- Home

- »

- Medical Devices

- »

-

Non-PVC IV Bags Market Size, Share & Growth Report, 2030GVR Report cover

![Non-PVC IV Bags Market Size, Share & Trends Report]()

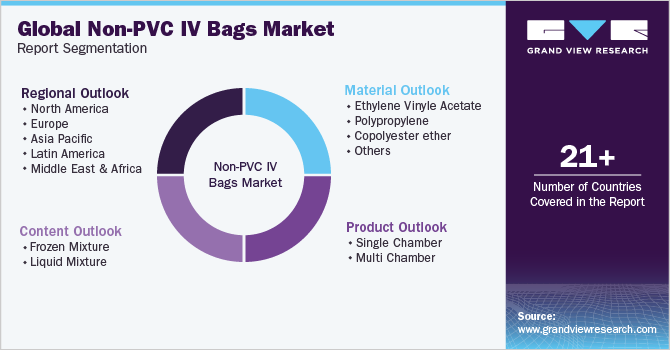

Non-PVC IV Bags Market Size, Share & Trends Analysis Report By Product (Single Chamber, Multi Chamber), By Material (Ethylene Vinyl Acetate, Polypropylene, Copolyester Ether), By Content, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-843-5

- Number of Pages: 90

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

The global non-PVC IV bags market size was valued at USD 1.73 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 11.3% from 2023 to 2030. Rising demand for preventive measures for errors such as improper dose delivery and augmented demand for advanced IV containers are among the major drivers of the market. Recently in March 2021, Fagron Sterile Services US (FSS), a 503B outsourcing leader, announces the addition of a new platform - intravenous (IV) bags - to its product portfolio. Issues with traditional IV containers include drug-packaging material interactions and difficulties in transporting, handling, and disposing of containers. The majority of these issues can be prevented by using non-PVC IV bags. As a result, demand for the same is predicted to skyrocket during the forecast period.

Furthermore, there is a growing demand in the treatment of oncology processes, mainly for chemotherapy and for targeted drug delivery, as most of these therapeutic agents are prone to interaction with the plasticizers and have a tendency to convert into harmful agents. This discordancy can be minimalized by the use of containers without plasticizers. These bags are made of polypropylene and ethylene-vinyl acetate. Several firms are turning to plasticizer-free, biologically inert materials to substitute the use of PVC. In the past 5 years, B. Braun has spent around USD 500.00 million in developing innovative ways to provide PVC and DEHP-free product lines. The development and availability of modern materials in different designs are forecast to expand growth through the replacement of glass and PVC containers.

The other factors supporting the market growth include growing reach of the local manufacturers in global market, stringent regulations against usage and disposal of polyvinyl chloride (PVC), and healthcare infrastructure development in emerging countries. Besides, technological advances in service quality and an increased number of hospitals worldwide are few additional factors that drive the growth of the market of non-PVC IV bags.

Cancer treatment deprives human body from nutrition. Moreover, it affects the human body by causing physical obstructions, GI dysfunction and ulcers. All of these limit the body to naturally extract food from the food. As a consequence, they must be externally injected. The demand for IV bags has risen significantly as cancer has increased over the past few years. For instance, according to the World Health Organization (WHO), cancer is the second leading cause of death across the world. It furthers stated that an estimated 9.6 million deaths, i.e., 1 in 6 deaths were reported, due to cancer in 2018. The American Cancer Society, on the other hand, estimated that more than 1.7 million new cancer cases were diagnosed in America in 2019. From the data by Cancer Research U.K., every year 36,7000 new cases of cancer are reported in the U.K. Increasing prevalence of cancer is the most promising factor for the growth of the IV solutions market.

There have been growing concerns in the medical field of PVC IV bags posing a risk to human health and the environment due to phthalates leaching from equipment. Furthermore, it results in the production of toxic HCL by disposal of PVC products using the incineration process. This contributes further to acid rainfall. Building IV bags, made of PVC-free material with thermal stability, moisture-barrier properties, and an environmentally-friendly disposal are therefore made for companies like Baxter, Hospira and B. Braun Melsungen AG. Hence, with the adoption of PVC-free IV bags, the healthcare industry can make a significant stride in protecting the health and safety of the patient population globally.

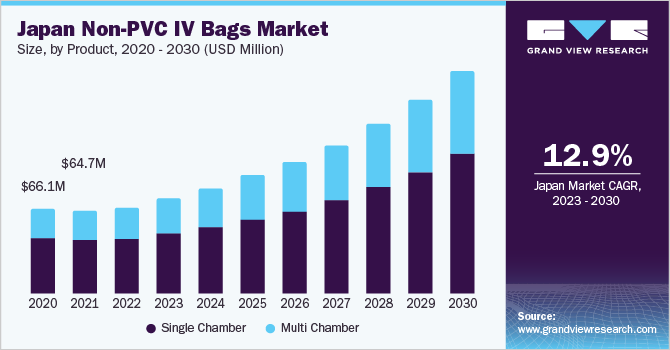

Product Insights

The single chamber segment accounted for the largest share of 63.62% in 2022. The use of single chamber IV bags is currently high and is projected to remain as in the future as IV bags replace other IV containers. The advent of non-PVC materials has accelerated the replacement of glass containers with plastic bags, owing to benefits such as ease of handling, transportation, and disposal. Irrigation fluids, drip bags, and sterile water are also commonly used intravenous solutions. As a result, single chamber bags are widely used, and the segment is expected to grow during the forecast period.

The multi-chambered segment is estimated to exhibit the fastest growth during the forecast period. Multi-chambered IV bags are preferred for intravenous therapy when a combination of medications must be administered to the patient. Multi Chamber IV bags are manufactured from materials such as non-PVC film with easy peel off and fast seal properties that are widely used in the healthcare industry for any emergency situation. Moreover, multi chamber IV bags are beneficial in the pharmaceutical industry because they have a very low waiting time during the opening hours of manufacturing units, lowering the inefficiency of standard IV bags that are commonly used in the market. Furthermore, due to their excellent stability, high pressure agility, outstanding transparency, toughness, and thermal sealing, as well as the fact that they are reusable, they are widely used in pharmaceuticals. Thus, growing utility of multi-chambered containers in several materials such as parenteral nutrition and drug reconstitution along with the availability of customized product offerings are the principal factors driving the growth of multi-chambered segment.

Material Insights

Ethylene vinyl acetate segment held the largest share of around 33.62% in 2022 and is anticipated to witness considerable growth rate over the forecast period. EVA, the most widely used PVC alternative, had the highest market share in 2020. In blood banks and the storage of frozen mixtures, EVA is anticipated to be widely used. Growing recognition and high demand for blood and blood component storage as a result of an increase in the number of blood banks are the factors driving the significant segment share over the forecast timeframe. Moreover, the demand for ethylene-vinyl acetate (EVA) infusion bags is expected to be driven by increased understanding of parenteral nutrition therapy and the high prevalence of chronic kidney diseases. For instance, according to the CDC, more than 1 in 7, that is 15% of US adults or 37 million people, are likely to have CKD. Compounding fluids are delivered parenterally using EVA bags. Various medicines are sometimes combined using ingredients or drugs. For instance, fluid from compounding parenteral nutrition and chemotherapy medications.

The copolyester ether segment is projected to exhibit fastest growth during the estimated study period. Durability, transparency, chemical resistance, and the ability to withstand a variety of sterilisation processes such as autoclave, radiation, and electron beam are several of the benefits associated with copolyester ether. Copolyester ether's strength is increased by the addition of other materials such as polypropylene and other polyolefin resins. The development of Ecdel elastomer has proven to be a watershed moment in the evolution of copolyester ether in pharmaceutical packaging. Abbott Laboratories, Sealed Air Corporation, B. Braun Melsungen AG, and Eastman Chemical Company are among the companies engaged in developing these combinations.

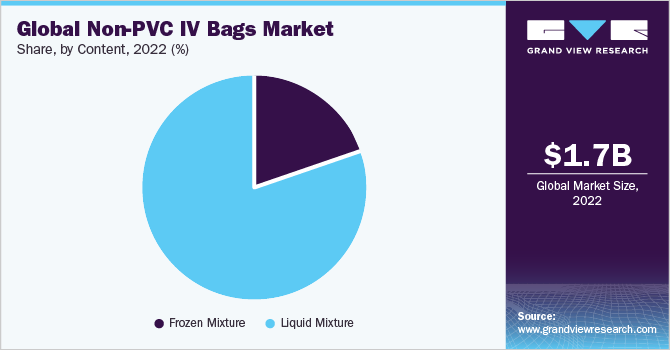

Content Insights

The liquid mixture segment captured the largest share of around 78.62% in 2022. Some of the factors leading to the large segment share include the implementation of novel designs and the high use of IV drips in hospitals. In the blood banks vertically there is an increasing demand for specialized IV containers which resist low temperatures and offer greater security than PVC. In addition, major players in the non-PVC IV bags market are concentrating on increasing production potential to increase their market share. For instance, in November 2019, Grifols initiated the production at its novel blood-collection systems plant in Brazil with a capacity of more than 10 million blood collection bags yearly.

The liquid mixture segment, the market shares currently obtained from non-PVC IV bags used for frozen mixes is very low. Bags of PVC tend to explode at low temperatures. However, EVA has considered to be a successful alternative to the lower temperatures of PVC. Some examples of frozen mixture include methylprednisolone, cefazolin, ceftriaxone, nafcillin, and nicardipine hydrochloride.

Regional Insights

North America captured the largest share of about 46.74% in 2022 and is expected to grow at a CAGR of 11.1% during the forecast period. In the United States, strict regulations aimed at improving patient safety have increased demand for non-PVC IV containers, which provide patient treatment without risking harm. Moreover, the demand for IV bags has risen significantly as prevalence of stomach cancer has increased over the past few years. For instance, the American Cancer Society estimated in the U.S in 2020 about 27,600 cases of stomach cancer are expected to be diagnosed and by extension approximately 11,010 patients would face death. The patients who are suffering from stomach cancer are unable to ingest food through mouth and thus have to entirely rely on total parenteral solutions for dietary needs and survival. This might surge the demand for ethylene-vinyl acetate (EVA) infusion bags, which in return is expected to boost the regional market. Additionally, rising adoption of novel drug delivery systems and technological innovations are anticipated to push the Non-PVC intravenous bags Market in this region.

The Asia Pacific region is expected to exhibit highest CAGR during the forecast period. The advent of local manufacturers that encourage international demand by selling goods at affordable rates, increased foreign direct investment, and rapid improvement in healthcare infrastructure, including a rise in the number of hospitals, clinics, and blood banks, are all factors that are having a significant effect on the industry's growth.

Key Companies & Market Share Insights

Prominent key players present in the non-PVC IV bags market are Baxter, B. Braun Melsungen AG, Pfizer, Inc. (Hospira), and Fresenius Kabi AG. Key players are involved in adopting strategies such as merger & acquisitions, partnership and launching new products to strengthen their foothold in the non-PVC IV bags market. For instance, in July 2019, Baxter received U.S. FDA approval for Myxredlin, the 1st and only ready-to-use insulin for IV infusion.

Key players are investing heavily on the research and development to manufacture technologically advanced products. For instance, in May 2019, Sihuan Pharmaceutical Holdings Group Ltd, launched the “non-PVC solid-liquid double chamber bag for ceftazidime/sodium chloride injection” cooperatively developed by the Group and its associated company Beijing Ruiye Drugs Manufacture Co. Ltd. The National Medical Products Administration (NMPA) of the People's Republic of China has approved it for drug registration. In China, the Group is the first to obtain certification for a “non-PVC solid-liquid double chamber bag for ceftazidime/sodium chloride injection. Some prominent players in the non-PVC IV bags market include:

-

Baxter

-

B. Braun Melsungen AG

-

Pfizer, Inc. (Hospira)

-

Fresenius Kabi AG

-

JW Life Science

-

RENOLIT

-

PolyCine GmbH

-

Sealed Air

-

ANGIPLAST PVT. LTD

-

Shanghai Solve Care Co Ltd.

-

Kraton Corporation

-

Jiangxi Sanxin Medtec Co., Ltd.

Non-PVC IV bags Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.87 billion

Revenue forecast in 2030

USD 3.97 billion

Growth Rate

CAGR of 11.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

June 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material, content, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA)

Country scope

U.S.; Canada; U.K.; Germany; Japan; China; Brazil; Mexico; South Africa; Saudi Arabia

Key companies profiled

Baxter; B. Braun Melsungen AG.; Pfizer, Inc.; (Hospira); Fresenius Kabi AG; JW Life Science; RENOLIT; PolyCine GmbH; Sealed Air; Shanghai Xin Gen Eco-Technologies Co., Ltd.; ANGIPLAST PVT. LTD; Shanghai Solve Care Co Ltd.; Kraton Corporation; Jiangxi Sanxin Medtec Co., Ltd.;

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Non-PVC IV Bags Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global non-PVC IV bags market report on the basis of product, material, content, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Single Chamber

-

Multi Chamber

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Ethylene Vinyle Acetate

-

Polypropylene

-

Copolyester ether

-

Others

-

-

Content Outlook (Revenue, USD Million, 2018 - 2030)

-

Frozen Mixture

-

Liquid Mixture

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

Japan

-

China

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global non-PVC IV bags market size was estimated at USD 1.73 billion in 2022 and is expected to reach USD 1.87 billion in 2023.

b. The global non-PVC IV bags market is expected to grow at a compound annual growth rate of 11.3% from 2023 to 2030 to reach USD 3.97 billion by 2030.

b. The single-chamber segment accounted for the largest revenue share of over 63.6% in 2022 in the non-PVC IV bags Market.

b. The EVS material segment held the largest revenue share of more than 33.6% in the non-PVC IV bags Market in 2022 and is anticipated to witness considerable growth over the forecast period.

b. The liquid mixture segment captured the largest revenue share of over 78.6% in 2022 in the non-PVC IV bags Market and will retain the leading position throughout the forecast period.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."