- Home

- »

- Plastics, Polymers & Resins

- »

-

Polyimide Film Market Size & Growth Analysis Report, 2030GVR Report cover

![Polyimide Film Market Size, Share & Trends Report]()

Polyimide Film Market Size, Share & Trends Analysis Report By Application (Flexible Printed Circuit, Wire & Cable, Pressure Sensitive Tape, Specialty Fabricated Product, Motor/Generator), By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-522-9

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Bulk Chemicals

Report Overview

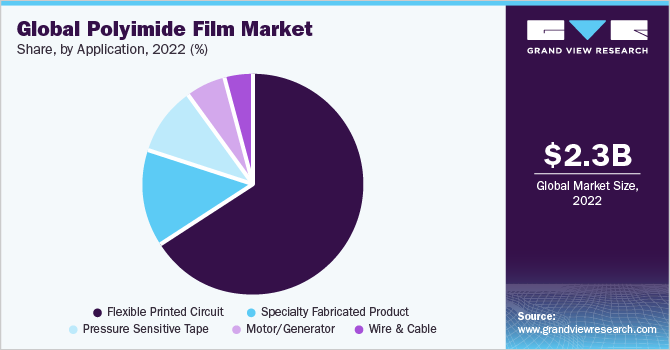

The global polyimide film market size was valued at USD 2.31 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 7.8% from 2023 to 2030. The rise in demand for consumer electronics such as modern computers, LEDs, mobiles, and others is likely to drive the growth of the polyimide films industry over the forecast period. Polyimide films are widely used in aerospace on account of their high heat resistance, electrical insulation, and high strength. It is also utilized by aerospace in certain labeling applications. Primarily these films are applied in wire insulation and for electric motors which operate in harsh temperatures where heat and electricity management is a major concern.

Additionally, polyimide is extensively employed for electrical & electronic applications owing to its superior mechanical strength, thermal stability, and electrically insulating properties. In electronics, wafer carriers and guides, chip trays, test holders, electrical connectors, hard disk drive components, coil bobbins, digital copiers, wire insulators, and printer components are the prime application of polyimide.

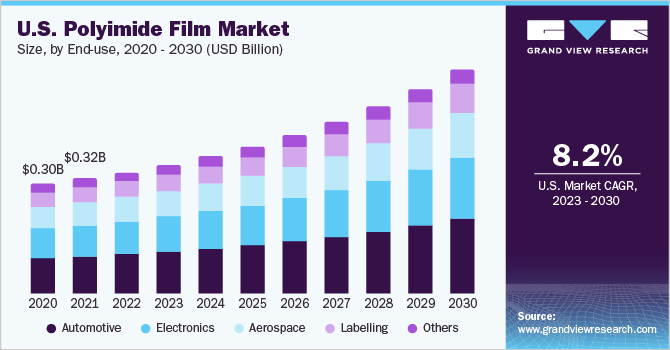

The polyimide films industry in the U.S. is projected to witness significant growth over the coming years owing to the development of electric vehicles, consumer electronics, electrical engines, and aerospace activities. Initiatives by the government to develop the aerospace & defense sector is creating more demand in this region which is further projected to propel the industry growth in the U.S.

The U.S. enjoys several advantages in the evolving field of flexible electronics technology. It has the best and largest system of research universities across the globe, most of which are presently engaged in research and development projects with themes related to flexible electronics. Electronics development in the U.S. The U.S. defense has fostered a high-technology flexible electronics industry for military use and has set up research centers for flexible electronics. However, for flexible electronics, in which government funding appears to be an essential driver in nascent-stage industrial developments, the U.S., seems to be being outspent by European & Asian governments.

Several key market players have into strategic mergers & acquisitions, joint ventures, and new product development to expand their market presence in the global market. In the past few years, the joint venture is an integral part of the polyimide films industry that allows market players to strengthen their market position globally. For instance, in January 2022, according to DuPont, electronics & industrial sector, the expansion project at the Ohio manufacturing facility of the company Interconnect Solutions has been completed. With the USD 250 million investment, DuPont will be better able to meet the growing demand for Pyralux flexible circuit and Kapton polyimide film materials used in defense, specialty industrial, consumer electronics, and automotive applications.

End-use Insights

Automotive dominated the global polyimide film industry and accounted for more than 33.0% of the total market share, in terms of revenue, in 2022. The growing automotive production along with the increasing percentage of electric vehicles continues to propel the demand. Common automotive applications of polyimide films are EGR valve bushings, thrust washers, seat sensor applications, and traction applications. The harsh temperature condition present in the powertrain applications requires materials that can withstand high thermal, mechanical, and electrical loads.

The growing lightweight trends in the automotive industry are pushing manufacturers to include lighter materials in their offerings. Next-generation compact cars (NGCC) which are compact and equipped with powerful engines are developing the demand for products with excellent electromechanical resistance. Polyimide films are projected to witness a higher market share in the automotive segment over the forecast period owing to their excellent properties which are capable of fulfilling the challenging automotive requirements.

Furthermore, these films are heavily used in various other applications including electronics, aerospace, and labeling. Growing flexible electronics create more requirements, which are projected to foster the product growth potential over the coming years. The films provide excellent strength at a relatively lesser dimension. The strong electromechanical properties of the film make it one of the most suitable candidates for the advanced plastics family.

Application Insights

Flexible printed circuits (FPC) dominated the application segment in the global polyimide films market and accounted for more than 66% of the total market share, in terms of revenue, in 2022. Growth in the electronics sector along with growing electrification trends in the automotive sector continues to augment the FPC demand which further attracts polyimide makers to expand their product portfolio for the application segment. Flexible printed circuits are used as connectors in numerous applications where production constraints, space savings, and flexibility restrict the serviceability of the rigid circuit board. These factors are likely to propel the demand for FPC in the polyimide films market.

Additionally, Specialty Fabricated Products (SFP) are an emerging application segment of polyimide films that are projected to gain a higher market share at a healthy growth rate. The growth in demand is primarily attributed to the growing consumer electronics technology which expands the new application scope for the SFPs. SFPs made by polyimide these films have a unique capability to operate at low and high operating temperatures which makes them suitable for numerous niche applications.

Currently, various industries are using SFPs in applications such as speaker coils, barcode labels, diaphragms, gaskets, and spiral-wrapped tuning. Other major application of specialty fabricated products includes nuclear linear accelerator insulation, space blankets, sensors, transportation belts, and aircraft shim stocks. SFPs made by polyimide films maintain electrical and mechanical integrity at a wide temperature range of -270°C to 400°C.

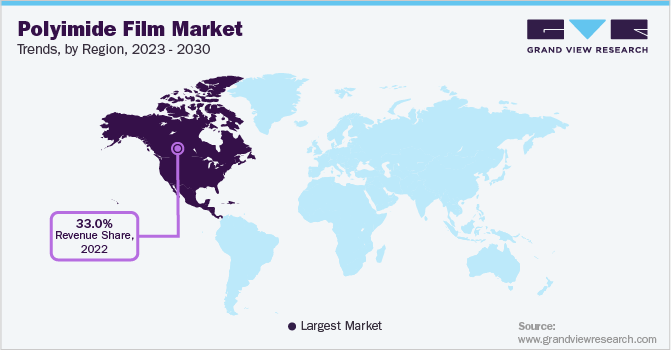

Regional Insights

North America dominated the polyimide film market in 2022 and accounted for more than 33.0% of the overall market revenue share.North America led by U.S., Mexico, and Canada accounted for the dominant market share globally. The market is projected to witness strong growth over the coming years owing to the developed electronics, automotive, and aerospace industries. The presence of top manufacturers in the automotive industry such as Ford, Chrysler, Cadillac, Tesla, and others. In this region and proper infrastructure coupled with high disposable income is expected to drive this market.

Mexico is another lucrative market in North America for automotive and auto components. In the last few years, the country has become a major region for investment through all categories of manufacturers, but mainly from automotive suppliers and automakers. Apart from low wages, the country offers informative workforce training and development programs along with other lucrative development incentives.

Europe accounted for a revenue share of more than 24.0% in 2022 owing to the development of electric vehicles, the presence of an established printing & labeling market, and the presence of numerous major market players. Development in technological services has enabled companies and consumers to track the product. Low data tariff cost is acting as a driver for the tracking technology. Polyimide films ensure a reliable and durable way to track the product by making the labeling at the optimal level. Growth in these sectors is contributing to the development of polyimide films in Europe. Development in printed electronics is a major factor in the rising demand for the product segment in this region.

However, recovering the economic situation in the United Kingdom has fostered the development of several employment opportunities. This, in turn, has driven the perception that a higher degree of energy is required to cater to the growing industrialization. These factors are thus promoting polyimide film market growth owing to its capability of enabling product operation at optimum efficiency with lower energy consumption.

Key Companies & Market Share Insights

The key players operating in the polyimide films industry include DuPont, Kolon Industries, Inc., Compagnie de Saint-Gobain, Taimide Tech. Inc., KANEKA CORPORATION, and others owing to the presence of top regional players. Due to the increasing demand for the production for various applications including flexible printed circuits and specialty fabricated products, key manufacturers are developing new polymers for the production.

The key global companies are expected to develop their polymer offerings to North America, Asia Pacific, the Middle East & Africa, and Central & South America, owing to the market demand in these regions owing to market expansion. Some of the prominent players operating in the global polyimide film market include:

-

DuPont

-

Compagnie de Saint-Gobain

-

Kolon Industries, Inc.

-

KANEKA CORPORATION

-

Taimide Tech. Inc.

-

FLEXcon Company, Inc.

-

Arakawa Chemical Industries Ltd.

-

Anabond

-

Goodfellow

-

I.S.T Corporation

Polyimide Film Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2.43 billion

Revenue forecast in 2030

USD 4.12 billion

Growth rate

CAGR of 7.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, CAGR from 2023 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; China; India; Japan; Brazil; Argentina; GCC Countries; South Africa

Key companies profiled

DuPont; Compagnie de Saint-Gobain; Kolon Industries, Inc.; KANEKA CORPORATION; Taimide Tech. Inc.; FLEXcon Company, Inc.; Arakawa Chemical Industries Ltd.; Anabond, Goodfellow; I.S.T Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polyimide Film Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global polyimide film market report based on application, end-use, and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Flexible Printed Circuit

-

Wire & Cable

-

Pressure Sensitive Tape

-

Specialty Fabricated Product

-

Motor/Generator

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Electronics

-

Aerospace

-

Automotive

-

Labelling

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

GCC Countries

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the polyimide films market include DuPont, Compagnie de Saint-Gobain, Kolon Industries, Inc., KANEKA CORPORATION, Taimide Tech. Inc., FLEXcon Company, Inc., and others.

b. Key factors that are driving the market growth include rising demand for consumer electronics and increasing investment in aerospace & defense sector.

b. The global polyimide film market size was valued at USD 2.31 billion in 2022 and is expected to reach USD 2.43 billion in 2023.

b. The global polyimide film market is expected to grow at a compound annual growth rate of 7.8% from 2023 to 2030 to reach USD 4.12 billion by 2030.

b. The flexible printed circuit segment dominated the polyimide film market with a share of over 66.0% in 2022 due to increasing demand from consumer electronics such as mobile phones, next-generation flexible displays and automobiles.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."