- Home

- »

- Communication Services

- »

-

Enterprise Governance, Risk And Compliance (eGRC) Market Report 2030GVR Report cover

![Enterprise Governance, Risk And Compliance (eGRC) Market Size, Share & Trends Report]()

Enterprise Governance, Risk And Compliance (eGRC) Market Size, Share & Trends Analysis Report By Component, By Software, By Services, By Software Usage, By Organization Size, By Deployment Mode, By Business Function, By Vertical, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-670-7

- Number of Pages: 165

- Format: Electronic (PDF)

- Historical Range: 2018 - 2023

- Industry: Technology

eGRC Market Size & Trends

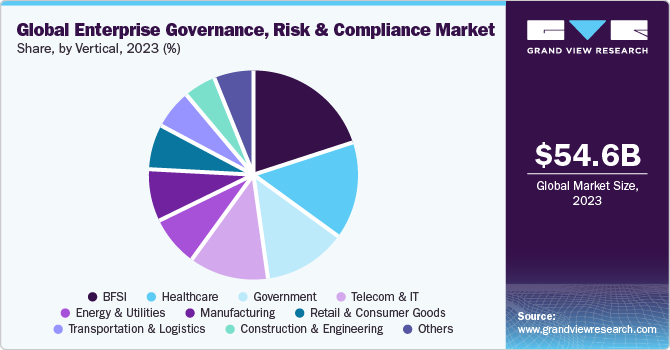

The global enterprise governance, risk, and compliance (eGRC) market size was valued at USD 54.61 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 13.8% from 2023 to 2030. The growth of this market can be attributed to the benefits of implementing eGRC, which include stability, optimization, transparency, reduced costs, and consistency, among others. Additionally, the presence of companies such as Microsoft, Oracle Corporation, SAP SE, and Software AG, which offer a solution with unique attributes, resulted in a wide range of products available in the market, driving its growth.

For instance, in September 2021, Microsoft announced the general availability of its Azure Purview, a cloud-native data governance solution that helps businesses to govern multi-cloud, SaaS, and on-premises data. Integrating AI with Enterprise Governance Risk and Compliances enhances the capabilities of the offered Enterprise Governance Risk and Compliances solution, which can help the solution be widely adopted in multiple industries to cater to high demand. For instance, the major cause of the high adoption of enterprise governance risk and compliance solutions in the financial institution includes increased technical needs among financial institutions in terms of complex systems for conducting various processes and managing compliances, among others.

Enterprise governance risk & compliance plays a crucial role for a wide range of industries; along with this, the strict regulation established by governments and other organizations has resulted in the growth of the enterprise governance, risk and compliance market during 2023 - 2030. Compliances formulated aim to ensure industries are accountable and take measures to overcome any risks. The future of any organization depends on understanding internal and external factors for making time-to-time decisions in line with the enterprise governance, risk and compliance (eGRC) guidelines.

The increased number of data breaches across industries has increased the demand for information security. The increased complexity of the transaction happening in industries has paved the way for the growth of the eGRC market during 2023 - 2030. GRC and eGRC benefit an organization in various aspects, including managing risks across the organization and preparing safeguards against attacks, streamlining processes and standardizing workflow, offering a buffer against company regulatory scrutiny and errors, and ensuring control systems are in place for consistency across the enterprise.

The capability of eGRC to provide an entire package of the aspects mentioned above has resulted in the market's growth during 2023 - 2030. The inception of the COVID-19 pandemic has resulted in enterprises/organizations adopting work-from-home, and remote working styles, which has resulted in organizations facing issues such as data confidentiality and breaching, among others. This space was easily an eGRC solution, resulting in increased revenue during this period. However, the case is quite different in the case of SMBs, where due to a lack of understanding, SMBs are finding it harder to adopt eGRC.

The companies in the eGRC market have been coming up with an eGRC solution with additional features, attracting customers and enabling the companies to capture a significant share of the eGRC market. For instance, MetricStream offers an AI-powered GRC solution enabling resilience and agility; some of the company's major customers include Trimble Inc., Cummins Inc., Capricorn Group Limited, and UBS, among others. Thus, eGRC solutions offering with additional features have been gaining traction in the eGRC market, driving its growth during 2023 - 2030.

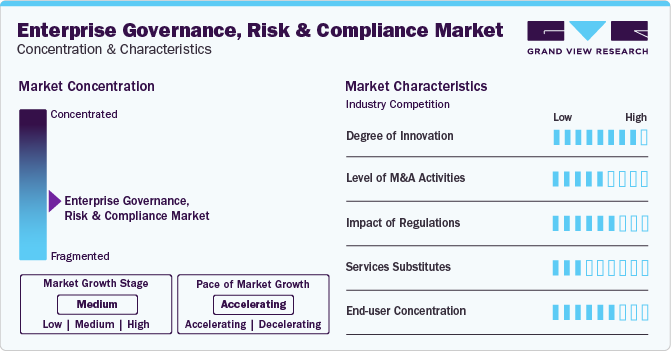

Market Concentration & Characteristics

The integration of enterprise governance, risk, and compliance (eGRC) has become imperative for enterprises attempting to manage the intricate terrain of company operations while guaranteeing conformity to ethical and legal norms. A range of integrated software solutions intended to simplify and manage these issues are included in the eGRC market. As more businesses realize they need to tackle governance, risk, and compliance holistically, the eGRC industry is expanding at a rapid pace. By providing a unified platform, integrated eGRC solutions help enterprises manage these components cohesively, do away with silos, and promote an operating environment that is more effective and transparent.

Corporate governance risk and compliance provides a framework for managing businesses and ensuring decisions are made to serve the interests of stakeholders best. Risk management, by its identification, assessment, and mitigation of possible threats to corporate objectives, promotes a proactive attitude to uncertainty. To avoid legal trouble and preserve one's reputation, compliance refers to abiding by the law, the rules, and one's moral principles. When combined, these components offer a sensible framework that directs companies toward ethical, transparent, and trustworthy operations. Robust GRC standards are essential for long-term success in a fast-moving and demanding business environment because they increase operational efficiency and foster stakeholder confidence.

Artificial intelligence and machine learning are examples of cutting-edge technologies that have been used into eGRC systems to further improve their capabilities. These technologies give companies the ability to detect possible hazards and compliance concerns before they become more serious by enabling predictive analytics, real-time monitoring, and data-driven decision-making. The growing intricacy of industry-specific regulatory environments. Organizations must implement agile eGRC solutions that can quickly adjust to new compliance needs due to the constantly changing nature of laws. Furthermore, the necessity for standardized procedures that can guarantee uniformity in governance, risk management, and compliance across many geographic locations has increased due to the growth of global corporate activities.

Solutions for enterprise governance, risk, and compliance (eGRC) are essential for optimizing organizational workflows, guaranteeing compliance with legal requirements, and successfully managing risks. Global IT giants like Oracle provide complete eGRC solutions that fit right into corporate ecosystems. A comprehensive platform for managing governance, risk, and compliance is offered by Oracle's eGRC suite, which includes tools for incident reporting, policy administration, and risk assessment. Oracle empowers businesses to make well-informed decisions, proactively manage risks, and maintain compliance in a variety of regulatory contexts with its powerful analytics and automation capabilities.

Component Insights

The software segment is expected to occupy the largest share of the market during 2023 - 2030. The growth of this segment can be attributed to a large number of players in the eGRC market offering software solutions. Moreover, many companies in the eGRC market have a presence spanning the globe, which has resulted in the wider adoption of the software segment during the forecast period. For instance, as of 2021, Oracle has user communities in 97 countries and 5 million registered members of Oracle customer and developer communities. The wide reach of the major companies in the market has resulted in high market growth during 2023 - 2030.

The services segment is expected to have significant growth during the period 2023 - 2030. The services segment's added benefits, including accessibility, cost-effectiveness, scalability, analytics, data storage, heightened security, and operational management, among others, have resulted in the growth of this segment during the forecast period. The presence of companies in the eGRC market offering SaaS GCR solutions paved the way for the services segment's growth. For instance, Archer Technologies LLC (a U.S.-based GRC solution provider) offers SaaS GRC solutions. The existence of such companies catering to the demand is expected to continue during the forecast period, driving market growth.

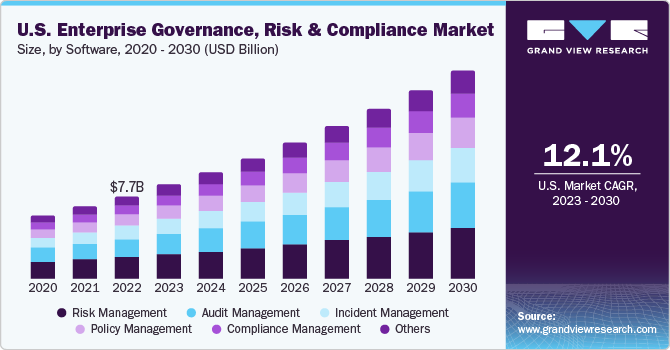

Software Insights

The risk management segment of the eGRC market by software is expected to occupy the largest share in 2022. The growth of this segment can be attributed to the increased demand in the market for tackling risks faced by organizations regarding their development. Risk management vendors meet the need by governing risk assessment and follow-up services. The COVID-19 pandemic has also resulted in remote working, for which the companies had to manage unforeseen risks, helping the growth of the risk management segment. Additionally, businesses are looking for risk management for certain processes requiring specialized demand. For instance, credit risk management is experiencing transformation, wherein financial institutions/banks prefer solutions such as real-time early warning systems for credit monitoring to tackle non-performing assets.

The compliance management segment is projected to have the highest CAGR from 2023 to 2030. Opting for compliance management includes easy collaboration, automating compliance processes, simplifying tracking regulatory changes, reducing operation costs, and increasing customer satisfaction, among others. The number of companies in the market that offer compliance management solution is also high, some of which includes IBM, and Microsoft, among others. The presence of such companies catering to the demand across industries has accelerated the growth of the compliance management segment during 2023 - 2030.

Services Insights

The consulting segment is expected to hold the largest share of the eGRC market revenue by services. The requirements of each of the businesses varies depending upon the industry being served, enterprise size, the complexity of the challenges being addressed, and changing government regulations across countries. All these aspects have resulted in the growth of the consulting segment of the enterprise governance, risk & compliance market during 2023 - 2030.

The integration segment of the enterprise governance, risk & compliance market by services is projected to have the highest CAGR during the period 2023-2030. Integration segment growth can be attributed to the benefits of integrated solutions, which include consistency in GRC measures, effective compliance programs for addressing constant changes in technology and regulation, proactively responding to risks by breaking down restrictive organization silos, and function, among others. All the aspects mentioned above of integrated GRC solutions have resulted in the growth of the integrated segment of the eGRC market during the forecast period.

Organization Size Insights

The large enterprise governance, risk & compliance market segment by organization size is projected to have significant growth in the market from 2023 - 2030. The benefits of adopting the eGRC solution are the major factor resulting in the development of this segment during 2023 - 2030. Some major attributes include full customization, 24/7 automation, smoother onboarding/integration, complete visibility/management, data security, and real-time reporting & monitoring, among others. Since large enterprises generally have the following characteristics: customer base, complex business operation, a high number of employees, and larger organization network, wherein implementation of GRC becomes crucial, directly fueling the growth of this segment from 2023 - 2030.

The SMEs segment of the enterprise governance, risk & compliance market by organization size is projected to have the highest growth during the period 2023 - 2030. This growth can be attributed to the SMEs focusing on enforcing advanced cloud-based risk compliance policies and cost-effective services. In the competitive world, SMEs mainly depend upon factors such as delivery time and cost-effectiveness to gain traction in the market. Implementing the eGRC solution ticks all the boxes concerned with the success of SMEs, thus resulting in the growth of this segment during the period 2023 - 2030.

Vertical Insights

BFSI is estimated to occupy the largest share in the enterprise governance, risk & compliance market by vertical in 2022 & 2030. The digitalization and adoption of other technologies in the financial sector have been on the rise in the prior years. This change in the financial industry is also benefiting the enterprise governance, risk & compliance market, which has resulted in the growth of the BFSI segment. For instance, in November 2022, The Bank of East Asia, Limited selected Wolters Kluwer N.V. (Dutch software solution provider) for offering its regulatory reporting software (OneSumX). Such adoption has been taking place in high numbers resulting in increased growth of the BFSI segment during 2023 - 2030.

IT & Telecom is projected to be the fastest growing segment in the enterprise governance, risk & compliance market by vertical. The telecom industry has been known for adopting innovation and new technology; the COVID-19 pandemic further accelerated this trend. The number of cyber-attacks in the telecom industry has been on the rise, which has directly fueled the adoption of GRC. For instance, in May 2022, Lumen Technologies (U.S.-based enterprise technology platform provider) published its quarterly DDoS report, according to which of the 500 large attacks that happened in Q1 2022, the telecom industry alone accounted for 76% of all the DDoS attacks. Such a high number of cyberattacks in the telecom industry has resulted in Telecom companies adopting all measures to secure the data, network, and others, thus resulting in the growth of IT & telecom during 2023 - 2030.

Regional Insights

North America is estimated to be holding the largest share of nearly 30% in 2022 in the enterprise governance, risk & compliance market by region. This region is home to some of the major players in the eGRC market, which includes Dell Inc., IBM, Microsoft, and Oracle, among others. The presence of the major companies has directly fueled the growth of this region. Moreover, businesses in this region have better attitudes towards digitalization, cyber security, and data protection. For instance, in September 2022, a report published by the International Institute for Management Development named "2022 IMD World Digital Competitiveness Ranking", according to which the U.S. ranks second among all the countries in terms of digital competitiveness.

Europe eGRC Market

The Europe eGRC market held a market share of 26.4% in 2022 in the global eGRC market. The growth of the eGRC market in Europe can be attributed to strict government regulation and industry standards for enterprise governance, risk & compliance solutions in Europe. Moreover, the increasing demand for eGRC solutions in the BFSI sector and the growing volume of digital data have also fueled the growth of the enterprise governance, risk & compliance market in Europe.

U.K. eGRC Market

The U.K. eGRC market held a market share of nearly 34% in 2022 in the Europe eGRC market. The growth of the U.K. in the eGRC market can be attributed to factors such as growing demand for corporate governance, the need for a holistic approach to risk management, and the integration of AI/ML and blockchain technologies in GRC solutions.

Germany eGRC Market

Germany eGRC market was estimated to be valued at USD 3.02 billion in 2022. The growth of the eGRC market in Germany can be attributed to factors that include stringent government regulation and industry standards, increased adoption of eGRC solutions in multiple industries, and wider adoption of cloud-based systems, among others.

France eGRC Market

The France eGRC market is expected to witness high growth in the coming years, which can be attributed to factors such as the increasing number of data breaches and higher volumes of data handling, all contributing to the growth of the eGRC market in France. Increasing demand for eGRC solutions across the region is also fueling the increased demand for eGRC solutions in France.

Asia Pacific eGRC Market

Asia Pacific is projected to have the highest growth rate during the period 2023-2030. The growth of the Asia Pacific region can be attributed to the technological advancement that has taken place in countries such as China and Japan. Major countries in the Asia Pacific are among the leaders in the latest technologies, such as 5G and automation. This trend of keeping up with the latest technology will also result in increased adoption of GRC in the Asia Pacific region in the coming years. Additionally, a growing economy such as India is also witnessing increased eGRC digitalization and data protection regulation, compliance which businesses must follow. All these aspects mentioned above have also driven the growth of GRC adoption in India, eventually resulting in the development of the Asia Pacific region.

China eGRC Market

The China eGRC market is expected to hold a market share nearly of 26% in 2022 in the Asia Pacific eGRC market. The growth of the eGRC market in China can be attribteud to improving regulation concerned with data breaches. For instance, in December 2023, the Chinese government pushed for improvements in data security as they discovered foreign geographic information software was potentially compromising sensitive and proprietary data in important sectors, which included advised security organizations and the military.

India eGRC Market

The India eGRC market held a market share nearly of 15% in 2022 in the Asia Pacific eGRC market. The growth of the eGRC market in India can be attributed to the increasing demand for specialized consulting and support services, a high number of verticals adopting eGRC solutions, and increased demand for corporate governance, regulatory requirements, and compliance, among others.

Japan eGRC Market

The Japan eGRC market was estimated to be valued at USD 2.09 billion in 2022. The growth of the eGRC market in Japan can be attributed to increased government initiatives that have been fueling the growth of the Japanese enterprise governance risk and compliance market. For instance, in July 2023, as part of their digital relationship, Japan and the EU convened their first ministerial-level council meeting. The relationship is based on four pillars: semiconductors, digital economy regulations, underwater cables, and collaboration on high-performance computing, encompassing 5G and beyond, according to a joint statement released later. Such initiatives would help in increased adoption of the global standards among businesses in the country, thereby fueling the adoption of eGRC solutions as well in Japan.

Middle East & Africa eGRC Market

The Middle East & Africa eGRC market was estimated to be USD 3.47 billion in 2022. The growth of the eGRC market in the MEA region can be attributed to improving digital infrastructure, improving digital security regulation, rising purchasing power, and globalization, among others.

Saudi Arabia eGRC Market

Saudi Arabia eGRC market is expected to witness a high growth rate in the coming years owing to factors such as increased demand for consulting and support services, improving digital infrastructure, increasing number of digital businesses, compliance with international standards, and improving business ecosystem, among others, all of which have together contributed to the growth of the eGRC market in the country.

Key Enterprise Governance, Risk, And Compliance Company Insights

Some of the key players operating in the enterprise governance, risk, and compliance (eGRC) market include Oracle, Genpact, and MetricStream, among others.

-

Among the key companies in the eGRC (Enterprise Governance, Risk, and Compliance) space, Oracle offers complete solutions that fit well into business ecosystems. Its eGRC package provides a unified platform for managing governance, risk, and compliance, integrating capabilities such as risk assessment, policy administration, and incident reporting. Organizations are able to make well-informed choices, proactively manage risks, and maintain compliance in a variety of regulatory contexts because of Oracle's powerful analytics and automation capabilities.

-

Leading the eGRC (Enterprise Governance, Risk, and Compliance) industry, Genpact provides cutting-edge solutions that are customized to satisfy various company requirements. Genpact's eGRC services encompass a range of skills, from policy design and enforcement to regulatory reporting and audit management, by utilizing its proficiency in process optimization and risk management. The company's use of technology-driven solutions improves transparency and efficiency, allowing businesses to handle complexity with grace.

-

Maclearglobal.com, and NAVEX Global, Inc., are some of the emerging market participants in the enterprise governance, risk and compliance (eGRC) market.

-

Maclearglobal.com offers innovative solutions for organizations navigating complex regulatory landscapes. With a focus on digital governance, risk management, and compliance, Maclearglobal.com provides tailored services to enhance operational efficiency and transparency. The company leverages advanced technologies to address evolving challenges, positioning itself as a forward-thinking contributor to the eGRC landscape. While specific details may vary, Maclearglobal.com is recognized for its commitment to empowering businesses with comprehensive tools to manage governance, mitigate risks, and ensure compliance in today's dynamic and highly regulated business environments.

-

NAVEX Global, Inc. is a prominent player in the eGRC (Enterprise Governance, Risk, and Compliance) market, specializing in comprehensive solutions for ethics and compliance management. The firm provides whistleblower hotlines, policy management, and training solutions with an emphasis on developing ethical organizations. Because of its dedication to upholding corporate integrity and reducing risks, NAVEX Global is regarded as a reliable partner by companies looking for strong eGRC solutions in the stringent regulatory frameworks of today.

Key Enterprise Governance, Risk And Compliance (eGRC) Companies:

The following are the leading companies in the Enterprise Governance, Risk, And Compliance Market market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these eGRC companies are analyzed to map the supply network.

- FIS

- Genpact

- IBM

- Maclearglobal.com

- MetricStream

- Microsoft

- NAVEX Global, Inc.

- Oracle

- RSA Security LLC

- SAI Global Pty Limited

- SAP SE

- SAS Institute Inc.

- Software AG

- Thomson Reuters

- Wolters Kluwer N.V.

Recent Developments

-

In November 2023, IBM announced that Watsonx.governance is expected to be widely accessible by December 2023. This platform is designed to aid organizations in dispelling misconceptions surrounding AI models, the data input into the system, and the resulting outputs. While the business world is witnessing a surge in applications leveraging generative AI powered by Large Language Models (LLM), it also grapples with associated risks and complexities. These challenges encompass issues ranging from the need for clearer sourcing of training data from the internet to the generation of outputs that need more explain ability. Watsonx.governance equips organizations with tools to manage risks effectively, foster transparency, and prepare for forthcoming regulations focused on AI.

-

In November 2023, Brillio forged a collaboration with Microsoft to collaboratively develop cutting-edge horizontal and industrial solutions utilizing the Microsoft Azure OpenAI Service. These intelligent solutions, accessible through the Microsoft Azure Marketplace, will merge Brillio's extensive industry and digital proficiency with Microsoft's AI and analytics platforms. This synergy is poised to empower businesses across diverse sectors, including healthcare, banking, retail, financial services, life sciences, consumer packaged goods, and insurance. The aim is to catalyze the transformation of business models, expedite innovation, and capitalize on new growth prospects.

-

In November 2023, MetricStream introduced a cloud GRC solution that leverages Amazon Web Services (AWS) AWS Audit Manager in conjunction with MetricStream CyberGRC. Customers will be able to manage risks, compliance standards, frameworks centrally, and controls with MetricStream's new cloud GRC solution, which also offers automated evidence collecting and assessments for both on-premises and AWS settings.

-

In September 2023, Oracle Access Governance has been updated to assist IT teams in assigning, tracking, and managing user access to apps and other digital resources more effectively. By limiting access to restricted assets like source code, patents, databases, apps, and infrastructure resources like cloud servers and services, only authorized users can use, view, or interact with them. This cloud-native service helps lower risk by offering a comprehensive insight into how users interact with tech resources.

Enterprise Governance, Risk and Compliance (eGRC) Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 54.61 billion

Revenue forecast in 2030

USD 134.86 billion

Growth rate

CAGR of 13.8% from 2023 to 2030

Actual Data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, software, software usage, services, deployment mode, business function, vertical, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Germany, U.K., France, China, Japan, India, South Korea, Australia, Brazil, Mexico, Saudi Arabia, UAE, and South Africa

Key companies profiled

SAI Global Pty Limited, RSA Security LLC, FIS, Genpact, IBM, Maclearglobal.com, MetricStream, Microsoft, Oracle, SAP SE, SAS Institute Inc., Software AG, Thomson Reuters, Wolters Kluwer N.V, and NAVEX Global, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Enterprise Governance, Risk, And Compliance Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global enterprise governance, risk, and compliance (eGRC) market report based on component, software, software usage, services, deployment mode, business function, organization size, vertical, and region.

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Software

-

Services

-

-

Software Outlook (Revenue, USD Billion, 2018 - 2030)

-

Audit Management

-

Compliance Management

-

Risk Management

-

Policy Management

-

Incident Management

-

Others

-

-

Software Usage Outlook (Revenue, USD Billion, 2018 - 2030)

-

Internal

-

External

-

-

Services Model Outlook (Revenue, USD Billion, 2018 - 2030)

-

Integration

-

Consulting

-

Support

-

-

Deployment Mode Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Business Function Outlook (Revenue, USD Billion, 2018 - 2030)

-

Finance

-

Information Technology

-

Legal

-

Operations

-

-

Organization Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Small & Medium Enterprise

-

Large Enterprise

-

-

Vertical Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Construction & Engineering

-

Energy & Utilities

-

Government

-

Healthcare

-

Manufacturing

-

Retail & consumer goods

-

Telecom & IT

-

Transportation & Logistics

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global enterprise governance, risk and compliance market size was estimated at USD 47,223.0 million in 2022 and is expected to reach USD 54,613.4 million in 2023.

b. The global enterprise governance, risk and compliance market is expected to grow at a compound annual growth rate of 13.8% from 2023 to 2030 to reach USD 134.86 billion by 2030.

b. The risk management software segment dominated the EGRC market with a share of 24.88% in 2022. This is attributable to the software capability in averting breaches, subsequent penalties, and managing possible threats to the business.

b. The software segment dominated the global EGRC market and accounted for the largest revenue share of over 60% in 2022 due to increasing demand for a cost-effective solution to comply with the myriad of regulations such as Occupational Safety and Health Association (OSHA), Health Insurance Portability and Accountability (HIPAA), GDPR, and others.

b. The consulting services led the global enterprise governance, risk & compliance market accounted for the maximum revenue share of more than 30.0% market share in 2022, owing to evolving technology, business practices, personnel requirements, and consumer demands and concerns that require consulting professional service to understand the eGRC need based on enterprise operation.

b. The large enterprise segment led the global enterprise governance, risk & compliance market with a revenue share of over 68.62% of the overall revenue share in 2022.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Market Definitions

1.3. Research Methodology

1.3.1. Information Procurement

1.3.2. Information or Data Analysis

1.3.3. Market Formulation & Data Visualization

1.3.4. Data Validation & Publishing

1.4. Research Scope and Assumptions

1.4.1. List of Data Sources

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. Enterprise Governance, Risk and Compliance (eGRC) Market Variables, Trends, & Scope

3.1. Market Introduction/Lineage Outlook

3.2. Industry Value Chain Analysis

3.3. Market Dynamics

3.3.1. Market Drivers Analysis

3.3.2. Market Restraints Analysis

3.3.3. Market Opportunity Analysis

3.4. Enterprise Governance, Risk and Compliance (eGRC) Market Analysis Tools

3.4.1. Porter’s Analysis

3.4.1.1. Bargaining power of the suppliers

3.4.1.2. Bargaining power of the buyers

3.4.1.3. Threats of substitution

3.4.1.4. Threats from new entrants

3.4.1.5. Competitive rivalry

3.4.2. PESTEL Analysis

3.4.2.1. Political landscape

3.4.2.2. Economic and Social landscape

3.4.2.3. Technological landscape

3.4.2.4. Environmental landscape

3.4.2.5. Legal landscape

Chapter 4. Enterprise Governance, Risk and Compliance (eGRC) Market: Component Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. Enterprise Governance, Risk and Compliance (eGRC) Market: Component Movement Analysis, USD Billion, 2023 & 2030

4.3. Software

4.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.4. Services

4.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 5. Enterprise Governance, Risk and Compliance (eGRC) Market: Software Estimates & Trend Analysis

5.1. Segment Dashboard

5.2. Enterprise Governance, Risk and Compliance (eGRC) Market: Software Movement Analysis, USD Billion, 2023 & 2030

5.3. Audit Management

5.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

5.4. Compliance Management

5.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

5.5. Risk Management

5.5.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

5.6. Policy Management

5.6.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

5.7. Incident Management

5.7.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

5.8. Others

5.8.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 6. Enterprise Governance, Risk and Compliance (eGRC) Market: Software Usage Estimates & Trend Analysis

6.1. Segment Dashboard

6.2. Enterprise Governance, Risk and Compliance (eGRC) Market: Software Usage Movement Analysis, USD Billion, 2023 & 2030

6.3. External

6.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

6.4. Internal

6.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 7. Enterprise Governance, Risk and Compliance (eGRC) Market: Services Estimates & Trend Analysis

7.1. Segment Dashboard

7.2. Enterprise Governance, Risk and Compliance (eGRC) Market: Services Movement Analysis, USD Billion, 2023 & 2030

7.3. Integration

7.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.4. Consulting

7.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.5. Support

7.5.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 8. Enterprise Governance, Risk and Compliance (eGRC) Market: Deployment Mode Estimates & Trend Analysis

8.1. Segment Dashboard

8.2. Enterprise Governance, Risk and Compliance (eGRC) Market: Deployment Mode Movement Analysis, USD Billion, 2023 & 2030

8.3. Cloud

8.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.4. On-premise

8.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 9. Enterprise Governance, Risk and Compliance (eGRC) Market: Organization Size Estimates & Trend Analysis

9.1. Segment Dashboard

9.2. Enterprise Governance, Risk and Compliance (eGRC) Market: Organization Size Movement Analysis, USD Billion, 2023 & 2030

9.3. Small & Medium Enterprise

9.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.4. Large Enterprise

9.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 10. Enterprise Governance, Risk and Compliance (eGRC) Market: Vertical Estimates & Trend Analysis

10.1. Segment Dashboard

10.2. Enterprise Governance, Risk and Compliance (eGRC) Market: Vertical Movement Analysis, USD Billion, 2023 & 2030

10.3. BFSI

10.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

10.4. Construction & Engineering

10.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

10.5. Energy & Utilities

10.5.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

10.6. Government

10.6.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

10.7. Healthcare

10.7.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

10.8. Manufacturing

10.8.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

10.9. Retail & Consumer Goods

10.9.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

10.10. Telecom & IT

10.10.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

10.11. Transportation & Logistics

10.11.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

10.12. Others

10.12.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 11. Enterprise Governance, Risk and Compliance (eGRC) Market: Regional Estimates & Trend Analysis

11.1. Enterprise Governance, Risk and Compliance (eGRC) Market Share by Region, 2023 & 2030 (USD Billion)

11.2. North America

11.2.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

11.2.2. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

11.2.3. Market Size Estimates and Forecasts by Software, 2018 - 2030 (USD Billion)

11.2.4. Market Size Estimates and Forecasts by Software Usage, 2018 - 2030 (USD Billion)

11.2.5. Market Size Estimates and Forecasts by Services, 2018 - 2030 (USD Billion)

11.2.6. Market Size Estimates and Forecasts by Deployment Mode, 2018 - 2030 (USD Billion)

11.2.7. Market Size Estimates and Forecasts by Business Function, 2018 - 2030 (USD Billion)

11.2.8. Market Size Estimates and Forecasts by Organization Size, 2018 - 2030 (USD Billion)

11.2.9. Market Size Estimates and Forecasts by Vertical, 2018 - 2030 (USD Billion)

11.2.10. U.S.

11.2.10.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

11.2.10.2. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

11.2.10.3. Market Size Estimates and Forecasts by Software, 2018 - 2030 (USD Billion)

11.2.10.4. Market Size Estimates and Forecasts by Software Usage, 2018 - 2030 (USD Billion)

11.2.10.5. Market Size Estimates and Forecasts by Services, 2018 - 2030 (USD Billion)

11.2.10.6. Market Size Estimates and Forecasts by Deployment Mode, 2018 - 2030 (USD Billion)

11.2.10.7. Market Size Estimates and Forecasts by Business Function, 2018 - 2030 (USD Billion)

11.2.10.8. Market Size Estimates and Forecasts by Organization Size, 2018 - 2030 (USD Billion)

11.2.10.9. Market Size Estimates and Forecasts by Vertical, 2018 - 2030 (USD Billion)

11.2.11. Canada

11.2.11.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

11.2.11.2. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

11.2.11.3. Market Size Estimates and Forecasts by Software, 2018 - 2030 (USD Billion)

11.2.11.4. Market Size Estimates and Forecasts by Software Usage, 2018 - 2030 (USD Billion)

11.2.11.5. Market Size Estimates and Forecasts by Services, 2018 - 2030 (USD Billion)

11.2.11.6. Market Size Estimates and Forecasts by Deployment Mode, 2018 - 2030 (USD Billion)

11.2.11.7. Market Size Estimates and Forecasts by Business Function, 2018 - 2030 (USD Billion)

11.2.11.8. Market Size Estimates and Forecasts by Organization Size, 2018 - 2030 (USD Billion)

11.2.11.9. Market Size Estimates and Forecasts by Vertical, 2018 - 2030 (USD Billion)

11.3. Europe

11.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

11.3.2. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

11.3.3. Market Size Estimates and Forecasts by Software, 2018 - 2030 (USD Billion)

11.3.4. Market Size Estimates and Forecasts by Software Usage, 2018 - 2030 (USD Billion)

11.3.5. Market Size Estimates and Forecasts by Services, 2018 - 2030 (USD Billion)

11.3.6. Market Size Estimates and Forecasts by Deployment Mode, 2018 - 2030 (USD Billion)

11.3.7. Market Size Estimates and Forecasts by Business Function, 2018 - 2030 (USD Billion)

11.3.8. Market Size Estimates and Forecasts by Organization Size, 2018 - 2030 (USD Billion)

11.3.9. Market Size Estimates and Forecasts by Vertical, 2018 - 2030 (USD Billion)

11.3.10. U.K.

11.3.10.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

11.3.10.2. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

11.3.10.3. Market Size Estimates and Forecasts by Software, 2018 - 2030 (USD Billion)

11.3.10.4. Market Size Estimates and Forecasts by Software Usage, 2018 - 2030 (USD Billion)

11.3.10.5. Market Size Estimates and Forecasts by Services, 2018 - 2030 (USD Billion)

11.3.10.6. Market Size Estimates and Forecasts by Deployment Mode, 2018 - 2030 (USD Billion)

11.3.10.7. Market Size Estimates and Forecasts by Business Function, 2018 - 2030 (USD Billion)

11.3.10.8. Market Size Estimates and Forecasts by Organization Size, 2018 - 2030 (USD Billion)

11.3.10.9. Market Size Estimates and Forecasts by Vertical, 2018 - 2030 (USD Billion)

11.3.11. Germany

11.3.11.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

11.3.11.2. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

11.3.11.3. Market Size Estimates and Forecasts by Software, 2018 - 2030 (USD Billion)

11.3.11.4. Market Size Estimates and Forecasts by Software Usage, 2018 - 2030 (USD Billion)

11.3.11.5. Market Size Estimates and Forecasts by Services, 2018 - 2030 (USD Billion)

11.3.11.6. Market Size Estimates and Forecasts by Deployment Mode, 2018 - 2030 (USD Billion)

11.3.11.7. Market Size Estimates and Forecasts by Business Function, 2018 - 2030 (USD Billion)

11.3.11.8. Market Size Estimates and Forecasts by Organization Size, 2018 - 2030 (USD Billion)

11.3.11.9. Market Size Estimates and Forecasts by Vertical, 2018 - 2030 (USD Billion)

11.3.12. France

11.3.12.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

11.3.12.2. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

11.3.12.3. Market Size Estimates and Forecasts by Software, 2018 - 2030 (USD Billion)

11.3.12.4. Market Size Estimates and Forecasts by Software Usage, 2018 - 2030 (USD Billion)

11.3.12.5. Market Size Estimates and Forecasts by Services, 2018 - 2030 (USD Billion)

11.3.12.6. Market Size Estimates and Forecasts by Deployment Mode, 2018 - 2030 (USD Billion)

11.3.12.7. Market Size Estimates and Forecasts by Business Function, 2018 - 2030 (USD Billion)

11.3.12.8. Market Size Estimates and Forecasts by Organization Size, 2018 - 2030 (USD Billion)

11.3.12.9. Market Size Estimates and Forecasts by Vertical, 2018 - 2030 (USD Billion)

11.4. Asia Pacific

11.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

11.4.2. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

11.4.3. Market Size Estimates and Forecasts by Software, 2018 - 2030 (USD Billion)

11.4.4. Market Size Estimates and Forecasts by Software Usage, 2018 - 2030 (USD Billion)

11.4.5. Market Size Estimates and Forecasts by Services, 2018 - 2030 (USD Billion)

11.4.6. Market Size Estimates and Forecasts by Deployment Mode, 2018 - 2030 (USD Billion)

11.4.7. Market Size Estimates and Forecasts by Business Function, 2018 - 2030 (USD Billion)

11.4.8. Market Size Estimates and Forecasts by Organization Size, 2018 - 2030 (USD Billion)

11.4.9. Market Size Estimates and Forecasts by Vertical, 2018 - 2030 (USD Billion)

11.4.10. China

11.4.10.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

11.4.10.2. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

11.4.10.3. Market Size Estimates and Forecasts by Software, 2018 - 2030 (USD Billion)

11.4.10.4. Market Size Estimates and Forecasts by Software Usage, 2018 - 2030 (USD Billion)

11.4.10.5. Market Size Estimates and Forecasts by Services, 2018 - 2030 (USD Billion)

11.4.10.6. Market Size Estimates and Forecasts by Deployment Mode, 2018 - 2030 (USD Billion)

11.4.10.7. Market Size Estimates and Forecasts by Business Function, 2018 - 2030 (USD Billion)

11.4.10.8. Market Size Estimates and Forecasts by Organization Size, 2018 - 2030 (USD Billion)

11.4.10.9. Market Size Estimates and Forecasts by Vertical, 2018 - 2030 (USD Billion)

11.4.11. India

11.4.11.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

11.4.11.2. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

11.4.11.3. Market Size Estimates and Forecasts by Software, 2018 - 2030 (USD Billion)

11.4.11.4. Market Size Estimates and Forecasts by Software Usage, 2018 - 2030 (USD Billion)

11.4.11.5. Market Size Estimates and Forecasts by Services, 2018 - 2030 (USD Billion)

11.4.11.6. Market Size Estimates and Forecasts by Deployment Mode, 2018 - 2030 (USD Billion)

11.4.11.7. Market Size Estimates and Forecasts by Business Function, 2018 - 2030 (USD Billion)

11.4.11.8. Market Size Estimates and Forecasts by Organization Size, 2018 - 2030 (USD Billion)

11.4.11.9. Market Size Estimates and Forecasts by Vertical, 2018 - 2030 (USD Billion)

11.4.12. Japan

11.4.12.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

11.4.12.2. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

11.4.12.3. Market Size Estimates and Forecasts by Software, 2018 - 2030 (USD Billion)

11.4.12.4. Market Size Estimates and Forecasts by Software Usage, 2018 - 2030 (USD Billion)

11.4.12.5. Market Size Estimates and Forecasts by Services, 2018 - 2030 (USD Billion)

11.4.12.6. Market Size Estimates and Forecasts by Deployment Mode, 2018 - 2030 (USD Billion)

11.4.12.7. Market Size Estimates and Forecasts by Business Function, 2018 - 2030 (USD Billion)

11.4.12.8. Market Size Estimates and Forecasts by Organization Size, 2018 - 2030 (USD Billion)

11.4.12.9. Market Size Estimates and Forecasts by Vertical, 2018 - 2030 (USD Billion)

11.4.13. Australia

11.4.13.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

11.4.13.2. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

11.4.13.3. Market Size Estimates and Forecasts by Software, 2018 - 2030 (USD Billion)

11.4.13.4. Market Size Estimates and Forecasts by Software Usage, 2018 - 2030 (USD Billion)

11.4.13.5. Market Size Estimates and Forecasts by Services, 2018 - 2030 (USD Billion)

11.4.13.6. Market Size Estimates and Forecasts by Deployment Mode, 2018 - 2030 (USD Billion)

11.4.13.7. Market Size Estimates and Forecasts by Business Function, 2018 - 2030 (USD Billion)

11.4.13.8. Market Size Estimates and Forecasts by Organization Size, 2018 - 2030 (USD Billion)

11.4.13.9. Market Size Estimates and Forecasts by Vertical, 2018 - 2030 (USD Billion)

11.4.14. South Korea

11.4.14.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

11.4.14.2. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

11.4.14.3. Market Size Estimates and Forecasts by Software, 2018 - 2030 (USD Billion)

11.4.14.4. Market Size Estimates and Forecasts by Software Usage, 2018 - 2030 (USD Billion)

11.4.14.5. Market Size Estimates and Forecasts by Services, 2018 - 2030 (USD Billion)

11.4.14.6. Market Size Estimates and Forecasts by Deployment Mode, 2018 - 2030 (USD Billion)

11.4.14.7. Market Size Estimates and Forecasts by Business Function, 2018 - 2030 (USD Billion)

11.4.14.8. Market Size Estimates and Forecasts by Organization Size, 2018 - 2030 (USD Billion)

11.4.14.9. Market Size Estimates and Forecasts by Vertical, 2018 - 2030 (USD Billion)

11.5. Latin America

11.5.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

11.5.2. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

11.5.3. Market Size Estimates and Forecasts by Software, 2018 - 2030 (USD Billion)

11.5.4. Market Size Estimates and Forecasts by Software Usage, 2018 - 2030 (USD Billion)

11.5.5. Market Size Estimates and Forecasts by Services, 2018 - 2030 (USD Billion)

11.5.6. Market Size Estimates and Forecasts by Deployment Mode, 2018 - 2030 (USD Billion)

11.5.7. Market Size Estimates and Forecasts by Business Function, 2018 - 2030 (USD Billion)

11.5.8. Market Size Estimates and Forecasts by Organization Size, 2018 - 2030 (USD Billion)

11.5.9. Market Size Estimates and Forecasts by Vertical, 2018 - 2030 (USD Billion)

11.5.10. Brazil

11.5.10.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

11.5.10.2. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

11.5.10.3. Market Size Estimates and Forecasts by Software, 2018 - 2030 (USD Billion)

11.5.10.4. Market Size Estimates and Forecasts by Software Usage, 2018 - 2030 (USD Billion)

11.5.10.5. Market Size Estimates and Forecasts by Services, 2018 - 2030 (USD Billion)

11.5.10.6. Market Size Estimates and Forecasts by Deployment Mode, 2018 - 2030 (USD Billion)

11.5.10.7. Market Size Estimates and Forecasts by Business Function, 2018 - 2030 (USD Billion)

11.5.10.8. Market Size Estimates and Forecasts by Organization Size, 2018 - 2030 (USD Billion)

11.5.10.9. Market Size Estimates and Forecasts by Vertical, 2018 - 2030 (USD Billion)

11.5.11. Mexico

11.5.11.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

11.5.11.2. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

11.5.11.3. Market Size Estimates and Forecasts by Software, 2018 - 2030 (USD Billion)

11.5.11.4. Market Size Estimates and Forecasts by Software Usage, 2018 - 2030 (USD Billion)

11.5.11.5. Market Size Estimates and Forecasts by Services, 2018 - 2030 (USD Billion)

11.5.11.6. Market Size Estimates and Forecasts by Deployment Mode, 2018 - 2030 (USD Billion)

11.5.11.7. Market Size Estimates and Forecasts by Business Function, 2018 - 2030 (USD Billion)

11.5.11.8. Market Size Estimates and Forecasts by Organization Size, 2018 - 2030 (USD Billion)

11.5.11.9. Market Size Estimates and Forecasts by Vertical, 2018 - 2030 (USD Billion)

11.6. Middle East & Africa

11.6.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

11.6.2. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

11.6.3. Market Size Estimates and Forecasts by Software, 2018 - 2030 (USD Billion)

11.6.4. Market Size Estimates and Forecasts by Software Usage, 2018 - 2030 (USD Billion)

11.6.5. Market Size Estimates and Forecasts by Services, 2018 - 2030 (USD Billion)

11.6.6. Market Size Estimates and Forecasts by Deployment Mode, 2018 - 2030 (USD Billion)

11.6.7. Market Size Estimates and Forecasts by Business Function, 2018 - 2030 (USD Billion)

11.6.8. Market Size Estimates and Forecasts by Organization Size, 2018 - 2030 (USD Billion)

11.6.9. Market Size Estimates and Forecasts by Vertical, 2018 - 2030 (USD Billion)

11.6.10. UAE

11.6.10.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

11.6.10.2. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

11.6.10.3. Market Size Estimates and Forecasts by Software, 2018 - 2030 (USD Billion)

11.6.10.4. Market Size Estimates and Forecasts by Software Usage, 2018 - 2030 (USD Billion)

11.6.10.5. Market Size Estimates and Forecasts by Services, 2018 - 2030 (USD Billion)

11.6.10.6. Market Size Estimates and Forecasts by Deployment Mode, 2018 - 2030 (USD Billion)

11.6.10.7. Market Size Estimates and Forecasts by Business Function, 2018 - 2030 (USD Billion)

11.6.10.8. Market Size Estimates and Forecasts by Organization Size, 2018 - 2030 (USD Billion)

11.6.10.9. Market Size Estimates and Forecasts by Vertical, 2018 - 2030 (USD Billion)

11.6.11. Saudi Arabia

11.6.11.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

11.6.11.2. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

11.6.11.3. Market Size Estimates and Forecasts by Software, 2018 - 2030 (USD Billion)

11.6.11.4. Market Size Estimates and Forecasts by Software Usage, 2018 - 2030 (USD Billion)

11.6.11.5. Market Size Estimates and Forecasts by Services, 2018 - 2030 (USD Billion)

11.6.11.6. Market Size Estimates and Forecasts by Deployment Mode, 2018 - 2030 (USD Billion)

11.6.11.7. Market Size Estimates and Forecasts by Business Function, 2018 - 2030 (USD Billion)

11.6.11.8. Market Size Estimates and Forecasts by Organization Size, 2018 - 2030 (USD Billion)

11.6.11.9. Market Size Estimates and Forecasts by Vertical, 2018 - 2030 (USD Billion)

11.6.12. South Africa

11.6.12.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

11.6.12.2. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

11.6.12.3. Market Size Estimates and Forecasts by Software, 2018 - 2030 (USD Billion)

11.6.12.4. Market Size Estimates and Forecasts by Software Usage, 2018 - 2030 (USD Billion)

11.6.12.5. Market Size Estimates and Forecasts by Services, 2018 - 2030 (USD Billion)

11.6.12.6. Market Size Estimates and Forecasts by Deployment Mode, 2018 - 2030 (USD Billion)

11.6.12.7. Market Size Estimates and Forecasts by Business Function, 2018 - 2030 (USD Billion)

11.6.12.8. Market Size Estimates and Forecasts by Organization Size, 2018 - 2030 (USD Billion)

11.6.12.9. Market Size Estimates and Forecasts by Vertical, 2018 - 2030 (USD Billion)

Chapter 12. Competitive Landscape

12.1. Recent Developments & Impact Analysis by Key Market Participants

12.2. Company Categorization

12.3. Company Market Share Analysis

12.4. Company Heat Map Analysis

12.5. Strategy Mapping

12.5.1. Expansion

12.5.2. Mergers & Acquisition

12.5.3. Partnerships & Collaborations

12.5.4. New Product Launches

12.5.5. Research And Development

12.6. Company Profiles

12.6.1. FIS

12.6.1.1. Participant’s Overview

12.6.1.2. Financial Performance

12.6.1.3. Product Benchmarking

12.6.1.4. Recent Developments

12.6.2. Genpact

12.6.2.1. Participant’s Overview

12.6.2.2. Financial Performance

12.6.2.3. Product Benchmarking

12.6.2.4. Recent Developments

12.6.3. IBM

12.6.3.1. Participant’s Overview

12.6.3.2. Financial Performance

12.6.3.3. Product Benchmarking

12.6.3.4. Recent Developments

12.6.4. Maclearglobal.com

12.6.4.1. Participant’s Overview

12.6.4.2. Financial Performance

12.6.4.3. Product Benchmarking

12.6.4.4. Recent Developments

12.6.5. MetricStream

12.6.5.1. Participant’s Overview

12.6.5.2. Financial Performance

12.6.5.3. Product Benchmarking

12.6.5.4. Recent Developments

12.6.6. Microsoft

12.6.6.1. Participant’s Overview

12.6.6.2. Financial Performance

12.6.6.3. Product Benchmarking

12.6.6.4. Recent Developments

12.6.7. NAVEX Global, Inc.

12.6.7.1. Participant’s Overview

12.6.7.2. Financial Performance

12.6.7.3. Product Benchmarking

12.6.7.4. Recent Developments

12.6.8. Oracle

12.6.8.1. Participant’s Overview

12.6.8.2. Financial Performance

12.6.8.3. Product Benchmarking

12.6.8.4. Recent Developments

12.6.9. RSA Security LLC

12.6.9.1. Participant’s Overview

12.6.9.2. Financial Performance

12.6.9.3. Product Benchmarking

12.6.9.4. Recent Developments

12.6.10. SAI Global Pty Limited

12.6.10.1. Participant’s Overview

12.6.10.2. Financial Performance

12.6.10.3. Product Benchmarking

12.6.10.4. Recent Developments

12.6.11. SAP SE.

12.6.11.1. Participant’s Overview

12.6.11.2. Financial Performance

12.6.11.3. Product Benchmarking

12.6.11.4. Recent Developments

12.6.12. SAS Institute Inc.

12.6.12.1. Participant’s Overview

12.6.12.2. Financial Performance

12.6.12.3. Product Benchmarking

12.6.12.4. Recent Developments

12.6.13. Software AG

12.6.13.1. Participant’s Overview

12.6.13.2. Financial Performance

12.6.13.3. Product Benchmarking

12.6.13.4. Recent Developments

12.6.14. Thomson Reuters

12.6.14.1. Participant’s Overview

12.6.14.2. Financial Performance

12.6.14.3. Product Benchmarking

12.6.14.4. Recent Developments

12.6.15. Wolters Kluwer N.V.

12.6.15.1. Participant’s Overview

12.6.15.2. Financial Performance

12.6.15.3. Product Benchmarking

List of Tables

Table 1 Enterprise governance, risk and compliance (eGRC) market 2018 - 2030 (USD Billion)

Table 2 Enterprise governance, risk and compliance (eGRC) market estimates and forecasts by region, 2018 - 2030 (USD Billion)

Table 3 Enterprise governance, risk and compliance (eGRC) market estimates and forecasts by component, 2018 - 2030 (USD Billion)

Table 4 Enterprise governance, risk and compliance (eGRC) market estimates and forecasts by software, 2018 - 2030 (USD Billion)

Table 5 Enterprise governance, risk and compliance (eGRC) market estimates and forecasts by software usage, 2018 - 2030 (USD Billion)

Table 6 Enterprise governance, risk and compliance (eGRC) market estimates and forecasts by services, 2018 - 2030 (USD Billion)

Table 7 Enterprise governance, risk and compliance (eGRC) market estimates and forecasts by deployment mode, 2018 - 2030 (USD Billion)

Table 8 Enterprise governance, risk and compliance (eGRC) market estimates and forecasts by business function, 2018 - 2030 (USD Billion)

Table 9 Enterprise governance, risk and compliance (eGRC) market estimates and forecasts by organization size, 2018 - 2030 (USD Billion)

Table 10 Enterprise governance, risk and compliance (eGRC) market estimates and forecasts by vertical, 2018 - 2030 (USD Billion)

Table 11 Software market by region, 2018 - 2030 (USD Billion)

Table 12 Services market by region, 2018 - 2030 (USD Billion)

Table 13 Audit management market by region, 2018 - 2030 (USD Billion)

Table 14 Compliance management market by region, 2018 - 2030 (USD Billion)

Table 15 Risk management market by region, 2018 - 2030 (USD Billion)

Table 16 Policy management market by region, 2018 - 2030 (USD Billion)

Table 17 Incident management market by region, 2018 - 2030 (USD Billion)

Table 18 Others market by region, 2018 - 2030 (USD Billion)

Table 19 Internal market by region, 2018 - 2030 (USD Billion)

Table 20 External market by region, 2018 - 2030 (USD Billion)

Table 21 Integration market by region, 2018 - 2030 (USD Billion)

Table 22 Consulting market by region, 2018 - 2030 (USD Billion)

Table 23 Support market by region, 2018 - 2030 (USD Billion)

Table 24 Cloud market by region, 2018 - 2030 (USD Billion)

Table 25 On-premise market by region, 2018 - 2030 (USD Billion)

Table 26 Finance market by region, 2018 - 2030 (USD Billion)

Table 27 Information technology market by region, 2018 - 2030 (USD Billion)

Table 28 Legal market by region, 2018 - 2030 (USD Billion)

Table 29 Operations market by region, 2018 - 2030 (USD Billion)

Table 30 Small & medium market by region, 2018 - 2030 (USD Billion)

Table 31 Large enterprise market by region, 2018 - 2030 (USD Billion)

Table 32 BFSI market by region, 2018 - 2030 (USD Billion)

Table 33 Construction & engineering market by region, 2018 - 2030 (USD Billion)

Table 34 Energy & utlities market by region, 2018 - 2030 (USD Billion)

Table 35 Government market by region, 2018 - 2030 (USD Billion)

Table 36 Healthcare market by region, 2018 - 2030 (USD Billion)

Table 37 Manufacturing market by region, 2018 - 2030 (USD Billion)

Table 38 Retail & consumer goods market by region, 2018 - 2030 (USD Billion)

Table 39 Telecom & IT market by region, 2018 - 2030 (USD Billion)

Table 40 Transportation & logistics market by region, 2018 - 2030 (USD Billion)

Table 41 Others market by region, 2018 - 2030 (USD Billion)

Table 42 North America enterprise governance, risk and compliance (eGRC) market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 43 North America enterprise governance, risk and compliance (eGRC) market, by software, 2018 - 2030 (Revenue, USD Billion)

Table 44 North America enterprise governance, risk and compliance (eGRC) market, by software usage, 2018 - 2030 (Revenue, USD Billion)

Table 45 North America enterprise governance, risk and compliance (eGRC) market, by services, 2018 - 2030 (Revenue, USD Billion)

Table 46 North America enterprise governance, risk and compliance (eGRC) market, by deployment mode, 2018 - 2030 (Revenue, USD Billion)

Table 47 North America enterprise governance, risk and compliance (eGRC) market, by business function, 2018 - 2030 (Revenue, USD Billion)

Table 48 North America enterprise governance, risk and compliance (eGRC) market, by organization size, 2018 - 2030 (Revenue, USD Billion)

Table 49 North America enterprise governance, risk and compliance (eGRC) market, by vertical, 2018 - 2030 (Revenue, USD Billion)

Table 50 U.S. enterprise governance, risk and compliance (eGRC) market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 51 U.S. enterprise governance, risk and compliance (eGRC) market, by software, 2018 - 2030 (Revenue, USD Billion)

Table 52 U.S. enterprise governance, risk and compliance (eGRC) market, by software usage, 2018 - 2030 (Revenue, USD Billion)

Table 53 U.S. enterprise governance, risk and compliance (eGRC) market, by services, 2018 - 2030 (Revenue, USD Billion)

Table 54 U.S. enterprise governance, risk and compliance (eGRC) market, by deployment mode, 2018 - 2030 (Revenue, USD Billion)

Table 55 U.S. enterprise governance, risk and compliance (eGRC) market, by business function, 2018 - 2030 (Revenue, USD Billion)

Table 56 U.S. enterprise governance, risk and compliance (eGRC) market, by organization size, 2018 - 2030 (Revenue, USD Billion)

Table 57 U.S. enterprise governance, risk and compliance (eGRC) market, by vertical, 2018 - 2030 (Revenue, USD Billion)

Table 58 Canada enterprise governance, risk and compliance (eGRC) market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 59 Canada enterprise governance, risk and compliance (eGRC) market, by software, 2018 - 2030 (Revenue, USD Billion)

Table 60 Canada enterprise governance, risk and compliance (eGRC) market, by software usage, 2018 - 2030 (Revenue, USD Billion)

Table 61 Canada enterprise governance, risk and compliance (eGRC) market, by services, 2018 - 2030 (Revenue, USD Billion)

Table 62 Canada enterprise governance, risk and compliance (eGRC) market, by deployment mode, 2018 - 2030 (Revenue, USD Billion)

Table 63 Canada enterprise governance, risk and compliance (eGRC) market, by business function, 2018 - 2030 (Revenue, USD Billion)

Table 64 Canada enterprise governance, risk and compliance (eGRC) market, by organization size, 2018 - 2030 (Revenue, USD Billion)

Table 65 Canada enterprise governance, risk and compliance (eGRC) market, by vertical, 2018 - 2030 (Revenue, USD Billion)

Table 66 Europe enterprise governance, risk and compliance (eGRC) market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 67 Europe enterprise governance, risk and compliance (eGRC) market, by software, 2018 - 2030 (Revenue, USD Billion)

Table 68 Europe enterprise governance, risk and compliance (eGRC) market, by software usage, 2018 - 2030 (Revenue, USD Billion)

Table 69 Europe enterprise governance, risk and compliance (eGRC) market, by services, 2018 - 2030 (Revenue, USD Billion)

Table 70 Europe enterprise governance, risk and compliance (eGRC) market, by deployment mode, 2018 - 2030 (Revenue, USD Billion)

Table 71 Europe enterprise governance, risk and compliance (eGRC) market, by business function, 2018 - 2030 (Revenue, USD Billion)

Table 72 Europe enterprise governance, risk and compliance (eGRC) market, by organization size, 2018 - 2030 (Revenue, USD Billion)

Table 73 Europe enterprise governance, risk and compliance (eGRC) market, by vertical, 2018 - 2030 (Revenue, USD Billion)

Table 74 U.K. enterprise governance, risk and compliance (eGRC) market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 75 U.K. enterprise governance, risk and compliance (eGRC) market, by software, 2018 - 2030 (Revenue, USD Billion)

Table 76 U.K. enterprise governance, risk and compliance (eGRC) market, by software usage, 2018 - 2030 (Revenue, USD Billion)

Table 77 U.K. enterprise governance, risk and compliance (eGRC) market, by services, 2018 - 2030 (Revenue, USD Billion)

Table 78 U.K. enterprise governance, risk and compliance (eGRC) market, by deployment mode, 2018 - 2030 (Revenue, USD Billion)

Table 79 U.K. enterprise governance, risk and compliance (eGRC) market, by business function, 2018 - 2030 (Revenue, USD Billion)

Table 80 U.K. enterprise governance, risk and compliance (eGRC) market, by organization size, 2018 - 2030 (Revenue, USD Billion)

Table 81 U.K. enterprise governance, risk and compliance (eGRC) market, by vertical, 2018 - 2030 (Revenue, USD Billion)

Table 82 Germany enterprise governance, risk and compliance (eGRC) market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 83 Germany enterprise governance, risk and compliance (eGRC) market, by software, 2018 - 2030 (Revenue, USD Billion)

Table 84 Germany enterprise governance, risk and compliance (eGRC) market, by software usage, 2018 - 2030 (Revenue, USD Billion)

Table 85 Germany enterprise governance, risk and compliance (eGRC) market, by services, 2018 - 2030 (Revenue, USD Billion)

Table 86 Germany enterprise governance, risk and compliance (eGRC) market, by deployment mode, 2018 - 2030 (Revenue, USD Billion)

Table 87 Germany enterprise governance, risk and compliance (eGRC) market, by business function, 2018 - 2030 (Revenue, USD Billion)

Table 88 Germany enterprise governance, risk and compliance (eGRC) market, by organization size, 2018 - 2030 (Revenue, USD Billion)

Table 89 Germany enterprise governance, risk and compliance (eGRC) market, by vertical, 2018 - 2030 (Revenue, USD Billion)

Table 90 France enterprise governance, risk and compliance (eGRC) market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 91 France enterprise governance, risk and compliance (eGRC) market, by software, 2018 - 2030 (Revenue, USD Billion)

Table 92 France enterprise governance, risk and compliance (eGRC) market, by software usage, 2018 - 2030 (Revenue, USD Billion)

Table 93 France enterprise governance, risk and compliance (eGRC) market, by services, 2018 - 2030 (Revenue, USD Billion)

Table 94 France enterprise governance, risk and compliance (eGRC) market, by deployment mode, 2018 - 2030 (Revenue, USD Billion)

Table 95 France enterprise governance, risk and compliance (eGRC) market, by business function, 2018 - 2030 (Revenue, USD Billion)

Table 96 France enterprise governance, risk and compliance (eGRC) market, by organization size, 2018 - 2030 (Revenue, USD Billion)

Table 97 France enterprise governance, risk and compliance (eGRC) market, by vertical, 2018 - 2030 (Revenue, USD Billion)

Table 98 Asia Pacific enterprise governance, risk and compliance (eGRC) market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 99 Asia Pacific enterprise governance, risk and compliance (eGRC) market, by software, 2018 - 2030 (Revenue, USD Billion)

Table 100 Asia Pacific enterprise governance, risk and compliance (eGRC) market, by software usage, 2018 - 2030 (Revenue, USD Billion)

Table 101 Asia Pacific enterprise governance, risk and compliance (eGRC) market, by services, 2018 - 2030 (Revenue, USD Billion)

Table 102 Asia Pacific enterprise governance, risk and compliance (eGRC) market, by deployment mode, 2018 - 2030 (Revenue, USD Billion)

Table 103 Asia Pacific enterprise governance, risk and compliance (eGRC) market, by business function, 2018 - 2030 (Revenue, USD Billion)

Table 104 Asia Pacific enterprise governance, risk and compliance (eGRC) market, by organization size, 2018 - 2030 (Revenue, USD Billion)

Table 105 Asia Pacific enterprise governance, risk and compliance (eGRC) market, by vertical, 2018 - 2030 (Revenue, USD Billion)

Table 106 China enterprise governance, risk and compliance (eGRC) market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 107 China enterprise governance, risk and compliance (eGRC) market, by software, 2018 - 2030 (Revenue, USD Billion)

Table 108 China enterprise governance, risk and compliance (eGRC) market, by software usage, 2018 - 2030 (Revenue, USD Billion)

Table 109 China enterprise governance, risk and compliance (eGRC) market, by services, 2018 - 2030 (Revenue, USD Billion)

Table 110 China enterprise governance, risk and compliance (eGRC) market, by deployment mode, 2018 - 2030 (Revenue, USD Billion)

Table 111 China enterprise governance, risk and compliance (eGRC) market, by business function, 2018 - 2030 (Revenue, USD Billion)

Table 112 China enterprise governance, risk and compliance (eGRC) market, by organization size, 2018 - 2030 (Revenue, USD Billion)

Table 113 China enterprise governance, risk and compliance (eGRC) market, by vertical, 2018 - 2030 (Revenue, USD Billion)

Table 114 India enterprise governance, risk and compliance (eGRC) market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 115 India enterprise governance, risk and compliance (eGRC) market, by software, 2018 - 2030 (Revenue, USD Billion)

Table 116 India enterprise governance, risk and compliance (eGRC) market, by software usage, 2018 - 2030 (Revenue, USD Billion)

Table 117 India enterprise governance, risk and compliance (eGRC) market, by services, 2018 - 2030 (Revenue, USD Billion)

Table 118 India enterprise governance, risk and compliance (eGRC) market, by deployment mode, 2018 - 2030 (Revenue, USD Billion)

Table 119 India enterprise governance, risk and compliance (eGRC) market, by business function, 2018 - 2030 (Revenue, USD Billion)

Table 120 India enterprise governance, risk and compliance (eGRC) market, by organization size, 2018 - 2030 (Revenue, USD Billion)

Table 121 India enterprise governance, risk and compliance (eGRC) market, by vertical, 2018 - 2030 (Revenue, USD Billion)

Table 122 Japan enterprise governance, risk and compliance (eGRC) market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 123 Japan enterprise governance, risk and compliance (eGRC) market, by software, 2018 - 2030 (Revenue, USD Billion)

Table 124 Japan enterprise governance, risk and compliance (eGRC) market, by software usage, 2018 - 2030 (Revenue, USD Billion)

Table 125 Japan enterprise governance, risk and compliance (eGRC) market, by services, 2018 - 2030 (Revenue, USD Billion)

Table 126 Japan enterprise governance, risk and compliance (eGRC) market, by deployment mode, 2018 - 2030 (Revenue, USD Billion)

Table 127 Japan enterprise governance, risk and compliance (eGRC) market, by business function, 2018 - 2030 (Revenue, USD Billion)

Table 128 Japan enterprise governance, risk and compliance (eGRC) market, by organization size, 2018 - 2030 (Revenue, USD Billion)

Table 129 Japan enterprise governance, risk and compliance (eGRC) market, by vertical, 2018 - 2030 (Revenue, USD Billion)

Table 130 Australia enterprise governance, risk and compliance (eGRC) market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 131 Australia enterprise governance, risk and compliance (eGRC) market, by software, 2018 - 2030 (Revenue, USD Billion)

Table 132 Australia enterprise governance, risk and compliance (eGRC) market, by software usage, 2018 - 2030 (Revenue, USD Billion)

Table 133 Australia enterprise governance, risk and compliance (eGRC) market, by services, 2018 - 2030 (Revenue, USD Billion)

Table 134 Australia enterprise governance, risk and compliance (eGRC) market, by deployment mode, 2018 - 2030 (Revenue, USD Billion)

Table 135 Australia enterprise governance, risk and compliance (eGRC) market, by business function, 2018 - 2030 (Revenue, USD Billion)

Table 136 Australia enterprise governance, risk and compliance (eGRC) market, by organization size, 2018 - 2030 (Revenue, USD Billion)

Table 137 Australia enterprise governance, risk and compliance (eGRC) market, by vertical, 2018 - 2030 (Revenue, USD Billion)

Table 138 South Korea enterprise governance, risk and compliance (eGRC) market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 139 South Korea enterprise governance, risk and compliance (eGRC) market, by software, 2018 - 2030 (Revenue, USD Billion)

Table 140 South Korea enterprise governance, risk and compliance (eGRC) market, by software usage, 2018 - 2030 (Revenue, USD Billion)

Table 141 South Korea enterprise governance, risk and compliance (eGRC) market, by services, 2018 - 2030 (Revenue, USD Billion)

Table 142 South Korea enterprise governance, risk and compliance (eGRC) market, by deployment mode, 2018 - 2030 (Revenue, USD Billion)

Table 143 South Korea enterprise governance, risk and compliance (eGRC) market, by business function, 2018 - 2030 (Revenue, USD Billion)

Table 144 South Korea enterprise governance, risk and compliance (eGRC) market, by organization size, 2018 - 2030 (Revenue, USD Billion)

Table 145 South Korea enterprise governance, risk and compliance (eGRC) market, by vertical, 2018 - 2030 (Revenue, USD Billion)

Table 146 Latin America enterprise governance, risk and compliance (eGRC) market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 147 Latin America enterprise governance, risk and compliance (eGRC) market, by software, 2018 - 2030 (Revenue, USD Billion)

Table 148 Latin America enterprise governance, risk and compliance (eGRC) market, by software usage, 2018 - 2030 (Revenue, USD Billion)

Table 149 Latin America enterprise governance, risk and compliance (eGRC) market, by services, 2018 - 2030 (Revenue, USD Billion)

Table 150 Latin America enterprise governance, risk and compliance (eGRC) market, by deployment mode, 2018 - 2030 (Revenue, USD Billion)

Table 151 Latin America enterprise governance, risk and compliance (eGRC) market, by business function, 2018 - 2030 (Revenue, USD Billion)

Table 152 Latin America enterprise governance, risk and compliance (eGRC) market, by organization size, 2018 - 2030 (Revenue, USD Billion)

Table 153 Latin America enterprise governance, risk and compliance (eGRC) market, by vertical, 2018 - 2030 (Revenue, USD Billion)

Table 154 Brazil enterprise governance, risk and compliance (eGRC) market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 155 Brazil enterprise governance, risk and compliance (eGRC) market, by software, 2018 - 2030 (Revenue, USD Billion)

Table 156 Brazil enterprise governance, risk and compliance (eGRC) market, by software usage, 2018 - 2030 (Revenue, USD Billion)

Table 157 Brazil enterprise governance, risk and compliance (eGRC) market, by services, 2018 - 2030 (Revenue, USD Billion)

Table 158 Brazil enterprise governance, risk and compliance (eGRC) market, by deployment mode, 2018 - 2030 (Revenue, USD Billion)

Table 159 Brazil enterprise governance, risk and compliance (eGRC) market, by business function, 2018 - 2030 (Revenue, USD Billion)

Table 160 Brazil enterprise governance, risk and compliance (eGRC) market, by organization size, 2018 - 2030 (Revenue, USD Billion)

Table 161 Brazil enterprise governance, risk and compliance (eGRC) market, by vertical, 2018 - 2030 (Revenue, USD Billion)

Table 162 Mexico enterprise governance, risk and compliance (eGRC) market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 163 Mexico enterprise governance, risk and compliance (eGRC) market, by software, 2018 - 2030 (Revenue, USD Billion)

Table 164 Mexico enterprise governance, risk and compliance (eGRC) market, by software usage, 2018 - 2030 (Revenue, USD Billion)

Table 165 Mexico enterprise governance, risk and compliance (eGRC) market, by services, 2018 - 2030 (Revenue, USD Billion)

Table 166 Mexico enterprise governance, risk and compliance (eGRC) market, by deployment mode, 2018 - 2030 (Revenue, USD Billion)

Table 167 Mexico enterprise governance, risk and compliance (eGRC) market, by business function, 2018 - 2030 (Revenue, USD Billion)

Table 168 Mexico enterprise governance, risk and compliance (eGRC) market, by organization size, 2018 - 2030 (Revenue, USD Billion)

Table 169 Mexico enterprise governance, risk and compliance (eGRC) market, by vertical, 2018 - 2030 (Revenue, USD Billion)

Table 170 Middle East & Africa enterprise governance, risk and compliance (eGRC) market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 171 Middle East & Africa enterprise governance, risk and compliance (eGRC) market, by software, 2018 - 2030 (Revenue, USD Billion)

Table 172 Middle East & Africa enterprise governance, risk and compliance (eGRC) market, by software usage, 2018 - 2030 (Revenue, USD Billion)