- Home

- »

- Communication Services

- »

-

Internet Protocol Television Market Growth Report, 2020-2027GVR Report cover

![Internet Protocol Television Market Size, Share & Trends Report]()

Internet Protocol Television Market Size, Share & Trends Analysis Report By Subscription Type (Subscription-based IPTV, Subscription-free IPTV), By Region, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-2-68038-342-3

- Number of Pages: 175

- Format: Electronic (PDF)

- Historical Range: 2016 - 2018

- Industry: Technology

Report Overview

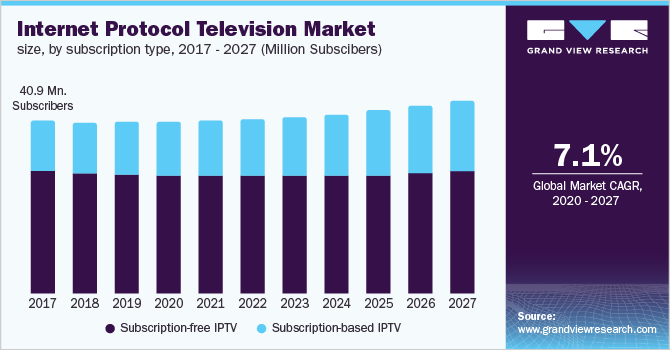

The global internet protocol television market size to be valued at USD 67.6 billion by 2027 and is expected to grow at a compound annual growth rate (CAGR) of 7.1% during the forecast period. The rising trend of viewing content via the internet and the continuous price reduction of bundled packages is expected to increase the subscriber base. IPTV’s virtue of flexible deployment, interactive and interoperable user interface, and highly personalization ability offers lucrative prospects to the market growth. Furthermore, the ability of this broadcast network to permit the deployment of one application program by multiple users in a single service network enhances the usability and functionality of the technology.

Service providers are offering triple-play bundled package services, including voice, video, and data, in one single access subscription, that has resulted in attracting a large customer base. Service providers are making significant investments in delivering and marketing triple-play services, with a large amount spent on their delivery infrastructure as well. Moreover, customers are trying to create a customized package as per their requirements, as the customers are not impressed with the current deals the providers are offering. Therefore, service providers such as MatrixStream Technologies, Inc., and AT&T, Inc. are offering customized solutions after reviewing the customer requirements, thereby helping them increase their subscriber portfolio.

The transition from legacy broadcasting methodologies to broadband internet protocol is also offering significant prospects to industry growth. The internet-based content delivery system facilitates a more straightforward and more effective distribution of content for providers, thus leading to incremental adoption of IPTV services. Additionally, a rising trend amongst telecom operators to deliver integrated services with internet packages is providing an impetus to industry growth. Telecom companies are also increasingly leveraging IPTV technology to transform into Complement Digital Service Providers (CDSP), owing to growing developments in internet infrastructure.

The integration of cloud technology offers growth opportunities for the industry. Leveraging cloud technology enables efficient statistical multiplexing, which offers cost-saving capabilities due to network virtualization features. The use of cloud technology for content delivery also allows service providers to lower costs related to storage and distribution content, which enables them to reduce the cost of service as well as ensure efficient profit generation.

Internet Protocol Television Market Trends

The growth of OTT services and the IPTV business is being fueled by the rise in digitalization and the increased use of mobile devices by people. Several vendors around the world offer various features such as video games, video calling, and OTT to attract clients and expand the number of subscribers. Furthermore, the Government of India is supportive toward the use of digital platforms that are essential in promoting IPTV adoption. These factors are expected to drive the market growth in the forecast period.

The number of IPTV subscribers has grown as a result of technological advancements owing to the high demand for high definition and video on demand. Moreover, due to the market expansions the rate of subscriber is on an increase. The industry is likely to be driven by the adoption of Internet-based streaming services. On contrary, IPTV adoption is limited to some extent by the competition from local satellite and cable TV due to their lower cost particularly in emerging and low-income nations.

Owing to the tremendous growth in internet access across the world the growing need for high-quality programming on television has gained some traction. Enhanced wired broadband infrastructure in metropolitan areas has aided market expansion and has the potential to grow in the forecast period.

Covid-19 Impact

The current outbreak of a global pandemic, Covid-19, offers temporary yet significant prospects to the IPTV market growth. The present scenario of people being confined to their homes due to lockdown being implemented by various state and national governments facilitates the need to subscribe to internet protocol television services. Furthermore, the rising trend of internet usage in households due to the implementation of ‘work-from-home’ practices has further resulted in the higher internet consumption. The need to subscribe for better internet packages with faster speeds and provision offered by service providers to adhere to add-on facilities such as IPTV services at minimal prices is further providing an impetus to the industry growth.

Furthermore, the closure of schools globally has facilitated the setting up of new channels that offer free, tailored content to existing subscribers. For instance, China Telecom Corp. Ltd. and China Unicom Ltd. in China and have started offering free online educational content and live sessions for students. Additionally, closing down of religious places and places of the public gathering are facilitating religious groups, such as churches, to broadcast their services via specified channels. KT Corp. in South Korea offers free usage of Olleh TV Community User Group for users to gain access to preaching offered by churches digitally.

Subscription Type Insights

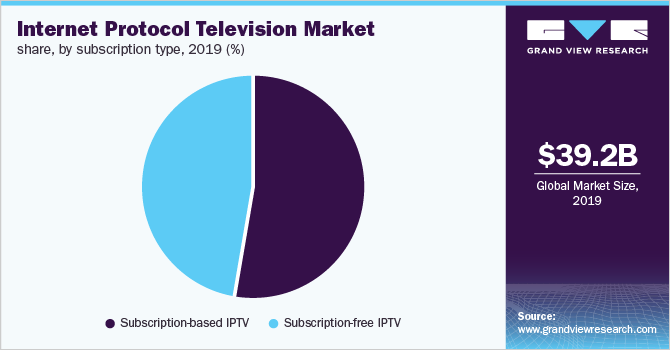

The subscription-based IPTV segment accounted for over 51% of the subscriber base in 2019. Provision of bundled packages and UHD TV viewing experience, continue to provide an impetus to the segment growth. Furthermore, rising demand amongst individuals to have access to ad-free and uninterrupted viewing experience is also facilitating the adoption of subscription services. Moreover, service providers have also started offering attractive offers to its paid subscription users as part of the customer loyalty program. For instance, AT&T, Inc. is providing smartphones at lower prices to attract individuals to confer with subscription-based IPTV and data services.

The subscription-free IPTV segment accounted for a significant share in 2019. The ability to pay for selected services or events such as the live broadcast of sporting events and pay-per-view events has offered cost-effective solutions to users and facilitated wide-scale adoption of the subscription-free model. This model has enabled customers to mitigate the chances of a data breach as content providers do not ask for Personally Identifiable Information (PII) of users. Furthermore, several regions, including North America, have put restrictions on the number of advertisements shown on free subscription IPTV, which offers a comfortable viewing experience to people, thus driving wide-scale adoption of subscription-free IPTV services.

Regional Insights

North America emerged as the industry leader with more than 46% revenue share in 2019. High penetration of the internet and the rapid growth of smart TVs are major driving factors for regional growth. Furthermore, inexpensive IPTV plans as compared to cable TV networks and enhanced functionality is driving regional growth. Moreover, the transition of moving from cable to wireless media delivery and exchange is further showcasing rising regional growth.

Europe captured significant share in 2019 owing to guidelines laid down by the European Telecommunication Standards Institute (ETSI) to regulate and monitor the authentic and legal distribution of IPTV services, which ensures steady growth of the industry. Furthermore, rising instances of R&D activities undertaken by telecom companies are offering significant opportunities for the adoption of internet protocol television in the region. For example, Vodafone GmBH announced the completion of gigabit cable rollout in 2019, which is expected to provide high-speed internet in several households. Moreover, large investment programs carried out by companies such as Deutsche Telekom AG to deploy optical fiber and VDSL is further offering an impetus to the industry growth.

Key Companies & Market Share Insights

There have been M&A activities between substantial players in the market for IPTV to improve on service offerings to capture a higher audience base. For instance, In April 2019, ARRIS International plc merged with Commscope Inc., to diversify and enhance communications practices and networks. Service providers have also started signing agreements with other systems and telecom providers to improve one another’s reach and offer more options to customers in different geographies. For instance, in September 2018, Huawei Technologies Co., Ltd. collaborated with OSN to deliver IPTV solutions to telecom operators in the Middle East.

Service providers have also started collaborating with several content libraries, as well as started developing content libraries of their own, to offer high-quality content for its customers. Furthermore, companies such as Deutsche Telekom AG has also begun offering new Nick+ service since March 2019, which is expected to showcase more than 900 new episodes for kids on its IPTV platform, MagentaTV. The new service is expected to result in higher audiences and thus ensure continual business practices for the company.

Recent Developments

-

In May 2022, Ericsson and Intel, two of the most innovative businesses in the world of technology have combined their R&D expertise to build high-performing Cloud RAN solutions

-

In June 2022, Xandr Inc., AT&T Inc.'s global programmatic advertising platform, has been sold to Microsoft.

-

In March 2021, Spark New Zealand added new features to its Cisco-powered IoT Control Center platform, which is expected to help businesses enhance service dependability and lower operational costs by leveraging artificial intelligence and machine learning.

Some prominent players in the IPTV market include:

-

AT&T Inc.

-

Cisco Systems, Inc.

-

Deutsche Telekom AG

-

Huawei Technologies Co., Ltd.

-

Verizon Communications Inc.

Internet Protocol Television Market Report Scope

Report Attribute

Details

Market size value in 2019

USD 39.2 billion

Revenue forecast in 2027

USD 67.6 billion

Growth Rate

CAGR of 7.1% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD Billion and Subscribers in Million and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Subscription type and region

Regional scope

North America, Europe, Asia Pacific, Latin America, and MEA

Country scope

U.S., Canada, U.K., Germany, China, India, Japan, Brazil, Mexico

Key companies profiled

AT&T Inc., Cisco Systems, Inc., Deutsche Telekom AG, Huawei Technologies Co., Ltd., and Verizon Communications Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Internet Protocol Television Market SegmentationThis report forecasts revenue growths at global, regional, and country levels and provides an analysis of the industry trends in each of the sub-segments from 2020 to 2027. For the purpose of this study, Grand View Research has segmented the global internet protocol television market report based on subscription type, and region.

-

Subscription Type Outlook (Number of Subscribers, Million, 2016 - 2027)

-

Subscription-based IPTV

-

Subscription free IPTV

-

-

Regional Outlook (Number of Subscribers, Million; Revenue, USD Billion; 2016 - 2027)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Mexico

-

-

MEA

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."