- Home

- »

- Communications Infrastructure

- »

-

Point-of-Sale Software Market Size & Share Report, 2030GVR Report cover

![Point-of-Sale Software Market Size, Share & Trends Report]()

Point-of-Sale Software Market Size, Share & Trends Analysis Report By Application (Fixed, Mobile), By Deployment Mode (On-premise, Cloud), By Organization Size (Large, SME), By End-user, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-417-8

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Technology

Report Overview

The global point-of-sale software market size was valued at USD 11.99 billion in 2022 and is estimated to register a compound annual growth rate (CAGR) of 10.8% from 2023 to 2030. The need for point of sale (POS) software has been fueled by the need to conduct cashless transactions, maintain track of sales and inventory data, and improve sales strategy utilizing analytics across retail chains, restaurants, hotels, drug stores, auto shops, and other establishments. Rising demand for advanced features, such as employee management analytics, inventory tracking, sales monitoring, customer data management, and reporting, is expected to boost the adoption of POS software across various industries.

The need for POS systems with enhanced functionality and analytics has surged significantly as a result of the diverse company operating scenarios. These tools assist users in effectively managing business staff, customers, payments, and invoices. These solutions help users efficiently manage their inventory, customer, payment, billing, and employees. The POS software handles numerous business operations, which must be installed on a desktop, laptop, notebook, or tablet with the appropriate operating system. The need for cloud-based mPOS software has increased as a result of the increasing popularity of cloud-based solutions. In addition, the web-based POS solution has been popular among small- and medium-scale stores due to its accessibility from a web browser or the internet.

This is likely to accelerate the growth of the industry over the forecast period. Vendors need to consider certain factors while developing POS software, such as software that should support different operating systems and payment methods, and manage & create a customer database in a structured format. For instance, at present, retailers demand a customizable, affordable POS solution that works with a range of hardware, including PCs, laptops, smartphones, and tablets. As a result, it is anticipated that the software will work with various operating systems, including Windows, Linux, Mac OS, Android, and iOS versions, among others. This would enable businesses to serve a vast consumer base without being hampered by software and hardware compatibility problems.

The primary industry problem is to create POS software that can accommodate the multi-channel demand. For instance, to increase their global reach, businesses in retail, packaged food service, and other sectors have gradually turned to online sales (e-commerce) channels. As a result, there is an increased need for POS software that can be effectively used to manage huge amounts of inventory, make payments more effortless, and streamline other corporate procedures. Furthermore, software feature preference varies across industries, which challenges the vendors to create a different solution for each user. Failure to cater to such demands may hinder their potential to grow in the industry.

Application Insights

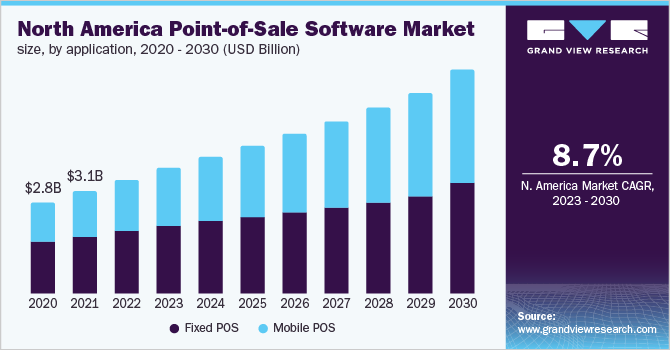

Based on applications, the industry has been segmented into fixed and mobile POS segments. The fixed POS segment dominated the industry in 2022, accounting for over 54.80% of the global revenue share. The segment growth is attributed to the current preference of most retail stores and brick-and-mortar restaurants for a fixed POS solution over mobile POS since they provide more functionality and features. Consumers prefer using a fixed POS system due to the benefit of highly robust management solutions with business functionality, inventory management, a cash drawer, employee time clocks, loyalty programs, and gift card management.

The mobile POS market is projected to grow significantly during the forecast period. The expansion of technology has transformed how people make payments, and the installation of mPOS guarantees speedy payments through applications without the system needing to be connected to a local network. The credit card reader on a smartphone or tablet with apps installed to control the scanner and charging system is being utilized to initiate payments. The market has flourished as a result of the increasing use of mobile POS terminals by small businesses for payment processing as well as for carrying out cutting-edge functions, including inventory management, shop management, and analytics to enhance business operations.

Deployment Mode Insights

On the basis of deployment, the industry has been further categorized into on-premise and cloud. The on-premises segment held the highest share of more than 65.70% in 2022. This can be attributed to the higher adoption of software for on-premise POS systems by large enterprises, which run on the local server over the remote facility. Large enterprises have a huge volume of sensitive customer information prone to data breaches. Hence, the on-premises deployment of software provides more control to the owner of the POS system, thus ensuring better security of crucial data.

Cloud-based deployment has started gaining traction with the advancement in technology. Moreover, the software for mobile POS systems has gained traction owing to the ease of using these small devices for quick payment services. The ease of payment based on monthly charges for availing cloud-based software is another factor allowing its demand to grow among price-conscious end-users. Hence, the cloud deployment mode of software is expected to witness the highest growth rate over the forecast period.

Organization Size Insights

The large enterprise segment dominated the industry in 2022 and accounted for the maximum share of more than 57.35% of the overall revenue. This growth can be attributed to the demand for customized POS software solutions by large enterprises to manage their cash flows and business operations. Such tailor-made POS software is more highly-priced than easily available software. Customized software for a large enterprise has to manage an array of business operations while improving customer engagement. The market for the SME segment is expected to expand at the highest CAGR over the forecast period.

SMEs are readily adopting cloud-based mobile POS software solutions owing to their affordability and scalability. Moreover, small- and medium-sized businesses in large numbers across the globe often expand at the city or state level and prefer budget-friendly POS software solutions based on word-of-mouth by similar business owners. Therefore, the SME user contribution to the industry has been vital in helping POS software vendors expand their presence in the local markets. Vendors targeting local business owners are focusing on small and medium-sized local businesses across the retail, hospitality, healthcare, and other major industries.

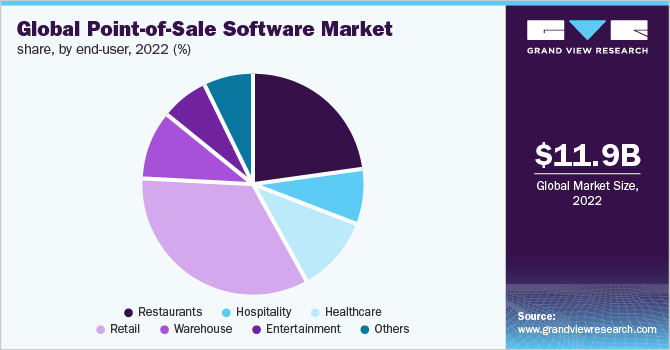

End-user Insights

On the basis of end-user, the industry is segmented into restaurants, hospitality, healthcare, retail, warehouse, entertainment, and others. The retail segment dominated the industry in 2022 and held the largest share of more than 34.35% of the overall revenue. The retail sector is the prime user of POS software. The industry is changing rapidly with the growth of e-commerce and multi-channel retailing and can perform better during the forecast period. The increasing adoption of innovative payment options by small retailers globally has driven the POS software market in the retail sector. Retailers are extensively adopting both mobile as well as cloud-based POS technology, which has created the necessity to integrate mobile and web-based platforms to provide an omnichannel experience to their customers.

The restaurant POS software industry is poised to expand at a healthy growth rate from 2023 to 2030. The restaurant sector is another lucrative segment for POS software vendors. The rising integration of restaurants with online delivery providers is a key feature influencing POS purchases. Online ordering and delivery are expected to drive POS investments in 2022, which will help restaurants avoid costly third-party fees. Data analytics, order management, marketing, and payments in the restaurant industry have created a staggering trajectory and are expected to augment over the forecast year. Also, the tourism industry’s growth positively affected the restaurant business and boosted the demand for the deployment of POS software for better service to travelers.

Regional Insights

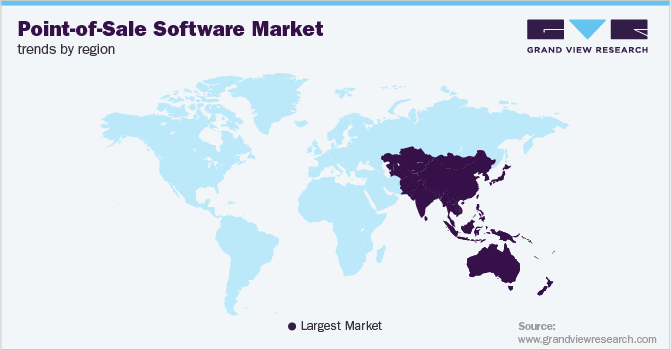

Asia Pacific is expected to progress at the fastest CAGR of 14.1% over the forecast period. A rise in the adoption of POS terminals in the region due to strong growth in the electronic payment industry is expected to boost the POS software market growth. In developing countries, such as China, India, Indonesia, and Vietnam, the demand for cashless payment in retail, restaurant, entertainment, and other industries is accelerating the proliferation of POS software in the region. Moreover, the ever-increasing demand for POS solutions with advanced features among rapidly growing businesses, such as e-commerce retail, the food service industry, and entertainment, is expected to drive market growth over the forecast period. North America accounted for a significant share of the overall revenue in 2022.

The region has the presence of prominent POS software vendors as well as high demand and adoption for advanced integrated POS software. Owing to the need to upgrade hospital facilities connected to payment, insurance, and patient management, the healthcare sector in the U.S. is anticipated to experience the highest growth rate. According to the American Hospital Association (AHA) annual survey for the fiscal year 2018, there were 6,148 hospitals, including the U.S. community and nonfederal long-term care hospitals, which indicates the requirement for cost-effective and robust POS software integrated with insurance payment processing, patient financial services software, reporting, and accounting to provide complete payment processing. Moreover, higher adoption of cashless payments and growth of retail, healthcare, restaurant, and other industries in North America is anticipated to propel the growth of the regional market.

Key Companies & Market Share Insights

The key players focus on providing a differentiated and consistent brand experience, as operators are looking for more functionalities and features from existing systems. There is strong competition in the market owing to the presence of a large number of POS software vendors. POS software vendors have opted for a mix of inorganic and organic growth strategies to increase their market share. For instance, in May 2022, Blaze Solutions, Inc. acquired a Vancouver-originated POS software by offering services to the U.S. and Canada. This acquisition is aimed to serve international clients, while also enabling clients to gain experience in the Canadian and U.S. marketplace. Some of the prominent players in the global point-of-sale software market include:

-

Clover Network, Inc.

-

H&L POS

-

IdealPOS

-

Lightspeed

-

NCR Corp.

-

Oracle Micros

-

Revel Systems

-

SwiftPOS

-

Square Inc.

-

TouchBistro Toast Inc.

Point-of-Sale Software Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 13.49 billion

Revenue forecast in 2030

USD 27.71 billion

Growth rate

CAGR of 10.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, deployment mode, organization size, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country SCOPE

U.S.; Canada; U.K.; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

Clover Network, Inc.; H&L POS; IdealPOS; Lightspeed; NCR Corp.; Oracle Micros; Revel Systems; SwiftPOS; Square Inc.; TouchBistro; Toast Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase 0ptions

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Point-of-Sale Software Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global point-of-sale software market report on the basis of application, deployment mode, organization size, end-user, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Fixed POS

-

Mobile POS

-

-

Deployment Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Organization Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprise

-

Small & Medium Enterprise (SME)

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Restaurants

-

Hospitality

-

Healthcare

-

Retail

-

Warehouse

-

Entertainment

-

Other

-

-

Regional Outlook (Revenue, USD Million 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The retail end-user segment dominated the POS software market with a share exceeding 34.0% in 2022. This is attributable to the rapidly growing multi-channel and e-commerce retailing along with the adoption of mobile POS by small retailers.

b. Some key players operating in the POS software market include Clover Network, Inc; Lightspeed; NCR Corporation; Revel System Inc.; ShopKeep; Square, Inc.; Toast Inc.; and TouchBistro.

b. Key factors that are driving the point-of-sale software market growth include carrying out the cashless transaction, keeping track of sales, inventory records, and improve sales strategy using analytics across retail chains, restaurants, hospitality, drug stores, and automotive shops among others.

b. The global point-of-sale software market size was estimated at USD 11.99 billion in 2022 and is expected to reach USD 13.49 billion in 2023.

b. The global point-of-sale software market is expected to grow at a compound annual growth rate of 10.8% from 2023 to 2030 to reach USD 27.71 billion by 2030.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."