- Home

- »

- Nutraceuticals & Functional Foods

- »

-

North America Organic Starch Market Size, Industry Report, 2018-2025GVR Report cover

![North America Organic Starch Market Size, Share & Trends Report]()

North America Organic Starch Market Size, Share & Trends Analysis Report By End-Use (Meat, Bakery, Confectionery and Dry Blends), By Ingredient (Corn, Potato, wheat), By Country, And Segment Forecasts, 2018 - 2025

- Report ID: GVR-2-68038-226-6

- Number of Pages: 60

- Format: Electronic (PDF)

- Historical Range: 2014 - 2015

- Industry: Consumer Goods

Industry Insights

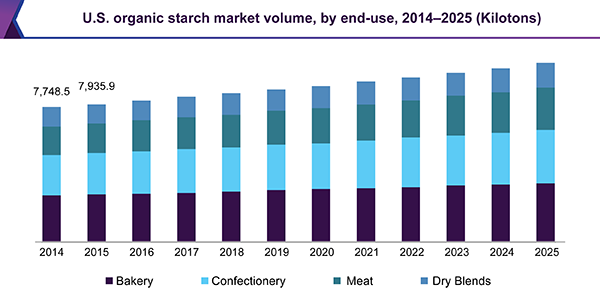

The North America organic starch market size was estimated at 10,231.1 kilotons in 2016. Rising demand for convenience foods coupled with growing end-use industries in the U.S. is expected to drive the market over the forecast period.

U.S. organic starch market is undergoing rapid growth. Led by tremendous benefits offered by them, their demand has witnessed an upsurge in the food and beverage industry of the U.S. Growing trend towards adoption of convenience foods owing to increasingly hectic lifestyles has supported to achieve a more conductive environment for the incorporation of starch in foods and beverages.

Organic starch in the U.S. is supplied via retailers, wholesalers, direct agreements between players and distributors, or through third party supply agreements. Majority of the manufacturers adopt a forward integration technique, which enables them to sell their products directly through exclusive stores.

Organic starch is widely used in the food & beverage industry as a sweetener, bulking agent, fat replacer, anti-caking agent, and stabilizer. High demand for starch-based products from the convenience and packaged food sectors is anticipated to drive the market over the forecast period. Convenience food is becoming increasingly popular in American households as it helps save food preparation time. Convenience food includes basic ingredients, complex ingredients, ready-to-cook (RTC) meals & snacks, and ready-to-eat (RTE) meals & snacks.

Cross-linked starches are used to produce various convenience food items including sauces, soups, bakery products, and desserts. Despite the price inflation in 2016, the demand for processed food remained steady. Changing consumer lifestyles, which have resulted in growing demand for ready-to-eat food, coupled with an increase in the number of retail stores selling packaged food are factors contributing to the organic starch market in North America.

Consumers in the U.S. are changing their perception toward healthy diet. The convenience and easy to carry option offered by these food products are additional factors boosting the demand. There is an increase in the awareness among consumers regarding the benefits such as maintaining the nutrition balance in the body which can be achieved by the consumption of snacks in between meals helps.

End-Use Insights

The demand for organic starch in bakery has witnessed augmented demand. Bakery was the largest end-use segment and accounted for 34.2% of the total volume share in 2016. It is utilized in a wide variety of baked products including potato chips, sausages, instant soups, noodles, gums, and gluten-free recipes. People in North America have become more conscious about the nutrient contents in food, which has led to increased demand for healthy baked goods. This has also led to the development of high-quality baking ingredients in the final products.

The pace of innovation is increasing in these regions with the manufacturers seeking to tap potential opportunities in the morning snacking category. Many food processing companies have introduced food items in the snacks category, which majorly include desserts such as cakes, pastries, and sweet baked products.

Meat is anticipated to witness promising growth over the forecast period. Organic potato is used in processed meat products such as hamburgers, frankfurters, wiener, bologna, meatballs, meatloaves, luncheon meat, and others. It has several unique properties such as a very low gelatinization temperature, high viscosity, fast swelling, bland flavor & taste, and a high water binding capacity. When it is heated at approximately 70ºC, the granules start absorbing a huge amount of water and also offer functionality at a similar temperature range as provided by meat proteins. Thus, it is the most commonly preferred ingredient for meat processing.

Consumption of meat products is rising rapidly in the U.S. Surging demand for packaged and frozen meat products owing to increasingly hectic lifestyles and demand for food products having high nutritive content is supplementing the demand for meat products in the U.S, which is in turn, anticipated to drive the market growth.

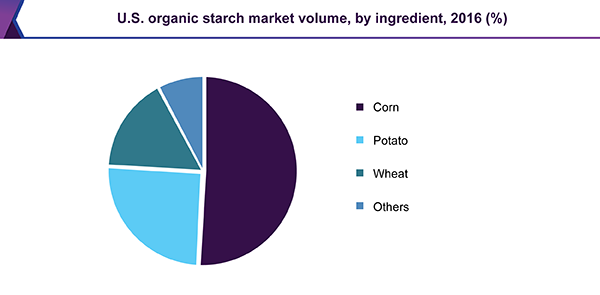

Ingredient Insights

Organic corn starch was the largest ingredient segment in 2016. It is derived from corn grain. It is a form of carbohydrate which is obtained from the endosperm of the kernel. It is commonly used as a thickening agent in tarts, sauces, gravies, pies, glazes for cakes, and is also utilized to produce corn syrups and sugars. It can also be used as an anti-caking agent. It is often dusted with shredded cheese to prevent any clumping. This also aids in absorbing moisture and prevents a slimy texture.

Wheat is anticipated to witness a staggered growth over the forecast period. The demand for wheat is restrained in the U.S. on account of rising gluten intolerance in the country. Gluten is a protein present in wheat, barley, oats, and rye. Digestive problems namely such as abdominal pain, diarrhea, and gassiness, may occur in the body due to gluten intolerance and are called coeliac disease. The immune systems tend to react with gluten, and allergic reactions develop causing harm to the small intestine.

North America Organic Starch Market Share Insights

Key industry participants include Parchem fine & specialty chemicals, Cargill, Incorporated, Ingredion Incorporated, Ciranda, Inc., KMC International, and AGRANA Beteiligungs-AG. Application development is expected to be the key parameters for attaining competitive strength, with frequent product launches and expansion being undertaken as an attempt to diversify the product portfolio.

Report Scope

Attribute

Details

Estimates/Historical data

2014 - 2015

Base year for estimation

2016

Forecast period

2017 - 2025

Market representation

Volume in kilotons, revenue in USD Million, and CAGR from 2017 to 2025

Country scope

U.S., Canada, Mexico

Report coverage

Volume & revenue forecast, company share, competitive landscape, growth factors, and trends

15% free customization scope (equivalent to 5 analyst working days)

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments Covered in the reportThis report forecasts revenue growth at the country levels and provides an analysis of the industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the North America organic starch market on the basis of end-use, ingredient, and country.

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million; 2014 - 2025)

-

Bakery

-

Meat

-

Confectionery

-

Dry Blends

-

Others

-

-

Ingredient Outlook (Volume, Kilotons; Revenue, USD Million; 2014 - 2025)

-

Potato

-

Wheat

-

Corn

-

Others

-

-

Country Outlook (Volume, Kilotons; Revenue, USD Million; 2014 - 2025)

-

The U.S.

-

Canada

-

Mexico

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."