- Home

- »

- Petrochemicals

- »

-

Global Transmission Fluids Market Size Report, 2020-2027GVR Report cover

![Transmission Fluids Market Size, Share & Trends Report]()

Transmission Fluids Market Size, Share & Trends Analysis Report By Product (Manual, Continuously Variable), By Application (Off Road Vehicles, Automotive), By Region, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-2-68038-849-7

- Number of Pages: 99

- Format: Electronic (PDF)

- Historical Range: 2016 - 2018

- Industry: Bulk Chemicals

Report Overview

The global transmission fluids market size was valued at USD 10.1 billion in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 3.8% from 2020 to 2027. Rising demand for technologically advanced vehicles with unique drivetrains that deliver ease of driving and high fuel economy is projected to augment the market growth over the forecast period. Advancement in technology by key manufacturers has led to several reforms in the automotive sector as well as from off-road vehicles development standpoint. The increasing development of modern drivetrains has led to the innovation of the product to deliver optimum driving comfort, quick shifts, enhanced fuel economy, lower exhaust emissions, and more. Fluids for CVTs offer exceptional fuel economy due to the easy movement of the vehicles through transmission range, thereby indicating minimal fuel consumption.

Advancement in the transmission series of vehicles has also led to a high level of innovations in off-road vehicles, which are utilized for heavy-duty applications. Construction vehicles, such as earthmovers, agricultural utility vehicles, such as tractors, demand high-performance ATF, and MTF products. Modern ATFs contain a combination of anti-wear additives, corrosion inhibitors, viscosity index improvers, anti-foam additives, petroleum dye, and more. The Dexron and Mercon series of the product are used based on vehicle specifications. There are a few synthetic ATFs available as aftermarket brands that provide better performance and longer life cycle of the vehicle.

Asia Pacific and North America are anticipated to remain the key regions driving the global market. The rise in ATVs to foster customer demand for longer vehicle operational life, ease of automatic transmission and better fuel efficiency is expected to augment the consumption and, in turn, boost the market in the foreseeable future. Government regulations in the Middle East and Africa as well as in the Asia Pacific in favor of infrastructure development are anticipated to lead to the growth of these oils over the forecast period.

In light of the recent global pandemic, supply networks worldwide are disrupted on account of minimized vehicular movement, low demand for products from aftermarkets and OEMs, and discontinued oil & lubricant production including transmission fluids. The major reason behind the disruption is the temporarily discontinued vehicular production, which essentially generates the majority of the product demand. Moreover, additive manufacturers reflected temporary discontinuation in product manufacturing due to low requirements from manufacturers worldwide.

However, the second quarter of 2020 reflected an improved production pace of vehicles compared to the first quarter of 2020. This has led to a slight stabilization of product availability across the global market, which is anticipated to develop further gradually over time with stabilizing the supply chain. The global automakers have been focusing on improving customer interfacing, in terms of automatic transmission in their vehicles, to gain a broader market share in the competitive automotive landscape. These factors are cumulatively anticipated to reflect the growth over the forecast period.

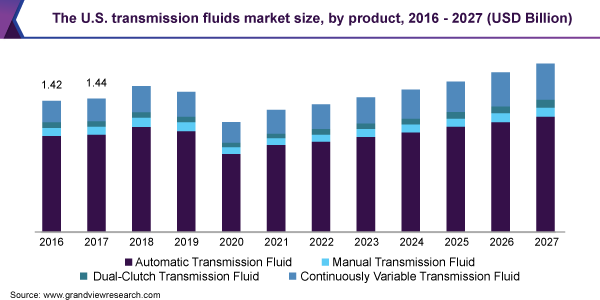

Product Insights

In terms of volume, manual transmission fluid products dominated the market with a share of 54.2% in 2019. MTF specifically finds applications in the manual transmission vehicle domain. Product innovation in this segment is constant since the major concern is enhancing fuel efficiency and suppressing the noise of manual transmission vehicles. Technological advancements and innovations in upgrading the motors are expected to support the product demand over the forecast period. MTF has witnessed significant growth in regions, such as Europe, owing to the increasing demand for manual transmission vehicles.

Innovations in the field of MTF, such as coping with dirt and dust of off-road vehicles used particularly for construction and agriculture applications is expected to fuel the segment growth. Several government initiatives have been implemented in emerging economies of Asia Pacific, Central America, and the Middle East to renovate and introduce green housing projects on a mass scale. These initiatives have led to increased production of manual transmission off-road vehicles, which is further projected to boost the demand for MTFs across these regions.

Furthermore, CVT fluids are formulated with unique anti-wear additives and stable viscosity enhancers that prevent oil film breakdown. They are widely used in multiple vehicles produced by Nissan, Mitsubishi, BMW Mini Cooper, Dodge, and Mercedes Benz due to CVT technology’s ability to deliver exceptional fuel economy and seamlessly shift between gears. Asia Pacific has a high market share of CVTF on account of constant innovations by automakers in the region.

However, the volatile raw material supply and stringent regulatory guidelines regarding emissions from motor vehicles are expected to negatively impact market growth. Though CVTF is comparatively costly, its eco-friendly properties drive its demand. North America CVTF market exhibits ample growth potential due to high product demand from the automotive and construction industries and shifting focus toward the enhanced performance of heavy-duty vehicles and passenger cars. These factors are cumulatively anticipated to reflect the slow yet steady growth of the global CVT fluids market over the forecast period.

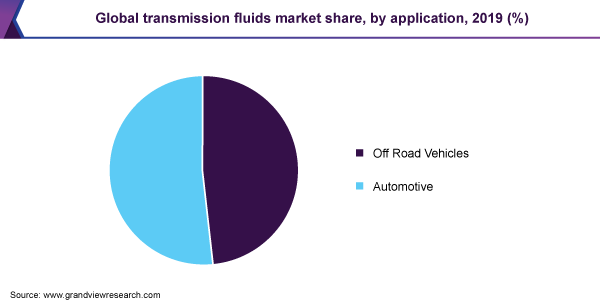

Application Insights

In terms of volume, off-road vehicles application led the market with a share of over 55% in 2019. The purpose of the fluids used in off-road vehicles, such as construction vehicles and agricultural machinery, is to deliver optimum on-road force by providing wear protection for transmission components for longer vehicle life. Construction, mining, agriculture, and forestry equipment require different formulations of oils for their transmissions for use in high-pressure hydraulic systems. The product is essential for various equipment and off-road vehicles used in construction, such as backhoe loaders that push tons of earth, require frictional stability, elastomer compatibility, sludge control, and hydraulic pump performance for smooth performance delivery for a longer lifespan.

Growth of the construction industry in emerging markets of China, India, Brazil, and Mexico is expected to remain a key factor driving the demand in off-road vehicles application globally. Asia Pacific is one of the largest regional markets in off-road vehicles application owing to the growth of the construction industry. Furthermore, with the increase in infrastructural development across the globe, the requirement for these oils in various vehicles is also significantly increasing. The housing sector in the U.K. is significantly growing at the rate of 6% on an average every year, and thus the scope of various fluids application in off-road vehicles is also increasing.

In addition, the product is extensively used in the automotive sector owing to the innovation in-vehicle technology with respect to drivetrains, transmission ease, fuel flow to the engine, and more. The rise in demand for automatic vehicles is expected to foster the growth of the automotive application segment in the coming years. The different vehicle requires a different transmission set-up, and the diversity has led to innovation in the fields worldwide. Different passenger vehicles, including the sports car, luxury vehicles, and economy class car segments, have different transmission and engine powers, which require different formulations of oils.

Moreover, the segment is expected to grow steadily in North America and Europe as an increasing number of automakers in these regions are demanding high-performance fluids specific to their requirements. Asia Pacific is increasingly becoming a hub for various automakers due to the easy availability of skilled labor, sufficient land availability, and other economic benefits as well as ease of trade factors. Increased consumer spending on modern technology cars for everyday utility has also paved the way for automotive manufacturers to grab a significant market share across the Asian market. The aforementioned factors are projected to increase the demand globally in the automotive application over the forecast period.

Regional Insights

Asia Pacific dominated the market and accounted for 53.9% of the global volume in 2019. This is attributable to a shift in the production landscape towards emerging economies, particularly China and India. The region is also home to several rapidly expanding industries, such as construction, automotive, and mining, that present vast potential for transmission fluid manufacturers. Increasing construction spending owing to the need for sustainable infrastructure is expected to drive overall product demand in the next couple of years.

Moreover, the use of off-road vehicles across the Asia Pacific is forecasted to be on a significant rise along with the requirement for the applicable transmission fluids to fuel the machines, altogether leading to increased product consumption in the Asia Pacific. MTFs as well as ATFs are expected to be heavily consumed by heavy-duty vehicles on account of their smooth, unhindered transmission enabling properties. Asia Pacific is the fastest-growing region globally, in terms of infrastructure construction, owing to heavy investments by the Southeast Asian nations. Furthermore, increasing per capita income in countries, such as China and India, is anticipated to fuel automobile sales.

Furthermore, Europe is witnessing a low-cost flight revolution with active connections to its airports from numerous global airports, which is expected to boost the tourist sector in the region. For example, the Italian government actively encourages foreign investments, particularly in rural areas, and offers various grants to reform rural properties to promote rural tourism in the country. In 2013, the Italian government allocated USD 2.7 billion for the expansion and improvement of regional highways, rail networks, and other infrastructural developments. These factors boosted the demand for commercial vehicles in the region.

The market in North America is concentrated with the presence of several multinational automakers, such as Chrysler LLC, General Motors, and Ford. The development in the automotive industries in the region is the key driving force for the growth of the transmission fluids market. Furthermore, spending in the construction sector in North America is recording a steady annual growth rate of 3%, showing a positive development curve in the market, particularly for off-road vehicles used for construction purposes. The demand for ATF is expected to grow in North America owing to the shift in trend from manual transmission vehicles to ATVs driven by consumer preference. ATVs offer ease of driving as well as increased fuel economy and lower emission rates as compared to traditional manual transmission vehicles.

Key Companies & Market Share Insights

The market is highly integrated by a few major multinationals, which offer their diverse range of products globally. These companies have widespread distribution networks and innovative product portfolios and are also recognized for their extensive R&D operations, which leads them to cater to all kinds of application sectors globally. For instance, BASF SE has its own diverse range of innovative products for heavy-duty vehicles, and its products are known for longer maintenance intervals and increased fuel economy in the applied vehicles. The company’s live product testing prior to launching in the market provides an edge over its competitors. Chevron Corporation’s products have exceptional anti-wear properties that assure delivery of hassle-free, year-long smooth transmission life even under severe loads. Some of the prominent players in the transmission fluids market include:

-

Royal Dutch Shell

-

ExxonMobil Corp.

-

Total S.A.

-

British Petroleum P.L.C.

Transmission Fluids Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 8.1 billion

Market volume in 2020

2,670.65 kilotons

Revenue forecast in 2027

USD 13.6 billion

Volume forecast in 2027

3,986.84 kilotons

Growth rate

CAGR of 3.8% from 2020 to 2027 (Revenue-based)

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Volume in kilotons, revenue in USD million and CAGR from 2020 to 2027

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

The U.S.; Canada; Mexico; Germany; the U.K.; France; China; India; Japan; Brazil; Argentina; Saudi Arabia

Key companies profiled

Royal Dutch Shell; BASF SE; Chevron Corp.; ExxonMobil Corp.; Total S.A.; British Petroleum P.L.C.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts volume and revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global transmission fluids market report on the basis of product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

Automatic Transmission Fluids

-

Manual Transmission Fluids

-

Dual Clutch Transmission Fluids

-

Continuously Variable Transmission Fluids

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

Automotive

-

Off-Road Vehicles

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

The U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global transmission fluids market size was estimated at USD 10.13 billion in 2019 and is expected to reach USD 8.06 billion in 2020.

b. The global transmission fluids market is expected to grow at a compound annual growth rate of 3.8% from 2020 to 2027 to reach USD 13.63 billion by 2027.

b. The Asia Pacific dominated the transmission fluids market with a share of 50.1% in 2019. This is attributable to a shift in the production landscape towards emerging economies, particularly China and India.

b. Some key players operating in the transmission fluids market include BASF SE, Chevron Corporation, Exxon Mobil Corporation, and Royal Dutch Shell.

b. Key factors that are driving the transmission fluids market growth include increasing innovation in fluid processing technologies and the advent of fuel-efficient automobile & industrial standards driving lower carbon emissions.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."