- Home

- »

- Conventional Energy

- »

-

Natural Gas Fired Electricity Generation Market Report, 2020-2027GVR Report cover

![Natural Gas Fired Electricity Generation Market Size, Share & Trends Report]()

Natural Gas Fired Electricity Generation Market Size, Share & Trends Analysis Report By Technology (Open Cycle, Combined Cycle), By End Use (Power & Utility, Industrial), By Region, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68039-046-6

- Number of Pages: 130

- Format: Electronic (PDF)

- Historical Range: 2016 - 2018

- Industry: Energy & Power

Report Overview

The global natural gas fired electricity generation market demand was 48,793.9 MW in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 4.71% from 2020 to 2027. The rise in environmental concerns regarding the high amount of carbon emissions from coal-based power generation plants has resulted in making natural gas fired power plants a cleaner option for baseload power generation. Furthermore, supporting regulations and policies for power generation using natural gas is the main factor driving the market in some of the major countries around the world. Some of the major countries around the world are planning to make natural gas the major power generation source by replacing coal with it. Natural gas production has been on the rise in the U.S. owing to technology advancement for the extraction of natural gas from shale gas reserves.

For instance, natural gas production in the country was recorded as 9.8 billion cubic feet per day in 2019, which was a 10% increase as compared to 2018. The availability of abundant natural gas has driven the market for natural gas fired electricity generation in the country. Furthermore, the government has taken necessary steps with regards to regulations and policies to support the growth of natural gas as a power generation source in the country. Furthermore, currently, natural gas is the major power generating fuel utilized in the country that accounted for a share of around 38% in 2019. These factors will boost the growth of the market in the forecast period.

The rise in the adoption of natural gas for electricity generation is considered a cleaner option in terms of coal-based power generation, which will boost the market growth. Dropping costs of natural gas owing to the cost-effective production from some of the unconventional gas resources in a large quantity are assessed to strengthen the market growth in the forecast period.

However, an increase in the share of renewable energy in the power generation mix is anticipated to hamper the industry growth over the forecast period. In addition, the presence of coal-based economies, primarily in the Asia Pacific region, along with a lack of suitable gas infrastructure in some of the countries, can further impede the market growth in the forecast period.

Technology Insights

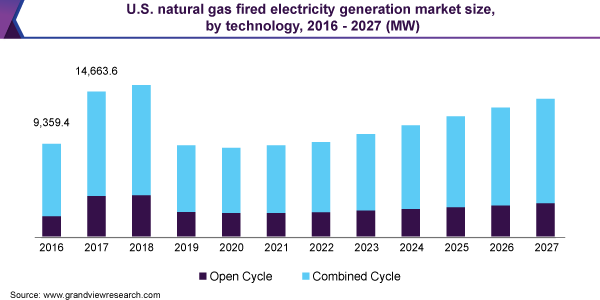

Based on technology, the market has been segmented into an open cycle and combined cycle. The combined cycle technology segment held the largest volume share of 78.2% in 2019. Combined cycle technology has gained momentum owing to its ability to enhance the overall efficiency of the plant. In addition, combined cycle technology requires lower fuel to produce the required energy output as compared to open cycle technology. The combined cycle technology segment is expected to witness significant growth in the years to come on account of a rise in demand for large capacity power plants to fulfill the growing power demand in various regions around the world.

Open cycle technology involves extracting air from the atmosphere, which is then compressed in a compressor and then fed in a combustion chamber. Further, fuel is being added and fired at constant pressure and air.

Open cycle technology provides an advantage in terms of lower space requirements for installation owing to which they are preferred for small scale installation. However, high energy loss results in lower efficiencies, which is expected to hinder the growth of the segment in the forecast period. However, the rise in demand for mobile and small scale power plants will enhance the growth of the open cycle technology segment.

End-use Insights

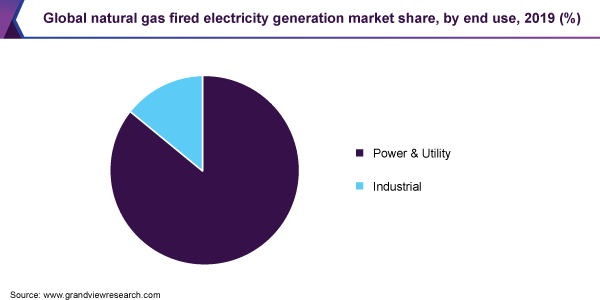

Based on the end-use, the market is segregated as power and utility and industrial. The power and utility segment accounted for a dominating share of 85.8% in terms of revenue in 2019 owing to the requirement of large scale power plants to fulfill the rise in baseload power demand. Furthermore, the rise in power demand from the residential, commercial, and industrial sectors, coupled with the retirement of old coal-based power generation plants, will boost the development of natural gas fired electricity generation plants. These factors will result in fueling the growth of the power and utility segment in the forecast period.

The industrial end-use segment is likely to expand at a significant rate on account of the increase in industrial operations across the countries. Growth of the industrial sector, coupled with government initiatives taken in various countries to improve the manufacturing sector, has driven the industrial sector to opt for natural gas fired electricity generation plants. These units are installed in various industries, such as cement, iron and steel, chemical, and refineries, for captive power generation purposes. Furthermore, frequent load shedding, blackouts, and power cuts in some regions have contributed to the rise in demand for natural gas fired electricity generation for captive power plants by the industrial segment.

Regional Insights

The Asia Pacific held the largest share of 35.0% in terms of revenue in 2019 and is expected to expand at the highest growth rate in the forecast period in terms of revenue. A substantial contribution from China and Japan is estimated to boost the growth of the region’s industrial sector in the upcoming years. Additionally, governments of such countries are continuously making exertions to decrease their carbon emission, thus inspiring the power generation sector to make usage of natural gas rather than making use of coal as a fuel.

North America held a significant revenue share in 2019. An increase in the production of shale gas across the region has been compelling the power generation industry to change its focus towards natural gas for power generation from other modes of fuels to generate electricity.

Furthermore, the presence of supporting policies and regulations aimed at reducing carbon emissions and switching to natural gas as a power generation source over coal is expected to enhance natural gas fired electricity generation plants in the region. These factors are expected to boost the growth in North America in the forecast period.

The Middle East and Africa is expected to witness significant growth in the forecast period owing to a number of projects in the pipeline in various countries, such as Saudi Arabia, Iraq, and UAE. Furthermore, most of the countries in the region are working to enhance electricity access in their respective countries. These factors will boost the growth of the region in the forecast period.

Key Companies & Market Share Insights

The market is concentrated with companies that account for a dominating share in the market. Some of the industry participants provide complete services ranging from equipment, construction, commissioning, to operation for natural gas fired electricity generation plants. Industry players are taking up several strategic initiatives, such as joint ventures, mergers & acquisitions, partnerships, and new product offerings, in order to strengthen their foothold in the market. Some of the prominent players in the natural gas fired electricity generation market include:

-

General Electric

-

Siemens AG

-

Mitsubishi Hitachi Power Systems, Ltd.

-

Kawasaki Heavy Industries, Ltd.,

-

Ansaldo Energia S.P.A.

Natural Gas Fired Electricity Generation Market Report Scope

Report Attribute

Details

Market size value in 2020

34,688.8 million

Revenue forecast in 2027

55,272.0 million

Growth Rate

CAGR of 5.18% from 2020 to 2027 (Revenue-based)

Market demand in 2020

47,373.6 MW

Volume forecast in 2027

70,500.0 MW

Growth Rate

CAGR of 4.71% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Volume in MW, revenue in USD million, and CAGR from 2020 to 2027

Report coverage

Revenue and volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

End-use, technology, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Russia; China; Japan; Thailand; Saudi Arabia; Iraq

Key companies profiled

General Electric; Siemens AG; Mitsubishi Hitachi Power Systems, Ltd.; Kawasaki Heavy Industries, Ltd.; Bharat Heavy Electricals Limited; Ansaldo Energia S.P.A.; Solar Turbines Incorporated; Opra Turbines B.V.; Man Energy Solutions; Centrax Gas Turbines

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts volume and revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2020 to 2027. Grand View Research has segmented the global natural gas fired electricity generation market report on the basis of technology, end-use, and region:

-

Technology Outlook (Volume, MW; Revenue, USD Million, 2016 - 2027)

-

Open Cycle

-

Combined Cycle

-

-

End-use Outlook (Volume, MW; Revenue, USD Million, 2016 - 2027)

-

Power & Utility

-

Industrial

-

-

Regional Outlook (Volume, MW; Revenue, USD Million, 2016 - 2027)

-

North America

-

The U.S.

-

-

Europe

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

Thailand

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Central & South America

-

Iraq

-

-

Frequently Asked Questions About This Report

b. The global natural gas fired electricity generation market demand was estimated at 48,793.9 MW in 2019 and is expected to reach 47,373.6 MW in 2020.

b. The global natural gas fired electricity generation market is expected to witness a compound annual growth rate of 4.71% from 2020 to 2027 to reach 70,500.0 MW by 2027.

b. Power & Utility was the largest end-use segment in the natural gas fired electricity generation market, accounting for 85.85% of the total volume in 2019 owing to the development of large-capacity power projects.

b. Some key players operating in the natural gas fired electricity generation market include General Electric, Siemens AG, Mitsubishi Hitachi Power Systems, Ltd., and Ansaldo Energia.

b. Key factors driving the growth of the natural gas fired electricity generation market include environmental concerns resulting in the closing of old coal-based power plants.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."