- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Protein Supplements Market Size And Share Report, 2030GVR Report cover

![Protein Supplements Market Size, Share & Trends Report]()

Protein Supplements Market Size, Share & Trends Analysis Report By Product (Protein Powders, Protein Bars), By Distribution Channel (Supermarkets, Online), By Application, By Source, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-694-3

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Consumer Goods

Report Overview

The global protein supplements market size was valued at USD 5.83 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 8.0% from 2023 to 2030. The key growth driving factors include the shift toward novel plant-protein sources and increased demand for supplements that aid in faster muscle recovery. A rising number of consumers globally are seeking sustainable, animal-free, and non-GMO sources of protein. For instance, the U.S. has witnessed significant growth in the consumption of plant-based meat, driving the demand for plant-based protein ingredients.

Cereal proteins and oilseed-based proteins are being used in new formulations by several manufacturers. Increasing government support for the plant-based protein industry is also contributing to market growth in North America. For instance, the Government of Canada is focused on commercializing new plant-based ingredients for food, livestock feed, and aquaculture industries. In June 2020, the Canadian Prime Minister announced a USD 100 million grant to an animal protein alternative company, Merit Functional Foods. The funds will be utilized by the company to set up its production plant in Canada.

Furthermore, the application of proteins has increased in the sports nutrition and dietary supplements markets due to the growing demand for fortified ingredients, plant-based protein sources, and products with high stability and longer shelf life. Production methods influence the quality of protein ingredients and the end products, such as protein bars, protein powders, and beverages.

Certain proteins, such as wheat gluten and hemp, are associated with a starchy, bitter, and distinct aroma. The market is undergoing major improvements in manufacturing methods to address this issue and remove tetrahydrocannabinol (THC) from hemp seeds. Applied Food Sciences has improved the method of extracting protein from hemp seeds by including an additional step. Removing the outer shell of the hemp seed results in an ingredient free of the bitter and pungent flavor associated with hemp.

Furthermore, microencapsulation technologies are gaining prominence in the protein supplements industry. Manufacturers use these techniques to achieve the controlled release of an ingredient in the human body. Microencapsulation of active compounds like minerals, vitamins, proteins, and omega-3s protects these compounds from oxidation reactions and loss of nutrients. Spray drying is among the most widely used techniques for encapsulating bioactive food ingredients such as fats, proteins, enzymes, and vitamins.

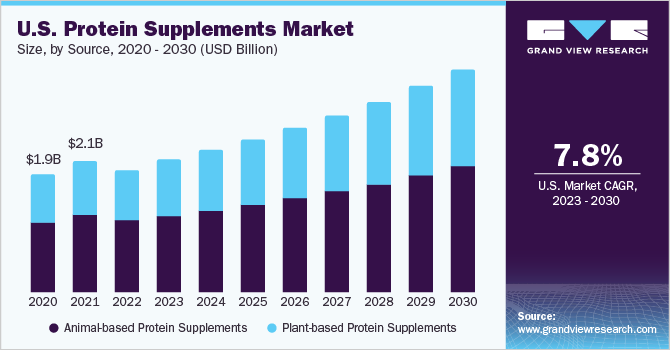

Source Insights

In terms of source, the animal-based segment held the largest revenue share of 61.1% in 2022. Whey, casein, collagen, and egg are key sources of animal proteins. The demand for animal-based protein supplements is likely to witness significant growth over the next few years owing to their many nutritional benefits. Animal sources have a higher protein concentration and are, therefore, preferred for manufacturing supplements.

The rising demand for high-value proteins is likely to drive market growth. According to Food Innovation Australia, global protein consumption grew by 40% between 2000 and 2018, mainly due to the growing population. Primary demand for animal proteins is expected to originate from regions such as Asia and Sub-Saharan Africa.

Furthermore, innovations by casein producers are likely to support the incorporation of casein in protein supplements. For instance, in February 2021, Lactalis Ingredients launched Pronativ Native Micellar Casein, which is minimally processed with high amino acid content. This casein has a high protein density and supports bone health. According to the company, Pronativ casein is ideal for protein supplements meant for older people and the young population that has been following the healthy aging trend.

The plant-based protein segment is expected to showcase the fastest CAGR of 8.8% during the forecast period. The rising consumer awareness regarding a healthy lifestyle is driving a shift toward new protein sources. Despite the high demand for animal-based proteins, several consumers are switching to a vegan diet owing to concerns regarding animal welfare and the meat industry’s impact on the environment.

As more consumers turn to plant-based proteins, soy protein supplements have showcased immense growth potential. The United Soybean Board (USB) Soy Protein and Flexitarian Study conducted in May 2021 showed that 65% of respondents in the U.S. were more open to eating plant-based foods, with the highest interest among consumers in the age group 18-50.

Moreover, 40% of young adults actively seek to incorporate plant-based proteins into their diet, compared to only 25% of consumers seeking animal protein. According to the same survey, soy was the most preferred plant-based protein ingredient. This presents an opportunity for soy protein supplement manufacturers to capitalize on growing consumer interest and the latest trends in plant-based protein sources such as soy.

Further, the rising usage of wheat and rice in protein supplements is also favoring the growth of the segment.Ingredient manufacturers are launching innovative products in the wheat protein supplements industry and are expanding their reach through business expansions and mergers. For instance, in February 2022, PureField Ingredients, a U.S.-based wheat protein provider, completed the expansion of its facility in Kansas. The increase in capacity will help the company meet the rising demand for wheat protein-based products.

Product Insights

The protein powder segment held the largest share of 56.1% in terms of revenue in 2022. The increasing consciousness toward health has driven the trend of incorporating protein powders into daily diets for weight management, muscle gain, and overall health and wellness. In addition, there is growing product demand from elite athletes, bodybuilders, and casual exercisers. Plant-based protein powders are also gaining popularity, driven by the increasing number of consumers opting for vegan or vegetarian diets.

Many companies are investing in research and development activities to offer innovative protein powder products that cater to consumers’ specific needs and preferences. For instance, the availability of protein powders that are plant-based, lactose-free, or specifically designed for women or athletes has increased in recent years.

In October 2022, Tata Consumer Products (TCP), which consolidates the food and beverage businesses of the Tata Group, expanded into the health supplements segment by introducing ‘Tata GoFit,’ a health supplement range designed specifically for health-conscious women. One of the products in the range is the Tata GoFit plant-protein powder that is simple to mix and contains probiotics beneficial for gut health. The powder is also free from lactose, soy, and added sugar.

As the market for protein powders grows, competition among manufacturers will increase, leading to a reduction in product prices, making them more accessible and affordable for a broader range of consumers. Strong online sales and mass distribution channels by companies such as The Nature's Bounty Co., Glanbia, and Iovate Health Sciences International Inc. have also increased the availability of protein powders.

In terms of end-user, the ready-to-drink (RTD) segment showcased the fastest growth and is projected to grow with a CAGR of 8.5% during the forecast period. The increasing demand for sports nutritional supplements and the growing popularity of easily consumable and readily available protein supplements are expected to drive the demand for RTD protein supplements over the forecast period.

In March 2022, MusclePharm Corporation, a global leader in sports nutrition products, announced its plan to expand in the RTD protein category by launching a new line of whey protein drinks in the summer of 2022. This high-protein beverage line was marketed under the well-established MusclePharm brand, offering more than 20g of protein per serving in various flavors.

Application Insights

The functional food segment held a market share of 35.3% in terms of revenue in 2022. Increasing awareness regarding leading a healthy and active lifestyle, coupled with a growing understanding of the relationship between exercising and maintaining a balanced and nutrient-rich diet, is driving the demand for protein-rich functional foods and beverages.

Functional foods are primarily consumed to ensure the intake of nutritional constituents essential for the human body. Rising occurrences of cardiovascular diseases owing to inactive and slow lifestyles and fluctuating dietary patterns, especially between the ages of 30 and 40, have driven consumer awareness regarding the importance of omega-3-based nutraceutical products, boosting their adoption.

The sports nutrition segment is anticipated to grow at the fastest CAGR of 8.2% during the forecast period. The increasing demand for sports nutritional supplements for core strength and endurance among athletes, weekend warriors, fitness enthusiasts, and professional athletes is expected to drive the segment. In addition, an increase in the number of gym-goers and rising demand for sports nutritional supplements to promote lean muscle growth, improve performance, assist in weight reduction, and boost stamina are expected to propel the segment growth.

Whey proteins exhibit prebiotic, antimicrobial, antioxidant, and hypertensive properties. In sports nutrition, protein supplements are used to manufacture various products such as low-pH clear beverages, nutritional beverages, RTD protein shakes, and dry mix beverages. All grades of whey proteins including concentrates, isolates, and hydrolysates have an excellent digestibility and amino acid profile. However, since hydrolyzed whey proteins are more expensive than their counterparts, most whey supplement manufacturers add a very small quantity of this ingredient to their respective formulas.

Distribution Channel Insights

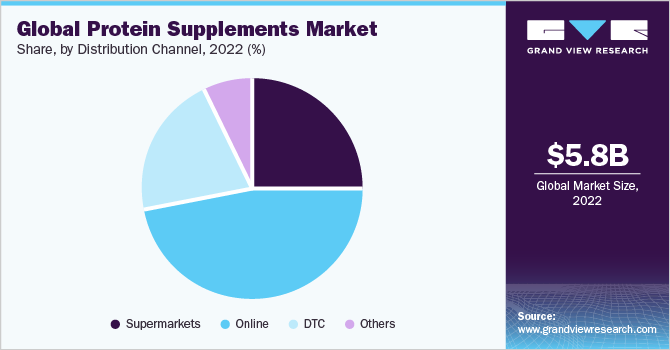

The online stores segment held the largest share of 60.4% in terms of revenue in 2022. The sales of protein supplements through the online distribution channel are expected to witness the highest growth in the coming years. Increased number of internet users, ease of access to numerous brands, fast-paced consumer lifestyle, 24/7 availability of products, convenience of shopping, and a wide range of products offered are factors driving the sales of protein supplements through online distribution channels.

The benefits to customers, including comparison in price range and the availability of numerous brands with customer reviews for the products, further drive the sales of supplements through this channel. Moreover, the presence of different discussion portals, discounts and offers, easy payment options, and various promotion strategies are projected to fuel the online sales of protein supplements over the forecast period.

The supermarket segment is anticipated to grow at the fastest CAGR of 8.3% during the forecast period. Supermarkets and hypermarkets conduct detailed consumer sentiment analyses to understand customer preferences for products and brands. This allows them to offer products that are most preferred by consumers and charge a premium price if customers are willing to pay for them.

Supermarkets are easily accessible and provide a convenient shopping experience for customers. They offer a variety of protein supplement options under one roof, making it convenient for customers to compare and choose the products that best meet their needs. Customers tend to trust established brands, and supermarkets and hypermarkets offer a wide selection of reputable brands in the protein supplements industry. This builds customer confidence in the products being sold and can lead to repeat purchases.

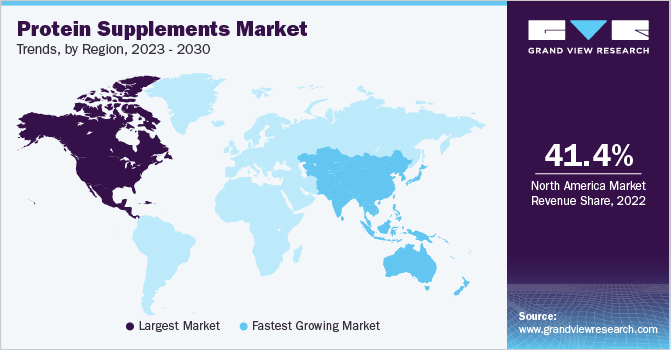

Regional Insights

The North America region held the dominant revenue share of 41.4% in 2022. The increasing interest of young and adult consumers in health and wellness trends is driving growth in the protein supplements industry. Consumers are becoming more conscious of their health and are willing to invest in products that can help them maintain or improve their overall well-being. As a result, the protein supplements industry is expected to continue growing in North America in the years to come. The high prevalence of lifestyle diseases, such as diabetes and obesity, is driving demand for products that can help manage these conditions. Protein supplements are often recommended as part of a healthy diet for individuals with these conditions.

Furthermore, the U.S. protein supplements industry is expected to showcase a significant CAGR of 7.8% over the forecast period. The increasing obesity rate in the U.S. has contributed to the growth of the protein supplement industry. With the rising awareness of the importance of a healthy diet and regular exercise, the trend of fitness has become increasingly popular in recent years.

The Asia Pacific protein supplement market is expected to grow at the fastest CAGR of 8.8% from 2023 to 2030. The demand for protein supplements in Asia Pacific has been steadily increasing over the years. This can be attributed to several factors, such as the rising interest in health and fitness, growing awareness about the importance of protein intake, and the increasing prevalence of lifestyle diseases. The Asia Pacific region has a large and diverse population, with a significant portion being vegetarian or vegan. This has led to a higher demand for plant-based protein supplements such as soy protein, pea protein, and rice protein. These supplements are popular among consumers with dietary restrictions and among those who prefer plant-based options.

The Europe region is expected to witness a CAGR of 7.3% over the forecast period. The Europe market is expected to showcase reasonable growth over the forecast period owing to various factors, such as increasing emphasis on healthy living, growing trend of preventive health care, and rising demand for protein supplements from countries such as the UK and Germany.

Key Companies & Market Share Insights

The global protein supplements industry is characterized by intense competition, mainly attributed to several players operating in the market. Various companies operating in the market are presenting innovative products to cater to consumer demand. For example, in October 2022, Optimum Nutrition, a sports nutrition brand of Glanbia, launched a new plant-based protein powder called Gold Standard 100% Plant Protein. The formula is made with 100% vegan ingredients and contains 24 grams of protein to support fitness activities. The launch is in response to the growing trend of plant-based alternatives in the market. Some prominent market players in the global protein supplements market include:

-

Glanbia Plc

-

MusclePharm

-

Abbott

-

CytoSport Inc.

-

QuestNutrition LLC

-

Iovate Health Sciences International Inc

-

The Bountiful Company

-

AMCO Proteins

-

Now Foods

-

Transparent Labs

-

WOODBOLT DISTRIBUTION LLC

-

Dymatize Enterprises LLC

-

BPI Sports

-

Jym-Supplement-Science

-

RSP Nutrition

-

International Dehydrated Foods, Inc

-

BRF

-

Rousselot

-

Gelita AG

-

Hoogwegt

Protein Supplements Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 6.34 billion

Revenue forecast in 2030

USD 10.8 billion

Growth rate

CAGR of 8.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

August 2023

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, product, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Spain; Italy; China; India; Japan; Brazil; UAE

Key companies profiled

Glanbia Plc; MusclePharm; Abbott; CytoSport Inc.; QuestNutrition LLC; Iovate Health Sciences International Inc; The Bountiful Company; AMCO Proteins; Now Foods; Transparent Labs; WOODBOLT DISTRIBUTION LLC; Dymatize Enterprises LLC; BPI Sports; Jym-Supplement-Science; RSP Nutrition; International Dehydrated Foods Inc; BRF; Rousselot; Gelita AG; Hoogwegt

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Protein Supplements Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global protein supplements market report based on source, product, application, distribution channel, and region:

-

Source Outlook (Revenue, USD Million, 2017 - 2030)

-

Animal-based Protein Supplements

-

Whey

-

Casein

-

Egg

-

Fish

-

Others

-

-

Plant-based Protein Supplements

-

Soy

-

Spirulina

-

Pumpkin Seeds

-

Wheat

-

Hemp

-

Rice

-

Pea

-

Others

-

-

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Protein Powders

-

Protein Bars

-

RTD

-

Others

-

-

Application Outlook (Revenue, USD Million; 2017 - 2030)

-

Sports Nutrition

-

Functional Foods

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Supermarkets

-

Online

-

DTC

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global protein supplements market size was estimated at USD 5.83 billion in 2022 and is expected to reach USD 6.34 billion in 2023.

b. The global protein supplements market is expected to grow at a compound annual growth rate of 8.0% from 2023 to 2030 to reach USD 10.80 billion by 2030.

b. Sports Nutrition application accounted for 76.3% of revenue share in 2022. Growing demand for nutritional products from athletes, sports enthusiasts, and professional bodybuilders is expected to drive the segment growth.

b. Some of the major players in the protein supplements market include Glanbia Plc, MusclePharm, Abbott, CytoSport Inc., QuestNutrition LLC, Iovate Health Sciences International Inc, The Bountiful Company, AMCO Proteins, Now Foods, among others

b. The rising popularity of plant-based diets coupled with popularity of clean label ingredients among all age groups is supporting the demand for the market.

Table of Contents

Chapter 1. Protein Supplements Market: Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Market Definitions

1.3. Information Procurement

1.4. Information analysis

1.4.1. Market formulation & data visualization

1.4.2. Data validation & publishing

1.5. Research Scope and Assumptions

1.6. List of Data Sources

Chapter 2. Protein Supplements Market: Executive Summary

Chapter 3. Protein Supplements Market: Industry Outlook

3.1. Market Lineage Outlook

3.2. Producer Pricing Analysis

3.3. Average Pricing Analysis

3.4. Protein Supplements Market

3.4.1. Industry Value Chain Analysis

3.4.2. Market Dynamics

3.4.2.1. Market driver analysis

3.4.2.2. Market restraint analysis

3.4.2.3. Market opportunity analysis

3.4.3. Market Analysis Tools

3.4.3.1. Industry Analysis - Porter’s Five Forces Analysis

3.4.3.2. PESTEL Analysis

3.5. Protein Supplements Market

3.5.1. Industry Value Chain Analysis

3.5.2. Market Dynamics

3.5.2.1. Market driver analysis

3.5.2.2. Market restraint analysis

3.5.2.3. Market opportunity analysis

3.5.3. Market Analysis Tools

3.5.3.1. Industry Analysis - Porter’s Five Forces Analysis

3.5.3.2. PESTEL Analysis

Chapter 4. Global Protein Supplements Market: Product Outlook

4.1. Source Movement Analysis & Market Share, 2022 & 2030 (USD Million)

4.2. Protein Supplements Market Estimates & Forecast, by Source (USD Million)

4.2.1. Animal-Based Protein Supplements

4.2.1.1. Whey

4.2.1.2. Casein

4.2.1.3. Egg

4.2.1.4. Fish

4.2.1.5. Others

4.2.2. Plant-Based Protein Supplements

4.2.2.1. Soy

4.2.2.2. Spirulina

4.2.2.3. Pumpkin Seed

4.2.2.4. Wheat

4.2.2.5. Hemp

4.2.2.6. Rice

4.2.2.7. Pea

4.2.2.8. Others

Chapter 5. Global Protein Supplements Market: Product Outlook

5.1. Product Movement Analysis & Market Share, 2022 & 2030 (USD Million)

5.2. Protein Supplements Market Estimates & Forecast, by Product (USD Million)

5.2.1. Protein Powders

5.2.2. Protein Bars

5.2.3. RTD

5.2.4. Others

Chapter 6. Global Protein Supplements Market: Application Outlook

6.1. Application Movement Analysis & Market Share, 2022 & 2030 (USD Million)

6.2. Global Protein Supplements Market Estimates & Forecast, by Application (USD Million)

6.2.1. Sports Nutrition

6.2.2. Functional Foods

Chapter 7. Global Protein Supplements Market: Distribution Channel Outlook

7.1. Distribution Channel Movement Analysis & Market Share, 2022 & 2030 (USD Million)

7.2. Global Protein Supplements Market Estimates & Forecast, by Distribution Channel (USD Million)

7.2.1. Supermarkets

7.2.2. Online

7.2.3. DTC

7.2.4. Others

Chapter 8. Protein Supplements Market: Regional Outlook

8.1. Protein Supplements Market Share by Region, 2022 & 2030 (USD Million)

8.2. North America

8.2.1. North America Protein Supplements Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.2.2. U.S.

8.2.2.1. U.S. Protein Supplements Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.2.3. Canada

8.2.3.1. Canada Protein Supplements Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.2.4. Mexico

8.2.4.1. Mexico Protein Supplements Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.3. Europe

8.3.1. Europe Protein Supplements Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.3.2. Germany

8.3.2.1. Germany Protein Supplements Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.3.3. UK

8.3.3.1. UK Protein Supplements Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.3.4. France

8.3.4.1. France Protein Supplements Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.3.5. Italy

8.3.5.1. Italy Protein Supplements Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.3.6. Spain

8.3.6.1. Spain Protein Supplements Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.4. Asia Pacific

8.4.1. Asia Pacific Protein Supplements Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.4.2. China

8.4.2.1. China Protein Supplements Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.4.3. India

8.4.3.1. India Protein Supplements Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.4.4. Japan

8.4.4.1. Japan Protein Supplements Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.4.5. Australia

8.4.5.1. Australia Protein Supplements Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.5. Central & South America

8.5.1. Central & South America Protein Supplements Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.5.2. Brazil

8.5.2.1. Brazil Protein Supplements Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.6. Middle East & Africa

8.6.1. Middle East & Africa Protein Supplements Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.6.2. UAE

8.6.2.1. Saudi Arabia Mushroom Market Estimates and Forecasts, 2017 - 2030 (USD Million)

Chapter 9. Competitive Landscape

9.1. Company Categorization

9.2. Participant’s Overview

9.2.1. Glanbia Plc

9.2.2. Muscle Pharm

9.2.3. Abbott

9.2.4. CytoSport, Inc.

9.2.5. Quest Nutrition LLC

9.2.6. Iovate Health Sciences International Inc.

9.2.7. The Bountiful Company

9.2.8. AMCO Proteins

9.2.9. NOW Foods

9.2.10. Transparent Labs

9.2.11. WOODBOLT DISTRIBUTION LLC

9.2.12. Dymatize Enterprises LLC

9.2.13. BPI Sports

9.2.14. Jym-Supplement-Science

9.2.15. RSP Nutrition

9.2.16. International Dehydrated Foods Inc.

9.2.17. BRF

9.2.18. Rousselot

9.2.19. GELITA AG

9.2.20. Hoogwegt

9.3. Financial Performance

9.4. Product Benchmarking

9.5. Company Market Positioning

9.6. Company Market Share Analysis, 2022

9.7. Company Heat Map Analysis

9.8. Strategy Mapping

List of Tables

Table 1 Global Protein Supplements Market Estimates and Forecasts, By Source, 2017 - 2030 (USD Million)

Table 2 Global Protein Supplements Market Estimates and Forecasts, By Product, 2017 - 2030 (USD Million)

Table 3 Global Protein Supplements Market Estimates and Forecasts, By Application, 2017 - 2030 (USD Million)

Table 4 Global Protein Supplements Market Estimates and Forecasts, By Distribution Channel, 2017 - 2030 (USD Million)

Table 5 Company Market Share, 2022

List of Figures

Fig. 1 Information procurement

Fig. 2 Primary research pattern

Fig. 3 Primary research process

Fig. 4 Primary research approaches

Fig. 5 Protein Supplements market: Market snapshot

Fig. 6 Protein Supplements market: Segment outlook

Fig. 7 Protein Supplements market: Competitive outlook

Fig. 8 Protein Supplements market: Value chain analysis

Fig. 9 Protein Supplements market: Porter’s analysis

Fig. 10 Protein Supplements market: PESTEL analysis

Fig. 11 Protein Supplements market, by source: Key takeaways

Fig. 12 Protein Supplements market, by source: Market share, 2022 & 2030

Fig. 13 Animal-based Protein Supplements market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 14 Whey market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 15 Casein market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 16 Egg market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 17 Fish market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 18 Others market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 19 Plant-based Protein Supplements market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 20 Soy market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 21 Spirulina market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 22 Pumpkin Seeds market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 23 Wheat market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 24 Hemp market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 25 Rice market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 26 Pea market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 27 Others market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 28 Protein Supplements market, by product: Key takeaways

Fig. 29 Protein Supplements market, by product: Market share, 2022 & 2030

Fig. 30 Protein powders market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 31 Protein bars market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 32 RTD market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 33 Others market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 34 Protein Supplements market, by application: Key takeaways

Fig. 35 Protein Supplements market, by application: Market share, 2022 & 2030

Fig. 36 Sports nutrition market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 37 Functional foods market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 38 Protein Supplements market, by distribution channel: Key takeaways

Fig. 39 Protein Supplements market, by distribution channel: Market share, 2022 & 2030

Fig. 40 Supermarkets market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 41 Online market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 42 DTC market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 43 Others market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 44 North America market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 45 U.S. market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 46 Canada market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 47 Mexico market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 48 Europe market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 49 Germany market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 50 UK market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 51 France market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 52 Italy market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 53 Spain market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 54 Asia Pacific market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 55 China market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 56 Japan market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 57 Australia market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 58 India market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 59 Central & South America market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 60 Brazil market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 61 Middle East & Africa market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 62 UAE market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 63 Protein Supplements market: Key Company/Competition categorization

Fig. 64 Protein Supplements market: Company market share analysis (public companies)

Fig. 65 Company market position analysisWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Protein Supplements Source Outlook (Revenue, USD Million, 2017 - 2030)

- Animal-based Protein Supplements

- Whey

- Casein

- Egg

- Fish

- Others

- Plant-based Protein Supplements

- Soy

- Spirulina

- Pumpkin Seed

- Wheat

- Hemp

- Rice

- Pea

- Others

- Animal-based Protein Supplements

- Protein Supplements Product Outlook (Revenue, USD Million, 2017 - 2030)

- Protein Powders

- Protein Bars

- RTD

- Others

- Protein Supplements Application Outlook (Revenue, USD Million, 2017 - 2030)

- Sports Nutrition

- Functional Foods

- Protein Supplements Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

- Supermarkets

- Online

- DTC

- Others

- Protein Supplements Regional Outlook (Revenue, USD Million; 2017 - 2030)

- North America

- North America Protein Supplements Market, by Source

- Animal-based Protein Supplements

- Whey

- Casein

- Egg

- Fish

- Others

- Plant-Based Protein Supplements

- Soy

- Spirulina

- Pumpkin Seed

- Wheat

- Hemp

- Rice

- Pea

- Others

- Animal-based Protein Supplements

- North America Protein Supplements, By Product

- Protein Powders

- Protein Bars

- RTD

- Others

- North America Protein Supplements Market, by Application

- Sports Nutrition

- Functional Foods

- North America Protein Supplements Market, by Distribution Channel

- Supermarkets

- Online

- DTC

- Others

- U.S.

- U.S. Protein Supplements Market, by Source

- Animal-based Protein Supplements

- Whey

- Casein

- Egg

- Fish

- Others

- Plant-Based Protein Supplements

- Soy

- Spirulina

- Pumpkin Seed

- Wheat

- Hemp

- Rice

- Peas

- Others

- Animal-based Protein Supplements

- U.S. Protein Supplements Market, by Product

- Protein Powder

- Protein Bars

- RTD

- Others

- U.S. Protein Supplements Market, by Application

- Sports Nutrition

- Functional Foods

- U.S. Protein Supplements Market, by Distribution Channel

- Supermarkets

- Online

- DTC

- Others

- U.S. Protein Supplements Market, by Source

- Canada

- Canada Protein Supplements Market, by Source

- Animal-based Protein Supplements

- Whey

- Casein

- Egg

- Fish

- Others

- Plant-based Protein Supplements

- Soy

- Spirulina

- Pumpkin Seed

- Wheat

- Hemp

- Rice

- Peas

- Others

- Animal-based Protein Supplements

- Canada Protein Supplements Market, by Product

- Protein Powder

- Protein Bars

- RTD

- Others

- Canada Protein Supplements Market, by Application

- Sports Nutrition

- Functional Foods

- Canada Protein Supplements Market, by Distribution Channel

- Supermarkets

- Online

- DTC

- Others

- Canada Protein Supplements Market, by Source

- Mexico

- Mexico Protein Supplements Market, by Source

- Animal-based Protein Supplements

- Whey

- Casein

- Egg

- Fish

- Others

- Plant-based Protein Supplements

- Soy

- Spirulina

- Pumpkin Seed

- Wheat

- Hemp

- Rice

- Peas

- Others

- Animal-based Protein Supplements

- Mexico Protein Supplements Market, by Product

- Protein Powder

- Protein Bars

- RTD

- Others

- Mexico Protein Supplements Market, by Application

- Sports Nutrition

- Functional Foods

- Mexico Protein Supplements Market, by Distribution Channel

- Supermarkets

- Online

- DTC

- Others

- Mexico Protein Supplements Market, by Source

- North America Protein Supplements Market, by Source

- Europe

- Europe Protein Supplements Market, by Source

- Animal-based Protein Supplements

- Whey

- Casein

- Egg

- Fish

- Others

- Plant-based Protein Supplements

- Soy

- Spirulina

- Pumpkin Seed

- Wheat

- Hemp

- Rice

- Pea

- Others

- Animal-based Protein Supplements

- Europe Protein Supplements, By Product

- Protein Powders

- Protein Bars

- RTD

- Others

- Europe Protein Supplements Market, by Application

- Sports Nutrition

- Functional Foods

- Europe Protein Supplements Market, by Distribution Channel

- Supermarkets

- Online

- DTC

- Others

- Germany

- Germany Protein Supplements Market, by Source.

- Animal-based Protein Supplements

- Whey

- Casein

- Egg

- Fish

- Others

- Plant-based Protein Supplements

- Soy

- Spirulina

- Pumpkin Seed

- Wheat

- Hemp

- Rice

- Peas

- Others

- Animal-based Protein Supplements

- Germany Protein Supplements Market, by Product

- Protein Powder

- Protein Bars

- RTD

- Others

- Germany Protein Supplements Market, by Application

- Sports Nutrition

- Functional Foods

- Germany Protein Supplements Market, by Distribution Channel

- Supermarkets

- Online

- DTC

- Others

- Germany Protein Supplements Market, by Source.

- UK

- UK Protein Supplements Market, by Source

- Animal-based Protein Supplements

- Whey

- Casein

- Egg

- Fish

- Others

- Plant-based Protein Supplements

- Soy

- Spirulina

- Pumpkin Seed

- Wheat

- Hemp

- Rice

- Peas

- Others

- Animal-based Protein Supplements

- UK Protein Supplements Market, by Product

- Protein Powder

- Protein Bars

- RTD

- Others

- UK Protein Supplements Market, by Application

- Sports Nutrition

- Functional Foods

- UK Protein Supplements Market, by Distribution Channel

- Supermarkets

- Online

- DTC

- Others

- UK Protein Supplements Market, by Source

- France

- France Protein Supplements Market, by Source

- Animal-based Protein Supplements

- Whey

- Casein

- Egg

- Fish

- Others

- Plant-based Protein Supplements

- Soy

- Spirulina

- Pumpkin Seed

- Wheat

- Hemp

- Rice

- Peas

- Others

- Animal-based Protein Supplements

- France Protein Supplements Market, by Product

- Protein Powder

- Protein Bars

- RTD

- Others

- France Protein Supplements Market, by Application

- Sports Nutrition

- Functional Foods

- France Protein Supplements Market, by Distribution Channel

- Supermarkets

- Online

- DTC

- Others

- France Protein Supplements Market, by Source

- Italy

- Italy Protein Supplements Market, by Source

- Animal-based Protein Supplements

- Whey

- Casein

- Egg

- Fish

- Others

- Plant-based Protein Supplements

- Soy

- Spirulina

- Pumpkin Seed

- Wheat

- Hemp

- Rice

- Peas

- Others

- Animal-based Protein Supplements

- Italy Protein Supplements Market, by Product

- Protein Powder

- Protein Bars

- RTD

- Others

- Italy Protein Supplements Market, by Application

- Sports Nutrition

- Functional Foods

- Italy Protein Supplements Market, by Distribution Channel

- Supermarkets

- Online

- DTC

- Others

- Italy Protein Supplements Market, by Source

- Spain

- Spain Protein Supplements Market, by Source

- Animal-based Protein Supplements

- Whey

- Casein

- Egg

- Fish

- Others

- Plant-based Protein Supplements

- Soy

- Spirulina

- Pumpkin Seed

- Wheat

- Hemp

- Rice

- Peas

- Others

- Animal-based Protein Supplements

- Spain Protein Supplements Market, by Product

- Protein Powder

- Protein Bars

- RTD

- Others

- Spain Protein Supplements Market, by Application

- Sports Nutrition

- Functional Foods

- Spain Protein Supplements Market, by Distribution Channel

- Supermarkets

- Online

- DTC

- Others

- Spain Protein Supplements Market, by Source

- Europe Protein Supplements Market, by Source

- Asia Pacific

- Asia Pacific Protein Supplements Market, by Source

- Animal-based Protein Supplements

- Whey

- Casein

- Egg

- Fish

- Others

- Plant-based Protein Supplements

- Soy

- Spirulina

- Pumpkin Seed

- Wheat

- Hemp

- Rice

- Pea

- Others

- Animal-based Protein Supplements

- Asia Pacific Protein Supplements, By Product

- Protein Powders

- Protein Bars

- RTD

- Others

- Asia Pacific Protein Supplements Market, by Application

- Sports Nutrition

- Functional Foods

- Asia Pacific Protein Supplements Market, by Distribution Channel

- Supermarkets

- Online

- DTC

- Others

- China

- China Protein Supplements Market, by Source

- Animal-based Protein Supplements

- Whey

- Casein

- Egg

- Fish

- Others

- Plant-based Protein Supplements

- Soy

- Spirulina

- Pumpkin Seed

- Wheat

- Hemp

- Rice

- Peas

- Others

- Animal-based Protein Supplements

- China Protein Supplements Market, by Product

- Protein Powder

- Protein Bars

- RTD

- Others

- China Protein Supplements Market, by Application

- Sports Nutrition

- Functional Foods

- China Protein Supplements Market, by Distribution Channel

- Supermarkets

- Online

- DTC

- Others

- China Protein Supplements Market, by Source

- Japan

- Japan Protein Supplements Market, by Source

- Animal-based Protein Supplements

- Whey

- Casein

- Egg

- Fish

- Others

- Plant-based Protein Supplements

- Soy

- Spirulina

- Pumpkin Seed

- Wheat

- Hemp

- Rice

- Peas

- Others

- Animal-based Protein Supplements

- Japan Protein Supplements Market, by Product

- Protein Powder

- Protein Bars

- RTD

- Others

- Japan Protein Supplements Market, by Application

- Sports Nutrition

- Functional Foods

- Japan Protein Supplements Market, by Distribution Channel

- Supermarkets

- Online

- DTC

- Others

- Japan Protein Supplements Market, by Source

- India

- India Protein Supplements Market, by Source

- Animal-based Protein Supplements

- Whey

- Casein

- Egg

- Fish

- Others

- Plant-based Protein Supplements

- Soy

- Spirulina

- Pumpkin Seed

- Wheat

- Hemp

- Rice

- Peas

- Others

- Animal-based Protein Supplements

- India Protein Supplements Market, by Product

- Protein Powder

- Protein Bars

- RTD

- Others

- India Protein Supplements Market, by Application

- Sports Nutrition

- Functional Foods

- India Protein Supplements Market, by Distribution Channel

- Supermarkets

- Online

- DTC

- Others

- India Protein Supplements Market, by Source

- Australia

- Australia Protein Supplements Market, by Source

- Animal-based Protein Supplements

- Whey

- Casein

- Egg

- Fish

- Others

- Plant-based Protein Supplements

- Soy

- Spirulina

- Pumpkin Seed

- Wheat

- Hemp

- Rice

- Peas

- Others

- Animal-based Protein Supplements

- Australia Protein Supplements Market, by Product

- Protein Powder

- Protein Bars

- RTD

- Others

- Australia Protein Supplements Market, by Application

- Sports Nutrition

- Functional Foods

- Australia Protein Supplements Market, by Distribution Channel

- Supermarkets

- Online

- DTC

- Others

- Australia Protein Supplements Market, by Source

- Asia Pacific Protein Supplements Market, by Source

- Central & South America

- Central & South America Protein Supplements Market, by Source

- Animal-based Protein Supplements

- Whey

- Casein

- Egg

- Fish

- Others

- Plant-based Protein Supplements

- Soy

- Spirulina

- Pumpkin Seed

- Wheat

- Hemp

- Rice

- Pea

- Others

- Central & South America Protein Supplements, By Product

- Protein Powders

- Protein Bars

- RTD

- Others

- Central & South America Protein Supplements Market, by Application

- Sports Nutrition

- Functional Foods

- Central & South America Protein Supplements Market, by Distribution Channel

- Supermarkets

- Online

- DTC

- Others

- Animal-based Protein Supplements

- Brazil

- Brazil Protein Supplements Market, by Source

- Animal-based Protein Supplements

- Whey

- Casein

- Egg

- Fish

- Others

- Plant-based Protein Supplements

- Soy

- Spirulina

- Pumpkin Seed

- Wheat

- Hemp

- Rice

- Peas

- Others

- Animal-based Protein Supplements

- Brazil Protein Supplements Market, by Product

- Protein Powder

- Protein Bars

- RTD

- Others

- Brazil Protein Supplements Market, by Application

- Sports Nutrition

- Functional Foods

- Brazil Protein Supplements Market, by Distribution Channel

- Supermarkets

- Online

- DTC

- Others

- Brazil Protein Supplements Market, by Source

- Central & South America Protein Supplements Market, by Source

- Middle East & Africa

- Middle East & Africa Protein Supplements Market, by Source

- Animal-based Protein Supplements

- Whey

- Casein

- Egg

- Fish

- Others

- Plant-based Protein Supplements

- Soy

- Spirulina

- Pumpkin Seed

- Wheat

- Hemp

- Rice

- Pea

- Others

- Middle East & Africa Protein Supplements, By Product

- Protein Powders

- Protein Bars

- RTD

- Others

- Middle East & Africa Protein Supplements Market, by Application

- Sports Nutrition

- Functional Food

- Middle East & Africa Protein Supplements Market, by Distribution Channel

- Supermarkets

- Online

- DTC

- Others

- Animal-based Protein Supplements

- UAE

- UAE Protein Supplements Market, by Source

- Animal-based Protein Supplements

- Whey

- Casein

- Egg

- Fish

- Others

- Plant-based Protein Supplements

- Soy

- Spirulina

- Pumpkin Seed

- Wheat

- Hemp

- Rice

- Peas

- Others

- Animal-based Protein Supplements

- UAE Protein Supplements Market, by Product

- Protein Powder

- Protein Bars

- RTD

- Others

- UAE Protein Supplements Market, by Application

- Sports Nutrition

- Functional Foods

- UAE Protein Supplements Market, by Distribution Channel

- Supermarkets

- Online

- DTC

- Others

- UAE Protein Supplements Market, by Source

- Middle East & Africa Protein Supplements Market, by Source

- North America

Protein Supplements Market Dynamics

Increasing Preference For Plant-Based Protein

There has been a rising awareness about the health benefits related to the plant-based diet due to which the consumer’s perspective is shifting towards organic and healthy living. This has resulted in the surging demand of the plant-based protein supplements as they are considered as a healthy and eco-friendlier option to the conventional animal-based protein supplements. Lower in saturated fat and higher in fiber than animal-based protein sources are one of the main benefits of plant-based protein supplements. Individuals with digestive concern and food sensitivities consider plant-based protein supplements as their popular choice as these supplements are easier to digest. Furthermore, Plant-based protein supplements are also perceived as a more sustainable and healthier alternative of animal-based protein sources. Animal agricultural significantly impact the environment through excessive greenhouse emission and water usage. Consumers can contribute towards a more sustainable food system and also reducing the environmental footprint by opting for plant-based protein supplements. The rise in the plant-based protein supplement is also driven by the increasing trend of veganism and vegetarianism. To meet their nutritional needs, consumers have adopted the vegan lifestyle due to which there is growing demand for high-quality plant based protein sources.

Increasing Demand For Sports Nutritional Supplements

The protein supplement market is marked by a significant growth in the recent years and one of the main factors driving this growth is growing demand of the sports nutritional supplements. To support their training and routine exercises, sports person and fitness enthusiasts needs high protein intake and protein supplements is an easy way to fulfil their protein requirements. Other than the fitness enthusiasts, there has been a growing awareness of balanced diet and healthy life among the general population. Due to this many individuals are opting for protein supplements to support their daily protein intake as well as overall wellbeing. The demand of protein supplements has been further fueled by the escalation of the fitness industry and attractiveness of sports and fitness activities. Consumers have the opportunity to choose from a range of products as per their needs, fitness goals and lifestyles. with the availability of the wide variety of protein supplements. In addition to that, With the evolution of online platforms and e-commerce websites, customers have the easy accessibility to purchase the protein supplements further driving the growth of market.

Market Restraint Analysis

High Volatility In Raw Material Prices

The fluctuating prices of raw materials, particularly milk and soybean, pose a significant challenge for the supplement industry. The volatility in prices is caused by supply and demand constraints, weather patterns, and other factors that affect the production and availability of raw materials such as whey, soy, and casein. Protein supplement manufacturers are particularly affected by these fluctuations as they rely heavily on these raw materials. This situation can lead to higher costs for manufacturers, which may result in higher prices for consumers or a decrease in product quality if shortages occur. The unpredictability of raw material prices is a major restraint for the supplement industry as it affects profitability and can make it challenging to plan and execute business strategies.

What Does This Report Include?

This section will provide insights into the contents included in this protein supplements market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

Protein supplements market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

Protein supplements market quantitative analysis

-

Market size, estimates, and forecast from 2017 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationResearch Methodology

A three-pronged approach was followed for deducing the protein supplements market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below:

Information procurement: Information procurement is one of the most extensive and important stages in our research process, and quality data is critical for accurate analysis. We followed a multi-channel data collection process for protein supplements market to gather the most reliable and current information possible.

- We buy access to paid databases such as Hoover’s and Factiva for company financials, industry information, white papers, industry journals, SME journals, and more.

- We tap into Grand View’s proprietary database of data points and insights from active and archived monitoring and reporting.

- We conduct primary research with industry experts through questionnaires and one-on-one phone interviews.

- We pull from reliable secondary sources such as white papers and government statistics, published by organizations like WHO, NGOs, World Bank, etc., Key Opinion Leaders (KoL) publications, company filings, investor documents, and more.

- We purchase and review investor analyst reports, broker reports, academic commentary, government quotes, and wealth management publications for insightful third-party perspectives.

Analysis: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilized different methods of protein supplements market data depending on the type of information we’re trying to uncover in our research.

-

Market Research Efforts: Bottom-up Approach for estimating and forecasting demand size and opportunity, top-down Approach for new product forecasting and penetration, and combined approach of both Bottom-up and Top-down for full coverage analysis.

-

Value-Chain-Based Sizing & Forecasting: Supply-side estimates for understanding potential revenue through competitive benchmarking, forecasting, and penetration modeling.

-

Demand-side estimates for identifying parent and ancillary markets, segment modeling, and heuristic forecasting.

-

Qualitative Functional Deployment (QFD) Modelling for market share assessment.

Market formulation and validation: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilize different methods of data analysis depending on the type of information we’re trying to uncover in our research.

-

Market Formulation: This step involves the finalization of market numbers. This step on an internal level is designed to manage outputs from the Data Analysis step.

-

Data Normalization: The final market estimates and forecasts are then aligned and sent to industry experts, in-panel quality control managers for validation.

-

This step also entails the finalization of the report scope and data representation pattern.

-

Validation: The process entails multiple levels of validation. All these steps run in parallel, and the study is forwarded for publishing only if all three levels render validated results.

Protein Supplements Market Categorization:

The protein supplements market was categorized into five segments, namely source (Animal-based Protein Supplements, Plant-based Protein Supplements), product (Protein Powders, Protein Bars, RTD), application (Sports Nutrition, Functional Foods), distribution channel (Supermarkets, Online, DTC), and regions (North America, Europe, Asia Pacific, Central & South America, Middle East & Africa) .

Segment Market Methodology:

The protein supplements market was segmented into source, product, application, distribution channel, and regions. The demand at a segment level was deduced using a funnel method. Concepts like the TAM, SAM, SOM, etc., were put into practice to understand the demand. We at GVR deploy three methods to deduce market estimates and determine forecasts. These methods are explained below:

Market research approaches: Bottom-up

-

Demand estimation of each product across countries/regions summed up to from the total market.

-

Variable analysis for demand forecast.

-

Demand estimation via analyzing paid database, and company financials either via annual reports or paid database.

-

Primary interviews for data revalidation and insight collection.

Market research approaches: Top-down

-

Used extensively for new product forecasting or analyzing penetration levels.

-

Tool used invoice product flow and penetration models Use of regression multi-variant analysis for forecasting Involves extensive use of paid and public databases.

-

Primary interviews and vendor-based primary research for variable impact analysis.

Market research approaches: Combined

- This is the most common method. We apply concepts from both the top-down and bottom-up approaches to arrive at a viable conclusion.

Regional Market Methodology:

The protein supplements market was analyzed at a regional level. The globe was divided into North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa, keeping in focus variables like consumption patterns, export-import regulations, consumer expectations, etc. These regions were further divided into twenty-five countries, namely, the U.S.; Canada; Mexico; the UK.; Germany; France; Spain; Italy; China; India; Japan; Australia; Brazil; UAE

All three above-mentioned market research methodologies were applied to arrive at regional-level conclusions. The regions were then summed up to form the global market.

Protein Supplements market companies & financials:

The protein supplements market was analyzed via companies operating in the sector. Analyzing these companies and cross-referencing them to the demand equation helped us validate our assumptions and conclusions. Key market players analyzed include:

-

Glanbia Plc - Glanbia Plc is a multinational company that specializes in producing nutrition products. Their offerings include cheese, dairy ingredients, sports nutrition, and supplements. Some of their popular brands include Isopure, BSN, Optimum Nutrition, Nutramino, and Amazing Grass. Glanbia Plc's product line includes protein bars, protein powders, animal feed, beverages, grains, and seeds. Overall, Glanbia Plc operates in the global nutrition industry.

-

MusclePharm - MusclePharm, a sports nutrition company based in Colorado, USA, was established in 2006. Its main focus is on developing and manufacturing nutritional supplements such as protein powders, gels, and bars for athletes and fitness enthusiasts. The company's product range includes four series: Sport Series, Core Series, Black Series, and Natural Series. MusclePharm's products are categorized based on their functions, including building muscle, daily support, energy, stimulant-free energy, pre-workout, post-workout, protein, multivitamin, thermogenic, fat burner, and weight loss.

-

Abbott - Abbott, a prominent healthcare and research company based in the United States, was established in 1888. Its core areas of focus include medical devices, diagnostics, nutrition, and branded generic pharmaceuticals. The organization operates through six primary business segments, namely Nutrition, Diagnostics, Vascular Care, Vision, Diabetes Care, and Pharmaceuticals. Abbott's notable brands include Similac, PediaSure, Pedialyte, EleCare, ZONEperfect, EAS Sports Nutrition, FreeStyle, and Glucerna. The company has a global presence in over 160 countries such as China, India, Malaysia, Japan, France, Germany, the UK, Canada, the U.S., Brazil, and Australia. As of 2020, Abbott employed more than 109,000 individuals.

-

CytoSport, Inc. - CytoSport, Inc., a subsidiary of Pepsico, is a California-based company that creates sports nutrition products and functional beverages. Established in 1997, their product line includes protein powders under brands like MUSCLE MILK, MONSTER MILK, and CYTOMAX. These products cater to athletes, active individuals, and weekend warriors, promoting workout recovery, sustained energy, and lean muscle growth. In summary, CytoSport develops and manufactures sports nutrition products for athletic performance and active lifestyles.

-

Quest Nutrition, LLC. - Quest Nutrition, founded in 2010, is a California-based nutritional supplement manufacturer specializing in protein supplements such as protein bars, protein powders, and protein chips. The company's mission is to create delicious, athlete-worthy nutrition products that are low in carbs and sugar, with a focus on taste. Quest Nutrition offers a wide range of products, including protein bars, hero bars, cereal bars, protein powders, chips, cravings, quest pasta. The company's products cater to a diverse customer base, including professional athletes, health-conscious consumers, bodybuilders, top fitness competitors, cross-fitters, low carb dieters, and yoga enthusiasts. Quest Nutrition's products are available online and in over 6,000 stores worldwide.

-

Iovate Health Sciences International Inc. - Iovate Health Sciences International Inc. is a Canadian company that was founded in 1995 and is headquartered in Ontario. The company specializes in developing, manufacturing, and marketing active nutrients and weight management supplements. It offers a wide range of products including creatine, protein bars, protein powders, thermogenic, amino acids, weight loss products, post-workout & pre-workout products, and meal replacement products. Iovate Health Sciences International Inc. manufactures protein powders under the brands including MuscleTech, Six Star Pro Nutrition, Purely Inspired, and Hydroxycut. The company is currently a subsidiary of Kerr Investment Holding Corp and distributes its products through retailers, health clubs, grocery shops, and health food stores worldwide.

-

The Bountiful Company - The Bountiful Company is a global manufacturer, marketer, distributor, and retailer of nutritional supplements, vitamins, sports and active nutrition, and ethical beauty products. The company was founded in 1971 and is headquartered in New York, U.S. It is currently owned by Nestle Group. The company operates through three main business segments, including Consumer Products Group, Holland & Barrett International, and Direct to Customer (DTC). The company offers over 16,000 products in categories including mineral, vitamins, herbs, supplement, active nutrition, and sports nutrition. The company's brands include Nature’s Bounty, Holland & Barrett, Sundown Naturals, Solgar, Osteo Bi-Flex, Balance Bar, and Puritan’s Pride. The company operates across various locations including the U.S., China, Canada, the UK, Netherlands, Spain, New Zealand, and South Africa. The Bountiful Company was acquired by Nestlé in 2021 for $5.75 billion.

-

AMCO Proteins - AMCO Proteins, formerly known as American Casein Company, was founded in 1956 and is headquartered in New Jersey, U.S. The company specializes in producing dairy and plant-based protein powders for the food, beverage, and nutrition industries. With a focus on providing functional and nutritional solutions, AMCO Proteins offers a wide range of products tailored to various applications, including bakery, confectionery, beverages, meat technology, nutrition supplements, and more. The company prides itself on its commitment to service, quality, and flexibility, aiming to be responsive, act with urgency, and reduce lead times while maintaining high-quality, consistent products. As of 2019, the company had over 150 employees and operates production facilities in the United States.

-

NOW Foods - NOW Foods is a family-owned natural foods company that was founded in 1968 and is headquartered in Illinois, U.S. The company has over 1,000 products including herbs, natural foods, vitamins, minerals, and natural personal care products marketed under its brands. It operates through six business segments, namely supplements, beauty & health, essential oils, sports nutrition, natural foods, and pet health. The sports nutrition segment manufactures protein powders. NOW Foods has seven manufacturing and distribution facilities in the U.S. and Canada, with the primary facility boasting a 263,000 square foot facility equipped with a thermostatically controlled warehouse and temperature-sensitive storage & refrigeration areas. The company has a presence across six continents and in over 70 countries. NOW Foods is still owned by the Richard family and has grown to become one of the natural product industry's most recognizable brands, providing one of the most extensive lines of natural products available.

-

Transparent Labs - Transparent Labs is a US-based company that specializes in developing and manufacturing protein supplements. Their products are made with all-natural sweeteners, clinically tested and effective dosages, and zero unnecessary fillers, food dyes, and harmful additives. The company offers a range of products, including pre-series, pre-workouts, protein series, intra & strength, fat burners, and raw series. They have stopped selling their products on third-party e-commerce websites such as Amazon and now sell directly to wholesale providers. Their most popular product is the 100% Grass-Fed Whey Protein Isolate, which is sourced from pure grass-fed American dairy cattle and is free of artificial sweeteners, fillers, food dyes, gluten, or preservatives.

Value chain-based sizing & forecasting

Supply Side Estimates

-

Company revenue estimation via referring to annual reports, investor presentations, and Hoover’s.

-

Segment revenue determination via variable analysis and penetration modeling.

-

Competitive benchmarking to identify market leaders and their collective revenue shares.

-

Forecasting via analyzing commercialization rates, pipelines, market initiatives, distribution networks, etc.

Demand side estimates

-

Identifying parent markets and ancillary markets

-

Segment penetration analysis to obtain pertinent

-

revenue/volume

-

Heuristic forecasting with the help of subject matter experts

-

Forecasting via variable analysis

Protein Supplements Market Report Objectives:

-

Understanding market dynamics (in terms of drivers, restraints, & opportunities) in the countries.

-

Understanding trends & variables in the individual countries & their impact on growth and using analytical tools to provide high-level insights into the market dynamics and the associated growth pattern.

-

Understanding market estimates and forecasts (with the base year as 2022, historic information from 2017 to 2021, and forecast from 2023 to 2030). Regional estimates & forecasts for each category are available and are summed up to form the global market estimates.

Protein Supplements Market Report Assumptions:

-

The report provides market value for the base year 2022 and a yearly forecast till 2030 in terms of revenue/volume or both. The market for each of the segment outlooks has been provided on region & country basis for the above-mentioned forecast period.

-

The key industry dynamics, major technological trends, and application markets are evaluated to understand their impact on the demand for the forecast period. The growth rates were estimated using correlation, regression, and time-series analysis.

-

We have used the bottom-up approach for market sizing, analyzing key regional markets, dynamics, & trends for various products and end-users. The total market has been estimated by integrating the country markets.

-

All market estimates and forecasts have been validated through primary interviews with the key industry participants.

-

Inflation has not been accounted for to estimate and forecast the market.

-

Numbers may not add up due to rounding off.

-

Europe consists of EU-8, Central & Eastern Europe, along with the Commonwealth of Independent States (CIS).

-

Asia Pacific includes South Asia, East Asia, Southeast Asia, and Oceania (Australia & New Zealand).

-

Latin America includes Central American countries and the South American continent

-

Middle East includes Western Asia (as assigned by the UN Statistics Division) and the African continent.

Primary Research

GVR strives to procure the latest and unique information for reports directly from industry experts, which gives it a competitive edge. Quality is of utmost importance to us, therefore every year we focus on increasing our experts’ panel. Primary interviews are one of the critical steps in identifying recent market trends and scenarios. This process enables us to justify and validate our market estimates and forecasts to our clients. With more than 8,000 reports in our database, we have connected with some key opinion leaders across various domains, including healthcare, technology, consumer goods, and the chemical sector. Our process starts with identifying the right platform for a particular type of report, i.e., emails, LinkedIn, seminars, or telephonic conversation, as every report is unique and requires a differentiated approach.

We send out questionnaires to different experts from various regions/ countries, which is dependent on the following factors:

-

Report/Market scope: If the market study is global, we send questionnaires to industry experts across various regions, including North America, Europe, Asia Pacific, Latin America, and MEA.

-

Market Penetration: If the market is driven by technological advancements, population density, disease prevalence, or other factors, we identify experts and send out questionnaires based on region or country dominance.

The time to start receiving responses from industry experts varies based on how niche or well-penetrated the market is. Our reports include a detailed chapter on the KoL opinion section, which helps our clients understand the perspective of experts already in the market space.

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationShare this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."