- Home

- »

- Biotechnology

- »

-

Microbiology & Bacterial Culture For Industrial Testing Market Report 2030GVR Report cover

![Microbiology & Bacterial Culture For Industrial Testing Market Size, Share & Trends Report]()

Microbiology & Bacterial Culture For Industrial Testing Market Size, Share & Trends Analysis Report By Consumables (Media, Reagents), By Application, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-936-4

- Number of Pages: 140

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

The global microbiology & bacterial culture for industrial testing market size was estimated at USD 6.14 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 7.4% from 2023 to 2030. The significant global rise in the burden of food-borne illnesses has served as a driving force for the plethora of microbiology research carried out in recent times. Ongoing development in microbiology due to advancements in biotechnological research, which are aimed at investigating the role of microbes in disease pathogenesis is one of the crucial factors propelling the market growth.

Moreover, the market is expected to grow over the forecast period due to the increasing demand for quality control, safety assurance, product development, rising incidences of contagious diseases, rising private-public funding for research on infectious diseases, and growing healthcare expenditure. According to the World Health Organization (WHO), every year, around 3 to 5 million cases of severe illness and about 2,90,000 to 6,50,000 respiratory deaths are reported globally.

The COVID-19 pandemic had a significantly positive impact on the global market for microbiology and bacterial culture for industrial testing due to factors such as the increased demand for food and water testing, as well as testing for the presence of COVID-19 virus. This has boosted the demand for microbiology & bacterial culture products and services. Pure bacterium culture is recognized as an essential tool for investigating virulence factors, antibiotic susceptibility, and genome sequence of microbes to understand their role in infection and food-borne diseases. In addition, the pandemic increased the interest of scientists to seek new ways to detect and combat the COVID-19 virus by focusing on research and development in the field of microbiology.

This has also created new opportunities for the microbiology & bacterial culture market. However, the pandemic also had some negative impacts on the market. For example, the closure of businesses and schools led to a decrease in demand and availability for some types of microbiology & bacterial culture products and services. According to the National Library of Medicine, during the COVID-19 pandemic, it is estimated that approximately 5 million human deaths were related to bacterial antimicrobial resistance (AMR), comprising over 1.25 million deaths directly attributable to bacterial AMR in 2019.

Furthermore, the growing usage of bacterial cell culture in animal feed testing to prevent microbial contamination is expected to have a positive impact on market growth. The field of microbiology research has many key aspects that ensure population safety and product quality. Pure bacterium culture is recognized as an essential tool for investigating virulence factors, antibiotic susceptibility, and genome sequence of microbes to understand their role in infection and foodborne diseases.

Escalating cases of animal feed recalling due to suspected Salmonella contamination have led several biologists and scientists to conduct research activities for microbiological assessment of animal feeds. Also, organizations such as Veterinary Laboratory Investigation and Response Network (Vet-LIRN) work in collaboration with various existing microbiology organizations. They are involved in conducting studies to evaluate the presence of selective microorganisms in various pet feeds. Thus, the presence of organizations conducting studies associated with veterinary health is attributed to the rise in the adoption of culture media and reagents, thereby contributing to segment growth. Research and studies have developed methods for testing and detoxification of animal feed contaminated with various toxins.

Application Insights

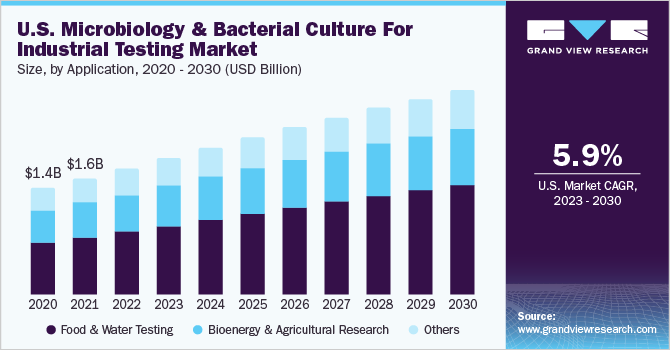

In terms of application, the food & water testing segment dominated the market in 2022 with the largest revenue share and is also expected to grow at the fastest CAGR over the forecast period. Food and water are the easiest and most common means of transfer of pathogens. Concerns for food safety have witnessed a rise owing to the rising incidence of food poisoning over the years. Maintaining microbial quality control at global supply chains is expected to raise demand for these products to test the presence of pathogens. Thus, the rising number of eatables manufacturing processing entities is expected to contribute to the lucrative growth of the market. In addition, maintaining microbial quality control at global supply chains and rising demand for consumables with increasing advent of experimentation in technology for water testing is expected to drive the segment over the forecast period. Initiatives taken up by the government are supportive of the projected growth rate.

For instance, the real-time microbial detection analyzer 7000RMS by METTLER TOLEDA composes two well-established capacity technologies, Mie scattering, and laser-induced fluorescence. The microbial detection analyzer counts individual microorganisms present in pharmaceutical water without accumulating a sample or waiting for days for plate count outcomes. The analyzer delivers instant real-time monitoring of bioburden contamination. Growing awareness of food safety and the importance of ensuring the safety of water supplies owing to the rising incidence of food poisoning over the years are some crucial factors expected for the growth of this segment.

According to the World Health Organization (WHO), unsafe food containing harmful parasites, bacteria, viruses, or other chemical constituents causes more than 200 diseases, ranging from diarrhea to cancer. Campylobacter, enterohaemorrhagic Escherichia coli, and salmonella are some of the most shared foodborne pathogens that affect millions of people every year. In addition, parasites, such as cryptosporidium, Ascaris, and Entamoeba histolytica, enter the food chain via soil or water and can contaminate fresh products. They estimated that almost 1 in 10, approximately 600 million people suffer from injurious diseases after eating contaminated food and nearly 420,000 die every year.

Consumables Insights

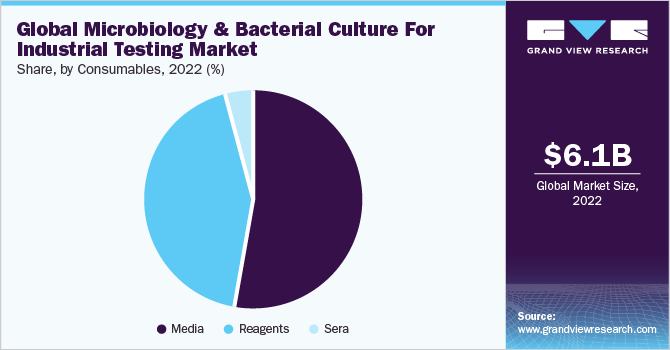

In terms of consumables, the media segment dominated the market in 2022 with the largest revenue share of 52.5%. It is further categorized into bacteria, fungi & algae, and other media. The growth of the media segment can be attributed to the high requirement for media due to the composition of cell culture. Growing bacterial cell cultivation is expected to have a direct positive impact on the adoption of media, consequently driving segment growth. For instance, in October 2022, MSL Solution Providers, a provider of integrated laboratory and regulatory testing services to the household cleansing, personal care, and cosmetics industries, announced the launch of VeganSure, a dehydrated culture media (DCM) as an expansion of its vegan testing solution portfolio. MSL Solution Providers are capable of providing companies globally and are equipped with in-house laboratories or engaged in sub-contracted microbiological testing, with vegan dehydrated culture media (DCM). This offering empowers them to conduct regular microbiological testing and uphold the safety standards of their cosmetic products.

The reagents segment is expected to grow at the fastest CAGR of 8.0% over the forecast period. It is further categorized into bacterial and other segments. The easy accessibility, relatively less expensive cultivation, innovations, and fast growth rate are some of the advantages that have attributed to the accelerated adoption of this product. E. coli is recognized as one of the widely used bacteria-based cell cultures in several microbial projects.

Regional Insights

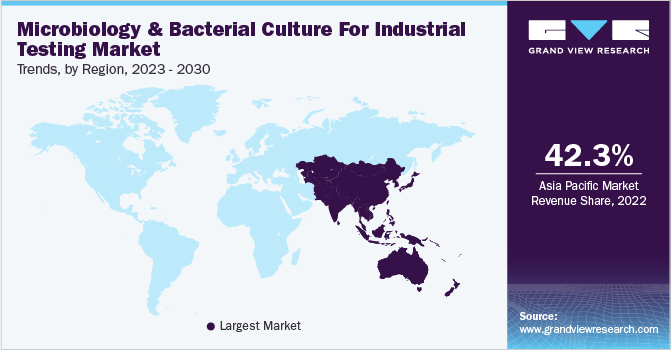

Asia Pacific dominated the market with the largest revenue share of 42.3% in 2022 and is expected to grow at the fastest CAGR of 8.6% over the forecast period from 2023 to 2030. The region has witnessed a significant increase in healthcare expenditure, leading to greater investment in research and development activities related to bacterial culture. This has helped in the development of new and innovative products and technologies, which has boosted the market growth. To avoid the spread of microbial illness and maintain quality and safety, several nations are creating risk management plans that incorporate new quality control criteria. According to World Health Organization (WHO), every year US$ 110 billion is spent on medical expenses caused from unsafe and contaminated food in low- and middle-income countries.

The U.S. market is expected to grow at a lucrative CAGR over the forecast period due to the availability of advanced technology. Other factors that are projected to bolster progress are increasing investments by multinational companies and extensive requirements for better food supplements & agricultural innovation. The increasing awareness of food safety and quality, the rising demand for bioenergy and bioplastics, the growing need for water treatment and purification, and the emergence of new applications of microbial biotechnology in various industries are some factors anticipated to drive the growth.

Key Companies & Market Share Insights

The rise in competition is leading to rapid technological advancements and companies are constantly working towards the improvement of their products with a major focus on research and development. Factors such as investment in research & development, and compliance with regulatory policies, and technological advancements are constantly driving the introduction of novel techniques. Mergers and acquisitions are a key sustainability strategy adopted by market participants. For instance, in February 2023, Cytek Biosciences, Inc. a cell analysis solutions company, announced a strategic partnership with Bio-Rad Laboratories, Inc., a provider of life science research and diagnostics products, to expand its reagents portfolio. The partnership will help Cytek Biosciences, Inc. gain access to Bio-Rad Laboratories, Inc.'s advanced and highly efficient StarBright Dyes. These dyes, known for their exceptional brightness and performance, will be utilized by Cytek Biosciences, Inc. in the development and commercialization of reagent products. These reagents will specifically cater to high-parameter applications on the Aurora and Northern Lights flow cytometry systems.

Similarly, in October 2022, Takara Bio USA, Inc., a life science reagent and instrument company based in the U.S., announced a partnership with BioExcel Diagnostics, to develop a comprehensive process for identifying syndromic-based infectious diseases. The approach utilizes real-time PCR automation technology and utilizes Takara Bio USA, Inc.'s reagents to identify viruses, bacteria, fungi, and antimicrobial resistance genes associated with the respective pathogens. The resulting data enables healthcare professionals to quickly identify the most suitable treatment strategy for their patients. Some prominent players in the global microbiology & bacterial culture for industrial testing market include:

-

Bio-Rad Laboratories, Inc.

-

BIOMÉRIEUX

-

Thermo Fisher Scientific Inc.

-

Merck KGaA

-

Neogen Corporation

-

HiMedia Laboratories

-

Eiken Chemical Co., Ltd.

-

ATCC

-

Titan Biotech

-

Hardy Diagnostics

Microbiology & Bacterial Culture For Industrial Testing Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 6.73 billion

Revenue forecast 2030

USD 11.12 billion

Growth Rate

CAGR of 7.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Consumables, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Bio-Rad Laboratories, Inc.; BIOMÉRIEUX; Thermo Fisher Scientific Inc.; Merck KGaA; Neogen Corporation; HiMedia Laboratories; Eiken Chemical Co., Ltd.; ATCC; Titan Biotech; Hardy Diagnostics

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Microbiology & Bacterial Culture for Industrial Testing Market Report Segmentation

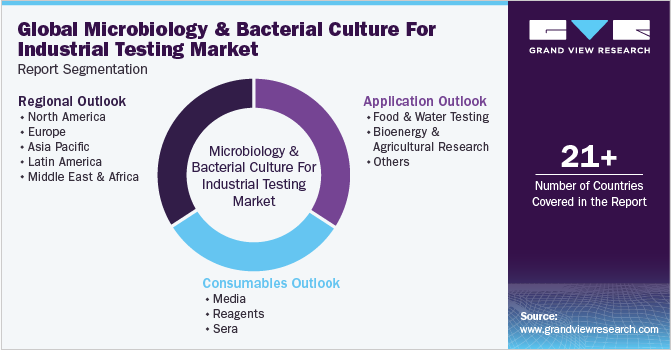

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global microbiology & bacterial culture for industrial testing marketreport based on consumables, application, and region:

-

Consumables Outlook (Revenue, USD Million, 2018 - 2030)

-

Media

-

Bacterial

-

Fungi & Algae

-

Others

-

Reagents

-

Bacterial

-

Others

-

Sera

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Water Testing

-

Food

-

Animal Feed

-

Water Testing

-

Bioenergy & Agricultural Research

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Frequently Asked Questions About This Report

b. The global microbiology & bacterial culture for industrial testing market size was estimated at USD 6.14 billion in 2022 and is expected to reach USD 6.73 billion in 2023.

b. The global microbiology & bacterial culture for industrial testing market is expected to grow at a compound annual growth rate of 7.4% from 2023 to 2030 to reach USD 11.12 billion by 2030.

b. Media dominated the microbiology & bacterial culture for industrial testing market with a share of 52.5% in 2022. This is attributable to the high requirement for media due to the different compositions of cell cultures.

b. Some key players operating in the microbiology & bacterial culture for industrial testing market include Merck KGaA, Bio-Rad Laboratories, Inc., Thermo Fisher Scientific, Inc., HiMedia Laboratories, bioMérieux SA, Eiken Chemical Co., Ltd, and Neogen Corporation.

b. Key factors that are driving the market growth include expanding applications of in-line spectroscopy and technological advancements in spectroscopic methods.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."