- Home

- »

- Smart Textiles

- »

-

Islamic Clothing Market Size, Share & Trends Report, 2025GVR Report cover

![Islamic Clothing Market Size, Share & Trends Report]()

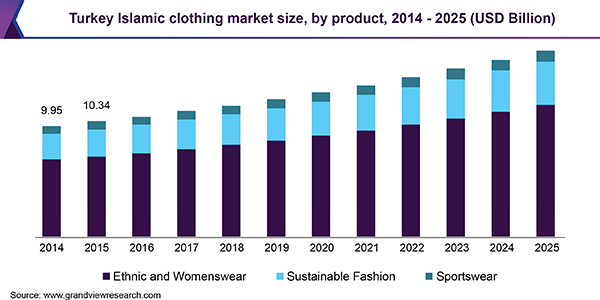

Islamic Clothing Market Size, Share & Trends Analysis Report By Product (Ethnic Wear, Sustainable Fashion, Sportswear), By Region (Middle East & Africa, Asia Pacific, Europe), And Segment Forecasts, 2018 - 2025

- Report ID: GVR-2-68038-677-6

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2014 - 2016

- Industry: Advanced Materials

Industry Insights

The global Islamic clothing market size was estimated at USD 59.7 billion in 2017 and is expected to witness a 5.0% CAGR in terms of revenue over the forecast period. Preferences for modest fashion wear coupled with increasing Islamic population is expected to drive the growth.

Islamic clothing is a symbolic type of modest clothing, which has been witnessing rapid growth over the last few years. Rising financial predicament from the global recession in the fashion industry is projected to boost the demand for modest fashion, thus, driving the market over the forecast period.

Rising popularity of Islamic clothing in the sports industry on account of favorable changes in regulations of international games is projected to boost product consumption. In addition, increasing consumer investments in online retail distribution are anticipated to drive the market growth. For instance, the brick and mortar strategy adopted by Aab along with online retailing is projected to provide a competitive edge to the company.

The consumer spending, among the Muslim population in the food and lifestyle sector, including modest clothing, is estimated to reach over USD 3.0 trillion by 2021 from USD 1.9 trillion in 2014, according to the State of the Global Islamic Economy Report. These figures portray a high growth potential for modest fashion products and the Islamic fashion industry.

Rapid growth of the Islamic clothing market is commanding attention and attracting huge investments in several geographies globally. A few of the mainstream fashion industry participants including DKNY, Mango, Uniqlo, and Tommy Hilfiger have made several investments in the sector to meet the growing demand and to introduce innovative clothing options.

Various geopolitical issues are expected to restrain market growth in the Muslim majority economies in Western Europe and Middle East. In addition, customs, payments, and logistics issues with regards to online retailers are projected to hamper product penetration through e-commerce platforms.

Product Insight

Ethnic wear held the dominant market share of over 70.9% in terms of revenue, in 2017. The demand for ethnic wear including burkhas and hijabs is projected to witness significant growth owing to the increasing availability of products through various brands including Tommy Hilfiger, Dolce & Gabbana, and DKNY globally.

Sustainable fashion is the second-largest product segment in terms of revenue. Islamic sustainable fashion is inspired by the modest dressing habit of Muslim women, which is a highly untapped market. Introduction of vibrant colored clothing has witnessed a revolutionary step in many Islamic geographies, driving the segment growth.

Islamic sustainable fashion is inspired by the modest ways that the Islamic women dressing such as covered hair, flowing lines, and a riot of colors inspired by Asian, African, and Arab heritage. These innovative clothing designs are created by blending modern fashion trends while maintaining ethnicity. This is projected to witness significant growth in the fashion world.

Presently, sustainable fashion is a niche market. However, increasing investment by luxury and high street brands, such as Mango, Marks & Spencer, and H & M are expected to boost new product development in the segment. Rising availability of a variety of products is anticipated to further fuel the market growth.

Regional Insights

Middle East and Africa accounted for 41.2% of the global market share, in terms of revenue, in 2017. High Islamic population coupled with rising adoption of innovative modest clothing in countries, such as UAE and Egypt is anticipated to drive regional demand. Rising population and consumer disposable income in several regional economies are the major factors driving the market growth.

Europe is anticipated to be one of the leading markets, being home to several leading fashion brands. These brands have significantly invested in Islamic clothing, which is the new and trending section of the fashion industry. Furthermore, rapid growth of the young Muslim population in the region coupled with rising ethnic fashion trends is projected to complement market growth.

North America is expected to witness significant market growth on account of the increasing immigration of Muslim population. In addition, the presence of several multinational companies manufacturing these apparels is expected to complement regional growth over the forecast period.

Asia Pacific is expected to expand at a CAGR of 5.0% over the projected period on account of increasing penetration of designer clothing in countries, such as Indonesia, Malaysia, and India. However, challenges such as maintaining a balance between changing fashion trends and upholding core Islamic principles is expected to restrain the growth to some extent.

Islamic Clothing Market Share Insights

Market players are taking initiatives in terms of innovation and collaborations in the market. For instance, Elzatta; an Indonesian fashion label has signed up with Raef Haggag, an American artist to be its brand ambassador. Such initiatives coupled with amendments in regulations have resulted in higher acceptance of clothing.

Companies, such as Nike are introducing clothing options such as sports hijabs, which will simplify issues for Muslim women participating in sports. These types of innovative products are anticipated to gain the attention of the potential customer base from around the world.

Report Scope

Attribute

Details

Base year for estimation

2017

Actual estimates/Historical data

2014 - 2016

Forecast period

2018 - 2025

Market representation

Revenue in USD million and CAGR from 2018 to 2025

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S., Turkey, Russia, Indonesia, Malaysia, Pakistan, India, UAE, Nigeria, Saudi Arabia, Egypt

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

15% free customization scope (equivalent to 5 analysts working days)

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research, Inc. has segmented the global Islamic clothing market report on the basis of product and region:

-

Product Outlook (Revenue, USD Million, 2014 - 2025)

-

Ethnic and Womenswear

-

Abayas & Hijabs

-

Prayer Outfits

-

Burkha & Naqaab

-

Thobes & Jubbas

-

Others

-

-

Sustainable Fashion

-

Sportswear

-

-

Regional Outlook (Revenue, USD Million, 2014 - 2025)

-

North America

-

The U.S.

-

-

Europe

-

Turkey

-

Russia

-

-

Asia Pacific

-

Indonesia

-

Malaysia

-

Pakistan

-

India

-

-

Central & South America (CSA)

-

Middle East & Africa (MEA)

-

UAE

-

Nigeria

-

Saudi Arabia

-

Egypt

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."