- Home

- »

- Healthcare IT

- »

-

Medical Alert Systems Market Size & Share Report, 2030GVR Report cover

![Medical Alert Systems Market Size, Share & Trends Report]()

Medical Alert Systems Market Size, Share & Trends Analysis Report By Type (Landline, Mobile, Standalone), By End-use (Home-based Users, Nursing Homes, Assisted Living Facilities), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-002-6

- Number of Pages: 113

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

The global medical alert systems market size was estimated at USD 9.3 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.4% from 2023 to 2030. The rise in the geriatric population, improvement in healthcare infrastructure, and a boost in technological advancement are some of the factors driving the growth of the market. According to a factsheet released by the World Health Organization (WHO) in October 2022, one in six people in the world was estimated to be aged 60 and above by 2030, whereas their proportion is expected to increase to 1.4 billion.

Following the rapid increase in the elderly population, the need for medical alert systems in homes of the elderly is also increasing. Falls is one of the most common causes of injury among the elderly. According to the American Hospital Association, more than one-third of adults aged 65 years and above suffer from a fall each year, and this is a serious problem that often leads to several other chronic and severe concerns for older adults. This is also expected to boost demand for medical alert systems.

Most of the elderly want to age in the comfort of their homes instead of opting for other options, such as nursing homes and assisted living facilities. According to the AARP, the number of people aging in a place is expected to increase in the coming years. In 2020, an estimated 40 million people aged 65 and above were living in their own homes, and this number is expected to grow to 50 million by 2030. Elderly people are more prone to falling and may require immediate medical attention hence, family members must keep track of their whereabouts which can be facilitated by the help of medical devices. Moreover, caregivers can also have easy access to help via medical alerts.

For people with mild cognitive diseases who suffer from dementia, location tracking or geo-fencing are critical features offered by medical alert devices. According to the fact sheet released by the World Health Organization in March 2023, more than 55 million people in the world are suffering from dementia, and 10 million new cases are added every year. The increasing incidence of such diseases is expected to drive the demand for medical alert systems.

Type Insights

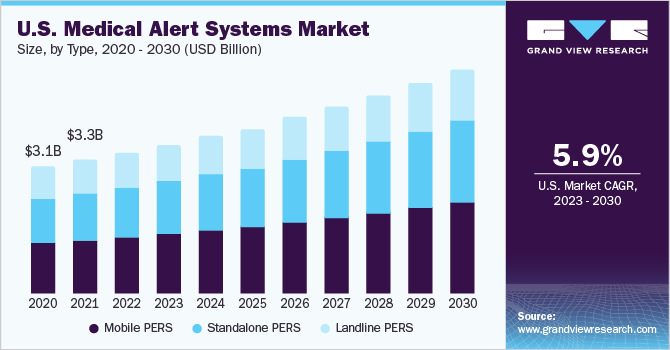

Based on type, the market is categorized into landline, mobile, and standalone devices. These devices provide seniors and their caregivers with 24/7 access to emergency care specialists with the press of a button. Specialists can send caregivers or medical personnel to users based on their requirements. Mobile PERS systems was the largest segment in 2022 owing to the wide utilization of the product. According to world telecommunication data by the Ministry of International Affairs and Communications (Japan), mobile phone usage is 100% in most countries, while landline usage is barely over 50% (ICT indicators database 2013).

The adoption of smart devices and the launch of technically advanced products are also expected to boost the growth of this segment. For instance, in May 2023, a home healthcare software-as-a-service provider, HandsFree Health announced the launch of WellBe, which is a voice-enabled virtual health assistant platform. The platform is expected to help older adults in better management of their health. Similarly, in January 2022, another player, Essence, launched a 5G-enabled mobile personal emergency response system (mPERS) with a built-in fall detector and real-time activity monitor.

Standalone devices are estimated to be the fastest-growing segment over the forecast period owing to better accessibility, compactness, and affordability. They are good options for people who live in areas where landline or internet service is unreliable as they do not require a landline or internet connection to function.

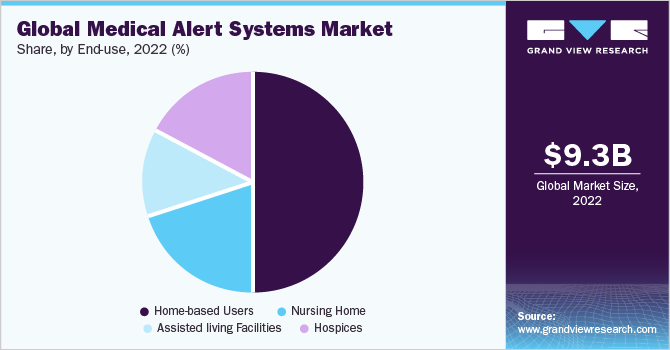

End-use Insights

Based on end-use, the medical alert systems market is segmented into home-based users, nursing homes, assisted living facilities, and hospices. The home-based user segment dominated with a revenue share of 49.9% in 2022 and is anticipated to grow at the fastest CAGR of 6.9% over the forecast period. PERS devices provide independent living with easy access to care. They enable seniors to call for help in case of emergency with the press of a button.

According to the survey conducted by the American Association of Retired Persons, 77% of people aged 50 years and above want to remain in their homes for a long term. In addition, a lot of elderly people have some sort of health issues or are in danger of falling and demanding immediate assistance, which has led to an increase in the number of home users of medical alert systems.

Regional Insights

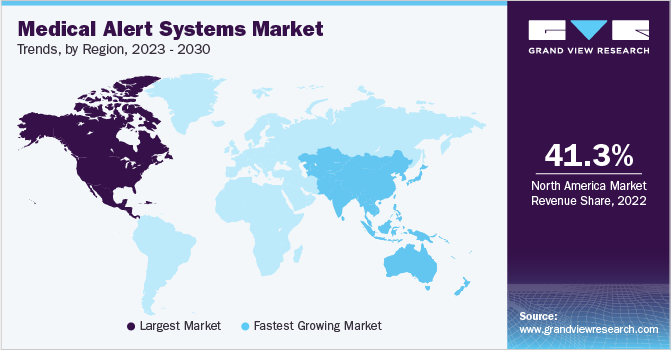

North America dominated the market with a revenue share of 41.3% in 2022. The local presence of key players’ established healthcare infrastructure, along with technological advancements and new product launches are some of the factors responsible for the large share of this region. For instance, in April 2023, Logic Mark announced the launch of medical alert devices such as Guardian Alert 911, Guardian Alert 911 Plus, and Freedom Alert on Amazon’s U.S. store to support the rapidly growing care economy and to strengthen its share in the market.

In addition, the increase in the incidence of Alzheimer’s disease and other forms of dementia is increasing the need for PERS. According to an article published in the National Library of Medicine in April 2023, approximately 6.7 million Americans suffer from Alzheimer's dementia and the number can increase to 13.8 million by 2060. This increase is likely to help in the growth of the medical alert systems industry.

Asia Pacific is expected to grow at the fastest CAGR of 7.4% over the forecast period owing to the growing geriatric population coupled with an increasing prevalence of chronic diseases. According to the Asian Development Bank, one in four people in the Asia Pacific region are predicted to be older than 60 by 2050, which can add to the growing demand for medical alert systems. The need for improved healthcare facilities and an increase in home-based health programs are expected to drive the market. Moreover, the rise in mobile health deployments in this region is projected to boost demand for PERS.

Key Companies & Market Share Insights

Key players are focusing on expanding their product portfolios to increase their market share. In addition, they are adopting strategies such as acquisitions and collaborations. For instance, In June 2023, Bay Alarm Medical launched a convenient SOS all-in-one medical alert device. It is portable and light enough for individuals to wear when they are out and no longer have to juggle between multiple systems. In June 2021, Tunstall Healthcare acquired Secuvita, a technology solution provider to increase its service offerings and international reach. Some prominent players in the global medical alert systems market include:

-

ADT.

-

Bay Alarm Medical

-

Lifeline.

-

Life Alert Emergency Response, Inc.

-

VRI

-

Tunstall Group

-

Medical Guardian LLC.

-

AlertONE Services Inc.

-

GreatCall.

-

Rescue Alert

-

LogicMark

-

Nice North America

Medical Alert Systems Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 9.8 billion

Revenue forecast in 2030

USD 15.2 billion

Growth rate

CAGR of 6.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

ADT; Bay Alarm Medical; Lifeline; Life Alert Emergency Response, Inc; VRI; Tunstall Group; Medical Guardian LLC; AlertONE Services Inc; GreatCall; Rescue Alert; Logic Mark; Nice North America

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

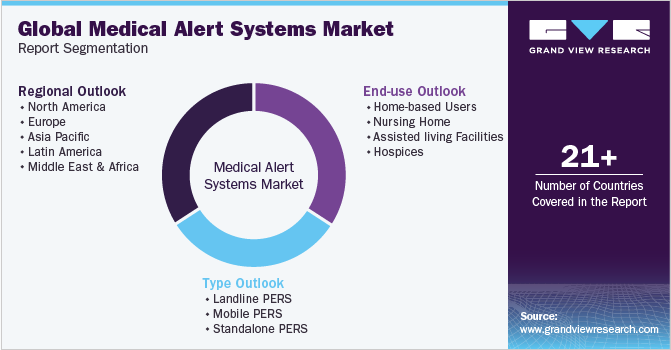

Global Medical Alert Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyses the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global medical alert systems market report based on type, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Landline PERS

-

Mobile PERS

-

Standalone PERS

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Home-based Users

-

Nursing Home

-

Assisted living facilities

-

Hospices

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global medical alert system market size was estimated at USD 9.3 billion in 2022 and is expected to reach USD 9.8 billion in 2023.

b. The global medical alert system market is expected to grow at a compound annual growth rate of 6.4% from 2023 to 2030 to reach around USD 15.2 billion by 2030.

b. North America dominated the medical alert system market with a share of 41.3% in 2022. This is attributable to the presence of key players, established healthcare infrastructure, and technological advancements

b. Some of the key medical alert system market players are Koninklijke Philips N.V.; ADT Security Services; Bay Alarm Medical; VRI, Inc.; Life Alert Emergency Response, Inc.; Tunstall; Medical Guardian LLC; AlertOne Services LLC; GreatCall; Rescue Alert; LogicMark; and Nortek Security and Control.

b. Key factors driving the medical alert system market growth include a rise in the geriatric population, increased risk of falls associated to old age, and improvement in healthcare infrastructure.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."