- Home

- »

- Renewable Chemicals

- »

-

UAE Palm Oil Market Size, Share, Industry Analysis Report, 2018-2025GVR Report cover

![UAE Palm Oil Market Size, Share & Trends Report]()

UAE Palm Oil Market Size, Share & Trends Analysis By Product ( CPO, Palm Kernel, RBD, PKO, Olein, Stearin), By Application (Edible Oil, Cosmetics, Bio-Diesel, Lubricants, Surfactants), And Segment Forecasts, 2018 - 2025

- Report ID: GVR-1-68038-442-0

- Number of Pages: 104

- Format: Electronic (PDF)

- Historical Range: 2014 - 2015

- Industry: Specialty & Chemicals

Industry Insights

The UAE palm oil market size was valued at USD 183.3 million in 2015. Increasing demand from the food & cosmetics sector is expected to drive product demand in the future. The product finds application across various end-use industries that include food & beverages, animal feed, lubricants, and renewable fuels among others.

Demand in the industry is mainly dependent on the trend of using renewable and halal certified cosmetics and the growth of the processed foods sector. The strategic position of the country provides easy access to three continents of Europe, Africa, and Asia. Dubai is a prominent hub for exports to other GCC countries. Further, the establishment of several free trade zones is some of the factors leading to an increase in oil exports.

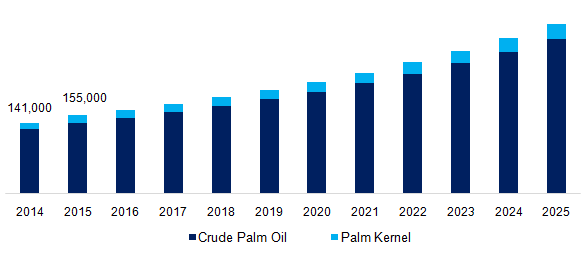

UAE palm oil market volume by product, 2014 - 2025 (Tons)

The UAE cosmetic industry is experiencing accelerated growth. Increasing exposure to international beauty trends and products coupled with the impact of social networking has made the people more conscious about their personal appearances. Growing awareness regarding the benefits of using natural products had led to a huge expansion in the cosmetic industry.

As a trade hub, UAE has benefitted from a stable supply of palm products over the past, and the scenario is most likely to remain the same in the future. Due to the country’s environment, opportunities for palm plantations remain bleak. However, new entrants vying to establish operations in refining and trade shall benefit from the business environment of UAE and cost advantages such as negligible import tariffs and those associated with plant establishment charges.

Product Insights

In terms of product categories, the industry is classified into two segments that include crude palm oil and palm kernel, which are two main constituents of the palm plant. CPO segment may be further categorized on the basis of three products, namely, RBD oil, olein, and stearin. The kernel sector is divided into palm kernel oil (PKO) and kernel cake. CPO is projected to be the fastest-growing segment with a CAGR of over 8.0% from 2017 to 2025 over the forecast period.

CPO is majorly used as edible oil and finds high demand among food manufacturers, and this is particularly due to CPO’s cheaper pricing compared to other cooking oils and its healthier properties as a cooking medium. The refined form of the oil can be used for direct consumption and cooking applications. RBD products are also popularly used in bakery, confections, frying, and food processing applications. CPO is increasingly being used as a biofuel.

With governments across the world ratifying Paris Climate Accord, the demand for alternative sources of energy has greatly increased. PKO is specifically used in confectionery fats, or cocoa butter substitute (CBS) and cocoa butter equivalent (CBE). It also has applications in the cosmetics, biodiesel, surfactants, animal feed, and lubricants businesses.

Application Insights

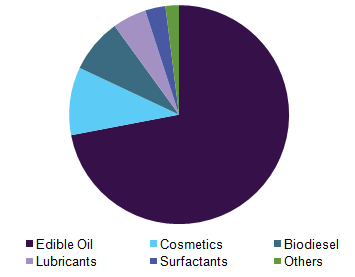

Edible oil is a common application (accounting for nearly 75% volume share in 2015) and is projected to maintain its dominance in the industry over the future course. The expansion in the food & beverage market mainly driven by the flourishing tourism industry has led to a rapid rise in the consumption of edible oil. Cosmetics presents tremendous scope for growth with CAGR projected at around 10.0% from 2017 to 2025. The UAE is one of the largest consumers of cosmetic products and a budding hub for manufacturing as well.

UAE palm oil market revenue share, by application, 2016 (%)

Consumers spend around USD 6.85 million in 2015 on beauty and personal care products. The cosmetic industry is expected to experience exponential growth. Exposure to social networking and consequent rise in awareness regarding beauty care and personal grooming had a positive influence on the past growth trajectory.

Bio-diesel currently represents a smaller size of the industry; however, the segment is projected to register considerable gains particularly due to regulations encouraging green-fuels and also due to the country’s position as a global petroleum hub. The country’s biodiesel sector has also been gaining acceptance among the general populace and further encouraging the industry to ramp-up production.

Lubricants are also considered as a potential growth segment, with growth expected from industrial and automotive lubrication applications alike. Companies are gradually increasing their lubricant blending capabilities in the country, which in turn is likely to generate demand for palm oil as a vital component in the blending process.

UAE Palm Oil Market Share Insights

Key players Abu Dhabi Vegetable Oil Co., ACCL International, Nuha General Trading Co, Omani Vegetable Oil Derivatives Co. LLC, Amira Nature Foods Ltd., AA Middle East FZE, FELDA IFFCO, and Asia & Africa. Other companies such as General Trading LLC, United Foods Company (UFC), AJWA MIGOP, Zakaria & Ghaniwala, General Trading Co. LLC, HAS Commodities Ltd. The participants specialize mostly in the distribution of edible oils in the Middle East and Africa region.

Report Scope

Attribute

Details

Base year for estimation

2015

Actual estimates/Historical data

2014 - 2015

Forecast period

2016 - 2025

Market representation

Volume in tons, revenue in USD Million and CAGR from 2016 to 2025

Regional scope

United Arab Emirates

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

15% free customization scope (equivalent to 5 analyst working days)

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments Covered in the ReportThis report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the UAE palm oil market on the basis of product and application:

-

Product Outlook (Volume, Tons; Revenue, USD Million; 2014 - 2025)

-

Crude Palm Oil

-

RBD Palm Oil

-

Palm Stearin

-

Palm Olein

-

-

Palm Kernel

-

Palm Kernel Oil

-

Palm Kernel Cake

-

-

-

Application Outlook (Volume, Tons; Revenue, USD Million; 2014 - 2025)

-

Edible Oil

-

Cosmetics

-

Biodiesel

-

Lubricants

-

Surfactants

-

Others

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."