- Home

- »

- Electronic & Electrical

- »

-

3D Camera Market Size, Share, Trends Analysis Report 2030GVR Report cover

![3D Camera Market Size, Share & Trends Report]()

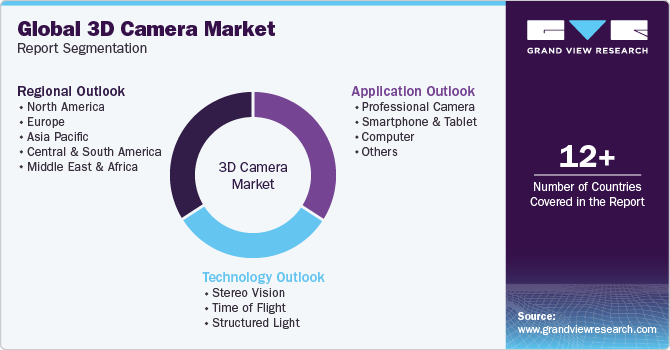

3D Camera Market Size, Share & Trends Analysis Report By Technology (Stereo Vision, Time of Flight, Structured Light), By Application (Professional Camera, Smartphone & Tablet, Computer, Others), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-263-1

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Consumer Goods

3D Camera Market Size & Trends

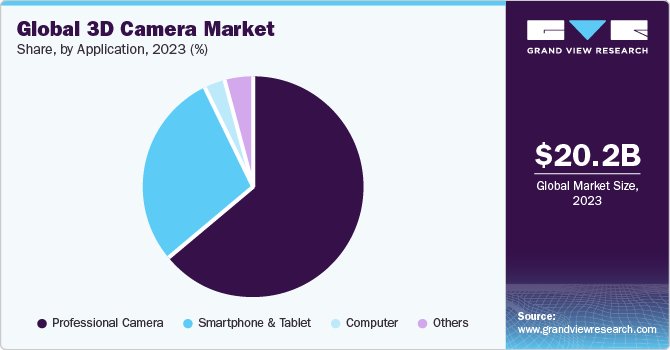

The global 3D camera market size was estimated at USD 20.18 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 30.8% from 2024 to 2030. The market is a niche within the broader digital camera market, catering specifically to consumers and professionals who require the ability to capture images with depth perception. 3D cameras use advanced imaging technology to capture and process depth information, enabling the creation of 3D models of objects. The market for 3D cameras is growing as demand increases in virtual reality, augmented reality, and 3D printing. The increasing adoption of technologies such as autonomous vehicles, drones, and robotics drives the market.

Furthermore, the escalating utilization of 3D cameras in sectors such as home security, military operations, and industrial environments is anticipated to boost their global adoption. These cameras also find widespread use in the film and television industry for capturing immersive 3D footage. The combined impact of these factors is predicted to propel the expansion of 3D cameras across diverse applications throughout the projected timeframe.

The market demonstrates intense competitiveness, featuring prominent industry players like Sony, Panasonic, Nikon, Canon, and Fujifilm. Additionally, emerging startups and new entrants, particularly in the domains of 3D scanning and computer vision, are introducing heightened competition. In general, the market for 3D cameras is projected to witness growth in the foreseeable future, driven by the escalating demand for advanced imaging technology and 3D content across diverse applications.

The increasing demand for 3D content has become one of the primary drivers of the market. With the advent of new technology, consumers are becoming more interested in immersive experiences that provide a sense of depth and realism. As a result, the demand for 3D content is growing at an unprecedented rate, and it is expected to exhibit the same in the coming years.

One of the primary drivers of 3D content is the increasing popularity of virtual reality (VR) and augmented reality (AR) technologies. These technologies allow users to interact with digital environments in real-time, providing a more immersive experience than traditional 2D content. This has led to a surge in demand for 3D content compatible with VR and AR systems.

In addition, the entertainment industry has also contributed to the growth of the market. Many movies and television shows are now being produced in 3D, requiring specialized 3D cameras. As a result, there has been a significant increase in demand for 3D cameras from studios and production companies. For instance, movies like Avatar, Avatar: The Way of Water, Gravity, and Jurassic World have been huge commercial successes, largely due to their innovative use of 3D technology. Similarly, television shows like Game of Thrones and The Mandalorian have utilized 3D technology to create stunning visual effects and immersive worlds.

Market Concentration & Characteristics

The market for 3D camera demonstrates a medium to high degree of innovation, with companies consistently adopting newer technology to cater to evolving consumer preferences. For instance, LiDAR (Light Detection and Ranging) technology is being integrated into 3D cameras to enable precise distance measurements and 3D mapping. LiDAR-equipped 3D cameras are used in applications such as autonomous vehicles, robotics, and environmental monitoring.

Mergers and acquisitions are in the range of medium to high in the 3D camera industry. Companies undergoing mergers and acquisitions are seeking strategic partnerships to enhance their product portfolios, expand their market presence, and leverage each other’s strengths. Moreover, the competitive nature of the market has led to further encouraging the players to explore synergies, leading to occasional mergers and acquisitions aiming to gain a competitive edge and achieving economies of scale in the market.

Regulatory authorities enforce precise labeling standards to ensure transparency and accurate information for consumers when it comes to 3D cameras. In the United States, the Federal Communications Commission (FCC) sets regulations for electromagnetic interference and radio frequency emissions from electronic devices, including cameras and imaging equipment.

Substitutes for 3D cameras include alternative imaging technologies and methods that can capture spatial information and depth perception. Infrared depth sensors use infrared light to measure distance and create depth maps, often used in robotics, gesture recognition, and gaming applications.

Application Insights

Professional camera dominated the market with a share of 63.74% in 2023. These cameras are also widely used in virtual reality (VR) and augmented reality (AR) to capture the geometry of a scene and create immersive experiences. In these applications, 3D cameras are often combined with other sensors, such as gyroscopes and accelerometers, to track the user's movement and adjust the perspective of the virtual or augmented environment accordingly.

For instance, Orbbec launched its high-resolution 3D camera, the Femto Magna, at the Consumer Electronics Show (CES) held in January 2023. The 3D cameras comprise Microsoft and NVIDIA technologies and enable easier access to sensing technology, rendering them suitable for logistics, robotics, retail, manufacturing, fitness systems, and healthcare.

The smartphone and tablet are projected to register a CAGR of 30.4% over the forecast period. Smartphones and tablets are increasingly using 3D cameras. These cameras capture and process three-dimensional images using a combination of hardware and software, enabling users to build 3D models, gauge distances, and even record virtual reality experiences. Major smartphone brands like Apple, Samsung, and Google Pixel are introducing cutting-edge technologies in camera sensors to cater to the rising demand for advanced smartphones globally.

Regional Insights

Asia Pacific held the largest revenue share globally accounting for around 38.28% in 2023 owing to several factors such as increasing penetration of smartphones, enhancing the entertainment industry, increasing disposable income, and low camera ownership. The growing use of 3D imaging in virtual reality, robotics, home automation, and video surveillance is another factor driving the demand for 3D cameras.

Key market players are focusing on product launches in the region to provide customers with high-quality products and excellent service. For instance, in February 2023, Alsontech, the manufacturer of 3D vision for industrial robots, unveiled its newest 3D vision camera, the AT-S1000-06C-S3. The AT-S1000-06C-S3 is a member of the NANO series and features Alsontech's advanced binocular imaging technology, which offers industrial automation customers dependable accuracy and operational stability.

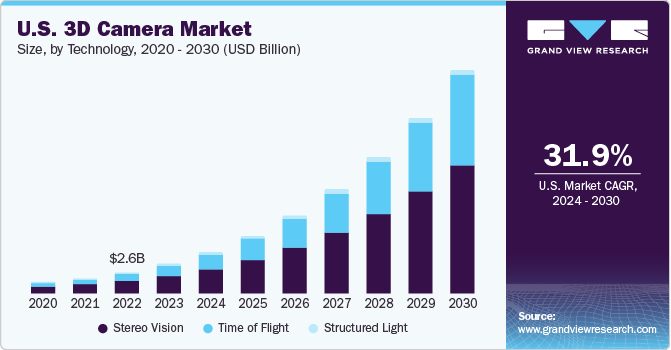

North America is anticipated to grow at a CAGR of 31.1% in the forecasted period. Time of flight is anticipated to be the fastest-growing technology segment in the North American region. The technology is poised to unleash its growth potential over the forecast period. Applications for time-of-flight sensors include car tracking, object detection, people counting, and robot navigation. Time-of-flight sensors measure the distance between places in the time photons take to move between two locations.

Many companies are focusing on new launches to provide customers with high-quality products and excellent service. In September 2022, researchers from the University of California created a camera that takes a single exposure to record 3D data about objects in a scene using a thin micro-lens array and new image processing algorithms. The camera may be helpful for a number of tasks, including the inspection of industrial parts, the recognition of gestures, and the gathering of information for 3D display systems.

Europe is expected to witness a steady growth rate of 29.9% over the forecast period. The key factors driving the growth of the European market are the increased demand for 3D enhanced content in the entertainment sector and improvements in 3D scanning technology. The market growth is also attributed to automated operations in industries like food & beverage and chemicals have started integrating 3D cameras with robotic arms.

The increased adoption of modern technology is another factor contributing to the market growth in the UK. For instance, in February 2023, SICK launched the safeVisionary2 compact 3D camera to boost output and reimagine 3D safety for mobile robots. 2D LiDAR sensors are typically used to safeguard hazardous areas in manufacturing and logistics environments. It has Performance Level c certification for its 3D time-of-flight (ToF) camera. It provides precise 3D measurement data when used for autonomous mobile robots.

Technology Insights

Stereo vision dominated the market with a share of 63.06% in 2023. Stereo vision cameras are often used in industrial and manufacturing settings for quality control and inspection tasks, as well as in surveillance and security systems. They are also increasingly used in consumer electronics such as smartphones and gaming consoles for gesture recognition and 3D scanning. The images are then processed using stereo vision or stereo triangulation, which involves comparing the two images and identifying the differences in the position of objects in the scene.

This allows the camera to create a depth map or a 3D model of the scene, which can be used for various applications such as robotics, 3D modeling, virtual reality, and autonomous vehicles. Stereo vision cameras are used in robotics, safety applications, medical technology, bin picking, autonomous vehicles, agricultural robotics, object tracking, 3D recording and production, and range sensing in mobile robotic navigation. In December 2022, Stereolabs launched ZED-X, the industry's first stereo camera created for robotic process automation and navigation in challenging indoor and outdoor conditions.

On the other hand, time of flight technology is expected to showcase the fastest growth at a CAGR of 33.0%. These cameras have several applications, including 3D scanning, object detection and recognition, and gesture recognition. They are commonly used in robotics, augmented reality, and virtual reality applications. ToF uses infrared light to capture real-time depth information, allowing for accurate and quick measurements. They are also relatively simple and do not require complex calibration procedures. Leading ToF cameras have been instrumental in the development of cameras with advanced sensors for depth measurement and object identification. In May 2022, e-Con Systems introduced the DepthVista Time of Flight camera. It features depth and shutter sensors for depth measuring and object identification.

Key Companies & Market Share Insights

The market includes both international and domestic participants. Brand market share analysis indicates that key market players are focusing on strategies such as new product launches, partnerships, mergers & acquisitions, global expansion, and others. Some of the initiatives include. Some of the initiatives taken are:

-

In February 2023, Alsontech, the manufacturer of 3D vision for industrial robots, unveiled its newest 3D vision camera, the AT-S1000-06C-S3. The AT-S1000-06C-S3 is a member of the NANO series and features Alsontech's advanced binocular imaging technology, which offers industrial automation customers dependable accuracy and operational stability.

-

In July 2022, Artilux and II-VI released a small 3D camera that uses shortwave infrared technology. The camera, created for 3D sensing in consumer electronics and the automotive industry, combines GeSi sensor arrays from Artilux with indium phosphide semiconductor lasers from II-VI.

-

In July 2022, The TKH Group acquired Germany-based Nerian Vision Technologies to expand its offerings by including stereo vision in its portfolio. Nerian will continue to sell goods under the Nerian brand and keep its current relationships while joining the TKH Vision network of machine vision businesses. In order to improve accuracy on challenging-to-measure objects, Nerian 3D cameras are completely compatible with active design projectors.

Key 3D Camera Companies:

- Sony Corporation

- Canon Inc.

- Samsung Electronics Co., Ltd.

- LG Electronics

- NIKON CORPORATION

- Panasonic Corporation

- GoPro, Inc.

- FUJIFILM Corporation

- Eastman Kodak Company

- Orbbec 3D Technology International, Inc.

3D Camera Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 28.07 billion

Revenue forecast in 2030

USD 140.27 billion

Growth rate

CAGR of 30.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million/Billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; UK; China; Japan; India; Brazil

Key companies profiled

Sony Corporation; Canon Inc.; Samsung Electronics Co., Ltd.; LG Electronics; NIKON CORPORATION; Panasonic Corporation; GoPro, Inc.; FUJIFILM Corporation; Eastman Kodak Company; Orbbec 3D Technology International, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global 3D Camera Market Report Segmentation

This report forecasts revenue growth at regional levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global 3D camera market report based on technology, application, and region.

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Stereo Vision

-

Time of Flight

-

Structured Light

-

-

Application Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Professional Camera

-

Smartphone and Tablet

-

Computer

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

-

Europe

-

U.K.

-

Germany

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global 3D camera size was estimated at USD 20.18 billion in 2023 and is expected to reach USD 28.07 billion in 2024.

b. Key factors that are driving the market growth include are increasing demand for 3D content in entertainment and media is a major driving force. With the rising popularity of 3D movies, virtual reality (VR) experiences, and augmented reality (AR) applications, there is a growing need for high-quality 3D cameras that can capture and create immersive content.

b. The global 3D camera is expected to grow at a compounded growth rate of 30.8% from 2024 to 2030 to reach USD 140.27 billion by 2030.

b. Stereo vision dominated the market with a share of 63.06% in 2023. Stereo vision cameras are often used in industrial and manufacturing settings for quality control and inspection tasks, as well as in surveillance and security systems.

b. Some key players operating in white 3D camera market are Sony Corporation, Canon Inc., Samsung Electronics Co., Ltd., LG Electronics, NIKON CORPORATION, Panasonic Corporation, GoPro, Inc., FUJIFILM Corporation, Eastman Kodak Company, Orbbec 3D Technology International, Inc.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."