- Home

- »

- Pharmaceuticals

- »

-

Gastroesophageal Reflux Disease Therapeutics Market Report 2030GVR Report cover

![Gastroesophageal Reflux Disease Therapeutics Market Size, Share & Trends Report]()

Gastroesophageal Reflux Disease Therapeutics Market Size, Share & Trends Analysis Report By Drug Type (Antacids, Proton Pump Inhibitors, H2 Receptor Blocker, Pro-kinetic Agents), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-778-0

- Number of Pages: 130

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

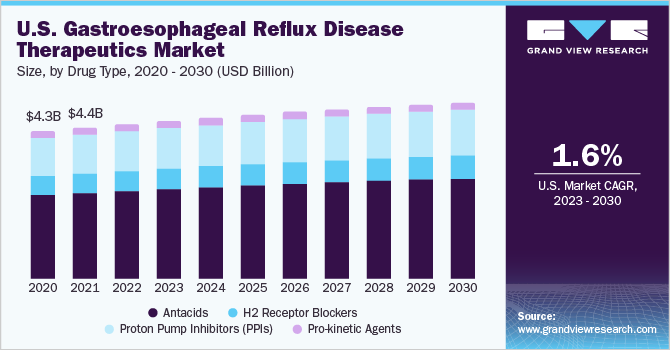

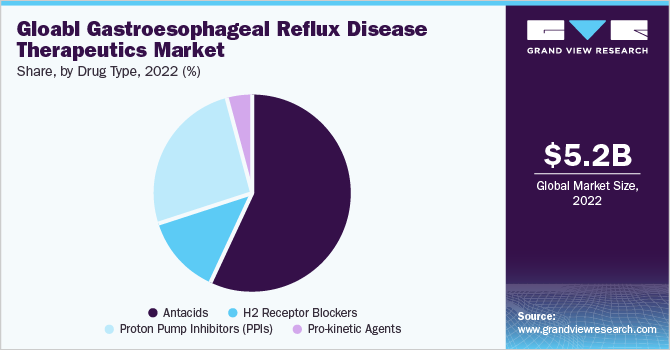

The global gastroesophageal reflux disease therapeutics market size was estimated at USD 5.18 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 1.76% from 2023 to 2030. The GERD treatment market is witnessing growth due to factors such as the low success rates associated with gastroesophageal reflux disease management devices, a rise in the prevalence of GERD and other gastrointestinal disorders, and a rising trend of self-medication aided by the presence of a strong product pipeline. Lockdowns have resulted in major lifestyle changes. Remote working, sedentary lifestyles, boredom, and anxiety caused by the COVID-19 lockdown have a direct impact on people's eating habits. During the COVID-19-induced home confinement period, there was a significant (P 0.001) increase in meals consumed, snacking, binge eating, and unhealthy food consumption.

An Italian Internet-based survey of medical students examining gastrointestinal symptoms before and after the COVID-19 lockdown period found a higher prevalence of heartburn (P 0.001) and indigestion symptoms (P 0.001) during the lockdown period due to altered eating habits and anxiety symptoms.

Gastroesophageal reflux disease is still one of the most prevalent disorders seen by gastroenterologists, surgeons, and primary care physicians. There are a number of management techniques available for the treatment of GERD, but, according to the American College of Gastroenterology, medications are one of the most successful treatment techniques that can help lessen and treat GERD symptoms such as heartburns, and some also allow the esophagus to heal from acid reflux damage. The majority of patients begin with an over-the-counter medication.

Moreover, the market has been witnessing significant growth, owing to the low success rates associated with GERD devices. Devices designed for GERD management have a long history of failure in terms of technology. Continuous failures are anticipated to have a negative impact on the demand for devices. The market for these minimally invasive devices has struggled to sustain itself for the past one and a half decades. Due to this, the widespread adoption of acid-reducing or neutralizing drugs as a first-line therapy for the treatment of acid reflux is being propelled.

However, one of the most difficult aspects of determining the prevalence of GERD is determining which patients have the disease. Many patients with GERD-related symptoms do not seek treatment from a primary care physician (PCP), and those who do seek therapy from a PCP are typically referred to a gastroenterologist only after symptoms become resistant to treatment (refractory). Moreover, as GERD is a chronic disease rather than an acute illness, it has a major economic impact due to the cost of long-term disease management. Over-the-counter and prescription pharmaceutical costs, physician office and hospital visits, and surgery charges are all direct costs linked with the disease.

Type Insights

The antacids segment held the largest share in 2022. The dominance of the segment is attributed to the effectiveness and rapid relief provided by antacids. Antacids are a prominent class of over-the-counter drugs sold worldwide, and customers suffering from acid reflux and heartburn spend billions of dollars on these non-prescription medications in pursuit of relief. They relieve the symptoms of heartburn, acid indigestion, hyperacidity, GERD, and upset stomach caused by these disorders. The growth of the segment can also be attributed to the increasing awareness among the population of self-medication. People prefer over-the-counter drugs rather than seeking medical professional procedures. Moreover, it has been observed that antacids are found to be effective and show no side effects even in pregnancy and other conditions, which further fuels the growth of the segment.

The proton pump inhibitors segment is expected to show lucrative growth over the forecast period. Proton pump inhibitors (PPIs) are the most often prescribed class of drugs for the treatment of heartburn and acid-related illnesses. They function by preventing acid formation in the parietal cell of the stomach. PPIs are available on prescription as well as over the counter. There is a wide range of PPI medications available in the market that serves the demand of the population suffering from the condition. For instance, omeprazole and lansoprazole have been available for the longest time and are thus the most familiar to physicians and patients. Omeprazole and lansoprazole have now been made available over the counter. Rabeprazole and pantoprazole show better efficacy than omeprazole and are better accepted by patients with swallowing problems. All these medications help in healing 90-94% of the population suffering from GERD.

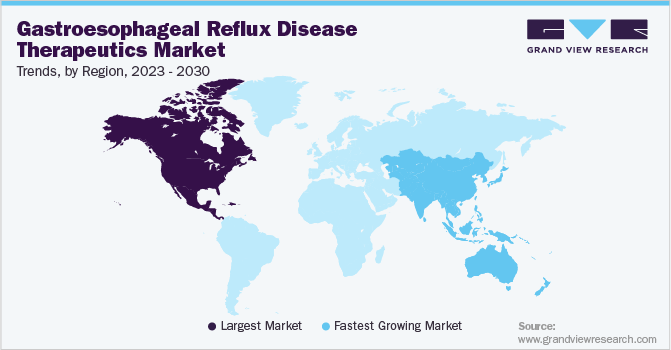

Regional Insights

North America dominated the overall gastroesophageal reflux disease treatment market in 2022, which can be attributed to the increasing adoption of GERD therapeutics owing to the increasing prevalence of GERD in the regional population. For instance, according to a study published in the journal GUT, the prevalence of GERD in North America was 18-28%. Moreover, there are increasing initiatives on spreading awareness about the condition in the population, further increasing the demand for GERD therapeutics. For instance, in November 2022, EndoGastric Solutions, Inc. launched a national campaign for supporting GERD awareness week. The aim of the campaign was to provide easy-to-follow reflux-friendly recipes for people suffering from GERD. The growth in the region is also supported by key players focusing on new product launches. In October 2022, Sebela Pharmaceuticals entered into a strategic collaboration for the development and commercialization of Tegoprazan in Canada and the U.S.

Asia Pacific is estimated to show the fastest growth over the forecast period. The growth of the market in the region is due to increasing awareness among the target audience regarding the treatment of the condition, increasing incidences, and an increasing focus by key market players to expand their product portfolios. In March 2022, Vonoprazan, an FDA-approved drug developed by Phantom Pharmaceuticals, was made commercially available in Japan and other Asian countries for the treatment of GERD. Moreover, a number of players have expanded their presence in Asia owing to increasing demand for GERD therapeutics in the region.

Key Companies & Market Share Insights

Key players are focusing on changing, introducing new technologies that enhance patient outcomes, and significantly increasing the effectiveness and efficiency of healthcare. For instance, in July 2022, Adcock Ingram launched dexlansoprazole, a PPI-modified release medication for the treatment of GERD. Some of the key players in the global gastroesophageal reflux disease therapeutics market include:

-

AstraZeneca

-

Eisai Co., Ltd.

-

GSK plc.

-

Takeda Pharmaceutical Company Limited.

-

Ironwood Pharmaceuticals, Inc.

-

Johnson & Johnson Services, Inc.

-

SFJ Pharmaceuticals

-

Sebela Pharmaceuticals

-

Phathom Pharmaceuticals, Inc.

-

Camber Pharmaceuticals, Inc.

Gastroesophageal Reflux Disease Therapeutics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 5.29 billion

Revenue forecast in 2030

USD 5.95 billion

Growth rate

CAGR of 1.76% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Drug type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

AstraZeneca; Eisai Co. Ltd.; GSK plc.; Takeda Pharmaceutical Company Limited.; Ironwood Pharmaceuticals, Inc.; Johnson & Johnson Services; Inc.; SFJ Pharmaceuticals; Sebela Pharmaceuticals; Phathom Pharmaceuticals Inc.; Camber Pharmaceuticals Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Global Gastroesophageal Reflux Disease Therapeutics Market Segmentation

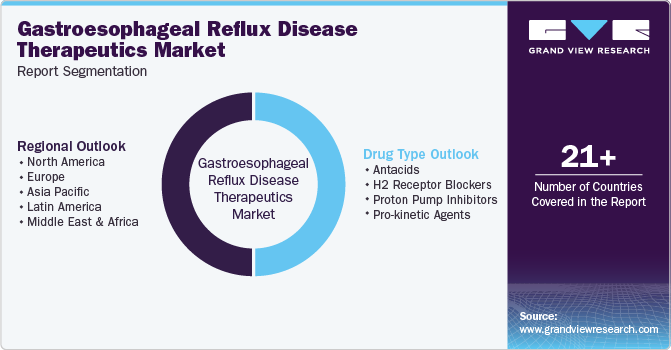

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global gastroesophageal reflux disease therapeutics market report based on the drug type and region:

-

Drug Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Antacids

-

H2 Receptor Blockers

-

Proton Pump Inhibitors (PPIs)

-

Pro-kinetic agents

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global gastroesophageal reflux disease therapeutics market size was estimated at USD 5.18 billion in 2022 and is expected to reach USD 5.29 billion in 2023.

b. The global gastroesophageal reflux disease therapeutics market is expected to decline at a compound annual growth rate of 1.76% from 2023 to 2030 to reach USD 5.95 billion by 2030.

b. North America dominated the gastroesophageal reflux disease therapeutics market with a share of 37.64% in 2022. This is attributable to the increasing adoption of GERD therapeutics owing to the increasing prevalence of GERD in the population. For instance, according to the study published in the journal Gut reports the prevalence of GERD in North America was 18-28%.

b. Some key players operating in the gastroesophageal reflux disease therapeutics market include AstraZeneca, Eisai Co., Ltd., GSK plc., Takeda Pharmaceutical Company Limited., Ironwood Pharmaceuticals, Inc., Johnson & Johnson Services, Inc., SFJ Pharmaceuticals, Sebela Pharmaceuticals, Phathom Pharmaceuticals, Inc., Camber Pharmaceuticals, Inc.

b. Key factors that are depriving the market growth include factors such as the low success rates associated with the GERD management devices, rising prevalence of GERD and other gastrointestinal disorders, and a rising trend of self-medication aided with presence of strong product pipeline.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."