- Home

- »

- Plastics, Polymers & Resins

- »

-

U.S. Construction Silicone Sealants Market Size Report, 2025GVR Report cover

![U.S. Construction Silicone Sealants Market Size, Share & Trends Report]()

U.S. Construction Silicone Sealants Market Size, Share & Trends Analysis Report By Sector (Residential, Commercial, Industrial), By Application (Interior, Exterior), By Region, And Segment Forecasts, 2020 - 2025

- Report ID: GVR-1-68038-519-9

- Number of Pages: 62

- Format: Electronic (PDF)

- Historical Range: 2014 - 2015

- Industry: Bulk Chemicals

Industry Insights

The U.S. construction silicone sealants market size was valued at USD 214.0 million in 2019. Increasing preference for silicone sealants in the construction industry is expected to be a key factor driving the growth. Moreover, several benefits offered by the product owing to its unique properties are expected to further fuel the demand.

Silicone sealants are multi-purpose products that have gained wide acceptance in various applications such as the industrial, and domestic areas. They are solvent-free, low-temperature flexibility, fire-resistant and have excellent UV stability. In addition, these sealants are also waterproof and able to withstand high temperatures. Easy application and the effective end result have augmented its demand in the real estate industry. They are available in varied forms in order to suit the specific requirements of industries and households.

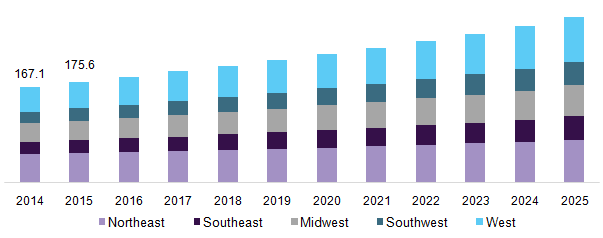

U.S. silicone sealants in construction market revenue by region, 2014 - 2025 (USD Million)

The growing construction industry has positively impacted the utilization of silicone sealants, which is expected to drive growth. Various raw materials including polysiloxane and additives & cross-linkers are utilized in the manufacturing process. The construction silicone sealants market is highly competitive in nature owing to the presence of a large number of established manufacturers, suppliers, and new entrants. The rapidly growing market in the U.S. is pushing key players, such as Wacker Chemie AG and Dow Corning Corporation, to adopt joint venture strategies in an attempt to increase their presence and expand share.

Integration through the entire value chain is projected to be a key element in the market as most of the players are trying to optimize costs and, therefore, backward and forward integration will be essential. Factors such as strong manufacturer-supplier relationships and tie-ups at multiple distribution levels are expected to be critical for companies to gain a competitive advantage over the forecast period.

Silicone sealants are widely used in various end-use industries including building, automotive, and glass. They are manufactured from two important raw materials which comprise siloxane & polysiloxane and additives & cross-linkers. The raw materials have different properties, which are highly essential for manufacturing silicone sealants and combined to impart adhesion, elongation, and thermal resistant properties to the product. The manufacturers ensure to incorporate properties such as resistance to extreme temperature & chemicals, compression, strength, high stretching traits, and tolerance into the end product.

U.S. Silicone Sealants in Construction Market Trends

Rising investments in construction activities are anticipated to boost the silicon sealants demand in the U.S. over the coming years. The U.S. government is investing in various infrastructure development projects for propelling the economic growth rate, which is likely to augment the demand for silicone sealants across the forecast period.

In November 2021, the U.S. government introduced USD 1.2 trillion worth plan to rebuild the country’s infrastructure. The government plans to rebuild 20,000 miles of road and repair the 10 most economically significant bridges in the country. Such infrastructural development projects are expected to fuel the silicone sealants market growth across the forecast period.

Growing spending on residential construction is projected to influence the market demand positively over the forecast period. For instance, according to the U.S. Census Bureau, the total construction spending in the U.S. increased by 11.2% y-o-y, i.e., to USD 1,704.38 billion in February 2022 compared to USD 1,533.25 billion in February 2021. The total residential construction spending increased to USD 859.88 billion in February 2022 compared to 738.28 billion in February 2021, an increase of 16.5% y-o-y.

Water and chemical resistance are one of the unique properties of silicone sealants. This has led to increased applications of silicone sealants in kitchens, internal sanitary ware in bathrooms, gutters, swimming pools, and others. It ensures high durability coupled with low maintenance cost and improved safety. The chemical and physical properties of silicone sealants are anticipated to improve on account of increased investments by key players in the research and development of the product to attain a competitive advantage in the market.

The market growth is, however, restricted by rising regulations regarding environmental concerns with the use of silicone. Solvent-based silicone sealants emit higher amounts of volatile organic compounds while drying. These compounds can affect the human health of individuals who are constantly exposed to these types of products. Moreover, the application of silicone sealants often leads to the contamination of groundwater as well as surface water.

Manufacturers are increasingly pushing the development of bio-based sealants, and this is expected to provide new opportunities for the growth of the U.S. silicone sealants market. The demand for low volatile organic compounds and green & sustainable sealants is expected to create lucrative growth opportunities for the market in the U.S. over the forecast period.

Sector Insights

Industrial dominates the overall market based on sector followed by commercial and residential. Silicone sealants are used in the industrial sector for various purposes including new construction, repair, alteration, restoration, and renovation of factories. They are used for maintenance, design, and installation of several mechanical and structural components. Industrial construction is specialized and thus requires unique expertise. Thus, contractors and builders prefer using a material that is efficient in performance and gives the desired result in lesser timelines.

The stable labor market, rising trends of leasing, easy availability of finances, and accelerated consumer spending are some of the factors which are expected to supplement the demand for the product from the residential sector. Moreover, the expanding housing construction for making more properties available has gained popularity in the U.S., which is, in turn, expected to create lucrative growth opportunities.

Application Insights

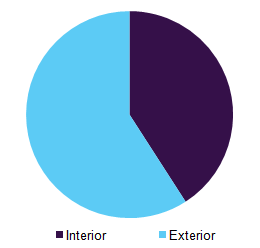

Exterior was estimated as the largest segment in 2015, accounting of the revenue share, followed by interior as the second-largest segment. Exterior applications include weather sealing door and window frames, expansion joints in brickwork, glazing, cladding, gutter, and roofing applications. They have the ability to withstand extreme weather and atmospheric conditions. These highly durable sealants seal air and water effectively and also keep the maintenance costs to a minimum.

U.S. Silicone Sealants in construction market revenue by application, 2016 (%)

Increasing application areas in internal sanitary ware such as bathroom fittings are expected to drive the overall demand for interior applications in the U.S. silicone sealants market. Increasing infrastructural development in the Southwest regions, particularly in Texas, is predicted to drive the overall growth from 2017 to 2025.

Regional Insights

The Northeast region dominated the U.S. silicone sealants in the construction market and accounted for the largest revenue share in 2019. The region is anticipated to continue its dominance over the forecast period. The growth can be attributed to extensive urbanization, high population, high per capita spending, and high value of construction.

The population density of New York is the highest in the U.S. i.e., 27,000 people per square mile. The rental properties in these regions are among the most expensive in the world. The construction industry in this region is expected to grow substantially over the forecast period.

The West region accounted for a revenue share in 2019 and is expected to grow significantly across the forecast period. The construction industry in the West U.S. is reviving after the recession. Residential construction builders are investing in Arizona to explore new growth opportunities in the region, which in turn is contributing to the growing demand for silicone sealants in the construction market.

Certain growth restraints in the region such as shortage of skilled workers, a lack of desirable building lots, and the inability of subcontractors to ramp up labor operations to handle the increasing opportunities that exist in the construction industry. This is expected to hinder the future market growth of silicone sealants in the construction industry in the coming years.

Key Companies & Market Share Insights

The market is highly competitive and fairly fragmented. Key players are investing in developing newer technologies coupled with forward and backward integration in the value chain. Key participants include Wacker Chemie AG, 3M Company, General Electric Company, Selena Group, and others.

U.S. Construction Silicone Sealants Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 224.9 million

Revenue forecast in 2025

USD 288.1 million

Growth rate

CAGR of 5.1% from 2020 to 2025

Base year for estimation

2019

Historical data

2014 - 2018

Forecast period

2020 - 2025

Quantitative units

Revenue in USD million/billion and CAGR from 2020 to 2025

Report coverage

Revenue forecast, player positioning, competitive landscape, growth factors, and trends

Segments covered

Sector, application, region

Regional scope

Northeast, Southeast, Midwest, Southwest, and West

Country scope

U.S.

Key companies profiled

Pecora Corporation; Dow Corning Corporation; Sika Corporation; 3M Company; American Sealants, Inc.; Wacker Chemie AG; C.R. Laurence Co., Inc.; General Electric Company (GE); CSL Silicones Inc.; Selena Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the report

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the U.S. construction silicone sealants market on the basis of sector, application, and region:

-

Sector Outlook (Revenue, USD Million; 2014 - 2025)

-

Residential

-

Commercial

-

Industrial

-

-

Application Outlook (Revenue, USD Million; 2014 - 2025)

-

Interior

-

Exterior

-

-

Regional Outlook (Revenue, USD Million; 2014 - 2025)

-

Northeast

-

Southeast

-

Midwest

-

Southwest

-

West

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."