- Home

- »

- Advanced Interior Materials

- »

-

Steel Market Size, Share, Trends And Growth Report, 2030GVR Report cover

![Steel Market Size, Share & Trends Report]()

Steel Market Size, Share & Trends Analysis Report By Product (Hot, Cold, Direct Rolled, Tubes), By End-use (Pre-engineered Metal Buildings, Bridges), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-863-3

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Advanced Materials

Steel Market Size & Trends

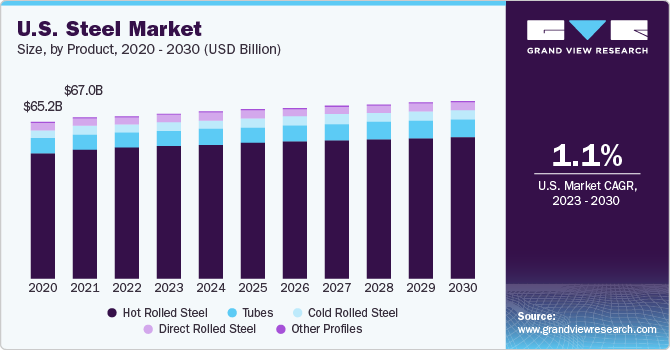

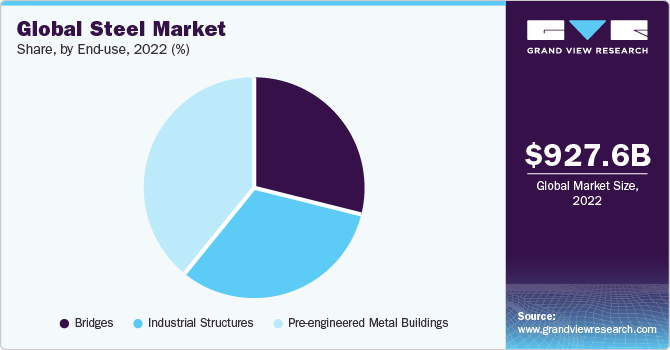

The global steel market size was valued at USD 927.66 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 2.8% from 2023 to 2030.The growing popularity of pre-engineered metal buildings and lightweight building materials to foster energy savings has been a key driver of the industry. The transition from conventional casting processes to novel technologies using recycled metals is another key driving factor. New steel products contribute to enhanced consumer safety, reduced construction costs, and minimized business risks associated with poor quality welding quality. Contractors are increasingly integrating products such as hot & cold rolled steel, and tubes into their projects to meet building & safety standards.

European steel companies are increasingly utilizing the Ultra-Low CO2 Steelmaking (ULCOS) process that reduces about 50% of carbon dioxide emissions & wastage, as compared to conventional processes such as the basic oxygen furnace. Increasing awareness regarding sustainable industrial manufacturing processes is expected to drive the growth of such technologies.

The global construction sector has rebounded post-recession in developed countries, including the U.S. and Germany. The industry is currently advancing at a moderate pace and contributes more to the overall economic growth in comparison with 2010. An increase in the number of building permits released by the U.S. Census Bureau is further anticipated to boost construction spending & employment levels, which is crucial to the development of the steel sector.

Modest improvements in offices, commercial buildings, and other construction segments have supported the demand for modern, efficient, and streamlined processes to obtain products. The industry is anticipated to witness the development of innovative technologies as major companies are engaging in extensive R&D and collaborations to supplement industry growth.

Steel Market Size, Share & Growth Insights:

- The U.S. steel market size was estimated at USD 67.0 billion in 2021.

- The global market size is expected to grow at a CAGR of 2.8% from 2023 to 2030.

- Asia Pacific accounted for the largest market share of 69.5% in 2022.

Rapid urbanization has led to increased infrastructure investment for residential and non-residential purposes. Multifamily houses & single-family houses in upscale neighborhoods and metropolitan cities are expected to grow rapidly in developed regions owing to high consumer income and spending power. Modest improvements in other areas, such as the office market and healthcare, are also helping to establish market growth.

An increase in nonresidential construction spending is expected in the coming years due to stabilization in the overall U.S. economy. Commercial and office construction is expected to exhibit a high growth rate during the forecast period. Factors such as the increasing number of food & retail stores, coupled with increasing office construction due to rising employment levels across the country, are anticipated to drive growth in the construction industry, thus benefiting steel demand.

However, the price volatility of iron ore and coking coal, which are the key raw materials in steelmaking, is likely to be the primary market restraint during the forecast period. Oversupply due to increasing production in China is the main factor leading to price volatility. The global trade of iron ore and coking coal is dominated by a few major players who can reduce their production levels to alter the market balance and impact prices. Steel demand is another factor impacting prices, which is driven by an uncertain global economic environment.

Product Insights

The hot rolled steel segment accounted for the largest revenue share of 74.6% in 2022. The product is increasingly being preferred owing to its relatively economical production and exceptional characteristics such as superior weldability, formidability, high residual strain during baking, and good adhesion ability. On the other hand, cold-rolled steel is usually manufactured below recrystallization temperatures and is essentially a hot-rolled product that has been processed further to obtain a superior surface finish and high tolerance. The end product is utilized in applications where the final appearance & texture is of utmost importance, such as rail wheels, axles, and fish plates.

Direct rolling practices are rapidly gaining popularity in the industry since they improve the final yield by almost 4-5%, while also providing cost savings. The process also reduces risks associated with lower production caused by multiple manual rolls, such as ingots finishing, loading, and mold setting. Steel tubes, sheets, and other profiles are also gaining popularity, albeit at a slower pace than conventional product forms. Sheets are utilized not only in construction applications but also in numerous other end-use industries such as automotive, transformers, beverage cans, and housing materials, owing to their durability, aesthetic appeal, and corrosion resistance.

The steel tubes segment is expected to expand at the fastest CAGR of 3.8% during the forecast period. Tubes are mostly used for applications such as underground transportation of gas and water across cities and also overhead electrical wire & cable protection. Rapid urbanization and growing construction spending are expected to remain major macro factors driving the demand growth for tubes in the coming years, especially in emerging economies.

End-use Insights

The pre-engineered metal buildings segment accounted for the largest revenue share of 39.2% in 2022. Increasing demand for ready-made and hassle-free buildings for industrial applications is a major driving factor for this segment. Rapid industrialization in emerging economies and growing awareness regarding lower costs associated with pre-engineered metal buildings (PMB) are expected to drive steel consumption in this segment over the coming years.

PMB is most commonly found in industrial buildings and warehouses since they are easily dismantled or assembled, depending upon the duration of use. These structures also significantly lower construction costs, offer design flexibility and improve energy efficiency since they consume lower amounts of electricity for HVAC control.

The PMB segment has been further broken down into primary & secondary members, roofs & walls, and panels. Primary members alone accounted for around 30% of the revenue share in 2022. These form the main support of the structure, such as columns, beams, and braces, which are crucial to a building’s structural integrity. Cold-rolled sections are increasingly being utilized for their production owing to their low weight, simplified design procedures, ease of erection, and design flexibility.

The industrial structures segment is expected to advance at the fastest CAGR of 3.0% during the forecast period. Structural steel is majorly used in industrial buildings due to its extreme strength, which is beneficial not only for structural integrity but also for minimizing the potential impact of repairs. It is also ideal for building large bridges owing to its high durability and excellent strength-to-weight ratio, which ensures high tolerance to the weight of cars and pedestrians.

The steel panels segment is expected to expand at a CAGR of 2.9% during the forecast period. These panels are utilized for both residential & non-residential infrastructures owing to their lightweight, ease of installation, and high resistance to adverse climatic conditions such as snow, storms, and heavy rains.

Regional Insights

Asia Pacific dominated the market and accounted for the largest revenue share of 69.5% in 2022 and is expected to expand at the fastest CAGR of 3.1% during the forecast period. Increasing preference for prefabricated engineered buildings (PEBs) among end-users, owing to advantages such as energy efficiency, design flexibility, and faster completion rate of projects, is expected to drive the steel industry in the Asia Pacific region.

The Indian market for steel is expected to grow significantly over the forecast period owing to increasing industrial construction activities, coupled with population expansion. Moreover, the increasing per capita disposable income along with rapid urbanization is expected to fuel residential construction over the forecast period. Favorable government policies and the untapped potential of the country are anticipated to increase foreign investments in construction projects and drive the market growth of steel in India.

Steel production remains a crucial contributor to Europe’s goal to increase the share of construction in GDP to 20% by 2020. Various EU funds and policy instruments such as Horizon 2020, Structural Funds, and the Research Fund for Coal and Steel are being mobilized by the European Commission to alleviate social costs and ensure the retention of competitive steel-producing skills. The European steel industry is faced with higher energy prices than its international competitors, a trend that has been amplified by price increases in recent years.

Key Companies & Market Share Insights

The global industry is characterized by the presence of large players who are increasingly facing pressure owing to the advent of advanced technologies and newer market players. The development of diversified product portfolios and extensive R&D activities for improved product offerings has driven competition in the market. Furthermore, an increasing focus on digitalization by manufacturers to address various challenges has become a major trend. Some of the key players operating in the global steel market include:

-

NIPPON STEEL CORPORATION

-

Baosteel

-

POSCO

-

ArcelorMittal S.A.

-

Hyundai Steel Co., Ltd.

-

JFE Steel Corporation (JFE Holdings Inc.)

-

Jiangsu Shagang Group Co., Ltd.

-

Tata Steel Ltd. (Tata Group)

-

ThyssenKrupp AG

Recent Developments

-

In June 2023, Tata Steel Limited signed a memorandum of understanding with Germany’s SMS group in order to collaborate on a decarbonized steel manufacturing process. The firms will conduct more technical discussions and take steps to do a Joint Industrial Demonstration of SMS group's EASyMelt technology, as part of the MoU

-

In February 2023, Nippon Steel entered into a strategic agreement with Teck Resources Limited in order to acquire royalty interests and equity in Elk Valley Resources Ltd. The purpose of the investment is securing high-quality steelmaking coal, which is necessary for Nippon Steel's carbon-neutral goal, and building a profitable and sustainable consolidated company portfolio via greater investment in high-quality raw materials

-

In March 2023, ArcelorMittal declared that it had successfully acquired Companhia Siderúrgica do Pecém ('CSP') in Brazil for an estimated USD 2.2 billion in enterprise value, after receiving the necessary regulatory clearance. This acquisition offers notable financial and operational synergies and also paves the way for future growth opportunities such as the possibility of increasing primary steelmaking capacity

-

In March 2023, JFE Steel announced that it had increased the fatigue resistance of its AFD (anti-fatigue-damage) steel by creating a thin version of it. The thin-walled variant of AFD steel is anticipated to be used in a wider range of applications, including structural components of bridges that are vulnerable to cracking over time, and is ideal for minimizing aging-related maintenance and replacement costs in steel construction intended for long-term use

-

In May 2023, after performing a feasibility study, JFE Steel Corporation and JSW Steel Limited agreed to a fundamental arrangement to establish a joint venture firm for manufacturing grain-oriented electrical steel sheets (GOES) in India. By providing GOES for green energy network improvement projects, this venture seeks to support the expanding Indian economy

-

In January 2022, POSCO and the Adani Group agreed to explore prospects for commercial collaboration, including the establishment of an integrated steel mill designed to be environment-friendly in Mundra, Gujarat, alongside other businesses

-

In July 2022, BP p.l.c. and ThyssenKrupp Steel established a strategic partnership to aid in the decarbonization of steel, including the supply of renewable power and low-carbon hydrogen. They intend to promote policies in Europe that will aid in the development of low-carbon hydrogen and green steel

Steel Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 953.06 billion

Revenue forecast in 2030

USD 1,158.15 billion

Growth rate

CAGR of 2.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Thailand; Indonesia; Malaysia; Australia; Brazil; Argentina; Saudi Arabia; UAE; Oman; Qatar; Egypt; South Africa

Key companies profiled

NIPPON STEEL CORPORATION; Baosteel; POSCO; ArcelorMittal S.A.; Hyundai Steel Co., Ltd.; JFE Steel Corporation (JFE Holdings Inc.); Jiangsu Shagang Group Co., Ltd.; Tata Steel Ltd. (Tata Group); ThyssenKrupp AG

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Steel Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global steel market report based on product, end-use, and region:

-

Product Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Hot Rolled Steel

-

Cold Rolled Steel

-

Direct Rolled Steel

-

Tubes

-

Other Profiles

-

-

End-use Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Pre-engineered Metal Buildings

-

Primary Members

-

Secondary Members

-

Roofs & Walls

-

Panels

-

-

Bridges

-

Industrial Structures

-

-

Regional Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Thailand

-

Indonesia

-

Malaysia

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

United Arab Emirates

-

Oman

-

Qatar

-

Egypt

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Key factors that are driving the market growth include growing popularity of pre-engineered metal buildings and lightweight building materials.

b. The global steel market size was estimated at USD 927.66 billion in 2022 and is expected to reach USD 953.06 billion in 2023.

b. The global steel market is expected to grow at a compound annual growth rate of 2.8% from 2023 to 2030 to reach USD 1,158.15 billion by 2030.

b. Hot rolled steel dominated the steel market with a revenue share of over 74.0% in 2022. This is attributable to relatively more economic production and exceptional characteristics such as superior weldability, formidability, high residual strain during baking, and good adhesion ability.

b. Some key players operating in the steel market include Tata Steel, Nippon Steel, NUCOR, ArcelorMittal, Baosteel, United States Steel Corporation, and POSCO, among others.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."