- Home

- »

- Disinfectants & Preservatives

- »

-

Indoor Air Purification Market Size And Share Report, 2024GVR Report cover

![Indoor Air Purification Market Report]()

Indoor Air Purification Market Analysis By Product (Dust Collectors & Vacuums, Fume & Smoke Collectors, Mist Eliminators), By Technology, By Application, And Segment Forecasts To 2024

- Report ID: GVR-1-68038-000-2

- Number of Pages: 160

- Format: Electronic (PDF)

- Historical Data: 2010-2012

- Industry: Bulk Chemicals

Report Overview

The global indoor air purification market size was valued at USD 11.34 billion in 2015. Favorable government laws & regulations and increasing awareness of the harmful impact of indoor air pollutants on health & well-being are expected to drive the global indoor air purification market over the forecast period.

Indoor air purification plays a significant role in the filtration of harmful pollutants present in the environment. Their increasing use in the commercial, residential, retail, manufacturing, healthcare, hospitality, construction, automobile, and pharmaceuticals sector is anticipated to spur market growth from 2016 to 2024.

Growing urbanization in Asia Pacific mainly in China and India is expected to drive their demand over the forecast period. The reluctance of manufacturers to make huge capital investments in indoor air purification systems is projected to hinder the market demand over the forecast period.

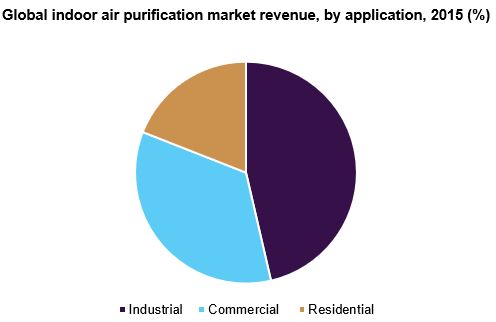

The industrial sector is anticipated to dominate the indoor air purification market on account of stringent government regulations implemented for the health and safety of laborers at a workplace. The residential sector is expected to grow at the highest CAGR on account of increasing indoor air pollution level in urbanized areas and lower prices of residential air purifiers.

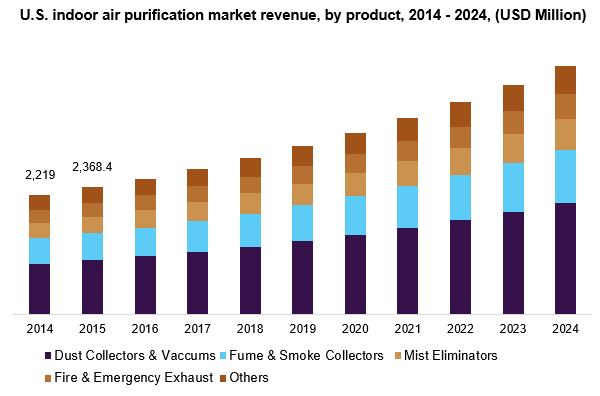

Product Insights

On the basis of product, the market is divided into dust collectors & vacuums fume & smoke collectors, mist eliminators, fire & emergency exhausts, and others. Dust collectors & vacuums accounted for the largest share in the global indoor air purification market. The market is expected to grow at the highest CAGR over the forecast period, on account of increasing industrial & residential demand.

Fume & smoke collectors occupied the second largest share in the global indoor air purification market. The extensive use of fume & smoke collectors in removing wet & dry vapors, gasses, dust, and smoke from an air stream is expected to drive overall market growth over the coming years.

Mist collectors occupied around 11.9% market revenue share of the global indoor air purification market in 2015. Mist collectors are broadly used to eliminate sub-micron contaminants in the plant’s atmosphere. These purifiers are low profile, highly-efficient, machine-mountable solutions for semi-synthetic, wet machining, with oil-based, synthetic, and water-soluble coolants. Mist collectors also have the ability to remove both small and large particles from indoor factory processes.

Technology Insights

The indoor air purification market on the basis of technology comprises of HEPA, electrostatic precipitators, activated carbon, ionization, and others. The HEPA segment accounted for 40.7% of the total demand in 2015, among all the technologies used in the industry. This technology is used to trap harmful particles such as pollen, dust mites, etc.

HEPA filters are highly efficient as they are manufactured using ultra-fine and glass fiber media, which capture microscopic particles that may pass easily through other filters by a combination of interception, diffusion, and inertial impaction.

Activated carbon is anticipated to occupy the second-largest share in the global market. The increasing use of activated carbon in the manufacture of air purifiers for various applications is expected to augment market growth over the coming years.

Application Insights

Industrial application of indoor air purifiers is projected to dominate the overall industry. Favorable regulations on maintaining clean indoor air quality levels in manufacturing facilities and production sites are expected to boost its demand in this segment over the forecast period.

The residential sector is expected to grow at the highest CAGR over the forecast period. The decreasing prices of residential air purification products used in rooms and kitchens are projected to drive the demand growth.

High demand for residential air purifiers is expected to arise from the Asia Pacific region on account of high pollution levels prevailing in some of the developing countries of Asia Pacific. The stringent guidelines implemented in the hospitality and healthcare segment is expected to increase the demand for air purification systems in the commercial sector.

Regional Insights

Asia Pacific indoor air purification market led the global industry and accounted for over 35% of total demand in 2015. The region is expected to experience the largest demand for indoor air purification systems & solutions. Increasing demand across the commercial, industrial, and residential sectors in China, India, and Japan is expected to drive the regional growth over the forecast period.

North Americans are known to spend a maximum amount of their time indoors. Awareness pertaining to the increasing indoor air pollution levels is expected to drive the demand for indoor air purifiers in this region. The indoor air purification demand in North America is driven by the countries such as Canada, Mexico, and the U.S.

Key Companies & Market Share Insights

The leading companies in the indoor air purification market invest heavily in R&D activities to achieve product innovation based on customer requirements. Key players operating in the global indoor air purification industry include 3M Purification Inc., Abatement Technologies, Inc., AllerAir Industries Inc., Aprilaire, Blueair, Inc., Honeywell International Inc., Sharp Corporation, Clarcor, Inc., MANN+HUMMEL GmbH, Lifewell Environment Technology Co. Ltd, Daikin Industries, Ltd., Industrial Air Solutions Inc., Halton Group, Trane Inc., Electrocorp and Lennox International Inc.

Recent Developments

-

In January 2023, Lennox Industries launched Lennox S40 Smart Thermostat with air quality monitor. The product ensures perfect indoor air by detecting and tracking air pollutants, thus delivering healthy air.

-

In October 2022, Aprilaire launched IAQ thermostats, a house system for all in one fresh air purification, air ventilation, and humidity control.

-

In October 2021, Trane Residential launched Trane Home, a smart home integration platform that allows users to monitor air quality through a connected experience. The technology includes awair element (IAQ monitor) which monitors the in-house air quality score.

-

In March 2021, MANN+HUMMEL invested in Pamlico Air for wholesale and retail applications. The strategic investment aimed to strengthen the existing air filtration portfolio.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."