- Home

- »

- Renewable Chemicals

- »

-

U.S. Specialty Oleochemicals Market Size, Industry Report, 2018-2025GVR Report cover

![U.S. Specialty Oleochemicals Market Size, Share & Trends Report]()

U.S. Specialty Oleochemicals Market Size, Share & Trends Analysis By Product (Specialty Esters, Fatty Acid Methyl Esters, Glycerol Esters, Alkoxylates, Fatty Amines), By Application, And Segment Forecasts, 2018 - 2025

- Report ID: GVR-1-68038-404-8

- Number of Pages: 60

- Format: Electronic (PDF)

- Historical Range: 2014 - 2016

- Industry: Specialty & Chemicals

Industry Insights

The U.S. specialty oleochemicals market size was estimated at 1,097 kilotons in 2015. The increasing demand for sustainable solutions and bio-degradable products coupled with changes in the U.S. regulations such as EPA are raising the influence of oleochemicals in various segments of the chemical industry.

The recent developments have created new applications for oleochemical products in various segments such as in biosurfactants, lubricants, and polymers which offer substantial prospects for companies in the long run.

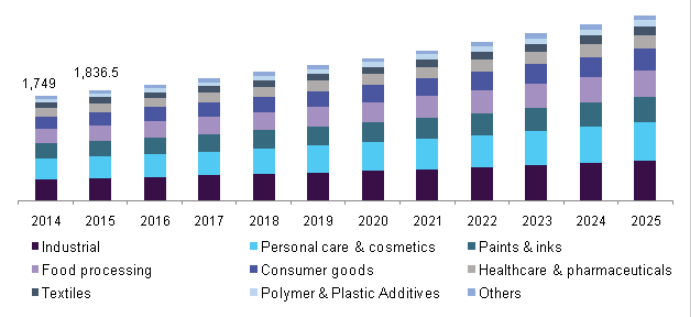

U.S. specialty oleochemicals market by application, 2014 - 2025 (USD Million)

Customers increasingly prefer natural-based products and this trend is likely to become more prominent in the U.S. in the near future. The chemical companies are increasingly involved in sustainable development as part of liable care initiatives, which further drives the product demand in the region.

In the U.S., the banning of trans fats may further boost the consumption of palm-based products. The demand for specialty oleochemicals derivatives is growing at a steady pace owing to increase in the consumption of personal care, pharmaceutical, and food products. Demand for personal care products is increasing owing to increase in disposable incomes, product innovation, and high market penetration.

The current regulatory framework in the U.S. is defined by tax incentives provided by the government in order to encourage biofuel consumption. The demand for biodiesel is directly associated with the blending norms and specification standards established by U.S. governments across the region through legislative policies.

The change in blending and production standards may have a considerable impact on the biodiesel market, which in turn is expected to affect oleochemicals demand in biodiesel production. Additionally, growing popularity of shale gas as an alternative energy source is expected to have an adverse impact on biodiesel demand in the U.S., which is expected to remain a major hindrance to the industry expansion.

Product Insights

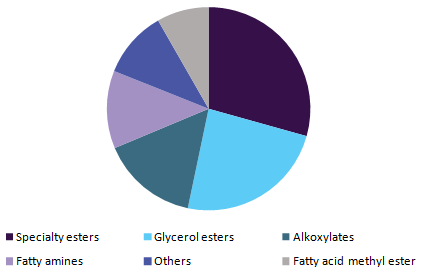

Specialty esters dominated the U.S. market with a volume of 321.9 kilotons in 2015. Esters provide a sustainable alternative to petroleum-based chemicals and materials for diverse end-use applications. These chemicals also help manufacturers and consumers to meet REACH and U.S. EPA guidelines to reduce carbon footprint and utilize bio-based resources in environmentally sensitive applications.

Fatty acid methyl esters (FAME) accounted for 8.3% of the overall market volume in 2014. Fatty esters are largely used as food additives in ice creams, baked goods, and other processed products to moisturize, stabilize, and thicken the food.

Glycerol esters include glycerol monostearate (GMS), glycerol di-stearate, oleates, medium-chain triglycerides (MCT), and other glycerides. Owing to its chemical composition, GMS has witnessed a significant increase in demand as an emulsifier and thickener in food and beverage and personal care industries.

Alkoxylates include ethoxylates of fatty acid, fatty amine, fatty alcohol, and methyl ester. Alkoxylates find significance as emulsifiers for manufacturing various products such as household care, agrochemical, and fabric softeners. Growing significance of surfactants in various industrial sectors is anticipated to drive alkoxylates demand over the forecast period.

U.S. specialty oleochemicals market by product, 2015 (%)

The fatty amines segment primarily comprises primary, secondary, and tertiary amines. Fatty amines find significance as floatation agents, corrosion inhibitors, and anti-caking agents. This has attributed to the fatty amines demand for manufacturing hair conditioners, agricultural wetting agents, textile chemicals, oilfield chemicals, and biocides.

Application Insight

The personal care and cosmetics segment is anticipated to emerge as the fastest-growing application and is expected to account for over 20% of the total revenue by 2025. Decreasing use of harmful chemicals including parabens, aluminum salts, and phthalates coupled with committed efforts from numerous multinational corporations for adopting sustainable products has contributed to increasing consumption of specialty oleochemical derivatives.

Consumer goods include direct chemical products, household cleaners, beverages, and food flavorings. Shifting consumer trend towards natural and less toxic ingredients in household products and beverages is anticipated to steer specialty oleochemical demand in the U.S. over the forecast period.

The textiles segment includes chemical agents used in textile printing, fiber finishing, coning, fabric softener, etc. Specialty oleochemical derivatives in this segment find significance majorly as emulsifiers, antistatic agents, microbial agents, lubricants, dyeing agents, and wetting agents.

U.S. Specialty Oleochemicals Market Share Insights

The U.S. companies have been extensively involved in R&D to develop bio-based chemicals from vegetable oils. Health and environmental hazards posed by petrochemical-based lubricants regarding their degradability when disposed of have been a challenge for the last few years. In order to overcome these challenges, companies are working towards the production of bio-based lubricants using oleochemicals such as soybean oil as raw materials. One such instance is Cargill, which has developed electrical insulation fluid through soybean oil.

The U.S. industry is dominated by large multinationals, which makes price differentiation unfeasible for other companies. The key players in the U.S. specialty oleochemical it market include Vantage Specialty Chemicals, Emery Oleochemicals, Evonik Industries, Wilmar International, Cargill, TerraVia Holdings, Inc., and Kao Chemicals.

Report Scope

Attribute

Details

Base year for estimation

2016

Actual estimates/Historical data

2014 - 2016

Forecast period

2017 - 2025

Market representation

Volume in Kilo Tons, Revenue in USD Million & CAGR from 2016 to 2025

Country scope

U.S.

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

15% free customization scope (equivalent to 5 analyst working days)

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments Covered in the ReportThis report forecasts revenue growth at the U.S. country levels and provides an analysis of the industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the U.S. specialty oleochemicals market on the basis of product and application:

-

Product Outlook (Volume, Kilo Tons; Revenue, USD Million, 2014 - 2025)

-

Specialty esters

-

Fatty acid methyl ester

-

Glycerol esters

-

Alkoxylates

-

Fatty amines

-

Others

-

-

Application Outlook (Volume, Kilo Tons; Revenue, USD Million, 2014 - 2025)

-

Personal care & cosmetics

-

Consumer goods

-

Food processing

-

Textiles

-

Paints & inks

-

Industrial

-

Healthcare & pharmaceuticals

-

Polymer & Plastic Additives

-

Others

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."