- Home

- »

- Water & Sludge Treatment

- »

-

U.S. Liquid Waste Management Market Size Report, 2030GVR Report cover

![U.S. Liquid Waste Management Market Size, Share & Trends Report]()

U.S. Liquid Waste Management Market Size, Share & Trends Analysis Report By Category (CWT, Onsite Facilities), By Waste Type (Residential, Commercial), By Source, By Services, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-888-6

- Number of Pages: 156

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Bulk Chemicals

Market Size & Trends

The U.S. liquid waste management market size was estimated at USD 26.7 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 1.6% from 2024 to 2030. The growth is attributed to the expanding industrial manufacturing sector leading to rising wastewater and liquid waste generation and requirement for waste management. The outbreak of COVID-19 had a mixed impact on the industry’s growth. Government restrictions and lockdowns resulted in a halt in industrial production and negatively affected industrial liquid waste management, while municipal wastewater generation had a positive impact. Over the forecast period, the market is projected to exhibit promising growth.

The U.S. government is actively focusing on growing wastewater management infrastructure across the country. Residential connections to the wastewater treatment facilities are expanding with investments in construction of pipelines in countryside regions. Moreover, new wastewater treatment plants are being constructed across the country.

In August 2020, the U.S. government launched an initiative to close a gap in between wastewater treatment access. For 11 rural communities across the country, the U.S. Environmental Protection Agency (EPA) and the U.S. Department of Agriculture jointly launched a pilot project to provide solutions for unmet sanitation needs. This pilot project is expected to also enhance the wastewater management system for these communities.

Furthermore, wastewater from the industrial sector contains heavy metals and chemical components, like lead, arsenic, and mercury, which tend to be harmful to humans and environment. Rising concerns over environmental impact of such toxic contaminants present in industrial wastewater discharge are increasingly driving the U.S. liquid waste management industry growth.

New stringent regulations for industrial as well as commercial sectors limiting chemicals and toxic compounds concentration in discharge wastewater are likely to drive the growth of the U.S. market. For instance, in 2021, EPA announced new wastewater regulations with new effluent limitations for poultry, metal finishing, and plastics & fibers industry.

Market Dynamics

Growing population coupled with the construction of new housing developments and an increasing number of users being connected to centralized wastewater treatment systems is expected to drive the demand for wastewater treatment. These aforementioned factors will further drive the market growth.

Companies operating in various industries, such as manufacturing, mining, construction, and metallurgical, generate a significant quantity of liquid waste, which is neither recyclable nor consumable. The operation of big corporations on large scale results in the production of a high amount of liquid waste along with other waste byproducts. This, in turn, has resulted in boosting the importance of proper management of waste by these companies for preventing further degradation of environment and planet.

Waste Type Insights

The residential segment dominated the U.S. market with around 43.8% revenue share in 2023 and contributed majorly to the country’s liquid waste generation from activities of bathing, cooking, toilet flushing, laundry, etc. The generated liquid waste is collected via sewer network and efficiently transported to treatment facilities.

According to the U.S. EPA, over 75% of the population in the country is connected to the proper wastewater treatment facilities. While the remaining population uses septic tanks and other onsite systems to treat and dispose of the wastewater produced at home. However, U.S. EPA estimates that around 20% of the facilities in small communities carry out improper wastewater treatment.

Commercial sector is anticipated to witness a significant CAGR over 2.0% from 2024 to 2030. Growing number of restaurants & cafes, swimming pools & recreational facilities, medical facilities, and other commercial buildings are likely to contribute to the growth of waste generated and liquid waste management services.

Industrial segment is also estimated to witness significant growth over the forecast period. Growing manufacturing activities, mining, and energy sector are expected to drive the need for wastewater treatment.

Category Insights

The centralized waste treatment (CWT) facilities segment held the largest revenue share of over 77.6% in 2023. According to the U.S. EPA, centralized waste treatment facilities are the main wastewater treatment plants that treat 34 billion gallons of wastewater every day. Centralized treatment plants are large-scale facilities that treat wastewater and serve large municipal or regional areas.

These centralized treatment facilities treat both municipal and industrial wastewater from manufacturing and production factories. The objective of CWT facilities is to reduce the levels of contaminants and other toxic trace elements before they are released into surface water bodies.

Onsite facilities segment is anticipated to witness a significant CAGR of over 2.6% from 2024 to 2030. Increasing awareness about the health and environmental benefits of proper sanitation practices is likely to drive the use of onsite treatment systems in rural areas. According to the U.S. EPA, in rural areas, 20% of the facilities still depend on improper waste management.

The U.S. government is taking initiatives to provide onsite systems, such as septic tanks to improve the sanitation system. Moreover, stringent regulations as well as water scarcity are forcing manufacturers to construct and implement onsite wastewater treatment facilities.

Source Insights

Municipal source segment held the largest revenue share of over 71.1% in 2023. A high amount of wastewater is generated per person in the U.S. due to activities at home and other places. The municipal source segment comprises residential and commercial wastewater, which is generated by everyday human activities at houses, offices, and other commercial buildings.

Textile industry is also a significant source of wastewater generation. This industry requires a vast amount of water for the dyeing process, resulting in chemicals and color effluents in the wastewater. For the production of 1 kg textile, around 200 liters of water is utilized and the resulting wastewater contains trace elements such as zinc, chromium, and other toxic chemicals.

Emerging technology and research & development are enabling the use of new techniques and limiting the use of chemicals and dyes in the textile industry. For example, inkjet printing, radiofrequency & ultrasound dyeing, and dyebath monitoring and automated systems are expected to reduce the use of dyes and chemicals.

Oil & gas sector also emits large quantities of liquid waste owing to the high levels of water consumption during various processes. Oil & gas sector requires processed water, also water is produced during the drilling process, which needs to be treated before being released to the surface water or by underground well injection.

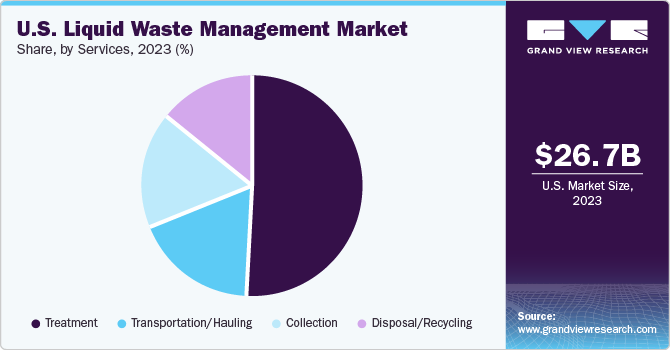

Services Insights

The treatment segment held a revenue share of over 51.7% in 2023. The segment is also expected to witness a significant CAGR during the forecast period with the development of new treatment technologies and rising new infrastructure for wastewater treatment facilities.

Liquid waste treatment at wastewater treatment facilities includes three major steps, primary, secondary, and tertiary treatment. Sometimes pre-treatment process is also carried out. Some of the techniques used for treatment comprise sedimentation, aeration, membrane bioreactor, UV disinfection, filtration, etc.

The disposal/recycling segment is expected to witness a significant CAGR of over 1.4% from 2024 to 2030. Treated wastewater in the U.S. is mainly disposed of via discharge to sea and irrigation use while water reuse is still limited. The segment is expected to witness growth attributed to the increasing activities of recycling wastewater for reuse.

Transportation/hauling service of liquid waste consists of movement of liquid from the storage location to the treatment location, i.e., wastewater treatment plants. Transportation of hazardous liquid waste requires special containers, and transporting vehicles that ensure safe movement along the road. Transportation is also subjected to the adherence to several regulations under the RCR act.

Key Companies & Market Share Insights

The U.S. liquid waste management industry is fragmented with the presence of a few major players. Key players are actively focusing on several strategies, including research & development, product innovation, expansion, and joint venture. With these strategies, key players aim to target new customers from end-use industries and increase market penetration.

For instance, in January 2020, Veolia signed an agreement with Alcoa USA Corporation to take over the hazardous waste treatment site located in Arkansas, USA. This acquisition is expected to strengthen the geographical presence of the company in the country.

Key U.S. Liquid Waste Management Companies:

- Veolia

- Waste Management Solutions

- Clean Harbors

- Clean Water Environmental

- DC Water

- Covanta Holding Corporation

- Stericycle, Inc.

- US Ecology, Inc.

- Republic Services, Inc.

- Hazardous Waste Experts

U.S. Liquid Waste Management Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 29.8 billion

Growth rate

CAGR of 1.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Category, waste type, source, services

Key companies profiled

Veolia; Waste Management Solutions; Clean Harbors; Clean Water Environmental; DC Water; Covanta Holding Corporation; Stericycle, Inc.; US Ecology, Inc.; Republic Services, Inc.; Hazardous Waste Experts.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Liquid Waste Management Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. liquid waste management market report based on category, waste type, source, and services:

-

Category Outlook (Revenue, USD Billion, 2018 - 2030)

-

CWT

-

Onsite Facilities

-

-

Waste Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Residential

-

Commercial

-

Toxic & Hazardous Waste

-

Organic & Non-Hazardous Waste

-

Industrial

-

Toxic & Hazardous Waste

-

Organic & Non-Hazardous Waste

-

Chemical Waste

-

-

Source Outlook (Revenue, USD Billion, 2018 - 2030)

-

Municipal

-

Textile

-

Pulp & Paper

-

Iron & Steel

-

Automotive

-

Pharmaceutical

-

Oil & Gas

-

Others

-

-

Services Outlook (Revenue, USD Billion, 2018 - 2030)

-

Collection

-

Transportation/Hauling

-

Treatment

-

Disposal/Recycling

-

Frequently Asked Questions About This Report

b. U.S. liquid waste management market size was estimated at USD 26.7 billion in 2023 and is expected to be USD 27.1 billion in 2024

b. The U.S. liquid waste management market, in terms of revenue, is expected to grow at a compound annual growth rate of 1.6% from 2024 to 2030 to reach USD 29.8 billion by 2030

b. Residential waste dominated the U.S. liquid waste management market with a share of 43.9% in 2022, owing to rapid population growth in the country, resulting in an increased demand for water, thereby augmenting the amount of per capita wastewater generated.

b. Some of the key players operating in the U.S. liquid waste management market include: Veolia, Waste Management Solutions, Clean Harbors, Clean Water Environmental, DC Water, and Covanta Holding Corporation

b. Key factors driving the U.S. liquid waste management market are rising awareness about onsite management technologies among consumers, increasing liquid waste generation, and developments in treatment technologies

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."