- Home

- »

- Nutraceuticals & Functional Foods

- »

-

North America Dietary Supplements Market Report, 2021-2028GVR Report cover

![North America Dietary Supplements Market Size, Share & Trends Report]()

North America Dietary Supplements Market Size, Share & Trends Analysis Report By Ingredient, By Form, By Application, By End-user, By Distribution Channel, By Region, And Segment Forecasts, 2021 - 2028

- Report ID: GVR-1-68038-916-6

- Number of Pages: 140

- Format: Electronic (PDF)

- Historical Range: 2017 - 2019

- Industry: Consumer Goods

Report Overview

The North America dietary supplements market size was valued at USD 50,118.6 million in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 5.6% from 2021 to 2028. The increasing consumer awareness regarding personal health and wellbeing is one of the key drivers of the market. Furthermore, growing demand for preventive health products to lead healthy & disease-free life and rising number of fitness centers, health clubs, & gymnasiums are expected to drive the market over the forecast period.

North America is one of the key regions in dietary supplements market with large number of players and contract manufacturers based in the region. The vertical integration within the value chain has pushed the supply chain to be more compact and efficient. The industry in North America is transforming to a less centralized, decluttering trend.

The manufacturers are focusing on incorporating new technologies and customized solutions to meet the consumer demands. Food and beverage packaging manufacturers are aiming to reduce the weight to save costs from reductions in raw materials and lower transportation costs.

The players directly offer products to consumers through their company websites and offline distribution channels. Manufacturers partner with online retailers, such as Amazon, to deliver products directly to end users. On the value basis, supermarkets, hypermarkets and food stores contribute over half of the regional sales of OTC dietary supplements industry in North America

Ingredient Insights

Vitamins were the majorly used ingredients to produce dietary supplements, accounting for 31.3% of total revenue share in 2020. Factors fueling interest in these products include the rapid advances in science and technology, increasing healthcare costs, changes in food laws affecting label and product claims, burgeoning aging population, and rising interest in attaining wellness through diet.

The protein & amino acids ingredient segment is expected to grow at a faster pace over the forecast period. This is due to the increasing demand for protein and amino acids in sports nutrition products. Furthermore, emergence of new plant-based proteins such as soy, spirulina and hemp are expected to further contribute to the segment growth.

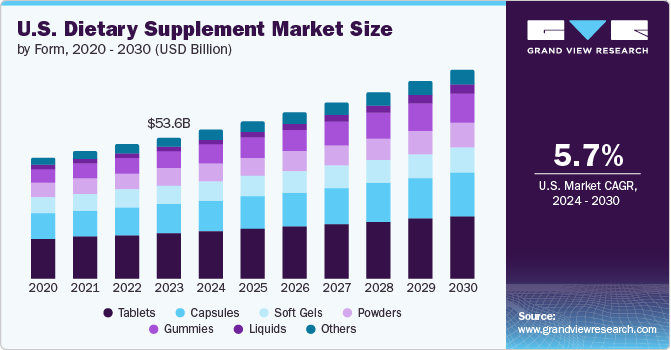

Form Insights

The tablet segment held the highest share of 33.4% in 2020 and is expected to grow at a CAGR of 4.5% over the forecast period. This is due to the ease in usage, packaging, and high absorption. Tablets is followed by capsules in terms of revenue in 2020.

Liquid dietary supplement is a liposomal product, which is evenly dispersed in water for smooth consumption. This allows the blending of liquid dietary supplements in yogurt, water, smoothies, and energy drinks. The product is ideal for adults and Gen X; owing to this, the liquid form type is expected to grow at a CAGR of 8.7% over the forecast period.

Application Insights

The energy & weight management segment dominated the market in 2020. The demand for dietary supplements containing proteins and vitamins is widely influenced by sports enthusiasts. These products help athletics restore energy, improve muscular endurance, and minimize bodywear & tear. Nearly 6 in 10 adults used a sports nutrition product and combined consumer sale of nutrition bars, sports nutrition supplements, and energy drinks are expected to fuel energy nutrition demand.

The anti-cancer segment is expected to grow at a CAGR of 10.5% over the forecast period. Studies show that beta-carotene may increase the risk of lung cancer in smokers and people who have been exposed to asbestos. Fish oil contains omega-3 fatty acids, which help the body absorb nutrients and avoid inflammation. Some studies indicate that omega-3 may prevent cancer and heart diseases. Lycopene is a plant carotenoid and research has shown that lycopene, when added to food products, appears to reduce the risk of prostate cancer.

Distribution Channel Insights

The offline segment dominated the market in 2020. Sales of dietary supplements through offline distribution channels are anticipated to witness steady growth owing to the flexibility of consumers as consumers get personalized attention from store staff which provides knowledgeable second opinions on the new products in the market. Furthermore, introduction of private label brands by retail channel players is expected to further boost the demand for dietary supplements markets.

Online retailing is the trending distribution channel in North America as it promotes the sales of dietary supplements through mobile and user-friendly websites, e-mails, paid marketing, affiliate marketing, and paid promotions through e-commerce websites. The younger population prefers online shopping more than in-store purchases. The emerging private label supplement brands may have advantages by opting for online retailing as it is cost-effective. Also, it takes lesser time to reach maximum population across the region when compared to other marketing strategies.

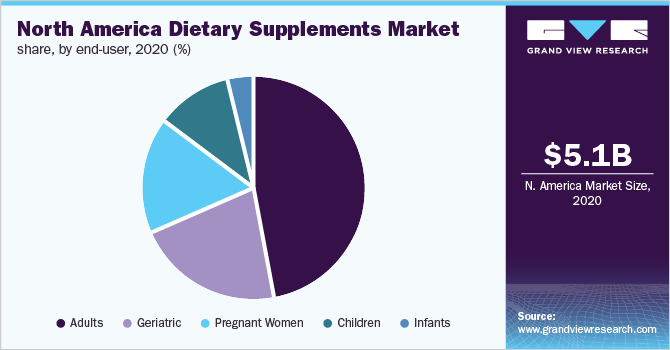

End-user Insights

The adults segment dominated the market in 2020 due to the rising consumption of dietary supplements by working individuals in order to maintain a healthy lifestyle. Furthermore, increasing awareness toward healthy diet among working individuals and sports athletes to maintain the nutritional balance in their bodies is expected to drive the demand for dietary supplements over the forecast period.

The infants segment is expected to grow at the fastest CAGR of 10.1% over the forecast period. Since fish and salmon are not a part of the regular staple diet in the region, mothers tend to lack basic omega 3 content in their meals, which, in turn, also cuts the omega 3 nutrition of infants in case of pregnant women.

Rising consumption of breast milk substitutes, which closely resemble the functionality and composition of breast milk, is anticipated to drive the demand for vitamin and omega 3-based dietary supplements.

Regional Insights

North America has a vast population with increased obesity levels and lifestyle-related diseases on account of their dietary habits, high disposable incomes, and the availability of several processed & ready-to-eat foods, which may not necessarily be good for health. The ‘transitioning face’ of food has evolved into functional foods & supplements, which offer numerous health benefits beyond basic nutrition

The adoption of dietary supplements across North America is increasing and this provides an opportunity for pharmacists to counsel patients on the appropriate use of available products. As the new product launches increase in the market, it is essential for pharmacists to remain informed about the latest recommendations regarding their use and safety. Although, the consumers in North America are reliant on supermarkets & hypermarkets, the practitioner channel supplements are observed to grow at a faster pace.

Key Companies & Market Share Insights

Some of the key players in the market are Amway Corp., Abbott, Arkopharma, Bayer AG, Glanbia PLC, Pfizer Inc., ADM, and Ayanda. The market is highly competitive with major public as well as private players focusing on innovation and research & development of products. In April 2021, Nestle buys the leading vitamin maker in the U.S., Bountiful brands. It is the latest expansion of Nestle’s health and nutrition business.

The presence of large number of contract manufacturers based in the region has been one of the key factors for the high growth of the North America dietary supplements market. This has also resulted in emergence of various private label brands in the region in past five years. Some of the prominent players in the North America dietary supplements market include:

-

Amway Corp.

-

Glanbia PLC

-

Abbott

-

Bayer AG

-

Pfizer Inc.

-

ADM

-

Nu Skin Enterprises, Inc.

-

GlaxoSmithKline plc

-

Bionova

-

Ayanda

-

Arkopharma

-

Herbalife International of America, Inc.

-

Nature’s Sunshine Products, Inc.

North America Dietary Supplements Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 52,874.7 million

Revenue forecast in 2028

USD 77.1 billion

Growth rate

CAGR of 5.6% from 2021 to 2028

Base year for estimation

2020

Historical data

2017 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Ingredient, form, application, end-user, distribution channel, region

Regional scope

North America

Country scope

U.S.; Canada; Mexico

Key companies profiled

Amway Corp.; Abbott; Arkopharma; Bayer AG, Glanbia PLC; Pfizer Inc.; ADM; The Nature’s Bounty Co; NU SKIN; NOW Foods; Herbalife Nutrition of America, Inc.; Nature’s Sunshine Products, Inc; Ayanda; XanGo, LLC; Nutracutics Corp.; American Health; BPI Sports, LLC; Dymatize Enterprices LLC; Bionova; GlaxoSmithKline Inc. Himalaya Global Holdings Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2028. For the purpose of this study, Grand View Research has segmented the global North America dietary supplements market report on the basis of ingredient, form, application, end-user, distribution channel and region:

-

Ingredient Outlook (Revenue, USD Million, 2017 - 2028)

-

Vitamins

-

Botanicals

-

Minerals

-

Proteins & Amino Acids

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Others

-

-

Form Outlook (Revenue, USD Million, 2017 - 2028)

-

Tablets

-

Capsules

-

Soft gels

-

Powders

-

Gummies

-

Liquids

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2028)

-

Energy & Weight Management

-

General Health

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Others

-

-

End-user Outlook (Revenue, USD Million, 2017 - 2028)

-

Adults

-

Geriatric

-

Pregnant Women

-

Children

-

Infants

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2028)

-

Offline

-

Pharmacy

-

Supermarket/Hypermarkets

-

Others

-

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2028)

-

U.S.

-

South East

-

North East

-

South West

-

West

-

Midwest

-

-

Canada

-

Mexico

-

Frequently Asked Questions About This Report

b. The North America dietary supplements market size was estimated at USD 50,118.6 million in 2020 and is expected to reach USD 52,874.7 million in 2021.

b. The North America dietary supplements market is expected to grow at a compound annual growth rate of 5.6% from 2021 to 2028 to reach USD 77.1 billion by 2028.

b. Energy and weight management accounted for the highest share of 29.8% in the North America dietary supplements market in 2020, with the growing popularity of trends such as online weight loss programs and growing awareness on healthy diet positively driving the segment growth.

b. Some of the key players operating in the North America dietary supplements market include Amway Corp.; Abbott; Arkopharma; Bayer AG, Glanbia PLC; Pfizer Inc.; ADM; The Nature’s Bounty Co; NU SKIN; NOW Foods; Herbalife Nutrition of America, Inc.; Nature’s Sunshine Products, Inc; Ayanda; XanGo, LLC and Nutracutics Corp.

b. The key factor that is driving the North America dietary supplements market growth includes the increasing demand for preventive health products in order to lead healthy & disease-free life.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."