders such as Parkinson's disease, epilepsy, dystonia, essential tremor, or obsessive-compulsive disorder

Bioelectric Medicine Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 23.48 billion

Revenue forecast in 2030

USD 35.42 billion

Growth Rate

CAGR of 6.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

December 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; Italy; France; Spain; Japan; China; India; Australia; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia

Key companies profiled

Medtronic; Abbott; Boston Scientific Corporation; Cochlear Ltd.; LivaNova PLC; Biotronik SE & Co. KG; electroCore, Inc.; Sonova; Nevro Corp.; Stimwave LLC

Customization scope

Free report customization (equivalent to up to analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bioelectric Medicine Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global bioelectric medicine market report based on product, type, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Implantable Cardioverter Defibrillators

-

Cardiac Pacemakers

-

Cochlear Implants

-

Spinal Cord Stimulators

-

Deep Brain Stimulators

-

Transcutaneous Electrical Nerve Stimulators

-

Sacral Nerve Stimulators

-

Vagus Nerve Stimulators

-

Other

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Implantable Electroceutical Devices

-

Non-invasive Electroceutical Devices

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Arrhythmia

-

Pain Management

-

Sensorineural Hearing Loss

-

Parkinson’s Disease

-

Tremor

-

Depression

-

Treatment-resistant Depression

-

Epilepsy

-

Urinary and Fecal Incontinence

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the bioelectric medicine market include Medtronic; Abbott; Boston Scientific Corporation; Cochlear Ltd.; LivaNova PLC; Biotronik SE & Co KG; electroCore, Inc.; Sonova; Nevro Corp.; and Stimwave LLC.

b. Key factors driving the bioelectric medicine market growth include the growing prevalence of chronic and acute conditions, the increasing geriatric population, product advancements, and initiatives by key companies and organizations.

b. The global bioelectric medicine market was estimated at USD 21.67 billion in 2022 and is expected to reach USD 23.48 billion in 2023.

b. The global bioelectric medicine market is expected to grow at a compound annual growth rate of 6.1% from 2023 to 2030 to reach USD 35.42 billion by 2030.

b. North America dominated the bioelectric medicines industry with the largest revenue share in 2022 due to the presence of medical device manufacturers such as Abbott and Boston Scientific Corporation. Moreover, the highly developed healthcare system and the availability of advanced products in this region have fueled growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."