- Home

- »

- Medical Devices

- »

-

Orthopedic Implants Market Size And Share Report, 2030GVR Report cover

![Orthopedic Implants Market Size, Share & Trends Report]()

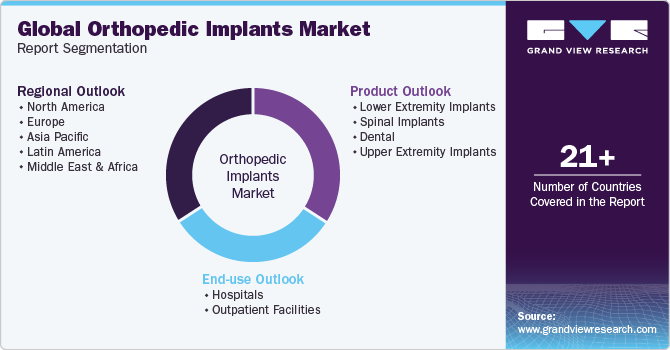

Orthopedic Implants Market Size, Share & Trends Analysis Report By Product (Dental Implants, Spinal Implants), By End-use (Hospitals, Outpatient Facilities, Homecare), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-020-0

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

The global orthopedic implants market size was estimated at USD 35.3 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 6.2% from 2023 to 2030. The growing prevalence of reduced bone density, weakened bones, & musculoskeletal disorders and the rising risk of degenerative bone disorders drive the demand. Moreover, the availability of advanced orthopedic implants and rapid development in healthcare infrastructure globally are anticipated to influence growth positively. Growing awareness and availability of minimally invasive surgical techniques owing to the multiple benefits these surgeries offer is another key driving force responsible for market growth.

In addition, growing participation in sporting & physical activities directly impacts the growing number of sports injuries requiring medical assistance, which is expected to impact market development. However, the availability of alternative medical treatment solutions, such as physical therapy, corticosteroids, NSAIDs, and rehabilitation exercises, is restraining market growth to a certain extent. The demand for minimally invasive procedures is growing as these procedures result in fewer traumas & quicker recovery than invasive ones. As the recovery time is shorter, patients’ hospital stay is reduced, resulting in lower costs associated with surgery & hospital stay.

For instance, in the case of knee replacement surgeries, traditional open surgeries involve making a vertical incision of about 8 to 10 inches to expose the joint. This can be attributed to the increasing sophistication and cost of replacement knees, hips, & other devices and implants used in orthopedic surgeries. Hence, the availability of a wide variety of minimally invasive treatment options and increasing adoption of minimally invasive surgeries drive market growth. The advent of COVID-19 had a significant influence on the demand for these devices on a worldwide scale. The cancellation of surgical treatments, especially bone implantations, had a direct influence on the global demand for implants.

Participants in the business saw a decline in their income from implant sales due to the COVID-19 pandemic. Furthermore, major market competitors are switching from offering expensive implants to a more common type, keeping lower costs. For instance, Conformis went from selling its more personalized versions of these devices during the lockout to selling its cost-effective, lesser-priced bone implants. In addition, few orthopedic healthcare organizations-such as the American Academy of Orthopedic Surgeons (AAOS)-developed stringent guidelines for surgeons to follow to reduce the risk of infection, which had a significant role in the decline in using these devices.

In addition, orthopedic specialists saw a noticeable drop in patient visits during the lockdown. Medical procedures were being postponed, particularly elective ones, to halt the spread of COVID-19. In addition, important producers in the industry reported significant revenue losses during the pandemic due to the lockdowns and disruptions in product distribution. The market is anticipated to witness significant growth owing to factors including the increased risk of osteoporosis and osteoarthritis, the growing geriatric population, the rising number of trauma cases due to traffic accidents and sports injuries, and changing lifestyles.

The increase in the use of orthopedic devices, issues with low bone density, the introduction of biodegradable implants and internal fixation devices, and the increase in the number of patients in their middle age choosing orthopedic implants are other factors driving the market growth. This demand has attracted orthopedic implant developers to develop newer biomaterials and improve the performance of existing materials in terms of corrosion resistance, biocompatibility, and lesser wear.

Product Insights

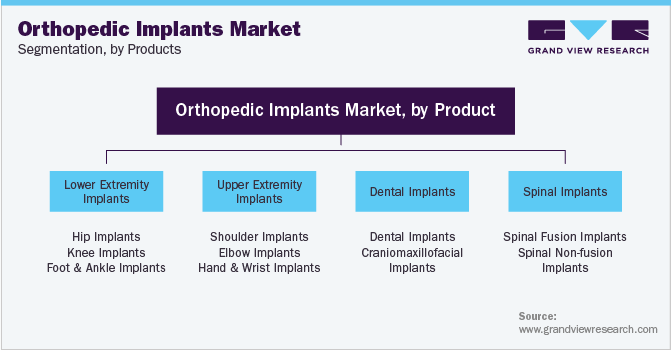

The product type segment includes lower extremity implants, dental implants, spinal implants, and upper extremity implants. The lower extremity implants segment dominated the market and accounted for the largest revenue share of 54.1% in 2022. This can be attributed to the rapidly rising number of knee surgeries, hip replacement surgeries, adoption of unhealthy lifestyles, and increasing prevalence of musculoskeletal & bone degenerative disorders. Furthermore, incorporating online tools for patients who underwent hip surgeries is expected to drive the segment. Patients refer to online and web-based tools to gain information about certain disorders. Several private companies and government institutions are launching apps and websites offering information to people.

Biolox Inside, AAOS Access, OrthoBullets, Insights Orthopedics, and Touch Surgery are some of the applications/websites available. Joint replacement is one such area witnessing the introduction of several online tools that can help patients receive post-surgical information regarding their surgeries and help them communicate with their surgeons. The dental implants segment is anticipated to record the fastest CAGR of 9.8% over the forecast period owing to the increasing incidence of dental injuries arising from accidents, trauma, and sports injuries. These implants serve as restorative treatment solutions, preserving natural bone and providing a secure foundation for a prosthesis.

The orthopedic implant product market is further segmented as follows:

End-use Insights

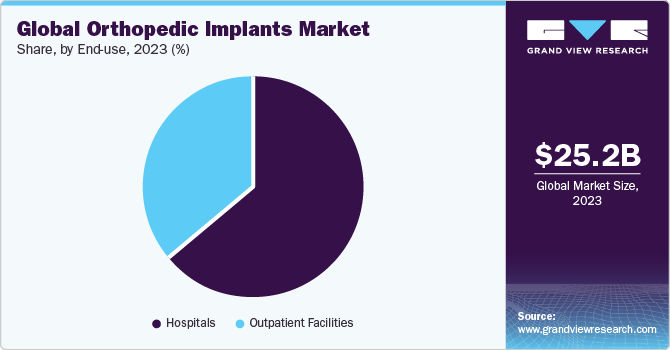

The hospital segment has dominated the market and held the largest revenue share of 54.8% in 2022. Hospitals possess a complete range of healthcare facilities and resources, including advanced surgical equipment, highly specialized medical staff, and intensive care units. These resources enable hospitals to provide various orthopedic services, from routine joint replacements to complex orthopedic surgeries. Moreover, patients often perceive hospitals as trustworthy and secure environments for surgical procedures, enhancing their preference for orthopedic implant surgeries in these settings. In addition, many hospitals have tie-ups with insurance providers, facilitating seamless reimbursement processes for patients.

In addition, orthopedic implant surgeries can require specialized post-operative care, making hospitals the most suitable institutions to offer thorough, round-the-clock medical attention. The outpatient facilities segment is expected to witness the fastest growth rate of 6.5% over the forecast period. These facilities are emerging as the fastest-growing segment in the market, primarily driven by advancements in medical technology and shifting healthcare trends. Outpatient facilities, such as ambulatory surgical centers and outpatient clinics, are gaining popularity due to their cost-effectiveness and convenience.

Patients increasingly prefer outpatient procedures for orthopedic implants, owing to the reduced hospitalization costs and shorter recovery times. In addition, minimally invasive treatments have expanded the scope of outpatient orthopedic surgeries, allowing quicker procedures with fewer complications. Moreover, outpatient facilities often have more streamlined processes, enabling patients to schedule surgeries more flexibly. As healthcare providers continue to invest in these facilities and regulations support outpatient orthopedic surgeries, this segment is expected to experience sustained growth, offering a compelling alternative to traditional hospital-based procedures.

Regional Insights

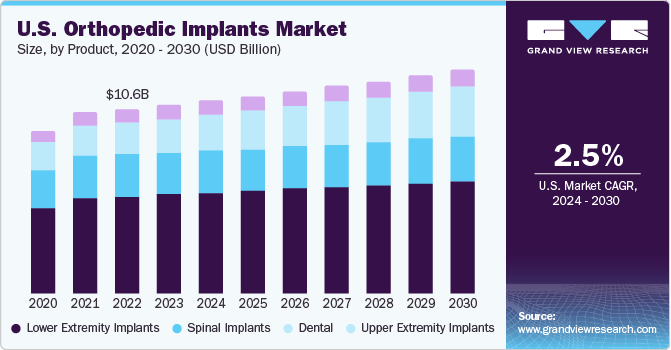

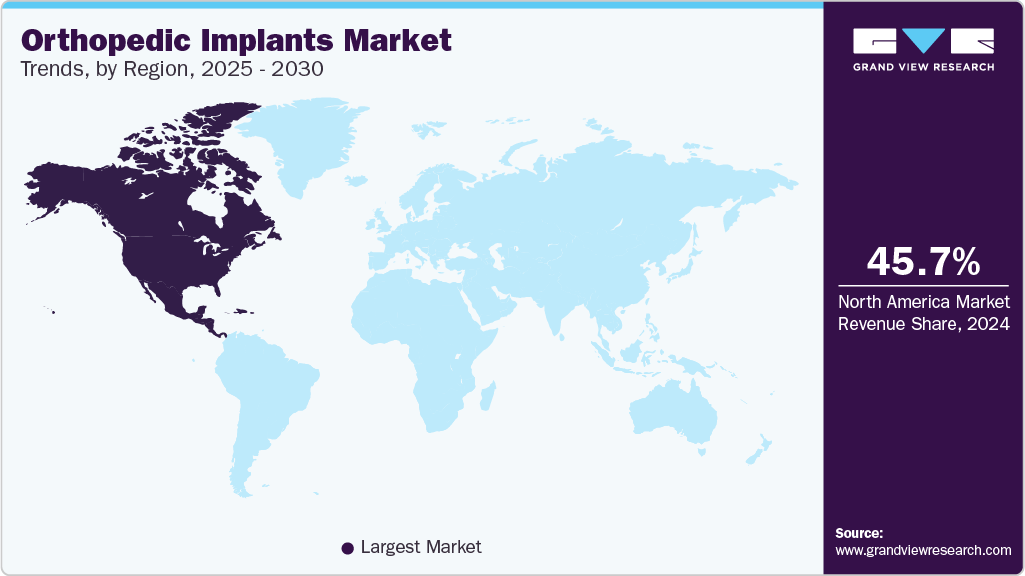

North America accounted for the largest revenue share of 47.9% in 2022 owing to the increasing incidence of osteoporosis and osteoarthritis, growing geriatric population, rising number of trauma cases due to traffic accidents & sports injuries, and changing lifestyles. Moreover, a rise in healthcare expenditure across the globe and an increase in the applications of 3D printing in the healthcare sector support market growth. The regulatory compliance requisites and the high capital investment requirement restrict the entry of new players into the market.

Asia Pacific is anticipated to grow at the fastest rate of 7.7% during the forecast period. The orthopedic industry in the region is expected to grow due to factors, such as greater healthcare spending and a growing older population with a higher incidence of osteoarthritis, osteoporosis, bone injuries, & obesity. The rapidly developing healthcare infrastructure in major countries, such as India, China, & Japan, and the booming medical tourism industry are propelling demand for these devices in the region.

Key Companies & Market Share Insights

The key companies are undertaking strategies, such as new product launches, acquisitions, mergers, collaborations, and partnerships, to maintain a competitive edge. In June 2021, Mathys AG Bettlach, a Swiss company that develops innovative products for synthetic bone graft solutions, sports medicine, and artificial joint replacement, was acquired by DJO. This acquisition enhances the company’s capacity to develop and deliver next-generation orthopedic solutions. In June 2020, a provider of medical technology, Smith+Nephew, introduced the Intellio connected tower solution, a platform for managing and connecting sports medicine systems. Intellio enables wireless connection and control of arthroscopy surgical towers. Some of the key players in the global orthopedic implants market are:

-

Stryker

-

Arthrex, Inc.

-

Smith & Nephew

-

Zimmer Biomet

-

DePuy Synthes, Inc.

Orthopedic Implants Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 37.1 billion

Revenue forecast in 2030

USD 56.5 billion

Growth rate

CAGR of 6.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; Spain; France; Italy; Sweden; Denmark; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Stryker; Arthrex, Inc.; Smith & Nephew; Zimmer Biomet; DePuy Synthes, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Orthopedic Implants Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each sub-segment from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the orthopedic implants market report on the basis of product, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Lower Extremity Implants

-

Hip Implants

-

Knee Implants

-

Foot & Ankle Implants

-

-

Upper Extremity Implants

-

Shoulder Implants

-

Elbow Implants

-

Hand & Wrist Implants

-

-

Dental Implants

-

Dental Implants

-

Craniomaxillofacial Implants

-

-

Spinal Implants

-

Spinal Fusion Implants

-

Spinal Non-fusion Implants

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Outpatient Facilities

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

Spain

-

France

-

Italy

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global orthopedic implants market size was estimated at USD 35.3 billion in 2022 and is expected to reach USD 37.1 billion in 2023.

b. The global orthopedic implants market is expected to grow at a compound annual growth rate of 6.2% from 2023 to 2030 to reach USD 56.5 billion by 2030.

b. Knee dominated the orthopedic implants market with a share of 33.4% in 2022. Factors facilitating the rapid adoption of knee treatments are the rising geriatric population, increased incidences of chronic diseases such as diabetes & obesity, and negative lifestyles. The growing demand has prompted knee implant developers to come up with newer biomaterials and improve the performance of existing materials in terms of corrosion resistance, biocompatibility, and lesser wear.

b. Some key players operating in the orthopedic implants market include Zimmer Biomet Holdings, Inc.; Stryker Corporation; DePuySynthes; Smith & Nephew plc; Wright Medical Group N.V; and Medtronic Plc.

b. Key factors that are driving the market growth include to increasing number of sports-related injuries, growing phenomena of road accidents, and constantly rising geriatric population prone to develop degenerative disc disease, low bone density, and osteoarthritis.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."