- Home

- »

- Automotive & Transportation

- »

-

MEA Cold Chain Market Size, Share, Industry Report, 2018-2025GVR Report cover

![MEA Cold Chain Market Size, Share & Trends Report]()

MEA Cold Chain Market Size, Share & Trends Analysis Report By Type (Storage, Transportation, Monitoring Components), By Application, By Region, And Segment Forecasts, 2018 - 2025

- Report ID: GVR-1-68038-445-1

- Number of Pages: 65

- Format: Electronic (PDF)

- Historical Range: 2014 - 2015

- Industry: Technology

Industry Insights

The MEA cold chain market size was estimated at USD 6.13 billion in 2015. The cold chain is a part of logistics activities that serve perishable produce from the harvest to end consumers. The players in the market primarily rely on the supply-based approach and meet customer requirements using cooling and packaging techniques.

Cold chain operators are continuously upgrading technology to ensure integrity, efficiency, and safety. Early Suspension Fast Response (ESFR) sprinklers have gained traction in the market owing to the high maintenance cost of the traditional in-rack fire sprinklers. For instance, the third-party logistic (3PL) operators have offered integrating warehousing and transportation services on an outsourced basis.

Saudi Arabia cold chain market, by type, 2014 - 2025 (Million)

The order fulfillment process is enhanced with the increasing use of Automatic Identification and Data Capture (AIDC) and RFID technologies. The AIDC technology is expected to gain traction in the market owing to the growing penetration of RFID sensors and Bluetooth technologies throughout the logistics industry.

The increasing adoption of warehouse automation has enabled the companies to maximize the throughput. Order accuracy is achieved through automated Materials Handling (MH) equipment, robotics applications, and high-speed conveyor systems. The Warehouse Management System (WMS) plays a major role in enhancing the efficiency of cold warehouse facilities by performing various functions such as batch traceability, quality control, practicing First-in-First-Out rules, expiration dates of products, which is likely to spur the market growth.

Type Insights

Based on types, the industry has been bifurcated into categories including storage, transportation, and monitoring components. The storage type dominated the market in terms of revenue in 2015 and was valued at USD 4,879.9 million. The monitoring components segment is anticipated to witness a high growth rate over the forecast period with a CAGR of 9.6%.

The storage segment includes warehouses and refrigerated containers. The growing warehouse automation drives the warehouse storage segment. Warehouse automation includes cloud technology, robots, conveyor belts, truck loading automation, and energy management. Refrigerated containers are used for intermodal transportation through various modes such as road, sea, rail, and air.

Based on temperature range, the cold storage warehouses in the MEA cold chain market include class L, class D, and class J. Products under the class L range include fruits, vegetables, eggs, and pharmaceutical materials. Class D range products include meat and seafood whereas class J includes deep-frozen food and ice cream.

Warehouse energy management is a critical success factor for the market as refrigerated storage consumes more power. Companies such as Global Shipping & Logistics LLC (Dubai) and Oceana Group Limited (South Africa) work with regional environmental protection agencies and the Department of Energy to help consumers and businesses with energy-efficient products and practices.

Application Insights

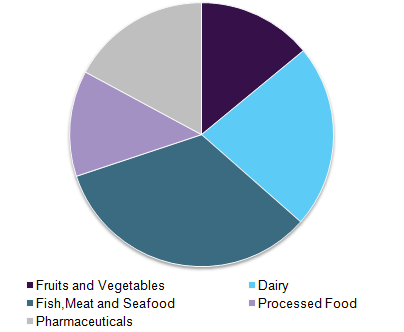

Based on applications, the industry has been classified as dairy, fish, meat, and seafood; fruits and vegetables; pharmaceuticals; and processed food. The fish, meat, and seafood segment dominated the market in terms of revenue in 2015. The pharmaceutical segment is anticipated to witness significant growth over the forecast period owing to the prevailing sedentary lifestyle in the region.

Furthermore, the pharma industry in the Middle Eastern and North African regions is expected to exhibit rapid development on account of the growing population. The sector is also expecting a boost due to the occurrence of diseases such as diabetes and the objective to attain superior healthcare services.

MEA cold chain market, by application, 2015

Frozen processed meat products, such as salami-based packaged foods and hot dogs, are more popular among the younger generation across the Gulf Cooperation Council (GCC), which is a key factor driving the processed food segment in the region. Furthermore, increasing investments carried out by industry players in the food processing facilities in the regions further enhanced the market demand.

Increasing government focus on establishing organic farms across the MEA region is anticipated to drive the industry demand. The rising per capita consumption of meat in the GCC region is likely to influence the fish, meat, and seafood segment demand.

Regional Insight

Based on regions, Saudi Arabia is anticipated to witness a high growth rate over the forecast period. This growth is driven by the rising government support to enhance the cold chain infrastructure and improve trade relations with other countries.

The Alliance for a Green Revolution in Africa (AGRA) partnered with UPL Limited, an India based agrochemical market. The partnership was aimed at establishing post-harvest storage facilities across sub-Saharan Africa for perishable products such as fruits and vegetables.

The growing Foreign Direct Investment (FDI) in the African region to develop cold chain transportation is likely to spur the market demand. Governments can facilitate cold chain services by providing public infrastructure and legislation.

Furthermore, service providers can train employees to enhance technical expertise in the operation, management, and maintenance of specialized facilities. The government must establish partnerships with private sectors to promote the emergence of cold chain-based commodity associations to enhance the storage facilities.

MEA Cold Chain Market Share Insights

Key industry players in the market include Barloworld Limited (South Africa), Al-Rai Logistica K.S.C (Kuwait), and Global Shipping & Logistics LLC (Dubai), among others. The service providers act as a business function in the distribution service market and serve the needs of franchises and retailers.

Report Scope

Attribute

Details

The base year for estimation

2015

Actual estimates/Historical data

2014 - 2015

Forecast period

2016 - 2025

Market representation

Value in USD Million and CAGR from 2016 to 2025

Regional scope

MEA

Country scope

Saudi Arabia, UAE

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

15% free customization scope (equivalent to 5 analysts working days)

If you need specific market information which is not currently within the scope of the report, we will provide it to you as a part of the customization

Segments Covered in the reportThis report forecasts revenue growth at MEA regional and country levels and provides an analysis of the industry trends in each of the sub-segments from 2014 to 2025. For this study, Grand View Research has segmented the MEA cold chain market based on types, applications, and regions.

-

Type Outlook (Revenue, USD Million; 2014 - 2025)

-

Storage

-

Warehouse

-

Refrigerated container

-

-

Transportation

-

Road

-

Sea

-

Rail

-

Air

-

-

Monitoring Components

-

-

Application Outlook (Revenue, USD Million; 2014 - 2025)

-

Fruits and Vegetables

-

Dairy

-

Fish, Meat, and Seafood

-

Processed Food

-

Pharmaceuticals

-

-

Regional Outlook (Revenue, USD Million; 2014 - 2025)

-

MEA

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."