- Home

- »

- Renewable Chemicals

- »

-

Fatty Methyl Ester Sulfonate Market, FMES Industry Report, 2018-2025GVR Report cover

![Fatty Methyl Ester Sulfonate Market Size, Share & Trends Report]()

Fatty Methyl Ester Sulfonate Market Size, Share & Trends Analysis By End-Use (Personal Care, Detergents), By Region, Competitive Landscape, And Segment Forecasts, 2018 - 2025

- Report ID: GVR-1-68038-401-7

- Number of Pages: 94

- Format: Electronic (PDF)

- Historical Range: 2014 - 2016

- Industry: Specialty & Chemicals

Report Overview

The global fatty methyl ester sulfonate market size was estimated at 444.6 kilo tons in 2015. This industry is expected to witness impressive growth over the next decade owing to the growing product demand in various applications sectors such as cosmetics, washing powder, and liquid detergents. Increasing natural ingredients demand across the personal care and hair care segments also helps to enhance the global FMES demand.

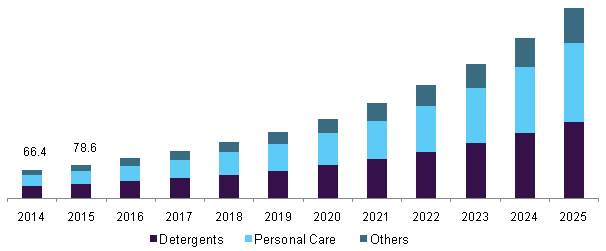

U.S. fatty methyl ester sulfonate market by end-use, 2014 - 2025 (USD Million)

Europe fatty ethyl ester sulfonate market dominated the global consumption with Germany being the frontrunner in the region. Germany emerged as the leading manufacturing hub for the detergents and personal care products in Europe over the past decade. Growing consumer awareness towards cleanliness and hygiene in countries such as Germany and Italy is expected to propel the detergent demand over the next few years.

Rising consumer disposable income coupled with ongoing urbanization trend across Canada and the U.S. has majorly contributed to the growing social awareness regarding personal hygiene and wellness in North America. Mounting FMES consumption in laundry applications owing to its enhanced whiteness and physicochemical properties is anticipated to offer immense opportunities for market expansion in the region.

Increasing natural ingredients demand in products such as shampoo and soap is another major trend witnessed among consumers in Europe and North America. In addition, detergents with good water solubility, water hardness stability, and wetting power have witnessed increasing adoption among consumers in these regions.

Fatty Methyl Ester Sulfonate Market Trends

The global fatty methyl ester sulfonates market expected to be driven by the increasing consumption of fatty methyl ester sulfonate in detergent across the globe. Rising trend towards maintaining personal hygiene including clean apparel across growing economies is anticipated to remain a keynote driving force for the industry over the coming years.

FMES are widely used in the manufacturing of surfactants, which are further used in several end- use industries which include cosmetics, laundry detergents, personal care, and lubricants, among others. Rapidly growing personal care industry and an increase in consumer spending on quality products are expected to boost the surfactants market growth. In addition, retail sector in developing countries such as Brazil, India, and China is becoming well-organized, which is anticipated to further trigger the growth of the personal care & cosmetics industry, in turn, promoting the consumption of FMES for surfactant production.

The availability of plant-based chemicals as substitutes and efficient replacement to petrochemical-based chemicals is expected to significantly drive the laundry detergent chemicals. Laundry detergent chemicals can be synthesized from petrochemicals as well as oleochemicals derived from plant oils such as palm kernel oil, palm stearin, and coconut oil. Consumer consciousness toward sustainability of chemical ingredients used to manufacture consumer goods has increased. This trend is observed to be more prevalent in developed countries such as the U.S. and the UK. Therefore, in North America, the market growth is driven by the availability of plant-based oleochemicals such as FMES, which are used in the production of laundry detergents.

At present, the oil palm expansion needs to be effectively regulated in order to mitigate negative environmental impacts caused by large-scale palm oil plantations. These issues have become a major concern in Asia Pacific countries such as Indonesia and Malaysia which are the primary suppliers of palm oil across geographies. Further, palm oil plantation requires large-scale conversion of primary forest area into agricultural land and this factor is responsible for a significant biodiversity loss, which hamper the market growth.

Fatty methyl ester sulfonates are classified as anionic surfactants and used in the production of laundry detergents in considerable amounts. They are used in both household as well as institutional applications. Their widespread application is attributed to various properties such as reduced sensitivity to water hardness and high foaming capability as they are mainly used in light-duty liquid dishwashing products and laundry detergent formulations.

The market competition is extremely high with companies engaging in strategic divestures and investments in project expansions. Companies are also looking for strategic partnerships and collaborations to improve brand image and invest in new product development. Key global industry participants include Henkel AG & Co. KGaA, P&G, Wilmar International, and Emery Oleochemicals among others.

End-Use Insights

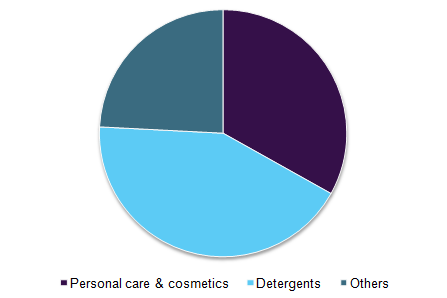

Detergents emerged as leading end-use segment in 2015 and its revenue share is expected to grow at a CAGR of 18% over the next nine years. Stringent regulatory guidelines in the laundry care sector regarding wastewater disposal can be attributed to the presence of petrochemical surfactants and auxiliary agents. These synthetic compounds impart adverse environmental effect surrounding industrial and residential establishments. This has urged detergent manufacturers to shift towards utilizing natural and highly bio-degradable ingredients in their products.

Global fatty methyl ester sulfonate market by end-use, 2015 (USD Million)

Personal care segment is anticipated to emerge as fastest growing segment and account for over 34% of the fatty methyl ester sulfonate market volume share by 2025. Adverse impact of synthetic chemical products on skin health and product disposal has steered natural ingredients demand across various consumer age groups.

Regional Insight

Europe emerged as the dominant FMES consumer accounting for 32.8% of revenue share in 2015. Growing preference of naturally derived products coupled with favorable regulatory scenario are expected to steer bio-based skin care and fabric care product demand over the forecast period.

Fatty methyl ester sulfonate demand in North America was over 110 kilo tons in 2015. Presence of large number of detergent producers in the U.S. and Canada have contributed to the market penetration over the past few years. In addition, the launch of new product lines in personal care and laundry care sector is anticipated to steer moderate market growth in the region.

Asia Pacific was a prominent FMES market and is expected to witness a CAGR of over 19% over the forecast period. This can be attributed to high growth in end-use industries such as cosmetics, soap/detergent, oilfield chemical, and agrochemicals in China, Japan, and India. Another factor attributed to high market growth is the growing bio-based personal care product demand in South East Asia.

Central & South America FMES market size is estimated to exceed 270 kilo tons by 2025. Products such as liquid fabric softeners, spot & stain removers, and carpet cleaners have gained prominence in the region. Furthermore, consumption of key consumer products such as hand wash and fabric cleaners in residential and commercial sector is anticipated to drive product demand over the forecast period.

Europe is the largest market globally for detergents, comprising of nearly one-fifth of the worldwide demand. The substance is highly utilized in formulation of powdered detergents as well as detergent cakes. Countries in Europe including Germany, Spain, and UK registered high demand for detergent powder since the past decade. Detergent pods are increasing gaining traction in the region due to their ease of preservation and storage. Germany is the major market in Europe driving market demand. The demand is driven by high consumption of the substance in detergent formulation followed by personal care segment.

Asia Pacific is the second largest market globally for fatty methyl ester sulfonate and is anticipated to reflect the fastest growth over the forecast period. China is the largest market for fatty methyl ester sulfonate across Asia Pacific over the forecast period. This is majorly due to high demand for commercial laundry detergents in the country. Exploding population in the country has led to high intervention of apparel & textile manufacturers in China which subsequently paved way for multiple detergent producers in the country.

North America accounted for a volume share of 19.95% in the global FMES market in 2020. Increasing consumption of surfactants such as FMES in various applications such as personal care and industrial cleaners is expected to drive the product demand over the forecast period.

Fatty Methyl Ester Sulfonate Market Share Insights

The major vendors in fatty methyl ester sulfonate industry include KLK Oleo, Zanyu Technology Group Co., Ltd., Jinchang Chemicals, Sun Products, Lion Corporation, Chemithon, Fenchem, and Emery Oleochemicals. Other prominent companies include Wilmar International, Jiangsu Haiqing Biotechnology, KPL International, P&G Chemicals, Stepan Company, Henan Surface Chemical Industry Co., Ltd., PEMEX Chemicals, China Factories Group Company, and Alfa Aesar.

Lion Corporation of Japan uses its patented acid bleaching process to produce MES that caters to the detergent mainly in Japan and South East Asia. Chemithon offers methyl ester sulfonates (MES) from palm and coconut oil derivatives which are eco-friendly and find application in soaps and laundry. KLK Oleo’s offers Palmfonate, is an active cleaning element in laundry detergents. The product is made from renewable natural resources, and provides enhanced bio-degradability and calcium hardness resistance in hard water.

Fatty Methyl Ester Sulfonate Market Report Scope

Report Attribute

Details

Market size value in 2019

USD1135.71 million

Revenue forecast in 2025

USD2490 million

Growth Rate

CAGR of 15.0% from 2019 to 2025

Base year for estimation

2018

Historical data

2014 - 2017

Forecast period

2019 - 2025

Quantitative units

Revenue in USD million and CAGR from 2019 to 2025

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

End-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S., Germany, UK, France, Italy, China, India, Japan

Key companies profiled

KLK Oleo, Zanyu Technology Group Co., Ltd., Jinchang Chemicals, Sun Products, Lion Corporation, Chemithon, Fenchem, and Emery Oleochemicals.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments covered in the reportThis report forecasts revenue growth at regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the global fatty methyl ester sulfonate market on the basis of end-use industries and region:

-

End-Use Outlook (Volume, Kilo Tons; Revenue, USD Million, 2014 - 2025)

-

Personal Care

-

Detergents

-

Others

-

-

Regional Outlook (Volume, Kilo Tons; Revenue, USD Million, 2014 - 2025)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

- Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global fatty methyl ester sulfonate market size was estimated at USD 970.06 million in 2019 and is expected to reach USD 1135.71 million in 2020.

b. The global fatty methyl ester sulfonate market is expected to grow at a compound annual growth rate of 15.0% from 2019 to 2025 to reach USD 2490 billion by 2025.

b. Europe dominated the fatty methyl ester sulfonate market with a share of 32.45% in 2019. This is attributable to growing preference of naturally derived products coupled with favorable regulatory scenario.

b. Some key players operating in the fatty methyl ester sulfonate market include KLK Oleo, Zanyu Technology Group Co., Ltd., Jinchang Chemicals, Sun Products, Lion Corporation, Chemithon, Fenchem, and Emery Oleochemicals.

b. Key factors that are driving the market growth increasing product demand in various applications sectors such as cosmetics, washing powder, and liquid detergents.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."