- Home

- »

- Clinical Diagnostics

- »

-

Latin America Flow Cytometry Market Size Report, 2030GVR Report cover

![Latin America Flow Cytometry Market Size, Share & Trends Report]()

Latin America Flow Cytometry Market Size, Share & Trends Analysis Report By Product (Instruments, Reagents & Consumables), By Technology, By Application (Research, Industrial), By End-use, By Country, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-619-6

- Number of Pages: 102

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Latin America Flow Cytometry Market Trends

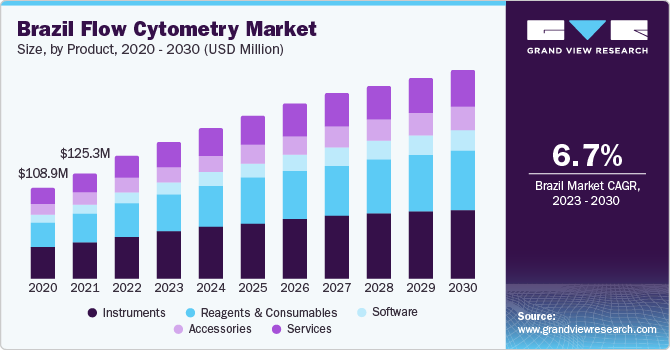

The Latin America flow cytometry market size was estimated at USD 337.60 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.44% from 2023 to 2030. The Latin America flow cytometry industry is witnessing growth due to rising R&D initiatives in clinical, biotechnology, and life sciences research, increasing technological advancements in reagents and instruments, increasing demand for point-of-care diagnostics, and an increasing prevalence of infectious and chronic diseases. In April 2020, BennuBio, Inc. received a USD 5 million investment to develop advanced particle and cell instrumentation, further accelerating research. Such investments and financing have resulted in a strong research and development infrastructure in biotechnology, clinical, biopharmaceutical, and life sciences research. This is projected to strengthen R&D for cell analysis in the realm of novel drug discovery and development operations using flow cytometry techniques. Moreover, technological advances in instrumentation have resulted in improved accuracy, efficiency, and cost-effectiveness of these systems, which is likely to open growth potential for the sector.

Flow cytometry applications have increased as a result of the COVID-19 pandemic. Because of its improved accuracy and throughput capacity, flow cytometry serves as an alternative for COVID-19 testing, overcoming the constraints associated with antibody-based testing options or conventional PCR. As a result, flow cytometry-based approaches for COVID-19 diagnoses and disease surveillance are further propelling the growth of the market in the region. Furthermore, the pandemic has fueled innovation in the flow cytometry field, as indicated by the introduction of new products.

Moreover, the increased need for point-of-care diagnostics for HIV and other sexually transmitted diseases is one of the factors driving market demand. The rising awareness among healthcare professionals about the precision and sensitivity associated with flow cytometry is aiding market expansion. Supportive government initiatives and the availability of improved instruments capable of multiplexing applications are two of the key factors driving the rapid rise of this technique in point-of-care healthcare facilities. Furthermore, clinics and other healthcare institutions are focusing on offering effective and speedy diagnostic results using point-of-care tests, which is projected to further fuel market expansion.

However, the high cost of the instruments and the low throughput rate of the cell are expected to hamper market growth. Some manufacturers, such as Sony, are beginning to produce flow cytometer devices for less than USD 100,000, however, a single unit can still cost anywhere from USD 100,000 to USD 500,000. The high cost of the instruments restrains the growth of the market, however, players operating in the market are focusing on developing novel and innovative technologies at affordable cost to enhance adoption.

Technology Insights

The cell-based segment held the largest share of 77.39% of the market in 2022due to increasing awareness of the advantages and benefits of cell-based assays and a growing demand for early diagnosis of various diseases. Furthermore, developments in cell-based assay technology, such as innovation in software, equipment, algorithms, affinity reagents, and labels, are projected to promote usage in the future. In January 2022, BD collaborated with the European Molecular Biology Laboratory (EMBL) and published profiles of the company’s innovation in flow cytometry that has the potential to transform cell biology, immunology, and genomics research and enable the discovery of cell-based therapeutics.

The bead-based segment is expected to show the fastest growth rate over the projected period.The assay using beads assesses intracellular soluble proteins such as growth factors, chemokines, cytokines, and phosphorylated cell signaling proteins. The high-throughput flow cytometry technique is observed as one of the most advanced instruments for performing multiplex bead-based experiments. The multiplex bead-based approach offers an unprecedented growth opportunity in the domain of infectious disease diagnosis, research, and treatment. The demand for bead-based products is anticipated to increase over the forecast period due to developments in molecular engineering, and monoclonal antibody production as well as the associated benefits such as cost-efficiency, quick turnaround time, and micro-sampling capabilities.

Product Insights

The instrument segment held the largest market share of 35.16% in 2022. The segment’s dominance is attributed to the rising adoption of flow cytometers and an increasing focus on technological advancements. The rising research in the field of diagnostics to provide accurate diagnostics is propelling the growth of the overall market. In January 2022, BD (Becton, Dickinson and Company) introduced an innovative high-speed sorting technology that helps unlock advancements in the diagnosis of oncology, immunology, cell therapies, and other fields. The development of novel products provides enhanced accuracy, cost-effectiveness, and portability, enabling growth opportunities in the market.

The software segment is expected to show fastest growth rate over the forecast period.Flow cytometry software controls and captures data generated by cytometers, analyzes the information, and gives a statistical analysis of the results. The software is used in research for cell capture, data processing, and clinical diagnostics for disease diagnosis by analyzing patient samples. The growing prevalence of various target diseases and the primary focus of major players in the development of novel software is further propelling the market growth. In February 2023, Agilent Technologies Inc. announced the launch of NovoExpress software that enables integrated compliance tools for NovoCyte flow cytometer systems.

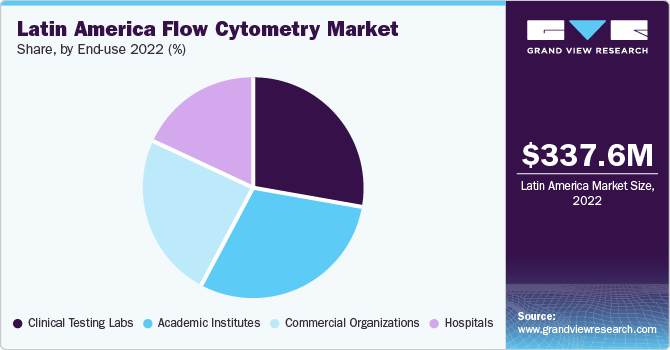

End-Use Insights

Academic institutes held largest market share of 30.23% in 2022 and is expected to maintain a dominant share throughout the forecast period. In cell biology and molecular diagnostic research, flow cytometry is utilized to detect cell parameters such as physical features of cells, recognition of biomarkers via particular antibodies, cell type, cell lineage, and maturation stage. This technique can be used in various educational settings, including molecular biology, pathology, immunology, plant biology, and marine biology. With increased R&D initiatives, the segment is expected to rise significantly over the forecast period.

Clinical testing labs are estimated to show the fastest growth over the forecast period. The growth of the market is due to the rising need for the diagnosis of target diseases, including cancer, infectious diseases, and immunological disorders, efficiently and cost-effectively. Flow cytometry is a widely adopted tool for diagnosing various diseases, and an increasing prevalence of target diseases in the region is propelling the demand for innovative products in the market. Furthermore, the rising demand for early diagnosis fuels the need for innovative products, further driving segment growth.

Application Insights

The clinical segment held the largest share of 45.83% of the market in 2022. The segment growth is attributed to the increased cancer and infectious disease research and development initiatives, particularly COVID-19. Flow cytometry is routinely used to diagnose both benign and malignant hematologic diseases. It can help with diagnosis, therapy regimens, and monitoring residual or relapsed disease in various clinical settings. Moreover, increased R&D investments in biotechnology and pharmaceutical industries are projected to fuel market growth. Furthermore, ongoing expansion efforts by leading market players and the introduction of novel technologies for clinical applications are expected to propel market growth considerably.

The industrial segment is expected to show the fastest growth rate over the forecast period. This is due to the growing use of the technique in cell culture. The technique is used in the pharmaceutical business for applications including target discovery, drug properties and compound screening, non-clinical safety & toxicity evaluation, and clinical research. Flow cytometry provides high throughput and speed for large-scale drug development and testing by detecting several factors on the cell surface and generating complicated and adequate data by avoiding false positives results in single-parameter tests. The benefits of utilizing flow cytometry in bioprocessing activities at larger-scale for drug discovery is likely to drive market growth.

Key Companies & Market Share Insights

The key players operating in Latin America flow cytometry market are continually concentrating on improving existing technologies and introducing new technologies that help improve patient outcomes and considerably increase healthcare efficiency and effectiveness. For Instance, in June 2023, BD (Becton, Dickinson and Company) announced the launch of a novel automated instrument that helps in preparing samples using flow cytometry for clinical diagnostics.

Key Latin America Flow Cytometry Companies:

- Cytiva

- Sartorius AG

- BD (Becton, Dickinson and Company)

- Agilent Technologies, Inc.

- Sysmex Corporation

- Apogee Flow Systems Ltd.

- Thermo Fisher Scientific Inc.

- Bio-Rad Laboratories, Inc.

- DiaSorin S.p.A.

- Miltenyi Biotec

Latin America Flow Cytometry Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 556.21 million

Growth rate

CAGR of 6.44% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, application, end-use, country

Regional scope

Latin America

Country scope

Brazil; Mexico; Argentina; Colombia; Peru; Chile; Uruguay; Dominican Republic; Costa Rica; Panama

Key companies profiled

Cytiva; Sartorius AG; BD (Becton; Dickinson and Company); Agilent Technologies, Inc.; Sysmex Corporation; Apogee Flow Systems Ltd.; Thermo Fisher Scientific Inc.; Bio-Rad Laboratories, Inc.; DiaSorin S.p.A.; Miltenyi Biotec

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Latin America Flow Cytometry Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the Latin America flow cytometry market based on the product, technology, application, end-use:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Cell Analyzers

-

Cell Sorters

-

-

Reagents & Consumables

-

Software

-

Accessories

-

Services

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Cell-based

-

Bead-based

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Research

-

Pharmaceutical

-

Drug Discovery

-

Stem Cell

-

In Vitro Toxicity

-

-

Apoptosis

-

Cell Sorting

-

Cell Cycle Analysis

-

Immunology

-

Cell Viability

-

-

Industrial

-

Clinical

-

Cancer

-

Organ Transplantation

-

Immunodeficiency

-

Hematology

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial Organizations

-

Biotechnology Companies

-

Pharmaceutical Companies

-

CROs

-

-

Hospitals

-

Academic Institutes

-

Clinical Testing Labs

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Brazil

-

Mexico

-

Argentina

-

Colombia

-

Peru

-

Chile

-

Uruguay

-

Dominican Republic

-

Costa Rica

-

Panama

-

Frequently Asked Questions About This Report

b. The global Latin America flow cytometry market size was estimated at USD 337.60 million in 2022 and is expected to reach USD 374.30 million in 2023.

b. The global Latin America flow cytometry market is expected to grow at a compound annual growth rate of 6.44% from 2023 to 2030 to reach USD 556.21 million by 2030.

b. Brazil dominated the Latin America flow cytometry market with a share of 4.42% in 2022. This is attributable to increasing healthcare expenditure in the region and rising penetration of molecular diagnostics coupled with economic development.

b. Some key players operating in the Latin America flow cytometry market include Beckman Coulter Inc, Life Technologies Corporation, EMD Millipore Corp, Sysmex Corporation, Stratedigm, Miltenyi Biotec, Luminex Corporation and Becton Dickinson and Company.

b. Key factors that are driving the market growth include rising prevalence of chronic diseases which needs toxicity testing such as leukemia, HIV, and others and and demand for rapid, accurate & sensitive prognosis techniques for disease validation.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."