- Home

- »

- Advanced Interior Materials

- »

-

Flat Steel Market Size, Share & Trends Analysis Report, 2030GVR Report cover

![Flat Steel Market Size, Share & Trends Report]()

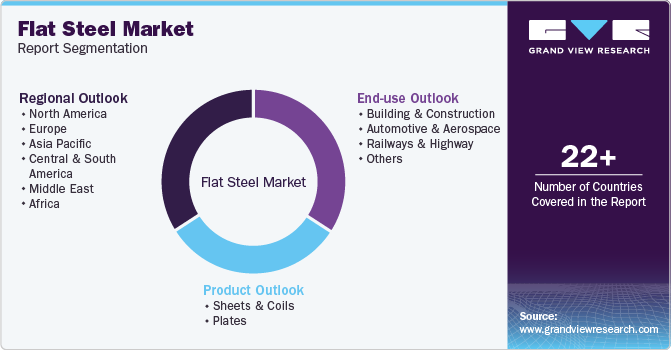

Flat Steel Market Size, Share & Trends Analysis Report By Product (Sheets & Coils, Plates), By End-use (Buildings & Construction, Railways & Highways, Automotive & Aerospace), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-988-3

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Advanced Materials

Flat Steel Market Size & Trends

The global flat steel market size was estimated at USD 816.15 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 2.5% from 2023 to 2030. The market is driven by the flourishing demand for flat steel from the construction and infrastructure sectors worldwide. The versatility of flat products in applications such as roofing, beams, columns, sheds, staircases, and building frames makes it a fundamental material. The increasing population has led to a high demand for residential properties worldwide The ongoing global urbanization and infrastructure development initiatives, particularly in emerging economies, further significantly contribute to the rising demand for flat steel products, thereby driving market growth.

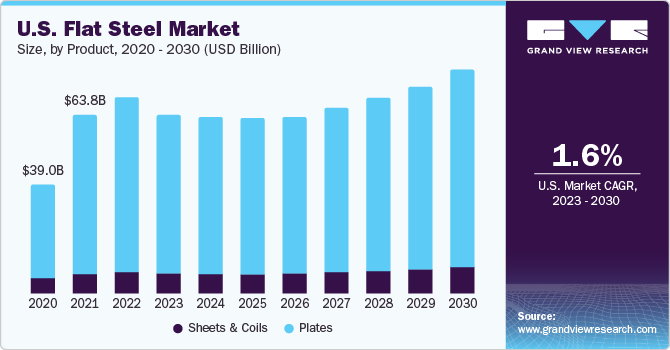

The U.S. government's efforts to revitalize domestic manufacturing, mainly through infrastructure development programs, have increased demand for flat steel. Moreover, imposing tariffs on imports from nations such as Brazil, Russia, and Mexico is a strategic initiative. This measure has promoted local manufacturers' growth and incentivized domestic and foreign investments in the U.S. markets. These initiatives are driving market growth within the country.

Due to its high strength and dent resistance, cold-rolled products are widely used in the automotive sector for exterior and interior applications. Moreover, it is affordable and readily available. Despite the rising penetration of substitutes like aluminum, substantial automotive parts such as vehicle frames and guards are manufactured from steel to improve profit margins, as the latter offers high strength, durability, and versatility, and is 100% recyclable. These factors propel product demand and provide growth opportunities for the market.

The Russia-Ukraine war negatively impacted the market growth after the world recovered from the pandemic. As significant steel producers, the conflict between the two countries disrupted the global supply chain. Also, the increase in energy costs and shipping budgets significantly pushed up global prices, which led local manufacturers to raise their prices in response to these factors.

The periodic fluctuations in raw material prices, such as iron ore, coal, and scrap, impact production costs and, thus, downstream products. Moreover, major geopolitical events, shifts in demand, and cyclic increases in raw material prices have hampered global market growth. The ups and downs across the globe restrain the expansion of the flat steel industry.

End-use Insights

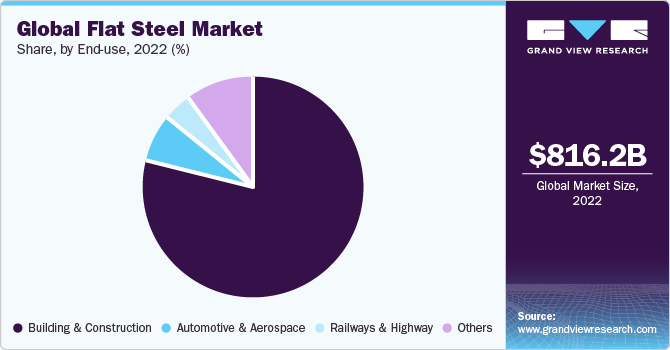

Based on end-use, the building & construction segment accounted for a revenue share of over 78.0% in 2022. Flat steel products are extensively used in the infrastructure sector for various applications. Their durability and ability to bear heavy loads make them essential in creating robust structures.

The automotive & aerospace is another crucial segment of the market. Automobiles with four-wheel chassis use plates, sheets, and coils with various thicknesses. As the world moves towards alternative sources of energy, a significant rise in the production of EVs is further expected to provide a lucrative opportunity for the flat steel industry. The global sales of EVs are surging rapidly. The recorded sales in 2020, 2021, and 2022 are 3.2 million, 6.7 million, and 10.5 million, respectively. China accounted for over 58.0% of global EV sales in 2022, with more than 6 million units sold in the country.

Product Insights

Based on product, the plates segment dominated the market with a revenue share of over 66.0% in 2022, and it is expected to continue its dominance over the forecast period. This is, due to growth in infrastructure projects, automotive manufacturing, energy sector, and industrial activities. Governments are taking initiatives to boost economic development, benefiting the market. For instance, in April 2022, the Government of Canada allocated USD 4 billion in its budget 2022 to launch the “Housing Accelerator Fund” for building 100,000 affordable homes over the next five years. Plates find application in strengthening the foundation of large structures.

The sheets & coils segment is anticipated to grow at a moderate rate over the forecast period. Sheets & coils have a wide range of applications in various other industries such as construction, automotive, railways, highways, aerospace, and energy. In construction, coils are extensively used in windows & doors, façades, and partitions. As a result, ongoing investments in the end-use industries are anticipated to prove fruitful for segment growth. For instance, in July 2022, Volvo announced an investment of EUR 1.20 billion (USD 1.22 billion) to set up a new manufacturing plant in Slovakia. Production from the plant is expected to begin by 2026. The rising penetration of electric vehicles creates new investment opportunities for strips & coil manufacturers.

Regional Insights

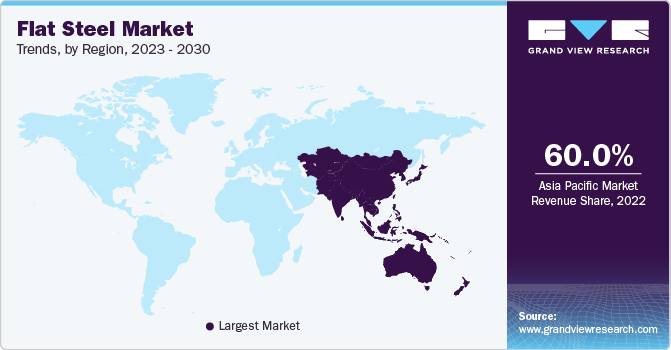

Asia Pacific accounted for the largest revenue share of over 60.0% in 2022. The expected expansion of this segment is attributed to the growing population and escalating infrastructure projects in the area. In addition, the increased demand in other industries such as automotive, railways, and highways contributes to the market's growth.

Rapid urbanization, population growth, and ongoing industrialization have increased the demand for flat products in constructing buildings, bridges, and various infrastructure projects. Moreover, the growing automotive industry in the Asia Pacific is a significant contributor, with the rising middle-class population driving the demand for automobiles, thus boosting the need for flat products in vehicle manufacturing. Additionally, the expansion of railway networks and the continuous development of highways further contribute to the escalating demand for the market.

The penetration of flat steel is anticipated to remain steady in low-growth regions. In Central & South America, the demand for steel products in Brazil is fueled by the product's growing adoption in machinery & equipment, metal products, and consumer goods. This trend is a significant driver propelling market growth. Similarly, the expansion of industrial facilities and the manufacturing sector in the Middle East & Africa region is contributing to the upward trajectory of the product, facilitating increased construction activities in the region.

Key Companies & Market Share Insights

The market growth has pushed key players and countries to opt for strategic initiatives to remain competitive. For instance, in September 2023, the Egyptian government plans to expand a flat steel production facility with an investment worth USD 1.0 billion. The industrial compound is anticipated to have a production capacity of 1.8 million tons annually and a target to export products majorly to global markets.

Key Flat Steel Companies:

- ArcelorMittal

- Baosteel Group

- Ezz Steel

- HBIS Group

- JFE Steel Corporation

- NIPPON STEEL CORPORATION

- NUCOR

- Outokumpu

- POSCO

- Tata Steel Limited

- ThyssenKrupp AG

- United States Steel Corporation

- Voestalpine Group

Flat Steel Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 763.50 billion

Revenue forecast in 2030

USD 997.35 billion

Growth rate

CAGR of 2.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, CAGR from 2023 to 2030

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S; Canada; Mexico; Germany; France; Italy; Russia; China; India; Japan; Indonesia; Philippines; Singapore; Thailand; Malaysia; Brazil; Bahrain; Kuwait; Oman; Qatar; Saudi Arabia; UAE; Ethiopia; Tanzania; Mozambique; Rwanda; Zimbabwe; Kenya

Key companies profiled

ArcelorMittal; Baosteel Group; Ezz Steel; HBIS Group; JFE Steel Corporation; NIPPON STEEL CORPORATION; NUCOR; Outokumpu; POSCO; Tata Steel Limited; ThyssenKrupp AG; United States Steel Corporation; Voestalpine Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Global Flat Steel Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global flat steel market report based on product, end-use, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Sheets & Coils

-

Plates

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Building & Construction

-

Automotive & Aerospace

-

Railways & Highway

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Mexico

-

Canada

-

-

Europe

-

Germany

-

France

-

Italy

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Indonesia

-

Philippines

-

Singapore

-

Thailand

-

Malaysia

-

-

Central & South America

-

Brazil

-

-

Middle East

-

Bahrain

-

Kuwait

-

Oman

-

Qatar

-

Saudi Arabia

-

UAE

-

-

Africa

-

Ethiopia

-

Tanzania

-

Mozambique

-

Rwanda

-

Zimbabwe

-

Kenya

-

-

Frequently Asked Questions About This Report

b. The global flat steel market size was estimated at USD 816.15 billion in 2022 and is expected to reach USD 763.50 billion in 2023.

b. The global flat steel market is expected to grow at a compound annual growth rate of 2.5% from 2023 to 2030 to reach USD 997.35 billion by 2030.

b. Based on region, Asia Pacific accounted for the largest revenue share of more than 60.0% in 2022 of the overall market. The growth is witnessed owing to the upcoming residential and non-residential construction projects in the region.

b. Some of the key players operating in the flat steel market include. ArcelorMittal, Baosteel Group, Ezz Steel, HBIS Group, JFE Steel Corporation, NIPPON STEEL CORPORATION, NUCOR, Outokumpu, POSCO, Tata Steel Limited, ThyssenKrupp AG, United States Steel Corporation, and Voestalpine Group.

b. The key factors that are driving the flat steel market include the growing demand for steel products in the construction and automotive industries. Also, the rising government investments in infrastructure and easy availability of home loans further propel market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."