- Home

- »

- Advanced Interior Materials

- »

-

Fire Safety Equipment Market Size & Share Report, 2030GVR Report cover

![Fire Safety Equipment Market Size, Share & Trends Report]()

Fire Safety Equipment Market Size, Share & Trends Analysis Report By Solution (Detection, Suppression), By Application (Commercial, Industrial, Residential), And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-789-6

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Advanced Materials

Fire Safety Equipment Market Size & Trends

The global fire safety equipment market size was valued at USD 49.82 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 6.4% from 2023 to 2030. The market is likely to benefit from advancements in wireless sensor networks and the increased adoption of wireless fire sensing devices. Growing awareness about combating fire hazards along with a substantial rise in building infrastructure development activities are also expected to be high-impact drivers for the market. Organizations across the globe are increasingly spending on the safety and security of infrastructure to reduce human losses. Implementation of fire safety codes for building and renovation activities is further expected to stimulate the demand for fire safety equipment across the globe.

The installation of safety rules for fire protection and reconstruction projects will both have a favorable effect on market expansion. The increase will be further boosted by technological developments such as wireless alarm systems, smoke detectors, and water mist technology. The increased knowledge of fire safety gear and the potentially disastrous results is anticipated to fuel market expansion. However, the market's expansion will be hampered by the high replacement costs of conventional fire apparatus.

The outbreak of the COVID-19 pandemic impacted the fire safety market adversely in the early quarters of 2020. This has resulted in a reduction in the installation of new fire safety equipment in industrial and commercial applications. However, increased spending on new construction activities and the replacement of obsolete fire alarms, sprinklers, and detectors are expected to boost the overall growth of the market in the forthcoming years.

The relatively mature market is likely to be driven by the rising number of laws and regulations mandating the installation of fire safety equipment across several industries and sectors over the forecast period. Factors such as the easy availability of technologically advanced equipment and advanced networking capabilities that allow efficient communication between fire detection solutions and fire suppression systems or solutions are also expected to drive the market.

The market is also likely to benefit from advancements in wireless sensor networks and the increased adoption of wireless fire-sensing devices. Growing awareness about combating fire hazards along with a substantial rise in building infrastructure development activities are also expected to be high-impact drivers for the market. Organizations across the globe are increasingly spending on the safety and security of infrastructure to reduce human losses. Implementation of fire safety codes for building and renovation activities is further expected to stimulate the demand for fire safety equipment across the globe.

With the development of sensor technologies and the consecutive introduction of smart wireless systems, the use of electronic components in fire safety devices has significantly increased. These improved devices have heightened sensitivity and respond quickly to emergency situations. As they are manufactured with high precision and enhanced materials, the cost of these components and systems is high. For instance, a high-end photoelectric smoke detector can cost up to as high as USD 2,400 each. Similarly, high-end photoelectric heat detectors would cost approximately USD 2,000 to USD 2,400 and flame detectors would range from USD 2,800 to USD 3,000 per unit.

The high costs may discourage the uptake of these products across a number of cost-conscious industries, organizations, and countries. Thus, making advanced systems affordable is crucial for steady growth for manufacturers over the forecast period. The easy availability of affordable systems and components is likely to lead to their widespread adoption among small & medium enterprises, which will ensure optimum growth prospects for the fire safety equipment market.

Solution Insights

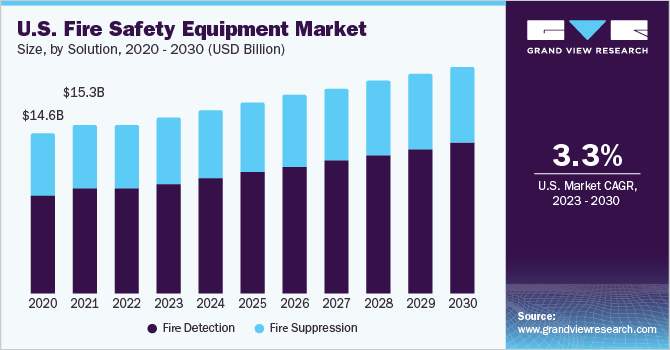

Based on the solution, the fire detection dominated the market and accounted for more than 64.0% share of the global revenue in 2022. This growth can be attributed to increasing policies, regulations, and government mandates, along with the use of advanced technology in detection devices. Furthermore, the growing number of fire accidents globally has compelled the need to install fire safety equipment.

The fire detection segment is anticipated to expand at the highest CAGR over the forecast period. The rapid development in commercial construction and growing smart city projects will boost the demand for fire detection equipment during the forecast period. Furthermore, increased consumer spending on construction activities owing to the availability of disposable income and growing awareness about fire detectors is expected to drive the growth of the market in the near future.

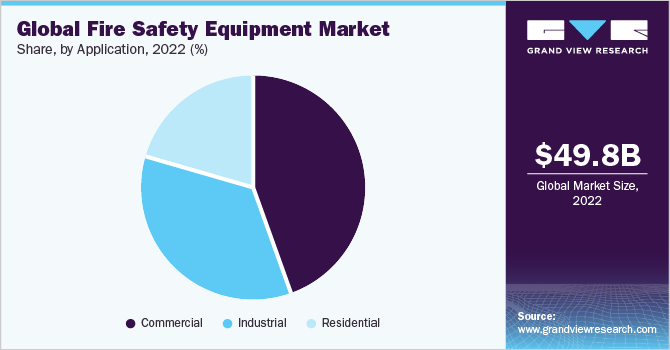

Application Insights

The industrial application segment dominated the market with a revenue share of over 40% in 2022. This segment includes oil and gas, transportation sectors, energy and power, and manufacturing. These sectors emphasize the installation of fire safety equipment due to the high risk involved. The use of flammable materials makes the oil and gas industries particularly vulnerable to fire mishaps. The need for fire safety equipment is being driven by governmental laws to protect workers from fire accidents.

Based on application, the market is segmented into industrial, residential, and commercial. The residential segment is expected to register the highest CAGR over the forecast period. In the past couple of years, the demand for fire safety equipment has increased significantly across this sector, owing to the rising awareness about fire safety equipment and its benefits. The growing infrastructure development in developed and developing countries is also anticipated to fuel the growth.

Regional Insights

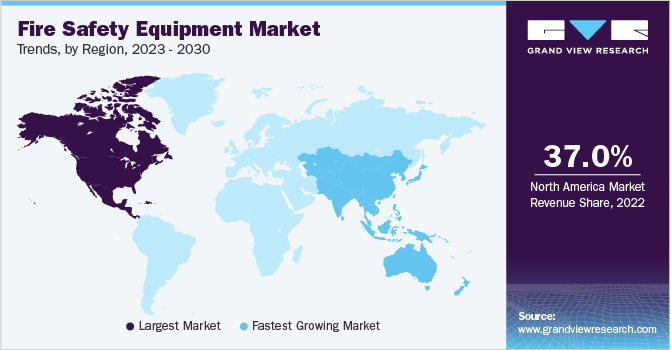

North America dominated the market with a market share exceeding 37.0% in 2022. The U.S. and Canada significantly contributed to the growth due to the rapid commercial and industrial construction development. Stringent fire safety regulations and norms are propelling regional growth. For instance, in the U.S., the Fire Code, a model code, is adopted by local and state jurisdictions and enforced by fire prevention officers in municipal fire departments. Rising concerns related to fire safety and security and the quick adoption of advanced technologies are also driving regional growth.

The Asia Pacific region is expected to register the highest CAGR of 9.2% over the forecast period. The Asia Pacific is a developing region, and countries such as India, China, and Japan are expected to drive the growth of the regional market. Factors such as rapid urbanization and industrialization in emerging nations are expected to boost the demand for fire safety equipment in the region. The strong presence of sensor manufacturing companies and a high level of production of fire safety equipment are other significant factors that are anticipated to contribute to the growth of the segment in the near future.

Key Companies & Market Share Insights

Most companies in the market are focusing on expanding their business and are adopting strategic initiatives and undertaking measures to gain benefits from the opportunities in the emerging market.

For instance, Eaton launched XDetect Fire Panel with an Instantly Familiar Interface and Cybersecurity in its DNA To Protect People, Property and Data. Similarly, Siemens introduced Fire Safety Digital Services, a first-in-market portfolio of digital and managed services that connects fire safety systems to the cloud, enabling organizations to convert from a reactive, compliance-driven approach to total protection through intelligent safety. Some prominent players in the global fire safety equipment market include:

-

Eaton

-

Gentex Corp.

-

Halma plc

-

Hochiki Corp.

-

Honeywell International, Inc.

-

Johnson Controls

-

Napco Security Technologies, Inc.

-

Nittan Company Ltd.

-

Robert Bosch GmbH

-

Siemens Building Technologies

-

Space Age Electronics

-

United Technologies Corp

Fire Safety Equipment Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 53.17 billion

Revenue forecast in 2030

USD 82.02 billion

Growth rate

CAGR of 6.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

June 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Solution, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Mexico; Argentina; U.A.E.; Saudi Arabia; South Africa

Key companies profiled

Robert Bosch GmbH; Eaton Corp., Inc.; Gentex Corp.; United Technologies Corp.; Siemens Building Technologies; Honeywell International, Inc.; Napco Security Technologies, Inc.; Johnson Controls

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Global Fire Safety Equipment Market Report Segmentation

The report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global fire safety equipment market report based on solution, application, and region.

-

Solution Outlook (Revenue, USD Million, 2018 - 2030)

-

Detection

-

Detector

-

Alarm

-

-

Suppression

-

Extinguisher

-

Sprinkler

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Industrial

-

Residential

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa (MEA)

-

U.A.E.

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global fire safety equipment market size was estimated at USD 49.82 billion in 2022 and is expected to reach USD 53.17 billion in 2023.

b. The global fire safety equipment market is expected to grow at a compound annual growth rate of 6.4% from 2023 to 2030 to reach USD 82.02 billion by 2030.

b. North America dominated the fire safety equipment market with a share of over 37.0% in 2022. This is attributable to rapid infrastructural developments and the implementation of stringent fire safety regulations and norms.

b. Some key players operating in the fire safety equipment market include Robert Bosch GmbH; Eaton; Gentex Corp.; United Technologies Corp.; Siemens Building Technologies; Honeywell International, Inc.; Napco Security Technologies, Inc.; and Johnson Controls.

b. Key factors that are driving the fire safety equipment market growth include reconstruction activities and the implementation of building safety codes against fire protection across the world.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."