- Home

- »

- Medical Devices

- »

-

Marijuana Drying And Curing Equipment Market Report, 2030GVR Report cover

![Marijuana Drying and Curing Equipment Market Size, Share & Trends Report]()

Marijuana Drying and Curing Equipment Market Size, Share & Trends Analysis Report By Country (U.S., Canada, Germany, Australia, Uruguay, Israel, Colombia), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-016-3

- Number of Pages: 60

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

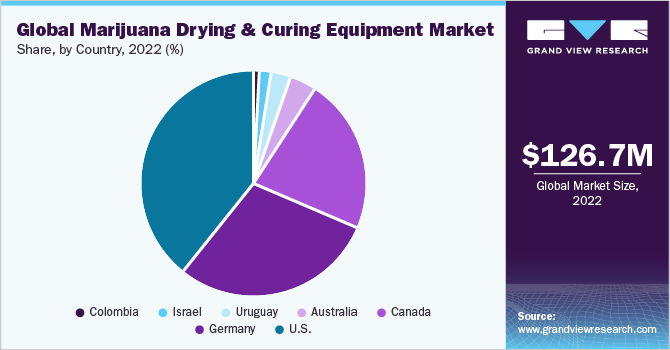

The global marijuana drying and curing equipment market size was valued at USD 126.7 million in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 9.3% from 2023 to 2030. There is a growing demand for marijuana drying and curing equipment, owing to increasing number of countries legalizing cannabis for medical and recreational consumption, the growing cannabis cultivation and demand for high-quality cannabis products, the need for efficient and effective drying and curing processes, and the emergence of advanced technologies in the industry. The number of patients living with chronic diseases, such as arthritis, migraine, and cancer, opting for cannabis to relieve pain has been on a rise, thereby fueling market growth. According to the report published by the American Cancer Society, in the U.S., around 1.9 million new cancer cases are anticipated to be diagnosed with around 609,820 deaths in 2023.

Widespread legalization of hemp across the world is anticipated to boost market demand. Due to this, the creation of new business opportunities and investments in the development of cultivation facilities and capital equipment are expected. Regulatory agencies are putting more stringent rules and quality control procedures into place as a result of the legalization of marijuana. To achieve these requirements and guarantee that cannabis products are secure, uniform, and lawful, proper drying and curing equipment are necessary.

As a result of changing governmental policy, many nations that have legalized medical marijuana usage are also allowing for its cultivation to reduce imports and generate tax revenue. This has led to the creation of jobs in the industry and a lot more companies are exploring this area. Quite a few startups in the U.S. and Europe are now concentrating on alternate uses of cannabis other than medicinal and recreational. For instance, a cannabis start-up company called 3Chi focuses on creating products with Delta-8 THC, a substance generated from hemp that is permitted under federal law. They offer candies, vape cartridges, and tinctures, all of which have undergone independent quality and purity testing.

Another significant factor influencing the market is the growing demand for high-quality cannabis products, such as edibles, concentrates, oils, and dried flowers. Cannabis drying and curing methods are receiving greater attention as consumers are getting pickier about the quality that they ingest. In order to maintain the potency, flavor, aroma, and general quality of cannabis products, effective drying and curing techniques are essential in the cannabis production post-harvest process. The need for efficient drying and curing processes is driving the demand for specialized equipment in the market.

The growing commercial cannabis cultivation and technological advancements are other factors driving demand. The increased cultivation requires efficient and reliable equipment to ensure proper drying and curing on a larger scale. Technological innovations such as precise humidity and temperature control mechanisms, climate-controlled environments, data monitoring solutions, and automated systems have revolutionized the drying and curing processes and offers cultivators greater control over the drying and curing conditions, resulting in improved product quality and reduced processing times.

Country Insights

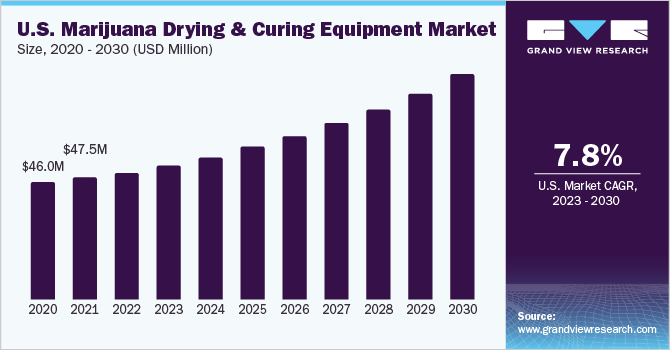

The U.S. dominated the marijuana drying and curing equipment market and accounted for the largest revenue share of 39.1% in 2022, owing to the social acceptance of marijuana, technological advancements and growing cultivation, and its role in relieving pain for patients. The rapid increase in the rate at which the government is decriminalizing cannabis for both medical and adult-use or recreational use of marijuana is a key factor driving the regional market. In May 2023, Minnesota became the 23rd jurisdiction to legalize marijuana for recreational use in the U.S.

Uruguay is expected to grow at the fastest CAGR of 12.3% during the forecast period. This can be attributed to the factors such as the increasing number of licensed cultivators and the rising opportunities in terms of new job creations and tax revenues due legalization of cannabis. Increasing cultivation is anticipated to increase demand for drying and curing equipment. The government has implemented regulations to support the legal cannabis industry, which is expected to attract both domestic and international investors and players in the market.

Key Companies & Market Share Insights

The global market is oligopolistic in nature.Competition is also expected to increase due to launch of machines equipped with several technologies, including microwave, heat-pump, and radiofrequency. These products are expected to drive demand for marijuana drying and curing equipment over the forecast period.

Market players employ various strategies to broaden their reach. These strategies include introducing new services, partnerships, acquisitions, and expanding their operations. For instance, in January 2022, Thomas Scientific was announced as Cann Drying Systems new partner in distribution. This alliance is anticipated to bring their CDS series of cannabis drying and curing chambers to an increased number of businesses worldwide. Another instance is when, in December 2021, EnWave struck a purchasing agreement with MSO, a cannabis startup based in Illinois for selling its 120kW Radiant Energy Vacuum dehydration equipment in the U.S. The REV procedure can be altered to retain more terpenes while maintaining or increasing cannabinoids levels. Some of the key players in the global marijuana drying and curing equipment market include:

-

CANN SYSTEMS

-

Darwin Chambers

-

Controlled Environments Limited

-

Auto Cure US

-

YOFUMO TECHNOLOGIES

-

Dhydra Technologies

-

EnWave

-

HARTER drying solutions

-

PROTEIN SOLUTIONS GROUP

Marijuana Drying And Curing Equipment Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 133.2 million

Revenue forecast in 2030

USD 248.7 million

Growth rate

CAGR of 9.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Country

Country scope

U.S., Canada, Germany, Australia, Uruguay, Israel. Colombia

Key companies profiled

CANN SYSTEMS; Darwin Chambers; Controlled Environments Limited; Auto Cure US; YOFUMO TECHNOLOGIES; Dhydra Technologies; EnWave; HARTER drying solutions; PROTEIN SOLUTIONS GROUP

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Marijuana Drying And Curing Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global marijuana drying and curing equipment market report on the basis of country:

-

Country Outlook (Revenue in USD Million, 2018 - 2030)

-

U.S.

-

Canada

-

Germany

-

Australia

-

Uruguay

-

Israel

-

Colombia

-

Frequently Asked Questions About This Report

b. The global marijuana drying and curing equipment market size was estimated at USD 126.7 million in 2022 and is expected to reach USD 133.2 million in 2023.

b. The global marijuana drying and curing equipment market is expected to grow at a compound annual growth rate of 9.3% from 2023 to 2030 to reach USD 248.7 million by 2030.

b. The U.S. dominated the marijuana drying and curing equipment market with a share of 39.1% in 2022. This is attributable to the increasing consumption of cannabis for medical and recreational purposes and rising cannabis cultivation.

b. Some key players operating in the marijuana drying and curing equipment market include Cann Systems, LLC; Darwin Chambers; Conviron; Autocure; Yofumo Technologies, Inc.; DHydra Technologies; EnWave Corporation; HARTER GmbH; and PROTEIN SOLUTIONS GROUP, LLC.

b. Key factors that are driving the market growth include increasing number of countries legalizing cannabis cultivation and consumption, growing cultivation capacity, rising cannabis preference by patients suffering from cancer pain, arthritis, and epilepsy, as well as for other relevant medical conditions.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."