- Home

- »

- Communication Services

- »

-

Higher Education Market Size, Share & Trends Report, 2030GVR Report cover

![Higher Education Market Size, Share & Trends Report]()

Higher Education Market Size, Share & Trends Analysis Report By Learning Mode (Offline, Online), By Course (Master’s, PhD), By Revenue Source (Tuition Fees, Investment Returns), By Institution (Public, Private), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-161-7

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Technology

Higher Education Market Size & Trends

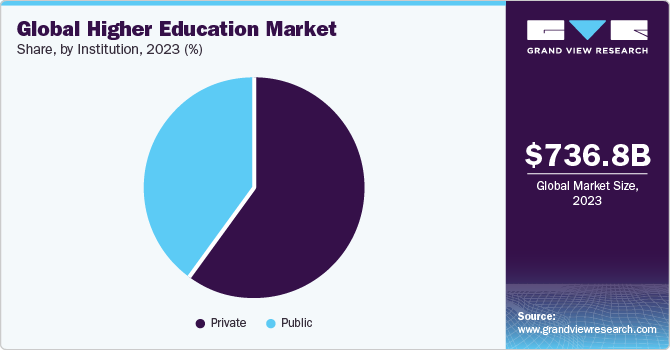

The global higher education market size was estimated at USD 736.80 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 12.1% from 2024 to 2030. The growing population in countries, such as the U.S., Canada, the UK, and India, is driving the demand for higher education institutions. The demand for worldwide collaboration with institutions has grown for global interconnection of higher education market. Idea of continuous learning and development is becoming a growing trend as individuals look to advance their skills. As a result, there is an increasing need for graduate degrees, career advancement, and short workshops in the market portfolio.

Many students can readily avail higher education because of various options, such as community-based college programs, distance learning courses, and financial assistance. The demand for skilled labor is rising as economies expand globally. Institutions are essential to support economic expansion. Different courses and degrees that students seek are influenced by changes in the labor market, including modifications to employment criteria and the need for particular abilities and personality traits. Course offerings, technological adoption, infrastructure development, and support services have evolved as rivalry between universities and educational institutions for students and capital.

Institutional evaluations and rankings can also impact enrollment and income figures. Institutions of higher education have become centers for innovation and research. With the advent of technology, cloud services allow educational institutions to preserve and retrieve data, apps, and resources privately and effectively. Administrative duties, such as responding to questions from students, streamlining the admissions procedure, and offering support, are handled by chatbots. To promote creativity and experiential learning across a range of subject areas, including engineering and design, higher education colleges and universities are investing in creative areas.

Economic downturns and recessions can result in less public support for education and more competition for grants and scholarships. The widespread adoption of online and hybrid learning techniques is projected to boost market growth. As people strive to gain additional skills throughout their career, short & skill-focused programs and small-scale certifications will grow in popularity. Technology advancements have improved distance learning practices and model adaptability making them a crucial element of the market.

The rising dependency on technology exposes institutions to risks related to cybersecurity. Safeguarding sensitive data and guaranteeing the security of digital platforms remain ongoing challenges in the interconnected world of the higher education sector. Innovative technologies in this sector, such as augmented, mixed, and virtual reality (AR, MR, VR), artificial intelligence (AI), and blockchain, will be integrated into learning, investigation, and management domains. Institutions in this industry will become more student-centered, providing customized educational experiences, adaptable program planning, and extensive support services.

Institution Insights

The public segment held a market share of 41% in 2023 and is expected to dominate the market throughout the forecast years. The segment dominance can be attributed to scholarships and financial aid programs sponsored by the government and managed by public institutions. Public organizations in politically stable countries, such as the U.S., Canada, and the UK, have worldwide popularity and student traction. Students from all over the world tend to study in politically stable conditions, contributing to the global growth of the public higher education market. Tuition fees at public universities are lower than at private institutions. The affordability element attracts students, leading to increased enrollment and overall growth of the market.

The private segment is expected to grow significantly at a CAGR of around 12% from 2024 to 2030. This segment growth can be attributed to more flexible admission policies at private-sector colleges. This adaptability enables them to admit a broad range of students, catering to those with non-traditional educational backgrounds. Private colleges promote faculty development, investing in training and resources to ensure a high-quality teaching staff. Private higher education institutions often use strategic financial management strategies. It involves cautious budgeting, diverse revenue streams, and efficient usage of funds, contributing to financial stability and survival towards economic uncertainties.

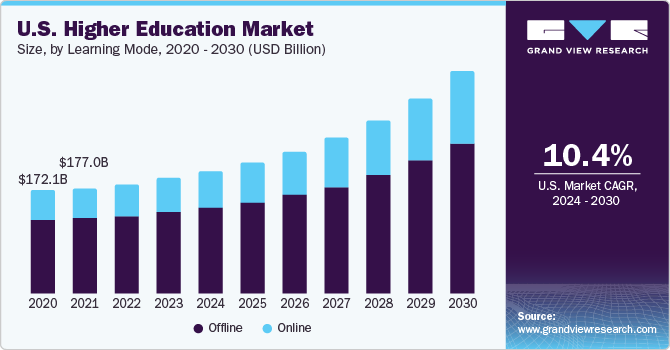

Learning Mode Insights

The offline segment accounted for the largest market share of around 70% in 2023. Technology is increasingly playing a vital role in this market, fueling the expansion of the offline learning segment. Providers, such as Coursera, Inc., Udemy, Inc., and BYJU, are launching advanced applications and platforms, making offline learning simple and more economical for students. Offline learning colleges and institutions are increasingly collaborating to produce courses and provide internship and job placement opportunities to students, leading to the growth of this segment.

The online segment is expected to grow at the fastest CAGR of around 13% from 2024 to 2030. The segment growth can be attributed to its flexibility and diverse selection of customized courses and certificates oriented toward specific professions, career pathways, and individual preferences. Online education platforms enable students worldwide to break down barriers, such as lack of access to advanced educational institutions, to learn and increase cross-border access to high-quality learning. The proliferation of advanced technologies, such as VR, MR, and AR, are widely used to offer enhanced and interactive online learning experiences. Online education colleges and universities are increasingly collaborating with educational institutions, colleges, businesses, and non-profit groups worldwide to provide collaborative programs, share resources, and mark their global presence.

Regional Insights

North America dominated the market with a revenue share of around 30% in 2023. North American universities are at the forefront of research and innovation. The region's devotion to cutting-edge research, technological improvements, and scientific breakthroughs makes it more appealing to domestic and international students. Universities in the region are frequently located in innovation centers and ecosystems strongly related to industries. Furthermore, a strong presence of world-renowned universities and educational institutions in the U.S. and Canada supports region’s growth.

Asia Pacific is anticipated to register the fastest CAGR of around 13% from 2024 to 2030 due to the involvement of the private sector in education, particularly the construction of private universities and institutes, which has increased the potential to meet the region’s rising demand for higher education. The APAC region is rapidly exploring opportunities for cross-border education. The dynamic nature of the employment market in countries, such as China, India, and Japan, drives students to pursue higher education to enhance their skills. The drive to remain competitive in fast-changing sectors fuels the demand for ideal academic programs in the APAC regional market.

Course Insights

The undergraduate segment accounted for the largest revenue share of 79% in 2023 as undergraduate degrees are essential for numerous professional careers and the most significant entry point into higher education courses for students. Moreover, undergraduate degree programs primarily take longer than postgraduate ones. Undergraduate education in many countries, such as the U.S., Canada, and India, usually spans three to four years. The future of undergraduate degrees is anticipated to witness a rise in interdisciplinary programs, allowing students to gain a broad range of skills and knowledge. The master’s segment is expected to grow at a CAGR of around 14% from 2024 to 2030.

As the global employment market becomes more competitive, individuals embrace the importance of advanced qualifications in securing prospects for career progression. Master's degree programs frequently include research components that contribute to innovation in various fields, such as marketing, finance, and business operations. This emphasis on research equates to the growing demand for professionals who can contribute to cutting-edge innovations in their respective fields. Furthermore, employers are increasingly placing higher value on specific skills, and professionals are pursuing master's degrees to stand out in highly competitive job markets.

Revenue Source Insights

The tuition fees revenue source segment held a share of around 36% in 2023 and is expected to dominate market throughout the forecast period. This segment growth can be attributed to tuition fees being important in defining an institution's market competitiveness. With the rapid globalization of the market, the segment is also expected to witness significant growth. Currency exchange rates, geopolitical concerns, and increased rivalry for a part of the foreign student market may all impact future pricing structures.

The grants, contracts, and gifts segment is expected to register the highest CAGR of over 12% from 2024 to 2030 as institutions obtain grants, contracts, and financial gifts to increase competitive advantage. Grants are used to foster new teaching methods and educational approaches. It includes creating online courses, interactive learning platforms, or other technologically driven educational advancements. Research grants and contracts play a vital role in fueling academic research initiatives. Institutions that get research revenue can attract top-tier faculty, invest in modern technology, and contribute to developments in various higher educational domains.

Public Insights

The state universities segment held a market share of 39% in 2023 and is expected to dominate market throughout the forecast period. This segment growth can be attributed to state universities subjected to stringent accreditation processes administered by government agencies. The university authorization acts as a quality assurance system for overseas students, assuring students of the institution's focus on academic quality. State universities and commercial enterprises work together on research and innovation. Furthermore, global partnerships of state universities expose international students to the practical application of academic expertise.

The government colleges segment is expected to grow significantly at a CAGR of more than 11% from 2024 to 2030. This growth can be attributed to the educational curriculum of government universities aligned with national development goals. This alignment gains government support and funds, particularly for addressing critical skill gaps and contributing to the country's socioeconomic growth. Government colleges are promoting strategic international cooperation and partnerships. Government institutions work with businesses to develop programs that fit current market demands. This boosts and facilitates job opportunities for graduates and support market growth.

Private Insights

The private colleges segment held a revenue share of around 39% in 2023 and is expected to dominate the market throughout the forecast period. The growth of the business segment can be attributed to the involvement of marketing and branding strategies. To reach a larger demographic and recruit new students, private universities spend on building a strong brand image through the use of social networking sites, digital platforms, and other promotion platforms. Moreover, private institutions provide competitive scholarship programs to attract students with exceptional performance, hence driving market growth.

The community colleges segment is expected to register a CAGR of more than 11% from 2024 to 2030. Private community colleges incorporate their programs with the goals of local economic growth. The strategic alignment attracts support from local stakeholders, such as corporations and municipal governments, resulting in long-term growth. Through specialized courses and resources, private community colleges actively promote entrepreneurship and small company development. Staff members at private community colleges are prioritized for ongoing professional development. Moreover, community colleges' emphasis on developing entrepreneurial abilities attracts students who are interested in starting their businesses and adds to the development of institutions.

Key Companies & Market Share Insights

Key players are investing resources in research & development activities to support growth and enhance their internal business operations. The report will include company analysis based on the financial performances, product benchmarking, key business strategies, and recent strategic alliances. Companies are engaging in mergers & acquisitions and partnerships to further upgrade their products and gain a competitive advantage in the market. They are working effectively on new product development and existing product enhancement to acquire new customers and capture more market shares.

For instance, in January 2023, The President and Fellows of Harvard College collaborated with the Royall House and Slave Quarters to increase historical understanding towards future research and educational programming. The partnership demonstrates Harvard's commitment to addressing historical circumstances, particularly slavery. The initiative attempts to promote societal understanding and communication. Harvard's participation emphasizes proactive participation in historical and societal discussions.

Key Higher Education Companies:

- California Institute of Technology

- Columbia University

- Imperial College London

- Massachusetts Institute of Technology

- Peking University

- Stanford University

- Tsinghua University

- The President and Fellows of Harvard College

- The Trustees of Princeton University

- The University of Tokyo

- University of Cape Town

- University College London, UCL

- University of Oxford

- University of the Andes

- University of Pennsylvania

- Yale University

Higher Education Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 792.65 billion

Revenue forecast in 2030

USD 1,569.37 billion

Growth rate

CAGR of 12.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, trends

Segments covered

Learning mode, course, revenue source, institution, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

California Institute of Technology; Columbia University; Imperial College London; Massachusetts Institute of Technology; Peking University; Stanford University; Tsinghua University; The President and Fellows of Harvard College; The Trustees of Princeton University; The University of Tokyo; University of Cape Town; University College London UCL; University of Oxford; University of the Andes; University of Pennsylvania; Yale University

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Higher Education Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the higher education market report based on learning mode, course, revenue source, institution, and region:

-

Learning Mode Outlook (Revenue, USD Billion, 2018 - 2030)

-

Online

-

Offline

-

-

Course Outlook (Revenue, USD Billion, 2018 - 2030)

-

Undergraduate

-

Master's

-

PhD

-

-

Revenue Source Outlook (Revenue, USD Billion, 2018 - 2030)

-

Tuition fees

-

Grants, Contracts, and Gifts

-

Investment Returns

-

Others

-

-

Institution Outlook (Revenue, USD Billion, 2018 - 2030)

-

Public

-

State Universities

-

Government Colleges

-

Others

-

-

Private

-

Private Colleges

-

Community Colleges

-

Others

-

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global higher education market size was estimated at USD 736.80 billion in 2023 and is expected to reach USD 792.65 billion in 2024.

b. The global higher education market is expected to grow at a compound annual growth rate of 12.1% from 2024 to 2030 to reach USD 1,569.37 billion by 2030.

b. North America dominated the higher education market with a share of 29% in 2023. This is attributable to to cutting-edge research, technological improvements, and scientific breakthroughs makes it more appealing to both domestic and international students.

b. Some key players operating in the higher education market include California Institute of Technology, Columbia University, Imperial College London, Massachusetts Institute of Technology, Peking University, Stanford University, Tsinghua University, The President and Fellows of Harvard College, The Trustees of Princeton University, The University of Tokyo, University of Cape Town, University College London UCL, University of Oxford, University of the Andes, University of Pennsylvania, Yale University

b. Key factors that are driving the market growth include Countries such as the U.S., Canada, the U.K., and India, which are witnessing population growth and increasing demand for higher education as a result of increasing birth rates, or immigrants.; The demand for worldwide collaboration with institutions has grown as a result of global interconnection of higher education market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."