- Home

- »

- Medical Imaging

- »

-

Nuclear Imaging Equipment Market Size, Share Report, 2030GVR Report cover

![Nuclear Imaging Equipment Market Size, Share & Trends Report]()

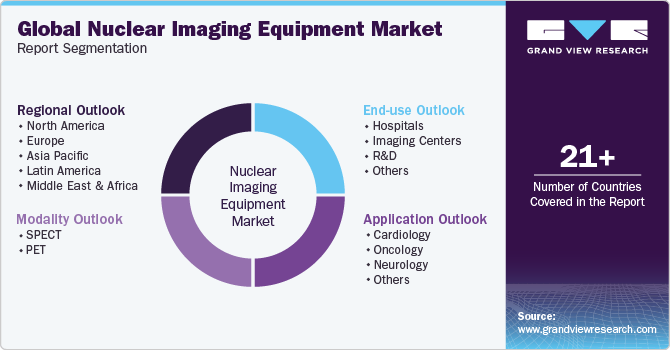

Nuclear Imaging Equipment Market Size, Share & Trends Analysis Report By Modality (SPECT, PET), By Application (Cardiology, Oncology, Neurology), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-187-7

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Healthcare

Nuclear Imaging Equipment Market Trends

The global nuclear imaging equipment marketsize was estimated at USD 6.41 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 3.14% from 2024 to 2030. The market is being driven by several factors such as the increasing prevalence of cancer worldwide, technological advancements, clinical applications, and research, and increasing nuclear medicine imaging procedures. According to the International Agency for Research on Cancer, by 2025 the worldwide cancer prevalence is expected to reach 50,550,287 from 19,292,789 in 2020.

Nuclear imaging equipment examples, include PET and SPECT scanners, they stand as highly efficient tools in medicine. They serve diverse purposes, from diagnosing cancer to studying organ function and assessing brain irregularities. Their efficacy lies in generating detailed internal images and facilitating precise diagnoses and treatment strategies. These technologies have markedly propelled advancements in medical science. Furthermore, technological advancements in these modalities are expected to propel market growth. In June 2022, Siemens Healthineers introduced the Symbia Pro.specta, a SPECT/CT system that has received both the CE mark and FDA clearance. This system integrates advanced SPECT and CT imaging technologies. Notable features include a low-dose CT capable of capturing up to 64 slices, offering impressive detail in imaging. Additionally, it includes automatic SPECT motion correction, enhancing image clarity, and streamlining the examination process with an intuitive, automated workflow that guides users through decision-making steps.

The rise in chronic diseases globally is anticipated to drive the use of nuclear imaging equipment. Conditions such as cancer, cardiovascular problems, neurological disorders, and metabolic issues are increasingly prevalent worldwide. Nuclear imaging technologies, such as PET and SPECT scanners, hold a crucial role in diagnosing and monitoring these chronic diseases. For instance, PET scans are efficient in cancer diagnosis, detecting tumors, assessing their severity, and tracking treatment responses. Similarly, in cardiovascular diseases, these imaging equipment’s are vital for evaluating blood flow, detecting blockages, and assessing heart function. Moreover, in neurology, nuclear imaging aids in diagnosing conditions like Alzheimer's disease and other neurodegenerative disorders by visualizing brain metabolism and abnormalities.

Market Concentration & Characteristics

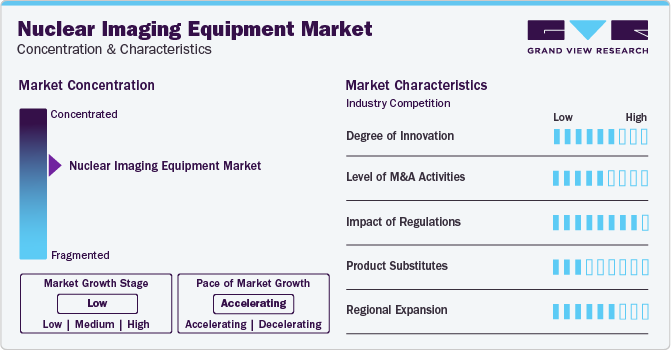

Market growth stage is low, and pace of the market growth is accelerating. The nuclear imaging equipment market has shown steady growth owing to technological advancements, increased occurrences of chronic illnesses, and an aging population. PET and SPECT modalities have become pivotal in diagnosing and monitoring conditions such as cancer, cardiovascular diseases, and neurological disorders. Manufacturers of nuclear imaging equipment are involved in developing new technologies to ensure their systems meet evolving diagnostic standards. One prevalent strategy involves integrating advanced imaging software and artificial intelligence algorithms. This combination is gaining popularity for its ability to heighten the precision and efficiency of nuclear imaging equipment.

Companies are strategically pursuing mergers and acquisitions to enhance their market presence and broaden their product portfolios. For instance, in April 2022, Mediso Ltd announced the acquisition of Bartec Technologies Ltd, a UK-based company specializing in the supply, installation, and support of nuclear medicine and molecular imaging equipment and accessories. This acquisition is expected to strengthen Mediso’s position in the UK and Ireland markets.

Degree of Innovation: Nuclear imaging equipment has achieved a high degree of innovation, owing to remarkable technological advancements that have positioned it at the forefront of medical diagnostics. Integrating with AI, implementing advanced detector technologies for enhanced image quality, and minimizing radiation exposure for patients are key contributors to this progress. Furthermore, a surge in the development of hybrid imaging systems is another factor to this, as they seamlessly combine nuclear imaging with modalities such as computed tomography (CT) or magnetic resonance imaging (MRI), offering a consolidated and comprehensive source of both anatomical and functional information in a single scan.

Companies involved in the manufacturing of nuclear imaging equipment are actively engaging in integration through merger and acquisition activities. This strategic approach aims to augment technological capabilities, broaden market reach, and ensure competitiveness in the continuously evolving healthcare landscape.

The influence of regulatory policies on nuclear imaging devices is significant. Governments and regulatory bodies globally enforce various stringent guidelines to uphold the safety, efficacy, and quality of nuclear imaging technologies. These regulations cover a range of aspects, including radiation safety standards, device performance, and manufacturing practices.

Within the market, the presence of product substitutes offers healthcare providers compelling alternatives to consider for their diagnostic technology investments. The advancements in non-nuclear imaging modalities, such as magnetic resonance imaging (MRI) and computed tomography (CT), serve as noteworthy substitutes. These alternative technologies have experienced significant improvements in resolution, speed, and versatility, strategically positioning them to effectively compete with specific aspects of nuclear imaging.

The geographical reach of nuclear imaging equipment exhibits a moderate to high level of expansion, primarily driven by increased adoption in developed economies like the U.S. and Japan. However, in underdeveloped or developing economies, the adoption of nuclear imaging equipment is comparatively lower due to factors such as limited healthcare access, inadequate regulations, and underdeveloped healthcare infrastructure.

Modality Insights

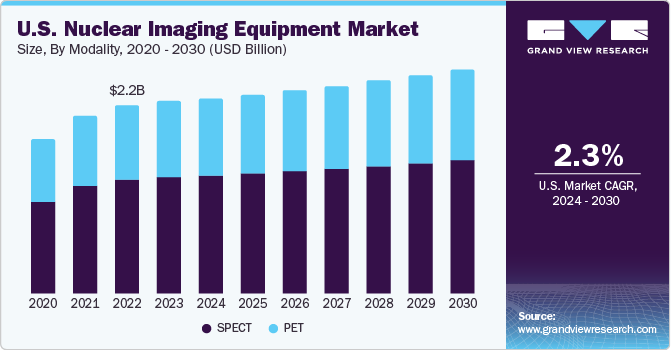

The single photon emission computed tomography (SPECT) segment dominated the nuclear imaging equipment market and accounted for the largest revenue share of 58.56 % in 2023. A key contributing factor is the cost-effectiveness associated with SPECT equipment and procedures. Compared to PET scanners, SPECT scanners are generally more economical to install and operate, thus increasing their accessibility across various healthcare settings. This affordability extends the adoption of SPECT technology to a wider array of healthcare facilities, including smaller clinics and hospitals with limited resources. Furthermore, SPECT imaging utilizes different radiotracers and imaging agents in comparison to PET, offering distinct advantages in specific diagnostic tests.

Positron emission tomography (PET) is anticipated to grow at the fastest rate over the forecast period. Advancements in PET imaging technology is a significant factor contributing to the market growth. PET scanners offer higher-resolution images and deliver more precise metabolic information, which holds immense importance across various specialties like oncology, neurology, and cardiology. Ongoing research and developmental studies primarily concentrate on refining PET imaging techniques. For instance, in November 2023, a small-scale study conducted by researchers at the National Institutes of Health showcased the potential of positron emission tomography (PET) scans in identifying individuals at risk of developing Parkinson's disease or Lewy body dementia. This research highlights PET scans can help in early detection and risk assessment for these diseases.

Application Insights

The oncology segment dominated the market and accounted for the largest revenue share of 49.21% in 2023. This is due to the growing prevalence of cancer worldwide and advanced nuclear imaging technology, notably PET and SPECT have seen significant expansion owing to their unmatched capability to thoroughly examine the molecular traits specific to cancer.Furthermore, these imaging modalities facilitate ongoing research in oncology. They aid in the development and evaluation of new cancer treatments and therapies by providing insights into the tumor's behavior, metabolism, and response to experimental drugs.

The cardiology segment is expected to grow at the fastest rate over the forecast period. The rising incidence of cardiovascular diseases (CVDs) coupled with the increased awareness regarding nuclear imaging's diagnostic capabilities is anticipated to fuel market growth. For instance, as per the World Health Organization (WHO), CVDs stand as the primary cause of global mortality, approximately 17.9 million lives annually. This prevalence shows the significance of nuclear imaging in comprehensively addressing the challenges posed by cardiovascular diseases.

End-use Insights

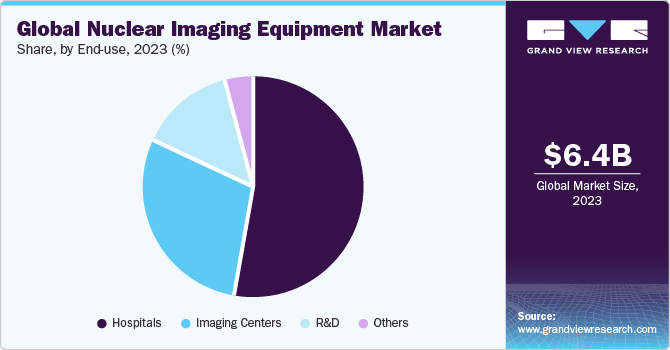

The hospitals segment captured the largest revenue share of 52.75% in 2023. Hospitals are adopting nuclear imaging equipment at an increasing rate. In February 2023, Skåne University Hospital in Sweden installed GE Healthcare's advanced SPECT/CT scanner, the StarGuide system. The comprehensive nature of hospitals allows for a wider array of medical services in one place, making nuclear imaging more accessible to a diverse patient population. Moreover, hospitals often manage more complex cases, where the detailed diagnostic precision of nuclear imaging, like PET and SPECT scans, holds immense importance in accurate diagnosis and treatment planning. Additionally, hospitals typically have larger budgets and resources compared to standalone imaging centers, enabling sustained investment and operation of these advanced imaging technologies.

The R&D institute segment is expected to witness a fastest CAGR during the forecast period. R&D institutes act as innovation centers, continuously exploring and enhancing imaging methods and equipment. Their research efforts receive consistent funding from various channels, including government, private, and corporate sources, driving their advancements.

Furthermore, the widening applications of nuclear imaging beyond traditional diagnostics contribute to the expansion of R&D institutes. These centers venture into various fields like drug development, neuroscience, cardiovascular research, and oncology, expanding the utility and importance of nuclear imaging technologies.

Regional Insights

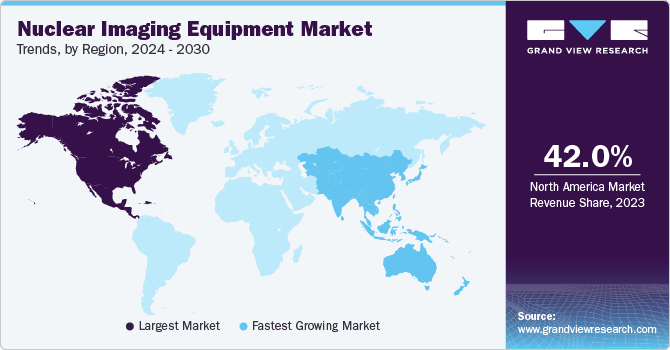

North America dominated the marketand accounted for the largest revenue share of 42.00% in 2023 and is expected to maintain its dominance during the forecast period. Growth in the region can be attributed to the rising elderly population and the increasing prevalence of chronic disorders due to lifestyle changes, resulting in a higher volume of nuclear medicine imaging procedures. Furthermore, the presence of key players in the region undertaking various initiatives to strengthen their presence is expected to contribute to regional growth.

In Asia Pacific, market is projected to exhibit the fastest CAGR over the forecast period. The growing prevalence of cancer coupled with the introduction of advanced nuclear imaging equipment in the region is expected to boost market growth. For instance, according to theInternational Agency for Research on Cancer, by 2025 Asia cancer prevalence is expected to reach 20,606,063 from 9,503,710 in 2020. Furthermore, the improving healthcare infrastructure and growing investments in the healthcare sector is expected to contribute to the adoption of nuclear imaging equipment. Countries in the Asia-Pacific region have been expanding their healthcare facilities, investing in advanced technology, and training healthcare professionals. For instance, in September 2023, Kokilaben Dhirubhai Ambani Hospital, located in India, announced the installation of the Biograph 64, Vision 600 - PET CT scanner. This milestone represents a substantial advancement in combating cancer by enabling early detection of malignancies and other lesions.

Key Nuclear Imaging Equipment Company Insights

Competition among manufacturers of nuclear imaging equipment devices is high owing to the continuous evolution of technology and the increasing demand for advanced diagnostic capabilities in the healthcare sector. Key industry players, including prominent names such as Siemens Healthineers, Koninklijke Philips N.V., Mediso, Canon Medical Systems Corporation and GE HealthCare, engage in intense competition to secure market share and sustain technological leadership.For instance, in January 2024,GE Healthcare entered into a partnership to acquire MIM Software, an international leader in delivering medical imaging analysis and artificial intelligence (AI) solutions across radiation oncology, molecular radiotherapy, diagnostic imaging, and urology. These solutions cater to imaging centers, hospitals, specialty clinics, and research organizations globally. Through this acquisition, GE Healthcare aims to utilize MIM Software's expertise in imaging analytics and digital workflow, applying them across different care domains to expedite innovation. This strategic move is expected to set GE Healthcare apart by enhancing its solutions for the well-being of patients and healthcare systems on a global scale.

Key Nuclear Imaging Equipment Companies:

The following are the leading companies in the nuclear imaging equipment market market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these nuclear imaging equipment companies are analyzed to map the supply network.

- GE HealthCare

- Siemens Healthineers

- Koninklijke Philips N.V.

- Canon Medical Systems Corporation

- Mediso, Cubresa Inc.

- Shimadzu Corporation

- United Imaging Healthcare Co

Recent Developments

-

In May 2023, Koninklijke Philips N.V., Elekta, and Mercurius Health announced a 3-year agreement, under which Philips and Elekta installed the diagnostic & therapeutic oncology equipment and aligned informatics solutions at Mercurius Health’s newly acquired Robert Janker Klinik cancer center in Bonn, Germany

-

In April 2022, Mediso Ltd announced the acquisition of Bartec Technologies Ltd, a UK-based company specializing in the supply, installation, and support of Nuclear Medicine and Molecular Imaging equipment and accessories. This acquisition is expected to strengthen Mediso’s position in the UK and Ireland markets

-

In June 2022, Siemens Healthineers introduced the Symbia Pro.specta, a SPECT/CT system that has received both the CE mark and FDA clearance. This system integrates advanced SPECT and CT imaging technologies. Notable features include a low-dose CT capable of capturing up to 64 slices, offering impressive detail in imaging

-

In November 2022, Canon, Inc. decided to establish an entirely new subsidiary, which would be called Canon Healthcare USA, INC. Canon boosted the development of medical business by expanding its position in the American medical market

Nuclear Imaging Equipment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.57 billion

Revenue forecast in 2030

USD 7.91 billion

Growth rate

CAGR of 3.14 % from 2024 to 2030

Actual period

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Modality, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

GE Healthcare; Siemens Healthineers; Koninklijke Philips N.V.; Canon Medical Systems Corporation; Mediso; Cubresa Inc.; Shimadzu Corporation; United Imaging Healthcare Co

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Nuclear Imaging Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global nuclear imaging equipment market report based on modality, application, end-use, and region:

-

Modality Outlook (Revenue, USD Million, 2018 - 2030)

-

SPECT

-

PET

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiology

-

Oncology

-

Neurology

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Imaging Centers

-

R&D

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global nuclear imaging equipment market size was estimated at USD 6.41 billion in 2023 and is expected to reach USD 6.57 billion in 2024.

b. The global nuclear imaging equipment market is expected to grow at a compound annual growth rate of 3.14% from 2024 to 2030 to reach USD 7.91 billion by 2030.

b. The oncology segment dominated the nuclear imaging equipment market with a share of 49.21% in 2023. This is due to the growing prevalence of cancer worldwide and advanced nuclear imaging technology.

b. Some key players operating in the nuclear imaging equipment market include GE HealthCare, Siemens Healthineers, Koninklijke Philips N.V., Canon Medical Systems Corporation, Mediso, Cubresa Inc., Shimadzu Corporation, United Imaging Healthcare Co.

b. Key factors that are driving the nuclear imaging equipment market growth include increasing prevalence of cancer worldwide, technological advancements, clinical applications, and research, and increasing nuclear medicine imaging procedures.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."