- Home

- »

- Paints, Coatings & Printing Inks

- »

-

U.S. Concrete Floor Coatings Market Share Report, 2030GVR Report cover

![U.S. Concrete Floor Coatings Market Size, Share & Trends Report]()

U.S. Concrete Floor Coatings Market Size, Share & Trends Analysis Report By Product (Epoxy, Polyurethanes, Polyaspartics), By Application (Residential, Commercial, Industrial), By Division, By End-user, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-554-0

- Number of Pages: 98

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Bulk Chemicals

Report Overview

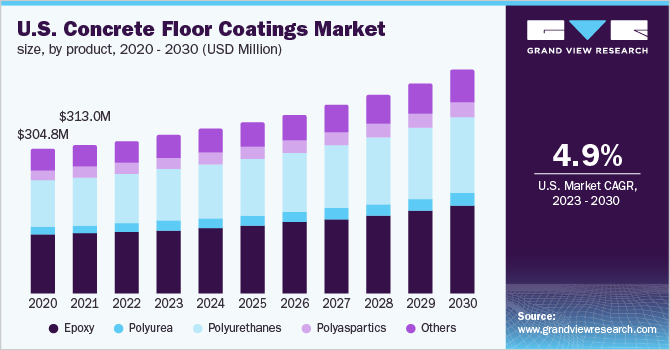

The U.S. concrete floor coatings market was valued at USD 323.0 million in 2022 and is expected to expand at a CAGR of 4.9% from 2023 to 2030. Rising demand for coatings as a protective medium in the flooring sector is projected to remain as a favorable factor. Concrete floor coatings are used for providing high-temperature resistance to indoor and outdoor areas as well as for protecting floors in commercial and residential buildings against wear & tear. These coatings are also used for providing protection to the floors of non-building structures in the power, metal, and environmental protection industries. The increment in the U.S. construction sector coupled with the positive outlook towards manufacturing sectors anticipated to increase the demand for concrete floors and thus in turn will have a positive impact. Furthermore, rising demand for residential, commercial, and industrial structures in the U.S. is anticipated to help boost the consumption of effective flooring solutions for providing wear & tear, corrosion, and thermal resistance.

Growing construction spending in the U.S. is expected to increase over the forecast period owing to economic development. The country is characterized by a low-risk environment, a stable economy, and a robust financial sector. These factors have provided a multitude of opportunities for investors in recent years, which are likely to trigger infrastructure spending in the country. This, in turn, is projected to positively impact the demand for concrete floor coatings in the U.S. construction industry.

The U.S. government has passed numerous regulations to improve the infrastructure including water supply systems at a domestic level for environmental protection. For instance, in October 2018, the U.S. Senate approved America’s Water Infrastructure Act. The bill focuses on new water projects that will be carried out by the Army Corps of Engineers and includes several provisions directly addressing the drinking water infrastructure. As a result, non-building structures, such as waste disposal and water supply systems, in the U.S. anticipated foreseeing an increased penetration of concrete floor coatings.

However, the rising threat from substitutes such as hardwood, tiles, marble, and flooring is anticipated to hamper the to hamper market growth over the forecast period. There has been a growing demand for wood, tiles, and marble among residential & commercial applications as these flooring solutions are easier to install and require relatively lesser skilled labor for installation as compared to concrete floors. In addition, the outbreak of COVID-19 in the country resulted in a halt or slowdown in construction activities in the first half of 2020, which negatively impacted the product demand in the U.S. Moreover, construction companies are recommencing their operations while adhering to government guidelines. This, in turn, is projected to fuel the overall market growth in the country over the forecast period.

Product Insights

The epoxy product segment led the market and accounted for more than 40.4% share of the global revenue in 2022. These coatings exhibit properties such as excellent adhesion, heat and chemical resistance, and favorable electrical insulation, which have led to their increased popularity in concrete floor coating formulations. In addition, the low cost of these coatings compared to their counterparts is expected to have a favorable impact on the market over the forecast period. However, these coatings are ineffective during UV exposure, since the UV light reacts with the coated surface to form radicals. The aforementioned trend is expected to hamper its market growth.

EPA has framed numerous directives intended for reducing GHG emissions, which is anticipated to restrict the application scope of hazardous chemicals. Epoxy concrete floor coatings contain polycarbonate, which is declared hazardous by EPA. This inclination towards restricting VOC emissions coupled with growing awareness towards eco-friendly alternatives such as powder coatings is anticipated to challenge market growth over the forecast period.

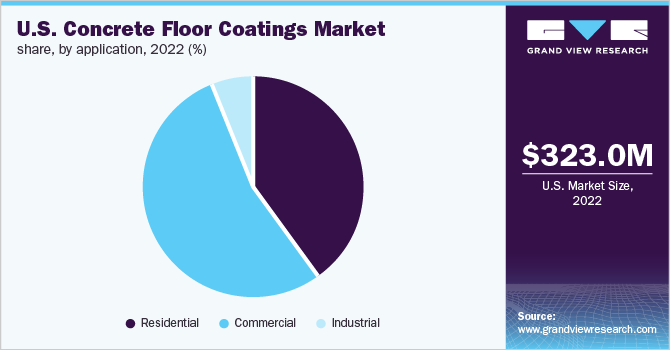

Application Insights

The commercial application segment led the market and accounted for more than 53.0% share of the global revenue in 2022. Improvement in manufacturing sectors including automotive, and industrial manufacturing in the U.S., as a result of increasing application on a domestic level, is expected to upscale the requirements of coatings. The strong foothold of commercial spaces, as well as corporate houses in the U.S. owing to the well-established infrastructure, trained workforce, and close access to production units on a domestic level, is expected to be a favorable trend for the market in commercial applications.

Residential includes the consumption of concrete floor coatings in garages, patios, walkways, and basements for new houses and townhouses built by the owner or for the owner on contract. The residential construction sector in the country is primarily driven by the growth in single-family housing units. According to the United States Census Bureau, 903,000 single-family homes and 352,000 multi-family units were completed in 2019. Moreover, single-family housing units comprise additional features such as larger garages. The additional features of single-family housing units are directly linked to more usage of concrete flooring for various operations.

Patios are exposed to heat, moisture, and other environmental factors across the year, which creates the need to protect patio surfaces. In summer, the surface is exposed to extreme heat and UV rays, which can lower the build quality of the patio and fade the surface. While in winter, snow, sleet, and ice can wear down the patio. In addition, patios come in constant contact with dirt and grime. As a result, flooring solutions such as concrete floor coatings are used to strengthen patios, improve their appearance, and make them durable. These coatings are easy to clean & maintain and offer resistance against weather, moisture, UV, and abrasion.

End-User Insights

The professional end-user segment led the market and accounted for more than 72.0% share of the global revenue in 2022. The professional end-user segment dominated the market and is anticipated to maintain its dominance over the forecast period. Professional concrete floor coating application is more durable as compared to DIY. Trained professionals use specialized equipment such as a shot blaster or diamond grinder to mechanically clean and abrade the floor in order to ensure the coatings adhere appropriately to the concrete and do not peel or delaminate over time. Thus, the application done by professionals is cost-effective in the long run owing to the low requirement of maintenance and high durability as compared to DIY.

The Do-it-yourself (DIY) concrete floor coatings segment is expected to witness a growth rate of 5.1% during the forecast period. It is primarily gaining popularity in residential applications owing to the low cost incurred as compared to professional. However, low durability as compared to professionalism is expected to impact the growth of DIY during the forecast period.

Division Insights

The south division segment led the market and accounted for more than 40.0% share of the global revenue in 2022. Increasing government initiatives for providing affordable homes are expected to fuel the growth of the construction industry, thereby, propelling demand for concrete floor coatings. For instance, in April 2019, the Mayor of Atlanta, Georgia, in partnership with Atlanta Housing and Invest Atlanta, announced a funding of USD 60 million for affordable housing projects. This fund is projected to create and preserve more than 2,000 new affordable housing units in the city of Atlanta.

Furthermore, the increasing focus of the government on spending on the construction of educational institutes is anticipated to fuel the product demand in the region. For instance, in June 2019, the government of North Carolina announced a state budget of USD 24 billion as a part of the new state-wide school construction and salary increases initiative. Moreover, increasing demand for green buildings owing to the rising awareness about the benefits associated with it coupled with increasing concern over sustainability is further anticipated to upsurge the growth of construction activities in the region. This, in turn, is further projected to create a demand for concrete floor coatings during the forecast period.

Concrete Floor Product Insights

The polished product segment led the market and accounted for more than 53.0% share of the global revenue in 2020. The polishing of concrete floors results in the generation of a tremendous amount of slurry that crews must collect and dispose of. The disadvantage mentioned above is expected to incline buyers towards coated floors and further expected to restrain the market growth of polished floors. A rise in building and construction expenditure in the U.S. is expected to strengthen the demand for coated floors. The increase in raw material and transportation costs has considerably eroded the profit margins of manufacturers.

However, technological developments aimed at increasing production efficiency have countered the issue of the rise in raw material prices to some extent. Epoxy-based concrete floor coatings account for a significant share of the market on account of their properties such as toughness, improved dimensional stability, and superior resistance to abrasion and UV light. In addition, their adhesion to a variety of substrate surfaces including concrete, metal, fiber, and glass is expected to fuel the demand for epoxy-based concrete floor coatings over the forecast period. Factors, such as the availability of innovative construction solutions that require low maintenance and durability, are expected to positively impact the growth of the market.

Concrete Floor Application Insights

The commercial application segment led the market and accounted for more than 53.0% share of the global revenue in 2022. The construction of hospitals and healthcare facilities is witnessing growth in the country owing to the increase in the geriatric population. The government of the country is taking various measures to increase funding viability for new hospitals. Moreover, the shift in the demographics of the country suggests a growth in the old-age population in the coming years. Increasing real estate development and remodeling projects are expected to propel the demand for coated concrete floors in the U.S. over the forecast period.

Residential construction is anticipated to witness lucrative growth owing to the numerous upcoming real estate projects in the country. Furthermore, the rise in consumer disposable income and consequent growing consumer attention toward home improvement are anticipated to drive the segment over the forecast period. The construction industry in the residential sector is expected to witness growth during the forecast period owing to the increase in the construction of single-family housing, which, in turn, is expected to fuel the product demand in the country. Moreover, re-insulation and refurbishment of old houses are also likely to contribute to the ascending product demand.

Key Companies & Market Share Insights

The U.S. concrete floor coatings market is fragmented in nature with the presence of several key players, such as Henkel AG & Co. KGaA, BASF SE, Jotun A/S, The Tennant Company, Axalta Coating Systems, Stonhard, Inc., Behr Paint Company, and PPG Industries, Inc., as well as various medium and small regional players, such as TruCrete Surfacing Systems, Cornerstone Coatings International, North American Coating Solutions, Vanguard Concrete Coating among others. The players face intense competition from each other as well as from regional players, who have strong distribution networks and good knowledge about suppliers and regulations.

The companies in the market compete on the basis of product quality offered and the technology used for the production of concrete floor coatings. However, established players compete on the basis of products that have a wider scope of application and new technologies used in product formulations. Furthermore, the raw materials used to manufacture concrete floor coatings play a significant role in determining the price of the final product. The fluctuation in prices of raw materials such as epoxy resin and polyurethane as well as their demand from other application industries are expected to impact the market over the forecast period. Some of the major companies operating in the U.S. concrete floor coatings market include:

-

The Sherwin-Williams Company

-

North American Coating Company

-

Henkel AG & Co. KGaA

-

Tennant Coatings

-

Axalta Coating Systems

-

PPG Pittsburgh Paints

-

Behr Paint Company

-

EPMAR Corporation

-

Cornerstone Coatings International, Inc

-

Sika Corporation

U.S. Concrete Floor Coatings Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 334.4 million

Revenue forecast in 2030

USD 472.3 million

Growth Rate

CAGR of 4.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Concrete floor coatings volume in kilotons, revenue in USD million and CAGR from 2023 to 2030

Concrete floor volume in million square feet, revenue in USD million and CAGR from 2023 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-user, division

Division scope

Northeast, Midwest, South, West

Key companies profiled

The Sherwin-Williams Company, North American Coating Company, Henkel AG & Co. KGaA, Tennant Coatings, Axalta Coating Systems, PPG Pittsburgh Paints, Behr Paint Company, EPMAR Corporation, Cornerstone Coatings International, Inc, and Sika Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Concrete Floor Coatings Market Segmentation

This report forecasts revenue and volume growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2028. For the purpose of this study, Grand View Research has segmented the U.S. concrete floor coatings market report based on product, application, end-user, and division:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Residential

-

Garages

-

Patios

-

Walkways

-

Basements

-

-

Commercial

-

Restaurants & Breweries

-

Supermarkets and Retail Stores

-

Educational Institutions

-

Other Commercial

-

-

Industrial

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Epoxy

-

Polyurea

-

Polyurethanes

-

Polyaspartics

-

Others

-

-

End-user Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Do-It-Yourself (DIY)

-

Professional

-

-

Division Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Northeast

-

Midwest

-

South

-

West

-

-

Product Outlook (Volume, Million Square Feet; Revenue, USD Million; 2018 - 2030)

-

Coated

-

Epoxy

-

Polyurea

-

Polyurethanes

-

Polyaspartics

-

Others

-

-

Polished

-

-

Application Outlook (Volume, Million Square Feet; Revenue, USD Million; 2018 - 2030)

-

Residential

-

Commercial

-

Frequently Asked Questions About This Report

b. The U.S. concrete floor coatings market size was estimated at USD 323.0 million in 2022 and is expected to reach USD 334.4 million in 2023.

b. The U.S. concrete floor coatings market is expected to grow at a compound annual growth rate of 4.9% from 2023 to 2030 to reach USD 472.3 million by 2030.

b. The epoxy coatings segment dominated the U.S. concrete floor coatings market with a share of more than 40% in 2022. This is attributable to the reason that they have lower costs as compared to their counterparts available in the market.

b. Some key players operating in the U.S. concrete floor coatings market include Henkel AG & Company; KGaA; BASF SE; Jotun A/S; Tennant Coatings; Axalta Coating Systems; Stonhard, Inc.; BEHR Process Corporation; and PPG Industries, Inc.

b. Key factors that are driving the U.S. concrete floor coatings market growth include rising demand for coatings as a protective medium in the flooring sector and the growth of the U.S. construction sector.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."