- Home

- »

- Next Generation Technologies

- »

-

Precision Farming Market Size, Share & Growth Report 2030GVR Report cover

![Precision Farming Market Size, Share & Trends Report]()

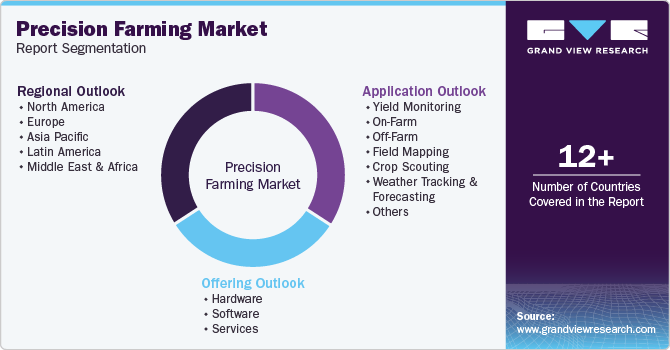

Precision Farming Market Size, Share & Trends Analysis Report By Offering (Hardware, Software, Service), By Application (Yield Monitoring, Field Mapping, Crop Scouting, Irrigation Management), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-376-8

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2017 - 2023

- Industry: Technology

Precision Farming Market Size & Trends

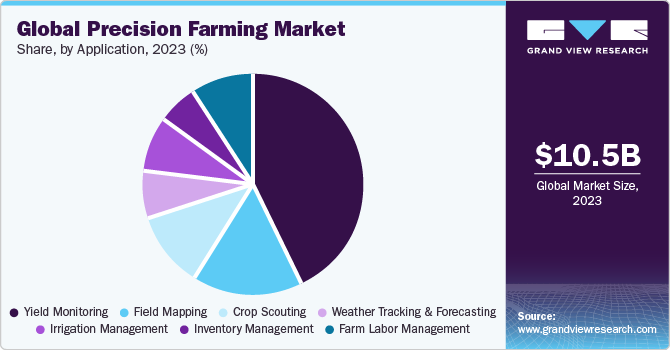

The global precision farming market size was valued at USD 10.50 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 12.8% from 2024 to 2030. The growth of precision farming is attributed to the burgeoning proliferation of the Internet of Things (IoT) along with the use of advanced analytics by farmers. Advanced analytics is a part of data science that uses numerous tools and methods to forecast data and ensure that the crop and soil receive adequate nurturing. This helps farmers to plan their actions accordingly.

For a deep understanding of different farming aspects such as irrigation and plowing, numerous technologies such as IoT, GPS, and remote sensing application control are used. IoT helps farmers address various challenges involved in the proper monitoring of crops. It provides real-time data about environment temperature and water content in the soil through sensors placed on the farm, which assists farmers in making improved decisions about harvesting times, crop market rate, and soil management. This is one of the key factors contributing to the growth of the market for precision farming.

Other factors that facilitate the adoption of sustainable farming technologies include better education and training for farmers, easily accessible information, availability of financial resources, and high demand for organic food. The depletion of natural resources and deterioration of the environment are some of the factors responsible for limiting crop production. Growing environmental concerns are encouraging farmers to shift their focus toward sustainable agriculture practices, such as the preservation of natural resources. This has driven the need for improving crop nutrition and protection, in turn bolstering the market growth.

Technological innovations, such as vertical farming with smart designs to maximize yields and reduce waste, have unfolded numerous growth opportunities. Moreover, increasing investments in technologies such as driverless tractors, guidance systems, and GPS sensing systems are also expected to contribute to the growth of the precision farming market size during the period of study. For instance, numerous sensors such as soil sensors, climate sensors, and water sensors are placed around the fields to help farmers monitor their crops and gain real-time information. Additionally, these sensors also help farmers obtain a high yield with less crop wastage. These sensors are also highly adopted in different applications such as agriculture, pharmaceutical and healthcare, automotive, and sports.

The outbreak of COVID-19 has adversely affected the global market for precision farming with several manufacturing units across China, India, European countries, Japan, and the U.S. temporarily shutting down. This has consequently led to a significant slowdown in the production of precision farming equipment. Lockdowns imposed by the governments in the wake of the coronavirus pandemic affected manufacturing and pegged back the consumer demand for such high capital equipment.

However, the use of farm management software tools and remote sensing could lead to higher adoption post-COVID-19 period. Companies have already begun focusing more on wireless platforms to enable real-time decision-making for crop health monitoring, yield monitoring, irrigation scheduling, field mapping, and harvesting management.

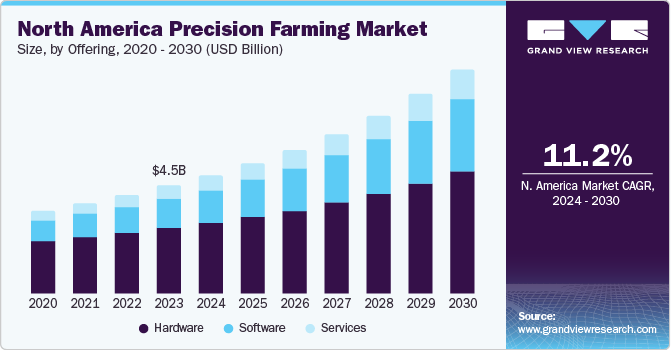

The North America precision farming market emerged as a profitable revenue belt in 2023, owing to the higher adoption of the technologies and devices such as the guidance system, and Variable Rate Technology (VRT) for growing crops. On the other side, smart solutions involve high investments, which act as a drawback for farmers, especially in developing countries such as China, India, and Brazil. The investment in the precision farming market is high, however, in the later run, it offers a notable return on investment as it reduces the overall production cost and increases efficiency.

The COVID-19 pandemic has brought widespread disruption to the global supply chain, resulting in food shortages and inflation. Necessary measures are required to strengthen the food supply chain and prepare for any future crisis. The ongoing pandemic has highlighted the significance of being able to carry out agricultural operations remotely. The ability of smart agricultural practices to help farmers recoup losses in a relatively shorter lead time is expected to drive future market growth.

Market Concentration & Characteristics

The precision farming market growth stage is moderate. The precision farming market is witnessing a significant degree of innovation, marked by the adoption of advanced technologies such as Wi-Fi technology, Zigbee technology, and RF technology and equipment that are integrated with sensors and cameras. The evolving precision farming technological landscape highlights that the market players continue to leverage cutting-edge solutions to address challenges and meet the evolving demands of the farmers.

The target market is also characterized by a high level of partnerships and collaborations by the leading players. This is due to several factors, including the need to enhance their offerings and increase geographical reach.

The target market is also subject to increasing regulatory scrutiny. The precision farming market faces increasing regulatory scrutiny as governments worldwide focus on enhancing transparency, protecting intellectual property, and safeguarding the data and environment. Stricter law implementation measures and evolving legal frameworks are shaping the regulatory landscape, necessitating adaptability and compliance from companies operating in the dynamic agriculture sector.

While there is a restricted availability of direct substitutes for precision farming, alternative methods such as conventional farming can impact the precision farming market. Some farmers may choose to continue with conventional farming methods without integrating extensive technologies. Also, this approach may involve fewer technological investments, which is expected to limit the ability to optimize resource use and maximize efficiency.

Offering Insights

The hardware segment accounted for the largest revenue share of 66.89% in 2023 and is expected to dominate the market during the forecast period. The hardware segment has been further segmented into automation and control systems, sensing devices, antennas, and access points. Hardware components such as automation and control systems, sensing devices, and drones play a major role in helping farmers. For instance, the GIS guidance system is very beneficial for growers as it is capable of visualizing agricultural workflows and the environment. Furthermore, VRT technology helps farmers determine areas that need more pesticides and seeds thereby distributing them equally across the field.

The software segment is fragmented based on web-based and cloud-based precision farming. Cloud computing focuses on shared networks, servers, and storage devices, owing to which the high costs incurred in maintaining hardware and software infrastructure are eliminated. As a result, the software segment is anticipated to register a CAGR of over 15.5% during the forecast period. Predictive analytics software is used to guide farmers about crop rotation, soil management, optimal planting times, and harvesting times.

Application Insights

The yield monitoring segment accounted for the largest revenue share of 43.25% in 2023 and is expected to continue its dominance over the forecast period as it helps the farmers to make decisions about their fields. The segment is further segregated into on-farm yield monitoring and off-farm yield monitoring. On-farm yield monitoring allows farmers to obtain real-time information during harvest and create a historical spatial database. This segment is expected to account for the largest share of the market for precision farming as it offers equitable landlord negotiations, documentation of environmental compliance, and track records for food safety.

The irrigation management segment is expected to witness considerable growth over the projected period. Smart irrigation involves the use of various technologies, such as rain sensors, weather-based controllers, sensor-based controllers, and water meters, to help estimate the right amount of irrigation water. Such benefits are likely to drive the adoption of irrigation drones. The weather tracking and forecasting segment is anticipated to expand at a CAGR of 17.4% during the forecast period. The use of sensors helps weather forecasters to provide accurate weather reading and forecasting. In addition, the introduction of machine learning techniques and advanced data analytics services have increased the reliability and accuracy of weather forecasts thus propelling the growth of the market.

Regional Insights

North America accounted for the largest revenue share of 44.07% in 2023. The region is an early adopter of technologies. Factors such as increasing government initiatives that support the adoption of modern agriculture technologies and developed infrastructure have contributed to the high revenue of the regional market. Furthermore, in May 2022, Government of Canada announced an investment of USD 4,41,917.5 in order to develop an integrated system for precision fruit tree farming. The investment also aimed to achieve sustainable solutions to tackle the uprising challenges in Canada’s apple industry.

Asia Pacific is expected to witness significant growth over the forecasted period. The region is expected to witness a CAGR of over 15.3% from 2024 to 2030. Numerous government initiatives are being undertaken in developing countries such as India, Sri Lanka, and Nigeria to encourage the implementation of modern precision farming technologies, thereby maximizing productivity. China and Israel signed a trade agreement in September 2017 worth USD 300 million to facilitate the export of environment-friendly Israeli technology to China. Moreover, an effective administrative framework is also enabling farmers to gain adequate knowledge of the proper use and maintenance of precision farming equipment.

U.S. Precision Farming Market

The precision farming market in the U.S. is expected to flourish in coming years due to favorable government initiatives. For instance, the National Institute of Food and Agriculture (NIFA)-part of the U.S. Department of Agriculture-conducts geospatial, sensor, and precision technology programs to create awareness among farmers. In partnership with Land-Grand universities, NIFA helps farmers develop robust sensors, associated software, and instrumentation for modeling, observing, and analyzing a wide range of complex biological materials and processes.

U.K. Precision Farming Market

The precision farming market in the U.K. is expected to account for a significant revenue share in the Europe precision farming market. Precision farming in the UK is gaining traction as technology continues to advance and farmers seek more efficient and sustainable agricultural practices. This approach involves the use of various technologies such as GPS, sensors, drones, and data analytics to optimize crop yields, minimize input usage, and reduce environmental impact.

Germany Precision Farming Market

The precision farming market in Germany is expected to account for a significant revenue share in the Europe precision farming market. Farmers in Germany are increasingly adopting precision farming techniques to enhance productivity, reduce costs, and mitigate risks associated with unpredictable weather patterns and soil variability.

France Precision Farming Market

The precision farming market in France is expected to account for a significant revenue share in the Europe precision farming market. Government support and incentives, such as grants for adopting precision farming technologies and subsidies for sustainable farming practices, further encourage uptake among France farmers.

China Precision Farming Market

The precision farming market in China is expected to account for a significant revenue share in the Asia Pacific precision farming market. The precision farming market in China is experiencing significant growth driven by the increasing adoption of advanced agricultural technologies and growing emphasis on sustainable farming practices.

India Precision Farming Market

The precision farming market in India is expected to account for a significant revenue share in the Asia Pacific precision farming market. With a large agricultural sector and rising demand for food security, Indian farmers are turning to precision farming techniques to improve crop yields, optimize resource utilization, and reduce environmental impact.

Japan Precision Farming Market

The precision farming market in India is expected to account for a significant revenue share in the Asia Pacific precision farming market. The integration of artificial intelligence (AI), drones, and big data analytics further enhances the efficiency and effectiveness of precision farming practices in Japan.

Saudi Arabia (KSA) Precision Farming Market

The precision farming market in Saudi Arabia (KSA) is expected to account for a significant revenue share in the Middle East & Africa precision farming market. Increasing investment from technology companies, agricultural cooperatives, and research institutions is fueling the development and adoption of cutting-edge precision farming solutions across Saudi Arabia.

Key Precision Farming Market Company Insights

Some of the key players operating in the market include Ag Leader Technology; AgJunction, Inc.; CropMetrics LLC; Trimble, Inc.; AGCO Corporation; Raven Industries Inc.; Deere and Company; Topcon Corporation; AgEagle Aerial Systems Inc. (Agribotix LLC); DICKEY-john Corporation; Farmers Edge Inc.; Grownetics, Inc.; Proagrica (SST Development Group, Inc.); The Climate Corporation among others.

-

Deere & Company is engaged in the manufacturing & construction of agricultural and forestry machinery; drivetrains and diesel engines for heavy equipment; and lawn care machinery. Additionally, the company also manufactures and provides other heavy manufacturing equipment. The company serves diverse industries such as agriculture, forestry, construction, landscaping & grounds care, engines & drivetrain, government and military, and sports turf.

-

AGCO Corporation is a U.S.-based agriculture equipment manufacturer. The company develops and sells products and solutions such as tractors, combines, foragers, hay tools, self-propelled sprayers, smart farming technologies, seeding equipment, and tillage equipment.

-

Prospera Technologies and Agrible, Inc. are some of the emerging market participants in the target market.

-

Porspera Technologies is a global service provider of agriculture technology for managing and optimizing irrigation and crop health. The company provides AI-based sensors and cameras that aid farmers in crop monitoring.

-

Agrible is a U.S.- based agriculture solution provider. The company helps customers in more than 30 countries optimize water use, crop protection, fertilization, fieldwork, research trials, food supply chains, and sustainability initiatives

Key Precision Farming Companies:

The following are the leading companies in the precision farming market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these precision farming companies are analyzed to map the supply network.

- Ag Leader Technology

- AgJunction, Inc.

- CropMetrics LLC

- Trimble, Inc.,

- AGCO Corporation

- Raven Industries Inc.

- Deere and Company

- Topcon Corporation

- AgEagle Aerial Systems Inc. (Agribotix LLC)

- DICKEY-john Corporation

- Farmers Edge Inc.

- Grownetics, Inc.

- Proagrica (SST Development Group, Inc.)

- The Climate Corporation

Recent Developments

-

In July 2023, Deere & Company, a global agriculture and construction equipment manufacturer announced the acquisition of Smart Apply Inc. an agriculture technology solution provider. Deere & Company is focused on using Smart Apply’s precision spraying solution to assist growers in addressing the challenges related to regulatory requirements, input costs, labor, etc. The acquisition is expected to help the company attract new customers.

-

In April 2023 AGCO Corporation, a global agriculture equipment provider, and Hexagon, an industrial technology solution provider declared their strategic collaboration. The collaboration is focused on the expansion of AGCO’s factory-fit and aftermarket guidance offerings.

-

In May 2023, AgEagle Aerial Systems Inc., a global agriculture technology solution provider announced its establishment of a new supply agreement with Wingtra AG. The 2-year supply agreement is expected to securely supply RedEdge-P sensor kits for incorporation with WingtraOne VTOL drones.

-

In May 2021, AGCO announced a targeted spraying solutions strategic collaboration with Raven Industries Inc., BASF Digital, and Robert Bosch GmbH. The objective of this deal was to assess the targeted spraying technology for enhancing crop protection product applications by limiting crop input costs and addressing environmental sustainability.

Precision Farming Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 10.50 billion

Revenue forecast in 2030

USD 24.09 billion

Growth Rate

CAGR of 12.8% from 2024 to 2030

Actual Data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Offerings, Application and Region

Regional scope

North America, Europe, Asia Pacific, South America, MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Russia; Italy; China; India; Japan; Australia; Singapore; Brazil.

Key companies profiled

Ag Leader Technology; AgJunction, Inc.; CropMetrics LLC; Trimble, Inc.; AGCO Corporation; Raven Industries Inc.; Deere and Company; Topcon Corporation; AgEagle Aerial Systems Inc. (Agribotix LLC); DICKEY-john Corporation; Farmers Edge Inc.; Grownetics, Inc.; Proagrica (SST Development Group, Inc.); The Climate Corporation.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Precision Farming Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global precision farming market report based on offering, application, and region.

-

Offering Outlook (Revenue, USD Million; 2017 - 2030)

-

Hardware

-

Automation & Control Systems

-

Drones

-

Application Control Devices

-

Guidance System

-

GPS

-

GIS

-

-

Remote Sensing

-

Handheld

-

Satellite Sensing

-

-

Driverless Tractors

-

Mobile Devices

-

VRT

-

Map-based

-

Sensor-based

-

-

Wireless Modules

-

Bluetooth Technology

-

Wi-Fi Technology

-

Zigbee Technology

-

RF Technology

-

-

-

Sensing Devices

-

Soil Sensor

-

Nutrient Sensor

-

Moisture Sensor

-

Temperature Sensor

-

-

Water Sensors

-

Climate Sensors

-

Others

-

-

Antennas & Access Points

-

-

Software

-

Web-based

-

Cloud-based

-

-

Services

-

System Integration & Consulting

-

Maintenance & Support

-

Managed Types

-

Data Types

-

Analytics Types

-

Farm Operation Types

-

-

Assisted Professional Types

-

Supply Chain Management Types

-

Climate Information Types

-

-

-

-

Application Outlook (Revenue, USD Million; 2017 - 2030)

-

Yield Monitoring

-

On-Farm

-

Off-Farm

-

-

Field Mapping

-

Crop Scouting

-

Weather Tracking & Forecasting

-

Irrigation Management

-

Inventory Management

-

Farm Labor Management

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Russia

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Singapore

-

-

South America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Frequently Asked Questions About This Report

b. The global precision farming market size was estimated at USD 9.48 billion in 2022 and is expected to reach USD 10.50 billion in 2023.

b. The global precision farming market is expected to grow at a compound annual growth rate of 12.6% from 2023 to 2030 to reach USD 24.09 billion by 2030.

b. North America dominated the precision farming market with a share of 44.58% in 2022. This is attributable to the increasing government initiatives for the adoption of modern agriculture technologies and developed agricultural infrastructure in the region.

b. Some key players operating in the precision farming market include Ag Leader Technology (U.S.); AgJunction, Inc. (U.S.); CropMetrics LLC (U.S.); Trimble, Inc. (U.S.); AGCO Corporation (U.S.); and Raven Industries Inc. (U.S.).

b. Key factors that are driving the precision farming market growth include the increasing proliferation of the Internet of Things (IoT) and the growing use of advanced analytics by farmers.

Table of Contents

Chapter 1. Precision Farming Market: Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Market Definitions

1.3. Research Methodology

1.3.1. Information Procurement

1.3.2. Information or Data Analysis

1.3.3. Market Formulation & Data Visualization

1.3.4. Data Validation & Publishing

1.4. Research Scope and Assumptions

1.4.1. List of Data Sources

Chapter 2. Precision Farming Market: Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. Precision Farming Market: Variables, Trends, & Scope

3.1. Market Introduction/Lineage Outlook

3.2. Industry Value Chain Analysis

3.3. Market Dynamics

3.3.1. Market Drivers Analysis

3.3.2. Market Restraints Analysis

3.3.3. Industry Opportunities

3.3.4. Industry Challenges

3.4. Precision Farming Market Analysis Tools

3.4.1. Porter’s Analysis

3.4.1.1. Bargaining power of the suppliers

3.4.1.2. Bargaining power of the buyers

3.4.1.3. Threats of substitution

3.4.1.4. Threats from new entrants

3.4.1.5. Competitive rivalry

3.4.2. PESTEL Analysis

3.4.2.1. Political landscape

3.4.2.2. Economic and Social landscape

3.4.2.3. Technological landscape

3.4.2.4. Environmental landscape

3.4.2.5. Legal landscape

3.5. Technology Adoption Analysis - Agriculture Sector

3.5.1. Drone

3.5.2. AI

3.5.3. Others

3.6. Cost Analysis- Precision Farming

3.7. Precision Farming- Use Case Analysis

Chapter 4. Precision Farming Market: Offering Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. Precision Farming Market: Offering Movement Analysis, USD Billion, 2023 & 2030

4.3. Hardware

4.3.1. Hardware Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

4.3.1.1. Automation & control systems

4.3.1.2. Automation & Control Systems Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

4.3.1.2.1. Drones

4.3.1.2.2. Drones Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

4.3.1.2.3. Application control devices

4.3.1.2.4. Application control devices Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

4.3.1.2.5. Guidance system

4.3.1.2.6. Guidance system Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

4.3.1.2.6.1. GPS

4.3.1.2.6.2. GPS Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

4.3.1.2.6.3. GIS

4.3.1.2.6.4. GIS Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

4.3.1.2.7. Remote sensing

4.3.1.2.8. Remote sensing Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

4.3.1.2.8.1. Handheld

4.3.1.2.8.2. Handheld Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

4.3.1.2.8.3. Satellite sensing

4.3.1.2.8.4. Satellite sensing Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

4.3.1.2.9. Driverless tractors

4.3.1.2.10. Driverless tractors Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

4.3.1.2.11. Mobile devices

4.3.1.2.12. Mobile devices Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

4.3.1.2.13. VRT

4.3.1.2.14. VRT Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

4.3.1.2.14.1. Map-based

4.3.1.2.14.2. Map-based Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

4.3.1.2.14.3. Sensor-based

4.3.1.2.14.4. Sensor-based Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

4.3.1.2.15. Wireless modules

4.3.1.2.16. Wireless modules Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

4.3.1.2.16.1. Bluetooth technology

4.3.1.2.16.2. Bluetooth technology Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

4.3.1.2.16.3. Wi-Fi technology

4.3.1.2.16.4. Wi-Fi technology Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

4.3.1.2.16.5. Zigbee technology

4.3.1.2.16.6. Zigbee technology Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

4.3.1.2.16.7. RF technology

4.3.1.2.16.8. RF technology Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

4.3.1.3. Sensing devices

4.3.1.4. Sensing devices Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

4.3.1.4.1. Soil sensor

4.3.1.4.2. Soil sensor Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

4.3.1.4.2.1. Soil sensor

4.3.1.4.2.2. Soil sensor Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

4.3.1.4.2.3. Nutrient sensor

4.3.1.4.2.4. Nutrient sensor Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

4.3.1.4.2.5. Moisture sensor

4.3.1.4.2.6. Moisture sensor Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

4.3.1.4.2.7. Temperature sensor

4.3.1.4.2.8. Temperature sensor Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

4.3.1.4.3. Water sensors

4.3.1.4.4. Water sensors Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

4.3.1.4.5. Climate sensors

4.3.1.4.6. Climate sensors Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

4.3.1.4.7. Others

4.3.1.4.8. Others Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

4.3.1.5. Antennas & access points

4.3.1.6. Antennas & access points Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

4.4. Software

4.4.1. Software Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

4.4.1.1. Web-based

4.4.1.2. Web-based Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

4.4.1.3. Cloud-based

4.4.1.4. Cloud-based Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

4.5. Service

4.5.1. Service Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

4.5.1.1. System integration & consulting

4.5.1.2. System integration & consulting Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

4.5.1.3. Maintenance & support

4.5.1.4. Maintenance & support Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

4.5.1.5. Managed types

4.5.1.6. Managed types Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

4.5.1.6.1. Data types

4.5.1.6.2. Data types Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

4.5.1.6.3. Analytics types

4.5.1.6.4. Analytics types Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

4.5.1.6.5. Farm operation types

4.5.1.6.6. Farm operation types Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

4.5.1.7. Assisted professional types

4.5.1.8. Assisted professional types Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

4.5.1.8.1. Supply chain management types

4.5.1.8.2. Supply chain management types Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

4.5.1.8.3. Climate information types

4.5.1.8.4. Climate information types Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

Chapter 5. Precision Farming Market: Application Estimates & Trend Analysis

5.1. Segment Dashboard

5.2. Precision Farming Market: Application Movement Analysis, USD Billion, 2023 & 2030

5.3. Precision farming application

5.3.1. Precision farming application Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

5.3.1.1. Yield monitoring

5.3.1.2. Yield monitoring Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

5.3.1.2.1. On-farm

5.3.1.2.2. On-farm Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

5.3.1.2.3. Off-farm

5.3.1.2.4. Off-farm Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

5.3.1.3. Field mapping

5.3.1.4. Field mapping Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

5.3.1.5. Crop scouting

5.3.1.6. Crop scouting Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

5.3.1.7. Weather tracking & forecasting

5.3.1.8. Weather tracking & forecasting Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

5.3.1.9. Irrigation management

5.3.1.10. Irrigation management Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

5.3.1.11. Inventory management

5.3.1.12. Inventory management Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

5.3.1.13. Farm labor management

5.3.1.14. Farm labor management Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

Chapter 6. Precision Farming Market: Regional Estimates & Trend Analysis

6.1. Precision Farming Market Share, By Region, 2023 & 2030, USD Billion

6.2. North America

6.2.1. North America Precision Farming Market Estimates and Forecasts, 2017 - 2030 (USD Billion)

6.2.2. North America Precision Farming Market Estimates and Forecasts, by Offering, 2017 - 2030 (USD Billion)

6.2.3. North America Precision Farming Market Estimates and Forecasts, By Application, 2017 - 2030 (USD Billion)

6.2.4. U.S.

6.2.4.1. U.S. Precision Farming Market Estimates and Forecasts, 2017 - 2030 (USD Billion)

6.2.4.2. U.S. Precision Farming Market Estimates and Forecasts, by Offering, 2017 - 2030 (USD Billion)

6.2.4.3. U.S. Precision Farming Market Estimates and Forecasts, By Application, 2017 - 2030 (USD Billion)

6.2.5. Canada

6.2.5.1. Canada Precision Farming Market Estimates and Forecasts, 2017 - 2030 (USD Billion)

6.2.5.2. Canada Precision Farming Market Estimates and Forecasts, by Offering, 2017 - 2030 (USD Billion)

6.2.5.3. Canada Precision Farming Market Estimates and Forecasts, By Application, 2017 - 2030 (USD Billion)

6.2.6. Mexico

6.2.6.1. Mexico Precision Farming Market Estimates and Forecasts, 2017 - 2030 (USD Billion)

6.2.6.2. Mexico Precision Farming Market Estimates and Forecasts, by Offering, 2017 - 2030 (USD Billion)

6.2.6.3. Mexico Precision Farming Market Estimates and Forecasts, By Application, 2017 - 2030 (USD Billion)

6.3. Europe

6.3.1. Europe Precision Farming Market Estimates and Forecasts, 2017 - 2030 (USD Billion)

6.3.2. Europe Precision Farming Market Estimates and Forecasts, by Offering, 2017 - 2030 (USD Billion)

6.3.3. Europe Precision Farming Market Estimates and Forecasts, By Application, 2017 - 2030 (USD Billion)

6.3.4. U.K.

6.3.4.1. U.K. Precision Farming Market Estimates and Forecasts, 2017 - 2030 (USD Billion)

6.3.4.2. U.K. Precision Farming Market Estimates and Forecasts, by Offering, 2017 - 2030 (USD Billion)

6.3.4.3. U.K. Precision Farming Market Estimates and Forecasts, By Application, 2017 - 2030 (USD Billion)

6.3.5. Germany

6.3.5.1. Germany Precision Farming Market Estimates and Forecasts, 2017 - 2030 (USD Billion)

6.3.5.2. Germany Precision Farming Market Estimates and Forecasts, by Offering, 2017 - 2030 (USD Billion)

6.3.5.3. Germany Precision Farming Market Estimates and Forecasts, By Application, 2017 - 2030 (USD Billion)

6.3.6. France

6.3.6.1. France Precision Farming Market Estimates and Forecasts, 2017 - 2030 (USD Billion)

6.3.6.2. France Precision Farming Market Estimates and Forecasts, by Offering, 2017 - 2030 (USD Billion)

6.3.6.3. France Precision Farming Market Estimates and Forecasts, By Application, 2017 - 2030 (USD Billion)

6.3.7. Russia

6.3.7.1. Russia Precision Farming Market Estimates and Forecasts, 2017 - 2030 (USD Billion)

6.3.7.2. Russia Precision Farming Market Estimates and Forecasts, by Offering, 2017 - 2030 (USD Billion)

6.3.7.3. Russia Precision Farming Market Estimates and Forecasts, By Application, 2017 - 2030 (USD Billion)

6.3.8. Italy

6.3.8.1. Italy Precision Farming Market Estimates and Forecasts, 2017 - 2030 (USD Billion)

6.3.8.2. Italy Precision Farming Market Estimates and Forecasts, by Offering, 2017 - 2030 (USD Billion)

6.3.8.3. Italy Precision Farming Market Estimates and Forecasts, By Application, 2017 - 2030 (USD Billion)

6.4. Asia Pacific

6.4.1. Asia Pacific Precision Farming Market Estimates and Forecasts, 2017 - 2030 (USD Billion)

6.4.2. Asia Pacific Precision Farming Market Estimates and Forecasts, by Offering, 2017 - 2030 (USD Billion)

6.4.3. Asia Pacific Precision Farming Market Estimates and Forecasts, By Application, 2017 - 2030 (USD Billion)

6.4.4. China

6.4.4.1. China Precision Farming Market Estimates and Forecasts, 2017 - 2030 (USD Billion)

6.4.4.2. China Precision Farming Market Estimates and Forecasts, by Offering, 2017 - 2030 (USD Billion)

6.4.4.3. China Precision Farming Market Estimates and Forecasts, By Application, 2017 - 2030 (USD Billion)

6.4.5. Japan

6.4.5.1. Japan Precision Farming Market Estimates and Forecasts, 2017 - 2030 (USD Billion)

6.4.5.2. Japan Precision Farming Market Estimates and Forecasts, by Offering, 2017 - 2030 (USD Billion)

6.4.5.3. Japan Precision Farming Market Estimates and Forecasts, By Application, 2017 - 2030 (USD Billion)

6.4.6. India

6.4.6.1. India Precision Farming Market Estimates and Forecasts, 2017 - 2030 (USD Billion)

6.4.6.2. India Precision Farming Market Estimates and Forecasts, by Offering, 2017 - 2030 (USD Billion)

6.4.6.3. India Precision Farming Market Estimates and Forecasts, By Application, 2017 - 2030 (USD Billion)

6.4.7. Australia

6.4.7.1. Australia Precision Farming Market Estimates and Forecasts, 2017 - 2030 (USD Billion)

6.4.7.2. Australia Precision Farming Market Estimates and Forecasts, by Offering, 2017 - 2030 (USD Billion)

6.4.7.3. Australia Precision Farming Market Estimates and Forecasts, By Application, 2017 - 2030 (USD Billion)

6.4.8. Singapore

6.4.8.1. Singapore Precision Farming Market Estimates and Forecasts, 2017 - 2030 (USD Billion)

6.4.8.2. Singapore Precision Farming Market Estimates and Forecasts, by Offering, 2017 - 2030 (USD Billion)

6.4.8.3. Singapore Precision Farming Market Estimates and Forecasts, By Application, 2017 - 2030 (USD Billion)

6.5. South America

6.5.1. South America Precision Farming Market Estimates and Forecasts, 2017 - 2030 (USD Billion)

6.5.2. South America Precision Farming Market Estimates and Forecasts, by Offering, 2017 - 2030 (USD Billion)

6.5.3. South America Precision Farming Market Estimates and Forecasts, By Application, 2017 - 2030 (USD Billion)

6.5.4. Brazil

6.5.4.1. Brazil Precision Farming Market Estimates and Forecasts, 2017 - 2030 (USD Billion)

6.5.4.2. Brazil Precision Farming Market Estimates and Forecasts, by Offering, 2017 - 2030 (USD Billion)

6.5.4.3. Brazil Precision Farming Market Estimates and Forecasts, By Application, 2017 - 2030 (USD Billion)

6.6. Middle East and Africa

6.6.1. Middle East and Africa Precision Farming Market Estimates and Forecasts, 2017 - 2030 (USD Billion)

6.6.2. Middle East and Africa Precision Farming Market Estimates and Forecasts, by Offering, 2017 - 2030 (USD Billion)

6.6.3. Middle East and Africa Precision Farming Market Estimates and Forecasts, By Application, 2017 - 2030 (USD Billion)

Chapter 7. Competitive Landscape

7.1. Recent Developments & Impact Analysis by Key Market Participants

7.2. Company Categorization

7.3. Company Market Positioning

7.4. Company Market Share Analysis

7.5. Strategy Mapping

7.5.1. Expansion

7.5.2. Mergers & Acquisition

7.5.3. Partnerships & Collaborations

7.5.4. New Offering Launches

7.5.5. Research And Development

7.6. Company Profiles

7.6.1. Ag Leader Technology

7.6.1.1. Participant’s Overview

7.6.1.2. Financial Performance

7.6.1.3. Offering Benchmarking

7.6.1.4. Recent Developments

7.6.2. AgJunction, Inc.

7.6.2.1. Participant’s Overview

7.6.2.2. Financial Performance

7.6.2.3. Offering Benchmarking

7.6.2.4. Recent Developments

7.6.3. CropMetrics LLC

7.6.3.1. Participant’s Overview

7.6.3.2. Financial Performance

7.6.3.3. Offering Benchmarking

7.6.3.4. Recent Developments

7.6.4. Trimble, Inc.,

7.6.4.1. Participant’s Overview

7.6.4.2. Financial Performance

7.6.4.3. Offering Benchmarking

7.6.4.4. Recent Developments

7.6.5. AGCO Corporation

7.6.5.1. Participant’s Overview

7.6.5.2. Financial Performance

7.6.5.3. Offering Benchmarking

7.6.5.4. Recent Developments

7.6.6. Raven Industries Inc.

7.6.6.1. Participant’s Overview

7.6.6.2. Financial Performance

7.6.6.3. Offering Benchmarking

7.6.6.4. Recent Developments

7.6.7. Deere and Company

7.6.7.1. Participant’s Overview

7.6.7.2. Financial Performance

7.6.7.3. Offering Benchmarking

7.6.7.4. Recent Developments

7.6.8. Topcon Corporation

7.6.8.1. Participant’s Overview

7.6.8.2. Financial Performance

7.6.8.3. Offering Benchmarking

7.6.8.4. Recent Developments

7.6.9. AgEagle Aerial Systems Inc. (Agribotix LLC)

7.6.9.1. Participant’s Overview

7.6.9.2. Financial Performance

7.6.9.3. Offering Benchmarking

7.6.9.4. Recent Developments

7.6.10. DICKEY-john Corporation

7.6.10.1. Participant’s Overview

7.6.10.2. Financial Performance

7.6.10.3. Offering Benchmarking

7.6.10.4. Recent Developments

7.6.11. Farmers Edge Inc.

7.6.11.1. Participant’s Overview

7.6.11.2. Financial Performance

7.6.11.3. Offering Benchmarking

7.6.11.4. Recent Developments

7.6.12. Grownetics, Inc.

7.6.12.1. Participant’s Overview

7.6.12.2. Financial Performance

7.6.12.3. Offering Benchmarking

7.6.12.4. Recent Developments

7.6.13. Proagrica (SST Development Group, Inc.)

7.6.13.1. Participant’s Overview

7.6.13.2. Financial Performance

7.6.13.3. Offering Benchmarking

7.6.13.4. Recent Developments

7.6.14. The Climate Corporation

7.6.14.1. Participant’s Overview

7.6.14.2. Financial Performance

7.6.14.3. Offering Benchmarking

7.6.14.4. Recent Developments

List of Tables

Table 1 List of Abrevation

Table 2 Global Precision Farming Market revenue estimates and forecast, by Offering, 2017 - 2030 (USD Billion)

Table 3 Global Precision Farming Market revenue estimates and forecast, By Application, 2017 - 2030 (USD Billion)

Table 4 Global Precision Farming Market revenue, by Region, 2023 & 2030 (USD Billion)

Table 5 North America Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Table 6 North America Precision Farming Market estimates & forecasts, by offering, 2017 - 2030 (USD Billion)

Table 7 North America Precision Farming Market estimates & forecasts, by application, 2017 - 2030 (USD Billion)

Table 8 U.S. Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Table 9 U.S. Precision Farming Market estimates & forecasts, by offering, 2017 - 2030 (USD Billion)

Table 10 U.S. Precision Farming Market estimates & forecasts, by application, 2017 - 2030 (USD Billion)

Table 11 Canada Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Table 12 Canada Precision Farming Market estimates & forecasts, by offering, 2017 - 2030 (USD Billion)

Table 13 Canada Precision Farming Market estimates & forecasts, by application, 2017 - 2030 (USD Billion)

Table 14 Mexico Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Table 15 Mexico Precision Farming Market estimates & forecasts, by offering, 2017 - 2030 (USD Billion)

Table 16 Mexico Precision Farming Market estimates & forecasts, by application, 2017 - 2030 (USD Billion)

Table 17 Europe Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Table 18 Europe Precision Farming Market estimates & forecasts, by offering, 2017 - 2030 (USD Billion)

Table 19 Europe Precision Farming Market estimates & forecasts, by application, 2017 - 2030 (USD Billion)

Table 20 U.K. Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Table 21 U.K. Precision Farming Market estimates & forecasts, by offering, 2017 - 2030 (USD Billion)

Table 22 U.K. Precision Farming Market estimates & forecasts, by application, 2017 - 2030 (USD Billion)

Table 23 Germany Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Table 24 Germany Precision Farming Market estimates & forecasts, by offering, 2017 - 2030 (USD Billion)

Table 25 Germany Precision Farming Market estimates & forecasts, by application, 2017 - 2030 (USD Billion)

Table 26 France Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Table 27 France Precision Farming Market estimates & forecasts, by offering, 2017 - 2030 (USD Billion)

Table 28 France Precision Farming Market estimates & forecasts, by application, 2017 - 2030 (USD Billion)

Table 29 Russia Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Table 30 Russia Precision Farming Market estimates & forecasts, by offering, 2017 - 2030 (USD Billion)

Table 31 Russia Precision Farming Market estimates & forecasts, by application, 2017 - 2030 (USD Billion)

Table 32 Italy Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Table 33 Italy Precision Farming Market estimates & forecasts, by offering, 2017 - 2030 (USD Billion)

Table 34 Italy Precision Farming Market estimates & forecasts, by application, 2017 - 2030 (USD Billion)

Table 35 Asia Pacific Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Table 36 Asia Pacific Precision Farming Market estimates & forecasts, by offering, 2017 - 2030 (USD Billion)

Table 37 Asia Pacific Precision Farming Market estimates & forecasts, by application, 2017 - 2030 (USD Billion)

Table 38 China Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Table 39 China Precision Farming Market estimates & forecasts, by offering, 2017 - 2030 (USD Billion)

Table 40 China Precision Farming Market estimates & forecasts, by application, 2017 - 2030 (USD Billion)

Table 41 India Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Table 42 India Precision Farming Market estimates & forecasts, by offering, 2017 - 2030 (USD Billion)

Table 43 India Precision Farming Market estimates & forecasts, by application, 2017 - 2030 (USD Billion)

Table 44 Japan Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Table 45 Japan Precision Farming Market estimates & forecasts, by offering, 2017 - 2030 (USD Billion)

Table 46 Japan Precision Farming Market estimates & forecasts, by application, 2017 - 2030 (USD Billion)

Table 47 Australia Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Table 48 Australia Precision Farming Market estimates & forecasts, by offering, 2017 - 2030 (USD Billion)

Table 49 Australia Precision Farming Market estimates & forecasts, by application, 2017 - 2030 (USD Billion)

Table 50 Australia Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Table 51 Australia Precision Farming Market estimates & forecasts, by offering, 2017 - 2030 (USD Billion)

Table 52 Australia Precision Farming Market estimates & forecasts, by application, 2017 - 2030 (USD Billion)

Table 53 Singapore Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Table 54 Singapore Precision Farming Market estimates & forecasts, by offering, 2017 - 2030 (USD Billion)

Table 55 SIngapore Precision Farming Market estimates & forecasts, by application, 2017 - 2030 (USD Billion)

Table 56 South America Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Table 57 South America Precision Farming Market estimates & forecasts, by offering, 2017 - 2030 (USD Billion)

Table 58 South America Precision Farming Market estimates & forecasts, by application, 2017 - 2030 (USD Billion)

Table 59 Brazil Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Table 60 Brazil Precision Farming Market estimates & forecasts, by offering, 2017 - 2030 (USD Billion)

Table 61 Brazil Precision Farming Market estimates & forecasts, by application, 2017 - 2030 (USD Billion)

Table 62 Middle East & Africa Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Table 63 Middle East & Africa Precision Farming Market estimates & forecasts, by offering, 2017 - 2030 (USD Billion)

Table 64 Middle East & Africa Precision Farming Market estimates & forecasts, by application, 2017 - 2030 (USD Billion)

Table 65 Participant’s Overview

Table 66 Financial Performance

Table 67 Offering Benchmarking

Table 68 Key companies undergoing expansion

Table 69 Key companies involved in mergers & acquisitions

Table 70 Key companies undertaking partnerships and collaboration

Table 71 Key companies launching new product/type launches

List of Figures

Fig. 1 Precision Farming Market segmentation

Fig. 2 Information procurement

Fig. 3 Data analysis models

Fig. 4 Market formulation and validation

Fig. 5 Data validating & publishing

Fig. 6 Market snapshot

Fig. 7 Segment snapshot, by Type and Offering

Fig. 8 Segment snapshot By Application

Fig. 9 Competitive landscape snapshot

Fig. 10 Precision Farming Market value, 2017-2030 (USD Billion)

Fig. 11 Precision Farming Market - Industry value chain analysis

Fig. 12 Precision Farming Market - Market trends

Fig. 13 Precision Farming Market: Porter’s analysis

Fig. 14 Precision Farming Market: PESTEL analysis

Fig. 15 Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 16 Precision Farming Market, by Offering: Key takeaways

Fig. 17 Precision Farming Market, by Offering: Market share, 2023 & 2030

Fig. 18 Hardware Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 19 Hardware Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 20 Automation & control systems Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 21 Drones Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 22 Application control devices Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 23 Guidance system Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 24 GPS Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 25 GIS Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 26 Remote sensing Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 27 Handheld Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 28 Satellite sensing Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 29 Driverless tractors Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 30 Mobile devices Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 31 VRT Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 32 Map-based Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 33 Sensor-based Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 34 Wireless modules Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 35 Bluetooth technology Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 36 Wi-Fi technology Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 37 Zigbee technology Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 38 RF technology Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 39 Sensing devices Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 40 Soil sensor Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 41 Nutrient sensor Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 42 Moisture sensor Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 43 Temperature sensor Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 44 Water sensors Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 45 Climate sensors Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 46 Others Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 47 Antennas & access points Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 48 Software Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 49 Web-based Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 50 Cloud-based Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 51 Services Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 52 System integration & consulting Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 53 Maintenance & support Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 54 Managed types Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 55 Data types Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 56 Analytics types Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion) Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 57 Farm operation types Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 58 Assisted professional types Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 59 Supply chain management types Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 60 Climate information types Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 61 Precision Farming Market, By Application: Key takeaways

Fig. 62 Precision Farming Market, By Application: Market share, 2023 & 2030

Fig. 63 Precision farming Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 64 Yield monitoring Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 65 On-farm Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 66 Off-farm Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 67 Field mapping Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 68 Crop scouting Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 69 Weather tracking & forecasting Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 70 Irrigation management Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 71 Inventory management Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 72 Farm labor management Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 73 Global Precision Farming Market revenue, by Region, 2023 & 2030 (USD Billion)

Fig. 74 North America Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 75 U.S. Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 76 Canada Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 77 Mexico Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 78 Europe Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 79 U.K. Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 80 Germany Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 81 France Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 82 Russia Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 83 Italy Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 84 Asia Pacific Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 85 China Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 86 India Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 87 Japan Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 88 Australia Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 89 Singapore Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 90 Brazil Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 91 Middle East & Africa Precision Farming Market estimates & forecasts, 2017 - 2030 (USD Billion)

Fig. 92 Key company categorization

Fig. 93 Precision Farming Market - Key company market share analysis, 2023

Fig. 94 Strategic frameworkWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Precision Farming Offering Outlook (Revenue, USD Billion; 2017 - 2030)

- Hardware

- Automation & Control Systems

- Drones

- Application Control Devices

- Guidance System

- GPS

- GIS

- Remote Sensing

- Handheld

- Satellite Sensing

- Driverless Tractors

- Mobile Devices

- VRT

- Map-based

- Sensor-based

- Wireless Modules

- Bluetooth Technology

- Wi-Fi Technology

- Zigbee Technology

- RF Technology

- Sensing Devices

- Soil Sensor

- Nutrient Sensor

- Moisture Sensor

- Temperature Sensor

- Water Sensors

- Climate Sensors

- Others

- Soil Sensor

- Antennas & Access Points

- Automation & Control Systems

- Software

- Web-based

- Cloud-based

- Services

- System Integration & Consulting

- Maintenance & Support

- Managed Types

- Data Types

- Analytics Types

- Farm Operation Types

- Assisted Professional Types

- Supply Chain Management Types

- Climate Information Types

- Hardware

- Precision Farming Type Outlook (Revenue, USD Billion; 2017 - 2030)

- Precision farming

- Yield monitoring

- On-farm

- Off-farm

- Field mapping

- Crop scouting

- Weather tracking & forecasting

- Irrigation management

- Inventory management

- Farm labor management

- Precision Farming Regional Outlook (Revenue, USD Billion; 2017 - 2030)

- North America

- North America Precision Farming Market by Offering

- Hardware

- Automation & Control Systems

- Drones

- Application Control Devices

- Guidance System

- GPS

- GIS

- Remote Sensing

- Handheld

- Satellite Sensing

- Driverless Tractors

- Mobile Devices

- VRT

- Map-based

- Sensor-based

- Wireless Modules

- Bluetooth Technology

- Wi-Fi Technology

- Zigbee Technology

- RF Technology

- Sensing Devices

- Soil Sensor

- Nutrient Sensor

- Moisture Sensor

- Temperature Sensor

- Water Sensors

- Climate Sensors

- Others

- Soil Sensor

- Antennas & Access Points

- Automation & Control Systems

- Software

- Web-based

- Cloud-based

- Services

- System Integration & Consulting

- Maintenance & Support

- Managed Types

- Data Types

- Analytics Types

- Farm Operation Types

- Assisted Professional Types

- Supply Chain Management Types

- Climate Information Types

- Hardware

- North America Precision Farming Market By Application

- Precision farming

- Yield monitoring

- On-farm

- Off-farm

- Field mapping

- Crop scouting

- Weather tracking & forecasting

- Irrigation management

- Inventory management

- Farm labor management

- U.S.

- U.S. Precision Farming Market by Offering

- Hardware

- Automation & Control Systems

- Drones

- Application Control Devices

- Guidance System

- GPS

- GIS

- Remote Sensing

- Handheld

- Satellite Sensing

- Driverless Tractors

- Mobile Devices

- VRT

- Map-based

- Sensor-based

- Wireless Modules

- Bluetooth Technology

- Wi-Fi Technology

- Zigbee Technology

- RF Technology

- Sensing Devices

- Soil Sensor

- Nutrient Sensor

- Moisture Sensor

- Temperature Sensor

- Water Sensors

- Climate Sensors

- Others

- Soil Sensor

- Antennas & Access Points

- Automation & Control Systems

- Software

- Web-based

- Cloud-based

- Services

- System Integration & Consulting

- Maintenance & Support

- Managed Types

- Data Types

- Analytics Types

- Farm Operation Types

- Assisted Professional Types

- Supply Chain Management Types

- Climate Information Types

- Hardware

- U.S. Precision Farming Market By Application

- Precision farming

- Yield monitoring

- On-farm

- Off-farm

- Field mapping

- Crop scouting

- Weather tracking & forecasting

- Irrigation management

- Inventory management

- Farm labor management

- U.S. Precision Farming Market by Offering

- Canada

- Canada Precision Farming Market by Offering

- Hardware

- Automation & Control Systems

- Drones

- Application Control Devices

- Guidance System

- GPS

- GIS

- Remote Sensing

- Handheld

- Satellite Sensing

- Driverless Tractors

- Mobile Devices

- VRT

- Map-based

- Sensor-based

- Wireless Modules

- Bluetooth Technology

- Wi-Fi Technology

- Zigbee Technology

- RF Technology

- Sensing Devices

- Soil Sensor

- Nutrient Sensor

- Moisture Sensor

- Temperature Sensor

- Water Sensors

- Climate Sensors

- Others

- Soil Sensor

- Antennas & Access Points

- Automation & Control Systems

- Software

- Web-based

- Cloud-based

- Services

- System Integration & Consulting

- Maintenance & Support

- Managed Types

- Data Types

- Analytics Types

- Farm Operation Types

- Assisted Professional Types

- Supply Chain Management Types

- Climate Information Types

- Hardware

- Canada Precision Farming Market By Application

- Precision farming

- Yield monitoring

- On-farm

- Off-farm

- Field mapping

- Crop scouting

- Weather tracking & forecasting

- Irrigation management

- Inventory management

- Farm labor management

- Canada Precision Farming Market by Offering

- Mexico

- Mexico Precision Farming Market by Offering

- Hardware

- Automation & Control Systems

- Drones

- Application Control Devices

- Guidance System

- GPS

- GIS

- Remote Sensing

- Handheld

- Satellite Sensing

- Driverless Tractors

- Mobile Devices

- VRT

- Map-based

- Sensor-based

- Wireless Modules

- Bluetooth Technology

- Wi-Fi Technology

- Zigbee Technology

- RF Technology

- Sensing Devices

- Soil Sensor

- Nutrient Sensor

- Moisture Sensor

- Temperature Sensor

- Water Sensors

- Climate Sensors

- Others

- Soil Sensor

- Antennas & Access Points

- Automation & Control Systems

- Software

- Web-based

- Cloud-based

- Services

- System Integration & Consulting

- Maintenance & Support

- Managed Types

- Data Types

- Analytics Types

- Farm Operation Types

- Assisted Professional Types

- Supply Chain Management Types

- Climate Information Types

- Hardware

- Mexico Precision Farming Market By Application

- Precision farming

- Yield monitoring

- On-farm

- Off-farm

- Field mapping

- Crop scouting

- Weather tracking & forecasting

- Irrigation management

- Inventory management

- Farm labor management

- Mexico Precision Farming Market by Offering

- North America Precision Farming Market by Offering

- Europe

- Europe Precision Farming Market by Offering

- Hardware

- Automation & Control Systems

- Drones

- Application Control Devices

- Guidance System

- GPS

- GIS

- Remote Sensing

- Handheld

- Satellite Sensing

- Driverless Tractors

- Mobile Devices

- VRT

- Map-based

- Sensor-based

- Wireless Modules

- Bluetooth Technology

- Wi-Fi Technology

- Zigbee Technology

- RF Technology

- Sensing Devices

- Soil Sensor

- Nutrient Sensor

- Moisture Sensor

- Temperature Sensor

- Water Sensors

- Climate Sensors

- Others

- Soil Sensor

- Antennas & Access Points

- Automation & Control Systems

- Software

- Web-based

- Cloud-based

- Services

- System Integration & Consulting

- Maintenance & Support

- Managed Types

- Data Types

- Analytics Types

- Farm Operation Types

- Assisted Professional Types

- Supply Chain Management Types

- Climate Information Types

- Hardware

- Europe Precision Farming Market By Application

- Precision farming

- Yield monitoring

- On-farm

- Off-farm

- Field mapping

- Crop scouting

- Weather tracking & forecasting

- Irrigation management

- Inventory management

- Farm labor management

- U.K.

- U.K. Precision Farming Market by Offering

- Hardware

- Automation & Control Systems

- Drones

- Application Control Devices

- Guidance System

- GPS

- GIS

- Remote Sensing

- Handheld

- Satellite Sensing

- Driverless Tractors

- Mobile Devices

- VRT

- Map-based

- Sensor-based

- Wireless Modules

- Bluetooth Technology

- Wi-Fi Technology

- Zigbee Technology

- RF Technology

- Sensing Devices

- Soil Sensor

- Nutrient Sensor

- Moisture Sensor

- Temperature Sensor

- Water Sensors

- Climate Sensors

- Others

- Soil Sensor

- Antennas & Access Points

- Automation & Control Systems

- Software

- Web-based

- Cloud-based

- Services

- System Integration & Consulting

- Maintenance & Support

- Managed Types

- Data Types

- Analytics Types

- Farm Operation Types

- Assisted Professional Types

- Supply Chain Management Types

- Climate Information Types

- Hardware

- U.K. Precision Farming Market By Application

- Precision farming

- Yield monitoring

- On-farm

- Off-farm

- Field mapping

- Crop scouting

- Weather tracking & forecasting

- Irrigation management

- Inventory management

- Farm labor management

- U.K. Precision Farming Market by Offering

- Germany

- Germany Precision Farming Market by Offering

- Hardware

- Automation & Control Systems

- Drones

- Application Control Devices

- Guidance System

- GPS

- GIS

- Remote Sensing

- Handheld

- Satellite Sensing

- Driverless Tractors

- Mobile Devices

- VRT

- Map-based

- Sensor-based

- Wireless Modules

- Bluetooth Technology

- Wi-Fi Technology

- Zigbee Technology

- RF Technology

- Sensing Devices

- Soil Sensor

- Nutrient Sensor

- Moisture Sensor

- Temperature Sensor

- Water Sensors

- Climate Sensors

- Others

- Soil Sensor

- Antennas & Access Points

- Automation & Control Systems

- Software

- Web-based

- Cloud-based

- Services

- System Integration & Consulting

- Maintenance & Support

- Managed Types

- Data Types

- Analytics Types

- Farm Operation Types

- Assisted Professional Types

- Supply Chain Management Types

- Climate Information Types

- Hardware

- Germany Precision Farming Market By Application

- Precision farming

- Yield monitoring

- On-farm

- Off-farm

- Field mapping

- Crop scouting

- Weather tracking & forecasting

- Irrigation management

- Inventory management

- Farm labor management

- Germany Precision Farming Market by Offering

- France

- France Precision Farming Market by Offering

- Hardware

- Automation & Control Systems

- Drones

- Application Control Devices

- Guidance System

- GPS

- GIS

- Remote Sensing

- Handheld

- Satellite Sensing

- Driverless Tractors

- Mobile Devices

- VRT

- Map-based

- Sensor-based

- Wireless Modules

- Bluetooth Technology

- Wi-Fi Technology

- Zigbee Technology

- RF Technology

- Sensing Devices

- Soil Sensor

- Nutrient Sensor

- Moisture Sensor

- Temperature Sensor

- Water Sensors

- Climate Sensors

- Others

- Soil Sensor

- Antennas & Access Points

- Automation & Control Systems

- Software

- Web-based

- Cloud-based

- Services

- System Integration & Consulting

- Maintenance & Support

- Managed Types

- Data Types

- Analytics Types

- Farm Operation Types

- Assisted Professional Types

- Supply Chain Management Types

- Climate Information Types

- Hardware

- France Precision Farming Market By Application

- Precision farming

- Yield monitoring

- On-farm

- Off-farm

- Field mapping

- Crop scouting

- Weather tracking & forecasting

- Irrigation management

- Inventory management

- Farm labor management

- France Precision Farming Market by Offering

- Russia

- Russia Precision Farming Market by Offering

- Hardware

- Automation & Control Systems

- Drones

- Application Control Devices

- Guidance System

- GPS

- GIS

- Remote Sensing

- Handheld

- Satellite Sensing

- Driverless Tractors

- Mobile Devices

- VRT

- Map-based

- Sensor-based

- Wireless Modules

- Bluetooth Technology

- Wi-Fi Technology

- Zigbee Technology

- RF Technology

- Sensing Devices

- Soil Sensor

- Nutrient Sensor

- Moisture Sensor

- Temperature Sensor

- Water Sensors

- Climate Sensors

- Others

- Soil Sensor

- Antennas & Access Points

- Automation & Control Systems

- Software

- Web-based

- Cloud-based

- Services

- System Integration & Consulting

- Maintenance & Support

- Managed Types

- Data Types

- Analytics Types

- Farm Operation Types

- Assisted Professional Types

- Supply Chain Management Types

- Climate Information Types

- Hardware

- Russia Precision Farming Market By Application

- Precision farming

- Yield monitoring

- On-farm

- Off-farm

- Field mapping

- Crop scouting

- Weather tracking & forecasting

- Irrigation management

- Inventory management

- Farm labor management

- Russia Precision Farming Market by Offering

- Italy

- Italy Precision Farming Market by Offering

- Hardware

- Automation & Control Systems

- Drones

- Application Control Devices

- Guidance System

- GPS

- GIS

- Remote Sensing

- Handheld

- Satellite Sensing

- Driverless Tractors

- Mobile Devices

- VRT

- Map-based

- Sensor-based

- Wireless Modules

- Bluetooth Technology

- Wi-Fi Technology

- Zigbee Technology

- RF Technology

- Sensing Devices

- Soil Sensor

- Nutrient Sensor

- Moisture Sensor

- Temperature Sensor

- Water Sensors

- Climate Sensors

- Others

- Soil Sensor

- Antennas & Access Points

- Automation & Control Systems

- Software

- Web-based

- Cloud-based

- Services

- System Integration & Consulting

- Maintenance & Support

- Managed Types

- Data Types

- Analytics Types

- Farm Operation Types

- Assisted Professional Types

- Supply Chain Management Types

- Climate Information Types

- Hardware

- Italy Precision Farming Market By Application

- Precision farming

- Yield monitoring

- On-farm

- Off-farm

- Field mapping

- Crop scouting

- Weather tracking & forecasting

- Irrigation management

- Inventory management

- Farm labor management

- Italy Precision Farming Market by Offering

- Europe Precision Farming Market by Offering

- Asia Pacific

- Asia Pacific Precision Farming Market by Offering

- Hardware

- Automation & Control Systems

- Drones

- Application Control Devices

- Guidance System

- GPS

- GIS

- Remote Sensing

- Handheld

- Satellite Sensing

- Driverless Tractors

- Mobile Devices

- VRT

- Map-based

- Sensor-based

- Wireless Modules

- Bluetooth Technology

- Wi-Fi Technology

- Zigbee Technology

- RF Technology

- Sensing Devices

- Soil Sensor

- Nutrient Sensor

- Moisture Sensor

- Temperature Sensor

- Water Sensors

- Climate Sensors

- Others

- Soil Sensor

- Antennas & Access Points

- Automation & Control Systems

- Software

- Web-based

- Cloud-based

- Services

- System Integration & Consulting

- Maintenance & Support

- Managed Types

- Data Types

- Analytics Types

- Farm Operation Types

- Assisted Professional Types

- Supply Chain Management Types

- Climate Information Types

- Hardware

- Asia Pacific Precision Farming Market By Application

- Precision farming

- Yield monitoring

- On-farm

- Off-farm

- Field mapping

- Crop scouting

- Weather tracking & forecasting

- Irrigation management

- Inventory management

- Farm labor management

- China

- China Precision Farming Market by Offering

- Hardware

- Automation & Control Systems

- Drones

- Application Control Devices

- Guidance System

- GPS

- GIS

- Remote Sensing

- Handheld

- Satellite Sensing

- Driverless Tractors

- Mobile Devices

- VRT

- Map-based

- Sensor-based

- Wireless Modules

- Bluetooth Technology

- Wi-Fi Technology

- Zigbee Technology

- RF Technology

- Sensing Devices

- Soil Sensor

- Nutrient Sensor

- Moisture Sensor

- Temperature Sensor

- Water Sensors

- Climate Sensors

- Others

- Soil Sensor

- Antennas & Access Points

- Automation & Control Systems

- Software

- Web-based

- Cloud-based

- Services

- System Integration & Consulting

- Maintenance & Support

- Managed Types

- Data Types

- Analytics Types

- Farm Operation Types

- Assisted Professional Types

- Supply Chain Management Types

- Climate Information Types

- Hardware

- China Precision Farming Market By Application

- Precision farming

- Yield monitoring

- On-farm

- Off-farm

- Field mapping

- Crop scouting

- Weather tracking & forecasting

- Irrigation management

- Inventory management

- Farm labor management

- China Precision Farming Market by Offering

- Japan

- Japan Precision Farming Market by Offering

- Hardware

- Automation & Control Systems

- Drones

- Application Control Devices

- Guidance System

- GPS

- GIS

- Remote Sensing

- Handheld

- Satellite Sensing

- Driverless Tractors

- Mobile Devices

- VRT

- Map-based

- Sensor-based

- Wireless Modules

- Bluetooth Technology

- Wi-Fi Technology

- Zigbee Technology

- RF Technology

- Sensing Devices

- Soil Sensor

- Nutrient Sensor

- Moisture Sensor

- Temperature Sensor

- Water Sensors

- Climate Sensors

- Others

- Soil Sensor

- Antennas & Access Points

- Automation & Control Systems

- Software

- Web-based

- Cloud-based

- Services

- System Integration & Consulting

- Maintenance & Support

- Managed Types

- Data Types

- Analytics Types

- Farm Operation Types

- Assisted Professional Types

- Supply Chain Management Types

- Climate Information Types

- Hardware

- Japan Precision Farming Market By Application

- Precision farming

- Yield monitoring

- On-farm

- Off-farm

- Field mapping

- Crop scouting