- Home

- »

- Medical Devices

- »

-

3D Bioprinting Market Size & Share Analysis Report, 2030GVR Report cover

![3D Bioprinting Market Size, Share & Trends Report]()

3D Bioprinting Market Size, Share & Trends Analysis Report By Technology (Magnetic Levitation, Inkjet-based), By Application (Medical, Dental, Biosensors, Bioinks), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-636-3

- Number of Pages: 109

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

3D Bioprinting Market Size & Trends

The global 3D bioprinting market size was valued at USD 2.0 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 12.5% from 2023 to 2030. The growth is attributed to a limited number of organ donors, and an increasingly aging population with chronic respiratory diseases. Rising R&D investment, technological advancement, and increasing incidence of chronic diseases are other vitally impacting attributes, likely to boost the market growth. The 3D printing community has responded to the COVID-19 crisis, pledging to support the production of vital medical equipment for hospitals grappling with this pandemic.

As the recent pandemic caused due to coronavirus has taken hold over the globe, even developed countries are witnessing their healthcare systems fatigued and overburdened. Hence, as a reaction to the rising cases of coronavirus, various 3D Bioprinting communities are responding to the worldwide crises by offering their respective skills to ease the burden on supply chains and governments.

As the cases of COVID-19 are increasing day by day, there has been a shortage of materials for medical professionals as well as for the general public. One of the biggest issues is the lack of availability of test kits for COVID-19. Hence, various 3D bioprinting companies are manufacturing 3D printers and related software on a large scale.

For example, Formlabs company based in Massachusetts, U.S. is now manufacturing 100,000 nasal swabs for COVID-19 testing each day. Due to the ever-increasing cases of COVID-19, the demand for 3D bioprinters is increasing and the market for 3D bioprinting is expected to witness exponential growth.

The coronavirus pandemic has also accelerated the development of drug and vaccine testing, as scientists are harnessing new technology for safety testing in patients after preclinical trials are completed. With the ever-increasing cases of COVID-19, the medical world is also facing a shortage of respirators and ventilators. The 3D bioprinting technology is helping in manufacturing respirators and ventilators to overcome the shortage of these devices.

Recently CLECELL, a 3D bioprinting company, has created a respiratory epithelium model using their proprietary 3D printer U-FAB, along with other bioprinting technologies. Respiratory epithelium is a type of tissue that lines most of the respiratory tract. This epithelium acts as a barrier to pathogens and foreign particles.

However, it also prevents infection and tissue injury with the help of the mucociliary elevator. Hence, with increasing incidences of demand for this respiratory epithelium model, the market for 3D bioprinting is anticipated to witness growth. Owing to such innovations, the market is expected to witness higher growth over the forecast period.

Many biotherapeutic companies are using 3D bioprinting technology to accelerate COVID-19 research. For example, Viscient Biosciences used 3D bioprinting technology to create lung tissue which supports viral infectivity research and helps in searching for effective therapy against SARS-CoV-2, the novel coronavirus which causes COVID-19.

The Wyss Institute at Harvard University has designed a fully injection-molded nasopharyngeal swab in collaboration with healthcare, industrial partners, and other research institutes.

3D bioprinting is witnessing demand on a large scale with the increasing spread of Covid-19. Hence, many pharmaceutical and biopharmaceutical participants are coming forward to help healthcare workers, physicians, and scientists in all possible ways. For example, Stratasys which is one of the leading manufacturers of 3D printers in America has manufactured face shields with the help of a 3D bioprinter. Until March 2020, they shipped 100,000 face shields to the U.S.

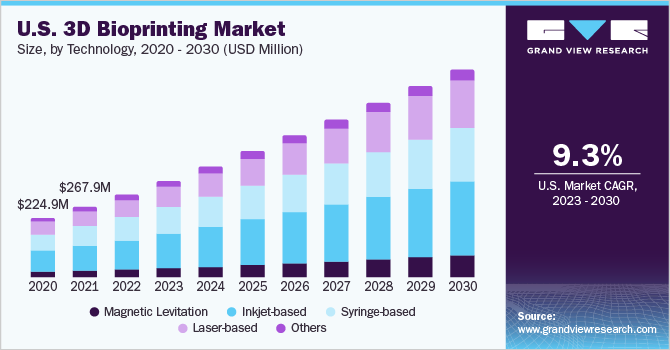

Technology Insights

The inkjet-based segment accounted for the largest revenue share of 35.9% in 2022, as this technology enables the printing of complex living organs or tissues on the culture substrates with the help of biomaterials such as bio-inks. The wide adoption of inkjet-based printing in the medical field is contributing to the segment’s growth. This work presents the research trends in inkjet printing as a bio-applicable technology, especially in the fields of tissue engineering and drug delivery systems. This segment is anticipated to observe significant growth over the forecast period owing to its increasing demand and higher reliability.

The magnetic levitation segment is projected to expand at the fastest CAGR of 13.7% over the forecast period. The lucrative growth can be attributed to the cost-efficiency associated with the technology. Magnetic levitation technology is expected to solve more than 80.0% of the errors in 3D bioprinting with its advanced features, enhanced speed, and precision.

These bioprinters are also used for toxicity screening, vascular muscle printing, and human cell regeneration. For instance, BioAssay has developed a tissue-like structure, with the help of magnetic levitation-based devices. Magnetic levitation-based devices are most likely to witness sluggish growth over the forecast period owing to the rapid increase in the usage of newer technologies.

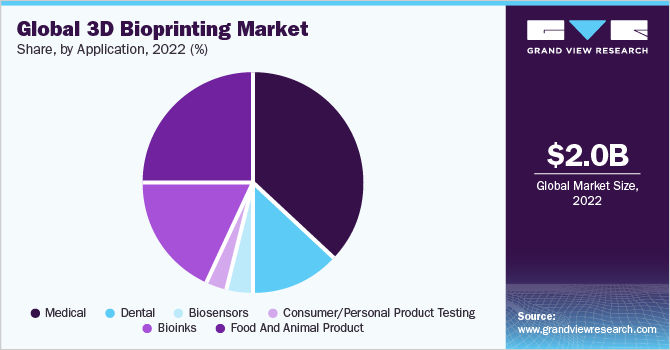

Application Type Insights

The medical segment held the largest market share of 37.6% in 2022 and is anticipated to grow at a CAGR of around 15.0% over the forecast period. The vast usage of medical pills to cure various chronic diseases is propelling the growth of the market for 3D bioprinting. Moreover, the growing need for medicines and cost-efficient application of bio-drugs using this technology is further driving the segment.

With the increasing number of participants in the pharmaceutical industry, the demand for medical pills is increasing. Millions of people, globally, are regular users of capsules and medicinal pills. Hence, this segment is expected to witness lucrative growth over the forecast period.

The tissue and organ generation sub-segment is expected to grow at the fastest CAGR of 15.4% over the forecast period. 3D bioprinting is most widely used to regenerate medicine to address the need for organs and tissue regeneration suitable for transplantation. With the rising incidence of COVID-19 disease, the demand for tissue and organ generation is increasing.

Due to this reason, the tissue and organ generation segment is expected to witness exponential growth over the forecast period. The increasing number of COVID-19 cases globally is expected to provide new growth avenues for the key market players. Various players in the market for 3D bioprinting are engaged in developing new techniques that can overcome this pandemic effect and produce a vaccine to treat COVID-19.

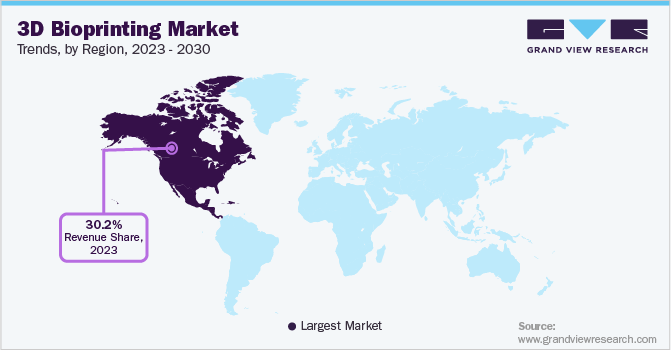

Regional Insight

Asia Pacific accounted for a revenue share of 26.0% in 2022 and is expected to continue its dominance over the forecast period. Japan and China accounted for the largest revenue share due to the increasing cases of COVID-19 cases and the rising investment from governments in R&D. As per the World Meter Report 2021, around 87,706 active cases of Covid-19 were reported in China until January 13, 2021. Moreover, increasing the mortality rate due to COVID-19 and the shortage of organ donors is further anticipated to drive the regional market’s growth.

North America captured a revenue share of 30.9% in 2022 and is expected to lead the market throughout the forecast period. The increasing incorporation of IT in the healthcare industry is estimated to stimulate growth. As per the World Meter Report 2021, around 23,369,732 active cases of COVID-19 were reported in the U.S. alone until January 13, 2021. There are currently over 50 vaccine candidates under trial. The government is spending more on R&D, to develop a vaccine. Hence, there is an increasing demand for 3D bioprinting as this technology has been reconnoitered for drug testing and organ transplantation.

Key Companies & Market Share Insights

Key companies are focusing on R&D to develop technologically advanced applications to gain a competitive edge. For instance, in November 2019, CELLINK’s developed the most advanced 3D bioprinting device, Bio X6, as well as Lumen X which produces vascular structures. Also, Fluicell Sweden-based company has launched a high-resolution bioprinting technology in both 3D and 2D forms, which is named Biopixlar.

Companies are engaging in mergers, partnerships, and acquisitions, aiming to strengthen their manufacturing capacities, and application portfolio, and provide competitive differentiation. For instance, in November 2019, BASF GmbH announced the acquisition of Sculpteo which is a 3D printing service provider. This acquisition is expected to aid BASF GmbH in the market and develop new industrial 3D printing materials more quickly. Some prominent players in the global 3D bioprinting market include:

-

EnvisionTEC, Inc.

-

Organovo Holdings, Inc.

-

Inventia Life Science PTY LTD

-

Poietis

-

Vivax Bio, LLC

-

Allevi

-

Cyfuse Biomedical K.K.

-

3D Bioprinting Solutions

-

Cellink Global

-

Regemat 3D S.L.

3D Bioprinting Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2.3 billion

Revenue forecast in 2030

USD 5.3 billion

Growth rate

CAGR of 12.5% from 2023 to 2030

Base year for estimation

2022

Actual estimates/Historical data

2018 - 2021

Forecast period

2023 - 2030

Market representation

Revenue in USD million and CAGR from 2023 to 2030

Segments covered

Technology, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Thailand; Australia; South Korea; Brazil; Mexico; Argentina; Columbia; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Envisiontec, Inc.; Organovo Holdings, Inc.; Inventia Life Science PTY LTD; Poietis; Vivax Bio, LLC; Allevi; Cyfuse Biomedical K.K.; 3D Bioprinting Solutions; Cellink Global; Regemat 3D S.L.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

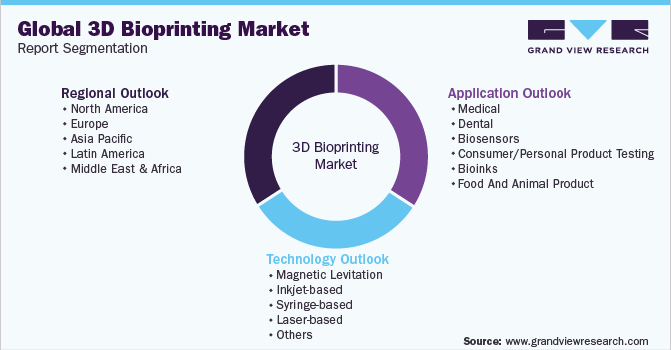

Global 3D Bioprinting Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global 3D bioprinting market report based on technology, application, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Magnetic Levitation

-

Inkjet-based

-

Syringe-based

-

Laser-based

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Medical

-

Tissue And Organ Generation

-

Medical Pills

-

Prosthetics And Implants

-

Others

-

-

Dental

-

Biosensors

-

Consumer/Personal Product Testing

-

Bioinks

-

Food And Animal Product

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Columbia

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global 3D bioprinting market size was estimated at USD 2.0 billion in 2022 and is expected to reach USD 2.3 billion in 2023.

b. The global 3D bioprinting market is expected to grow at a compound annual growth rate of 12.5% from 2023 to 2030 to reach USD 5.3 billion by 2030.

b. North America dominated the 3D bioprinting market with a share of 30.9% in 2022. This is attributable to the presence of well-established companies, sophisticated healthcare infrastructure extensive research activities conducted within the region.

b. Some key players operating in the 3D bioprinting market include Organovo Holding, Inc.; Luxexcel Group B.V.; TeVido BioDevices, LLC; 3Dynamics Systems Ltd.; Cyfuse Biomedical K.K.; Aspect Biosystems Ltd.; Stratasys Ltd.; Voxeljet A.G.; Bio3D Technologies Pte. Ltd.; Materialise N.V.; Envision TEC; and Solidscape, Inc. (acquired by Prodways Group).

b. Key factors that are driving the 3D bioprinting market growth include advancements in technology, rising advancements in chronic conditions, a rise in the old age population, and a limited number of organ donors.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."