- Home

- »

- Next Generation Technologies

- »

-

3D Printing Market Size, Share & Trends Analysis Report, 2030GVR Report cover

![3D Printing Market Size, Share & Trends Report]()

3D Printing Market Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Printer Type, By Technology, By Software, By Application, By Vertical, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-000-2

- Number of Pages: 250

- Format: Electronic (PDF)

- Historical Range: 2017 - 2022

- Industry: Technology

3D Printing Market Size & Trends

The global 3D printing market size was valued at USD 20.37 billion in 2023 and is expected to register a CAGR of 23.5% from 2024 to 2030. The aggressive research & development in three-dimensional printing and the growing demand for prototyping applications from various industry verticals, particularly healthcare, automotive, and aerospace & defense, are expected to drive the growth of the market.

The use of 3D printing in industrial applications is usually referred to as additive manufacturing (AM). Additive manufacturing involves a layer-by-layer addition of material to form an object, referring to a three-dimensional file, with the help of software and a 3-dimensional printer. A relevant 3D printing technology is selected from the available set of technologies to implement the process. The last step involves the deployment of this process across different industry verticals based on the necessity.

The deployment includes providing installation services, offering consultation solutions, and customer support, as well as handling aspects related to copyrights, licensing, and patenting. 3D printing is benefiting manufacturers in terms of prototyping, designing of the structure and end products, modeling, and time to market. As a result, the production expenses have been reduced considerably, and the manufacturers are in a position to offer better products at reasonable prices. As a result of these benefits, the demand for 3D printers is expected to be triggered more in the coming years.

However, the prevailing misconceptions with respect to the prototyping processes held by small and medium-scale manufacturers are hindering the adoption of additive manufacturing. Companies involved in designing, particularly small-scale and medium-scale enterprises, are deliberating before considering investments in prototyping as accountable investments rather than trying to understand the advantages and benefits of prototyping. The general notion prevailing among these enterprises is that prototyping is merely an expensive phase prior to manufacturing. Such perceptions regarding prototyping, coupled with the lack of technical knowledge and a looming lack of standard process controls, are expected to hinder market growth.

Market Concentration & Characteristics

The 3D Printing Market growth stage is high. The 3D printing market has witnessed a significant degree of innovation, marked by continuous advancements in 3D printing materials market, printing technologies, and the expansion of applications across diverse industries. Ongoing research and development efforts have led to the introduction of more sophisticated and efficient 3D printers, enabling the production of complex and functional objects with improved speed and precision. The dynamic landscape reflects a continuous quest for innovation, with 3D printing increasingly positioned as a transformative technology driving advancements in manufacturing and design processes.

The target market is also characterized by a high level of mergers & acquisitions by the leading players. The high level of mergers and acquisitions (M&A) in the 3D Printing (3PL) market is driven by the pursuit of market consolidation and strategic expansion. Companies engage in these transactions to access complementary technologies, broaden their product portfolios, and achieve economies of scale. The dynamic nature of the industry, coupled with the need for innovation and global competitiveness, motivates businesses to pursue mergers and acquisitions as a strategic approach to enhance their position in the evolving 3D printing market.

The 3D printing market faces regulatory scrutiny, with authorities focusing on ensuring the safety and quality of printed products, especially in industries like healthcare, where medical devices are produced. Impactful regulations play a role in shaping industry standards and influencing the adoption of 3D printing technologies, particularly in fields where stringent quality control is paramount. As 3D printing continues to advance, ongoing regulatory developments and adherence to standards become crucial factors in determining the market's trajectory and acceptance across various sectors.

Substitutes for 3D printing in the manufacturing sector include traditional manufacturing methods like injection molding and CNC machining, offering alternatives for certain production needs. Additionally, rapid prototyping services using alternative technologies such as stereolithography or selective laser sintering may serve as substitutes in specific applications. Emerging additive manufacturing technologies and advancements in traditional manufacturing methods also contribute to the evolving landscape of alternatives for the 3D printing market.

End user concentration is one of the significant factors in the 3D Printing Market. The end-user industry concentration in the 3D printing market exhibits diversification, with significant adoption observed in sectors such as healthcare, aerospace, and automotive. Healthcare applications include the production of customized medical implants, while aerospace leverages 3D printing for lightweight and complex components. In the automotive sector, 3D printing is increasingly utilized for prototyping, production tooling, and the creation of lightweight structures, showcasing a broad spectrum of applications across various industries.

Printer Type Insights

The industrial printer segment led the market and accounted for more than 76.0% share of the global revenue in 2023. Based on the printer type, the industry has been further segmented into industrial and desktop 3D printers. The large share of industrial 3D printers can be attributed to the extensive adoption of industrial printers in heavy industries, such as automotive, electronics, aerospace and defense, and healthcare. Prototyping, designing, and tooling are some of the most common industrial applications across these industry verticals.

Extensive adoption of 3D printing for prototyping, designing, and tooling is contributing to the growing demand from the industrial sector. Hence, the industrial printers segment is expected to continue dominating during the forecast period. The adoption of desktop 3-dimensional printers was initially limited to hobbyists and small enterprises. However, they are being increasingly used for household and domestic purposes nowadays. The education sector, which comprises schools, educational institutes, and universities, is also deploying desktop printers for technical training and research purposes.

Small businesses are particularly adopting desktop printers and diversifying their business operations to offer 3D printing and other related services. For instance, the concept of ‘fabshops’ is gaining popularity in the U.S. These fabshops offer on-demand 3D printing of parts and components as per the designs and requirements provided by the customers. Hence, the demand for desktop printers is expected to rise significantly during the forecast period.

Technology Insights

The stereolithography segment led the market and accounted for more than a 10.0% share of the global revenue in 2023. Based on technology, segmentation has been divided into stereolithography, fuse deposition modeling (FDM), direct metal laser sintering (DMLS), selective laser sintering (SLS), inkjet, polyjet, laser metal deposition, electron beam melting (EBM), digital light processing, laminated object manufacturing, and others.

Stereolithography technology is one of the oldest and most conventional printing technologies. Although the advantages and ease of operations associated with stereolithography technology are encouraging the adoption of this technology, advances in technology and aggressive research and development activities undertaken by industry experts and researchers are opening opportunities for several other efficient and reliable technologies.

Fused Deposition Modeling (FDM) accounted for a considerable revenue share in 2023 owing to the extensive adoption of the technology across various 3DP processes. The DLP, EBM, inkjet printing, and DMLS segments are expected to witness a growing adoption during the forecast period as these technologies are applicable in specialized additive manufacturing processes. The growing demand from aerospace and defense, healthcare, and automotive verticals would open opportunities for the adoption of these technologies.

Software Insight

The design software segment led the market and accounted for more than 36% share of the global revenue in 2023. It is expected to continue dominating the market during the forecast period. Based on software, the 3DP industry has been segmented into design software, inspection software, printer software, and scanning software. Design software is used for constructing the designs of the object to be printed, particularly in automotive, aerospace and defense, and construction and engineering verticals. Design software acts as a bridge between the objects to be printed and the printer’s hardware.

The demand for scanning software is estimated to grow on account of the growing trend of scanning objects and storing scanned documents. This ability to store the scanned images of the objects irrespective of their size or dimensions for 3-dimensional printing of these objects whenever necessary is expected to drive the scanning software segment during the forecast period. The scanning software segment is expected to register the highest CAGR of 23.8% from 2024 to 2030 and generate considerable revenues during the forecast period in line with the growing adoption of scanners.

Application Insight

The prototyping segment led the market and accounted for more than 54% share of the global revenue in 2023. Based on application, the industry has been segmented further into prototyping, tooling, and functional parts. Prototyping segment accounted for the largest share in 2023 owing to an extensive adoption of the prototyping process across several industry verticals. The automotive, aerospace and defense verticals mainly use prototyping to design and develop parts, components, and complex systems precisely.

Prototyping allows manufacturers to achieve higher accuracy and develop reliable end products. Hence, the prototyping segment is expected to continue dominating the market during the forecast period. Functional parts include smaller joints and other metallic hardware connecting components. The accuracy and precise sizing of these functional parts are of paramount importance while developing machinery and systems. The functional parts segment is expected to expand at a significant CAGR of 24.4% from 2024 to 2030 in line with the increasing demand for designing and building functional parts.

Vertical Insight

The automotive segment led the market and accounted for more than 23% share of the global revenue in 2023. Based on vertical, the industry has been segmented into separate verticals for desktop and industrial 3D printing. The verticals considered for desktop 3DP comprise educational purposes, fashion, jewelry, objects, dental, food, and others. The verticals considered for industrial 3DP comprise automotive, aerospace and defense, healthcare, consumer electronics, industrial, power and energy, and others.

The aerospace and defense, healthcare, and automotive verticals are anticipated to contribute significantly to the growth of industrial additive manufacturing during the forecast period owing to the active adoption of technology in various production processes associated with these verticals. In the healthcare sector, AM helps in the development of artificial tissues and muscles, which replicate the natural human tissues and can be used in replacement surgeries. These capabilities are expected to help in driving the adoption of 3DP across the healthcare vertical and contribute significantly to the growth of the industrial segment.

The dental, fashion and jewelry, and food verticals are anticipated to contribute significantly to the growth of the desktop 3DP segment during the forecast period. The dental vertical dominated the market in 2023 and it is expected to continue dominating the market during the forecast period. The adoption of 3D printing in manufacturing imitation jewelry, miniatures, art and craft, and clothing and apparel is also gaining traction.

Material Insight

The metal segment led the market for 3D printing and accounted for more than 54% share of the global revenue in 2023. Moreover, the metal segment is anticipated to maintain its lead during the forecast period and is expected to expand at the highest CAGR during the forecast period. Based on material, the industry has been segmented further into polymer, metal, and ceramic.

The polymer segment accounted for the second-largest revenue share in 2023. However, the metal segment is anticipated to keep dominating over the forecast period. The metal segment is also expected to grow at a highest CAGR of above 28% from 2024 - 2030. Considering that additive manufacturing using ceramic material is fairly new, the increasing R&D for 3DP technologies such as FDM and inkjet printing has led to rising demand for ceramic AM. The segment is expected to grow at a high CAGR of more than 25% over the forecast period.

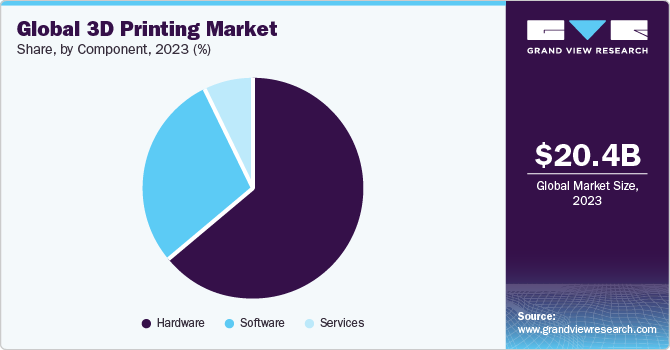

Component Insight

The hardware segment led the market and accounted for more than 63% share of the global revenue in 2023. The hardware segment has benefitted significantly from the growing necessity of rapid prototyping and advanced manufacturing practices. The growth of the hardware segment is primarily attributed to various factors such as rapid industrialization, increasing penetration of consumer electronic products, developing civil infrastructure, rapid urbanization, and optimized labor costs.

Based on components, the industry has been segmented further into hardware, software, and services. The 3DP hardware component segment has been bifurcated by printer type, technology, applications, vertical, and material. The software segment is further categorized by printer type and software type. The services segment is segregated only by the printer type. The software component segment is expected to witness significant growth during the forecast period.

Regional Insight

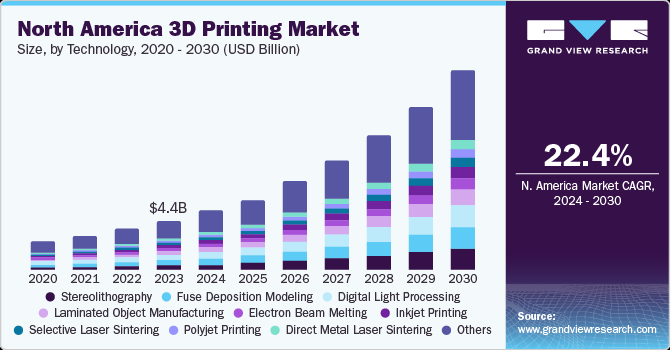

North America led the market and accounted for more than 33% share of the global revenue in 2023. This can be attributed to the extensive adoption of additive manufacturing in the region. North American countries, such as the U.S. and Canada, have been among the prominent and early adopters of these technologies in various manufacturing processes. Europe happens to be the largest region in terms of its geographical footprint. It is home to several additive manufacturing industry players with strong technical expertise in additive manufacturing processes. Hence, the European market emerged as the second-largest regional market in 2023.

U.S. 3D Printing Market

The growth of the 3D printing market in the U.S. is propelled by the technology's ability to facilitate rapid prototyping and product development is driving adoption across various industries, including aerospace, automotive, healthcare, and consumer goods.

The Asia Pacific region is projected to expand at the highest CAGR during 2024 - 2030. This rapid adoption of AM in the Asia Pacific can be attributed to the developments and upgrades across the manufacturing industry within the region. The Asia Pacific region is also emerging as a manufacturing hub for the automotive and healthcare industries. A stronghold on the production of consumer electronics, coupled with rapid urbanization, is also contributing to the region's rising demand for three-dimensional printing.

China 3D Printing Market

The growth of the 3D printing market in China is propelled by government initiatives promoting advanced manufacturing, substantial investments in research and development, and a burgeoning demand for customized products across various industries.

Australia 3D Printing Market

The growth of the 3D printing market in Australia is propelled by increasing adoption of 3D printing in sectors such as healthcare, aerospace, and automotive, driven by cost-effectiveness, technological advancements, and government initiatives.

Japan 3D Printing Market

Japan's 3D printing market expansion is driven by a strong focus on innovation, particularly in sectors like automotive and electronics, coupled with significant investments in additive manufacturing technologies by both government and private entities.

Europe 3D Printing Market

The 3D printing market in Europe is growing due to strong manufacturing heritage, government support for innovation, collaboration between research institutions and companies, diverse industry adoption in aerospace, automotive, healthcare, and consumer goods, and increasing awareness of sustainability benefits.

U.K. 3D Printing Market

The 3D printing market in U.K. is fueled by a robust ecosystem of startups and established players, supported by government funding for research and development, a strong focus on fostering innovation, and partnerships between academia and industry.

France 3D Printing Market

France's 3D printing market expansion is driven by initiatives to enhance competitiveness in manufacturing, investments in research and development, a thriving ecosystem of startups and innovation hubs, and increasing adoption across industries like aerospace, automotive, and consumer goods.

Germany 3D Printing Market

The 3D printing market in Germany is growing due to its strong manufacturing industry, emphasis on precision engineering, robust research and development ecosystem, adoption by automotive and aerospace industries, and potential for personalized healthcare solutions.

MEA 3D Printing Market

The 3D printing market in the Middle East and Africa (MEA) region is growing due to a combination of factors. Technological advancements in 3D printing are making the technology more accessible and affordable, driving innovation and economic growth. The region's growing manufacturing sector is adopting 3D printing for its benefits in rapid prototyping, customization, and cost-effective production. Government initiatives, such as funding research and development projects and providing incentives for businesses, are promoting the adoption of 3D printing technologies.

KSA 3D Printing Market

The growth of the 3D printing market in KSA is fueled by government efforts to diversify the economy, investments in advanced manufacturing technologies, and initiatives to localize production through partnerships with global players, particularly in sectors like construction, healthcare, and defense.

Key Companies & Market Share Insights

Some of the key players operating in the market include 3D Systems, Inc. and Materialise among others.

-

3D Systems, Inc. is the U.S.-based technology company. The company is involved in the development of Desktop 3D printing products and services such as 3D printers, materials, software, 3D scanners and virtual surgical simulators and haptic design tools. Additionally, the company serves its customers with 3D solutions to manufacture and design complex and unique parts, produce parts locally to reduce the lead time, and eliminate expensive tooling, among others. The company caters to numerous industries and verticals such as aerospace & defense, automotive, healthcare, educational, durable goods, and entertainment.

-

Materialise is a Belgium-based technology company operating in the additive manufacturing industry. The company is actively involved in the field of Desktop 3D printing to develop a broad range of software solutions, Desktop 3D printing services, and engineering. The company primarily caters to the industries such as healthcare, aerospace, automotive, consumer goods, and art & design.

madeinspace.us and Voxeljet AG are some of the emerging market participants in the target market.

-

madeinspace.us is an American company engaged in the space-based Desktop 3D printing technology. The company specializes in the engineering, designing, and development of the 3D printers and solutions. The company’s 3D printers are majorly used in spatial environments such as microgravity and vacuum conditions.

-

Voxeljet AG is a German technology company indulged in the mechanical and industrial engineering practices. The company is a manufacturer of three-dimensional printing systems. In addition, the company is operative in the on-demand manufacturing services of models & molds for the metal casting purposes worldwide. The company’s 3D printers operate based on the technologies such as powder binding and additive manufacturing to develop parts by utilizing different sets of materials such as particulate materials or proprietary chemical binding agents. Its major product offerings consist Desktop 3D printing a broad range of Desktop 3D printing systems and Desktop 3D printing materials.

Key 3D Printing Companies:

- 3D Systems, Inc.

- 3DCeram

- Arcam AB

- Autodesk, Inc.

- Canon, Inc.

- Dassault Systemes

- EnvisionTec, Inc.

- EOS (Electro Optical Systems) GmbH

- ExOne

- GE Additive

- HP Inc.

- madeinspace.us

- Materialise NV

- Optomec, Inc.

- Organovo Holdings Inc.

- Proto Labs, Inc.

- Shapeways, Inc.

- Stratasys Ltd.

- Tiertime

- Voxeljet AG

Recent Developments

-

In March 2023, 3D Systems, Inc. announced the launch of NextDent Cast and NextDent Base, two new printing materials, and NextDent LCD1, a printing platform. The materials are designed to enhance material properties, and the printing platform is an easy-to-use small-format printer. With these launches, the company aimed to aid its customers in accelerating additive manufacturing adoption.

-

In November 2023, Autodesk Inc. announced the launch of Autodesk AI. This new technology is available in Autodesk products and is designed to provide customers with generative capabilities and intelligent assistance. With the launch of this new technology in Autodesk products, the company aimed to minimize errors by automating repetitive tasks and the needs of its customers.

-

In February 2022, Dassault Systèmes has announced a strategic partnership with Cadence Design Systems, Inc. to provide integrated solutions for the development of high-performance electronic systems to enterprise customers in a variety of vertical markets, such as high tech, industrial equipment, and transportation and mobility, aerospace and defense, and healthcare.

3D Printing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 24,891.8 million

Revenue forecast in 2030

USD 88,281.2 million

Growth Rate

CAGR of 23.5% from 2024 to 2030

Actual Data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, Printer Type, Technology, Software, Application, Vertical, Material, And Region

Regional scope

North America; Europe; Asia Pacific; South America; MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Japan, China, India, South Korea, Singapore, Australia, Brazil, KSA, UAE, and South Africa

Key companies profiled

Stratsys, Ltd.; Materialise; EnvisionTec, Inc.; 3D Systems, Inc.; GE Additive; Autodesk Inc.; Made In Space; Canon Inc.; Voxeljet AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global 3D Printing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global 3D Printing Market report based on component, printer type, technology, software, application, vertical, material, and region.

-

3D Printing Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Software

-

Services

-

-

3D Printing Printer Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Desktop 3D Printer

-

Industrial 3D Printer

-

-

3D Printing Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Stereolithography

-

Fuse Deposition Modeling

-

Selective Laser Sintering

-

Direct Metal Laser Sintering

-

Polyjet Printing

-

Inkjet printing

-

Electron Beam Melting

-

Laser Metal Deposition

-

Digital Light Processing

-

Laminated Object Manufacturing

-

Others

-

-

3D Printing Software Outlook (Revenue, USD Million, 2017 - 2030)

-

Design Software

-

Inspection Software

-

Printer Software

-

Scanning Software

-

-

3D Printing Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Prototyping

-

Tooling

-

Functional Parts

-

-

3D Printing Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

Industrial 3D Printing

-

Automotive

-

Aerospace & Defense

-

Healthcare

-

Consumer Electronics

-

Industrial

-

Power & Energy

-

Others

-

-

Desktop 3D Printing

-

Educational Purpose

-

Fashion & Jewelry

-

Objects

-

Dental

-

Food

-

Others

-

-

-

3D Printing Material Outlook (Revenue, USD Million, 2017 - 2030)

-

Polymer

-

Metal

-

Ceramic

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Singapore

-

-

South America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global 3D printing market size was estimated at USD 20.37 billion in 2023 and is expected to reach USD 24.89 billion in 2024.

b. The global 3D printing market is expected to grow at a compound annual growth rate of 23.5% from 2024 to 2030 to reach USD 88,281.2 million by 2030.

b. The metal segment led the global 3D printing market and accounted for more than 54.91% share of the global revenue in 2023.

b. Some key players operating in the 3D printing market include Stratasys, Ltd.; Materialise; EnvisionTec, Inc.; 3D Systems, Inc.; GE Additive; Autodesk Inc.; Made In Space; Canon Inc.; and Voxeljet AG.

b. The stereolithography segment led the global 3D printing market and accounted for more than 10.86 % share of the global revenue in 2023.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Market Definitions

1.3. Research Methodology

1.3.1. Information Procurement

1.3.2. Information or Data Analysis

1.3.3. Market Formulation & Data Visualization

1.3.4. Data Validation & Publishing

1.4. Research Scope and Assumptions

1.4.1. List of Data Sources

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. 3D Printing Market Variables, Trends, & Scope

3.1. Market Introduction/Lineage Outlook

3.2. Industry Value Chain Analysis

3.3. Market Dynamics

3.3.1. Market Drivers Analysis

3.3.1.1. Prototyping, product development, innovation, and time-to-market

3.3.1.2. Benefits of Additive Manufacturing

3.3.1.3. Commercialization of the technology

3.3.1.4. Government investments & increased R&D in the Additive Manufacturing technology

3.3.2. Market Restraints Analysis

3.3.2.1. Capital Intensive Technologies and High Material Prices

3.3.2.2. Unavailability of Standard Process Controls and Misled Industry Participants

3.3.3. Industry Opportunities

3.3.3.1. Additive Manufacturing in construction medical implants and under water printing

3.3.3.2. Untapped end-use industry verticals and markets such as printed electronics and 3D printing under water

3.3.4. Industry Challenges

3.4. 3D Printing Market Analysis Tools

3.4.1. Porter’s Analysis

3.4.1.1. Bargaining power of the suppliers

3.4.1.2. Bargaining power of the buyers

3.4.1.3. Threats of substitution

3.4.1.4. Threats from new entrants

3.4.1.5. Competitive rivalry

3.4.2. PESTEL Analysis

3.4.2.1. Political landscape

3.4.2.2. Economic and Social landscape

3.4.2.3. Technological landscape

3.4.2.4. Environmental landscape

3.4.2.5. Legal landscape

3.5. Use Case Analysis

3.5.1. Utilizing 3D Printing for Classic Car Spare Parts: ABcars and Alfa Project

3.5.2. Integration of 3D Printing in the Development of an Electric Motorbike at Falectra

3.5.3. Implementation of Industrial 3D Printing in Automotive Manufacturing: RM Motors

3.5.4. Application of 3D Printed Custom Tooling in Toyota Factories

Chapter 4. 3D Printing Market: Component Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. 3D Printing Market: Component Movement Analysis, USD Million, 2023 & 2030

4.3. Hardware

4.3.1. Hardware Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

4.4. Software

4.4.1. Software Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

4.5. Services

4.5.1. Services Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

Chapter 5. 3D Printing Market: Printer Type Estimates & Trend Analysis

5.1. Segment Dashboard

5.2. 3D Printing Market: Printer Type Movement Analysis, USD Million, 2023 & 2030

5.3. Desktop 3D Printer

5.3.1. Desktop 3D Printer Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

5.4. Industrial Printer

5.4.1. Industrial Printer Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

Chapter 6. 3D Printing Market: Technology Estimates & Trend Analysis

6.1. Segment Dashboard

6.2. 3D Printing Market: Technology Movement Analysis, USD Million, 2023 & 2030

6.3. Stereolithography

6.3.1. Stereolithography Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

6.4. Fuse Deposition Modeling

6.4.1. Fuse Deposition Modeling Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

6.5. Selective Laser Sintering

6.5.1. Selective Laser Sintering Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

6.6. Direct Metal Laser Sintering

6.6.1. Direct Metal Laser Sintering Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

6.7. Polyjet Printing

6.7.1. Polyjet Printing Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

6.8. Inkjet printing

6.8.1. Inkjet Printing Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

6.9. Electron Beam Melting

6.9.1. Electron Beam Melting Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

6.10. Laser Metal Deposition

6.10.1. Laser Metal Deposition Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

6.11. Digital Light Processing

6.11.1. Digital Light Processing Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

6.12. Laminated Object Manufacturing

6.12.1. Laminated Object Manufacturing Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

6.13. Others

6.13.1. Others Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

Chapter 7. 3D Printing Market: Software Estimates & Trend Analysis

7.1. Segment Dashboard

7.2. 3D Printing Market: Software Movement Analysis, USD Million, 2023 & 2030

7.3. Design Software

7.3.1. Design Software Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

7.4. Inspection Software

7.4.1. Inspection Software Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

7.5. Printer Software

7.5.1. Printer Software Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

7.6. Scanning Software

7.6.1. Scanning Software Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

Chapter 8. 3D Printing Market: Application Estimates & Trend Analysis

8.1. Segment Dashboard

8.2. 3D Printing Market: Application Movement Analysis, USD Million, 2023 & 2030

8.3. Prototyping

8.3.1. Prototyping Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

8.4. Tooling

8.4.1. Tooling Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

8.5. Functional Parts

8.5.1. Functional Parts Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

Chapter 9. 3D Printing Market: Vertical Estimates & Trend Analysis

9.1. Segment Dashboard

9.2. 3D Printing Market: Vertical Movement Analysis, USD Million, 2023 & 2030

9.3. Industrial 3D Printing

9.3.1. Industrial 3D Printing Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

9.3.2. Automotive

9.3.2.1. Automotive 3D Printing Market Estimates and Forecasts, 2017 - 2030 (USD Million)

9.3.3. Aerospace & Defense

9.3.3.1. Aerospace & Defense 3D Printing Market Estimates and Forecasts, 2017 - 2030 (USD Million)

9.3.4. Healthcare

9.3.4.1. Healthcare 3D Printing Market Estimates and Forecasts, 2017 - 2030 (USD Million)

9.3.5. Consumer Electronics

9.3.5.1. Consumer Electronics 3D Printing Market Estimates and Forecasts, 2017 - 2030 (USD Million)

9.3.6. Power & Energy

9.3.6.1. Power & Energy 3D Printing Market Estimates and Forecasts, 2017 - 2030 (USD Million)

9.3.7. Others

9.3.7.1. Others 3D Printing Market Estimates and Forecasts, 2017 - 2030 (USD Million)

9.4. Desktop 3D Printing

9.4.1. Desktop 3D Printing Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

9.4.2. Educational Purpose

9.4.2.1. Educational Purpose 3D Printing Market Estimates and Forecasts, 2017 - 2030 (USD Million)

9.4.3. Fashion & Jewelry

9.4.3.1. Fashion & Jewelry 3D Printing Market Estimates and Forecasts, 2017 - 2030 (USD Million)

9.4.4. Objects

9.4.4.1. Objects 3D Printing Market Estimates and Forecasts, 2017 - 2030 (USD Million)

9.4.5. Dental

9.4.5.1. Dental 3D Printing Market Estimates and Forecasts, 2017 - 2030 (USD Million)

9.4.6. Food

9.4.6.1. Food 3D Printing Market Estimates and Forecasts, 2017 - 2030 (USD Million)

9.4.7. Others

9.4.7.1. Others 3D Printing Market Estimates and Forecasts, 2017 - 2030 (USD Million)

Chapter 10. 3D Printing Market: Material Estimates & Trend Analysis

10.1. Segment Dashboard

10.2. 3D Printing Market: Material Movement Analysis, USD Million, 2023 & 2030

10.3. Polymer

10.3.1. Polymer Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

10.4. Metal

10.4.1. Metal Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

10.5. Ceramic

10.5.1. Ceramic Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

Chapter 11. 3D Printing Market: Regional Estimates & Trend Analysis

11.1. 3D Printing Market Share, By Region, 2023 & 2030, USD Million

11.2. North America

11.2.1. North America 3D Printing Market Estimates and Forecasts, 2017 - 2030 (USD Million)

11.2.2. North America 3D Printing Market Estimates and Forecasts, by Component, 2017 - 2030 (USD Million)

11.2.3. North America 3D Printing Market Estimates and Forecasts, by Printer Type, 2017 - 2030 (USD Million)

11.2.4. North America 3D Printing Market Estimates and Forecasts, By Technology, 2017 - 2030 (USD Million)

11.2.5. North America 3D Printing Market Estimates and Forecasts, By Software, 2017 - 2030 (USD Million)

11.2.6. North America 3D Printing Market Estimates and Forecasts, By Application, 2017 - 2030 (USD Million)

11.2.7. North America 3D Printing Market Estimates and Forecasts, By Vertical, 2017 - 2030 (USD Million)

11.2.8. North America 3D Printing Market Estimates and Forecasts, By Material, 2017 - 2030 (USD Million)

11.2.9. U.S.

11.2.9.1. U.S. 3D Printing Market Estimates and Forecasts, 2017 - 2030 (USD Million)

11.2.9.2. U.S. 3D Printing Market Estimates and Forecasts, by Component, 2017 - 2030 (USD Million)

11.2.9.3. U.S. 3D Printing Market Estimates and Forecasts, by Printer Type, 2017 - 2030 (USD Million)

11.2.9.4. U.S. 3D Printing Market Estimates and Forecasts, By Technology, 2017 - 2030 (USD Million)

11.2.9.5. U.S. 3D Printing Market Estimates and Forecasts, By Software, 2017 - 2030 (USD Million)

11.2.9.6. U.S. 3D Printing Market Estimates and Forecasts, By Application, 2017 - 2030 (USD Million)

11.2.9.7. U.S. 3D Printing Market Estimates and Forecasts, By Vertical, 2017 - 2030 (USD Million)

11.2.9.8. U.S. 3D Printing Market Estimates and Forecasts, By Material, 2017 - 2030 (USD Million)

11.2.10. Canada

11.2.10.1. Canada 3D Printing Market Estimates and Forecasts, 2017 - 2030 (USD Million)

11.2.10.2. Canada 3D Printing Market Estimates and Forecasts, by Component, 2017 - 2030 (USD Million)

11.2.10.3. Canada 3D Printing Market Estimates and Forecasts, by Printer Type, 2017 - 2030 (USD Million)

11.2.10.4. Canada 3D Printing Market Estimates and Forecasts, By Technology, 2017 - 2030 (USD Million)

11.2.10.5. Canada 3D Printing Market Estimates and Forecasts, By Software, 2017 - 2030 (USD Million)

11.2.10.6. Canada 3D Printing Market Estimates and Forecasts, By Application, 2017 - 2030 (USD Million)

11.2.10.7. Canada 3D Printing Market Estimates and Forecasts, By Vertical, 2017 - 2030 (USD Million)

11.2.10.8. Canada 3D Printing Market Estimates and Forecasts, By Material, 2017 - 2030 (USD Million)

11.2.11. Mexico

11.2.11.1. Mexico 3D Printing Market Estimates and Forecasts, 2017 - 2030 (USD Million)

11.2.11.2. Mexico 3D Printing Market Estimates and Forecasts, by Component, 2017 - 2030 (USD Million)

11.2.11.3. Mexico 3D Printing Market Estimates and Forecasts, by Printer Type, 2017 - 2030 (USD Million)

11.2.11.4. Mexico 3D Printing Market Estimates and Forecasts, By Technology, 2017 - 2030 (USD Million)

11.2.11.5. Mexico 3D Printing Market Estimates and Forecasts, By Software, 2017 - 2030 (USD Million)

11.2.11.6. Mexico 3D Printing Market Estimates and Forecasts, By Application, 2017 - 2030 (USD Million)

11.2.11.7. Mexico 3D Printing Market Estimates and Forecasts, By Vertical, 2017 - 2030 (USD Million)

11.2.11.8. Mexico 3D Printing Market Estimates and Forecasts, By Material, 2017 - 2030 (USD Million)

11.3. Europe

11.3.1. Europe 3D Printing Market Estimates and Forecasts, 2017 - 2030 (USD Million)

11.3.2. Europe 3D Printing Market Estimates and Forecasts, by Component, 2017 - 2030 (USD Million)

11.3.3. Europe 3D Printing Market Estimates and Forecasts, by Printer Type, 2017 - 2030 (USD Million)

11.3.4. Europe 3D Printing Market Estimates and Forecasts, By Technology, 2017 - 2030 (USD Million)

11.3.5. Europe 3D Printing Market Estimates and Forecasts, By Software, 2017 - 2030 (USD Million)

11.3.6. Europe 3D Printing Market Estimates and Forecasts, By Application, 2017 - 2030 (USD Million)

11.3.7. Europe 3D Printing Market Estimates and Forecasts, By Vertical, 2017 - 2030 (USD Million)

11.3.8. Europe 3D Printing Market Estimates and Forecasts, By Material, 2017 - 2030 (USD Million)

11.3.9. U.K.

11.3.9.1. U.K. 3D Printing Market Estimates and Forecasts, 2017 - 2030 (USD Million)

11.3.9.2. U.K. 3D Printing Market Estimates and Forecasts, by Component, 2017 - 2030 (USD Million)

11.3.9.3. U.K. 3D Printing Market Estimates and Forecasts, by Printer Type, 2017 - 2030 (USD Million)

11.3.9.4. U.K. 3D Printing Market Estimates and Forecasts, By Technology, 2017 - 2030 (USD Million)

11.3.9.5. U.K. 3D Printing Market Estimates and Forecasts, By Software, 2017 - 2030 (USD Million)

11.3.9.6. U.K. 3D Printing Market Estimates and Forecasts, By Application, 2017 - 2030 (USD Million)

11.3.9.7. U.K. 3D Printing Market Estimates and Forecasts, By Vertical, 2017 - 2030 (USD Million)

11.3.9.8. U.K. 3D Printing Market Estimates and Forecasts, By Material, 2017 - 2030 (USD Million)

11.3.10. Germany

11.3.10.1. Germany 3D Printing Market Estimates and Forecasts, 2017 - 2030 (USD Million)

11.3.10.2. Germany 3D Printing Market Estimates and Forecasts, by Component, 2017 - 2030 (USD Million)

11.3.10.3. Germany 3D Printing Market Estimates and Forecasts, by Printer Type, 2017 - 2030 (USD Million)

11.3.10.4. Germany 3D Printing Market Estimates and Forecasts, By Technology, 2017 - 2030 (USD Million)

11.3.10.5. Germany 3D Printing Market Estimates and Forecasts, By Software, 2017 - 2030 (USD Million)

11.3.10.6. Germany 3D Printing Market Estimates and Forecasts, By Application, 2017 - 2030 (USD Million)

11.3.10.7. Germany 3D Printing Market Estimates and Forecasts, By Vertical, 2017 - 2030 (USD Million)

11.3.10.8. Germany 3D Printing Market Estimates and Forecasts, By Material, 2017 - 2030 (USD Million)

11.3.11. France

11.3.11.1. France 3D Printing Market Estimates and Forecasts, 2017 - 2030 (USD Million)

11.3.11.2. France 3D Printing Market Estimates and Forecasts, by Component, 2017 - 2030 (USD Million)

11.3.11.3. France 3D Printing Market Estimates and Forecasts, by Printer Type, 2017 - 2030 (USD Million)

11.3.11.4. France 3D Printing Market Estimates and Forecasts, By Technology, 2017 - 2030 (USD Million)

11.3.11.5. France 3D Printing Market Estimates and Forecasts, By Software, 2017 - 2030 (USD Million)

11.3.11.6. France 3D Printing Market Estimates and Forecasts, By Application, 2017 - 2030 (USD Million)

11.3.11.7. France 3D Printing Market Estimates and Forecasts, By Vertical, 2017 - 2030 (USD Million)

11.3.11.8. France 3D Printing Market Estimates and Forecasts, By Material, 2017 - 2030 (USD Million)

11.3.12. Italy

11.3.12.1. Italy 3D Printing Market Estimates and Forecasts, 2017 - 2030 (USD Million)

11.3.12.2. Italy 3D Printing Market Estimates and Forecasts, by Component, 2017 - 2030 (USD Million)

11.3.12.3. Italy 3D Printing Market Estimates and Forecasts, by Printer Type, 2017 - 2030 (USD Million)

11.3.12.4. Italy 3D Printing Market Estimates and Forecasts, By Technology, 2017 - 2030 (USD Million)

11.3.12.5. Italy 3D Printing Market Estimates and Forecasts, By Software, 2017 - 2030 (USD Million)

11.3.12.6. Italy 3D Printing Market Estimates and Forecasts, By Application, 2017 - 2030 (USD Million)

11.3.12.7. Italy 3D Printing Market Estimates and Forecasts, By Vertical, 2017 - 2030 (USD Million)

11.3.12.8. Italy 3D Printing Market Estimates and Forecasts, By Material, 2017 - 2030 (USD Million)

11.3.13. Spain

11.3.13.1. Spain 3D Printing Market Estimates and Forecasts, 2017 - 2030 (USD Million)

11.3.13.2. Spain 3D Printing Market Estimates and Forecasts, by Component, 2017 - 2030 (USD Million)

11.3.13.3. Spain 3D Printing Market Estimates and Forecasts, by Printer Type, 2017 - 2030 (USD Million)

11.3.13.4. Spain 3D Printing Market Estimates and Forecasts, By Technology, 2017 - 2030 (USD Million)

11.3.13.5. Spain 3D Printing Market Estimates and Forecasts, By Software, 2017 - 2030 (USD Million)

11.3.13.6. Spain 3D Printing Market Estimates and Forecasts, By Application, 2017 - 2030 (USD Million)

11.3.13.7. Spain 3D Printing Market Estimates and Forecasts, By Vertical, 2017 - 2030 (USD Million)

11.3.13.8. Spain 3D Printing Market Estimates and Forecasts, By Material, 2017 - 2030 (USD Million)

11.4. Asia Pacific

11.4.1. Asia Pacific 3D Printing Market Estimates and Forecasts, 2017 - 2030 (USD Million)

11.4.2. Asia Pacific 3D Printing Market Estimates and Forecasts, by Component, 2017 - 2030 (USD Million)

11.4.3. Asia Pacific 3D Printing Market Estimates and Forecasts, by Printer Type, 2017 - 2030 (USD Million)

11.4.4. Asia Pacific 3D Printing Market Estimates and Forecasts, By Technology, 2017 - 2030 (USD Million)

11.4.5. Asia Pacific 3D Printing Market Estimates and Forecasts, By Software, 2017 - 2030 (USD Million)

11.4.6. Asia Pacific 3D Printing Market Estimates and Forecasts, By Application, 2017 - 2030 (USD Million)

11.4.7. Asia Pacific 3D Printing Market Estimates and Forecasts, By Vertical, 2017 - 2030 (USD Million)

11.4.8. Asia Pacific 3D Printing Market Estimates and Forecasts, By Material, 2017 - 2030 (USD Million)

11.4.9. China

11.4.9.1. China 3D Printing Market Estimates and Forecasts, 2017 - 2030 (USD Million)

11.4.9.2. China 3D Printing Market Estimates and Forecasts, by Component, 2017 - 2030 (USD Million)

11.4.9.3. China 3D Printing Market Estimates and Forecasts, by Printer Type, 2017 - 2030 (USD Million)

11.4.9.4. China 3D Printing Market Estimates and Forecasts, By Technology, 2017 - 2030 (USD Million)

11.4.9.5. China 3D Printing Market Estimates and Forecasts, By Software, 2017 - 2030 (USD Million)

11.4.9.6. China 3D Printing Market Estimates and Forecasts, By Application, 2017 - 2030 (USD Million)

11.4.9.7. China 3D Printing Market Estimates and Forecasts, By Vertical, 2017 - 2030 (USD Million)

11.4.9.8. China 3D Printing Market Estimates and Forecasts, By Material, 2017 - 2030 (USD Million)

11.4.10. Japan

11.4.10.1. Japan 3D Printing Market Estimates and Forecasts, 2017 - 2030 (USD Million)

11.4.10.2. Japan 3D Printing Market Estimates and Forecasts, by Component, 2017 - 2030 (USD Million)

11.4.10.3. Japan 3D Printing Market Estimates and Forecasts, by Printer Type, 2017 - 2030 (USD Million)

11.4.10.4. Japan 3D Printing Market Estimates and Forecasts, By Technology, 2017 - 2030 (USD Million)

11.4.10.5. Japan 3D Printing Market Estimates and Forecasts, By Software, 2017 - 2030 (USD Million)

11.4.10.6. Japan 3D Printing Market Estimates and Forecasts, By Application, 2017 - 2030 (USD Million)

11.4.10.7. Japan 3D Printing Market Estimates and Forecasts, By Vertical, 2017 - 2030 (USD Million)

11.4.10.8. Japan 3D Printing Market Estimates and Forecasts, By Material, 2017 - 2030 (USD Million)

11.4.11. India

11.4.11.1. India 3D Printing Market Estimates and Forecasts, 2017 - 2030 (USD Million)

11.4.11.2. India 3D Printing Market Estimates and Forecasts, by Component, 2017 - 2030 (USD Million)

11.4.11.3. India 3D Printing Market Estimates and Forecasts, by Printer Type, 2017 - 2030 (USD Million)

11.4.11.4. India 3D Printing Market Estimates and Forecasts, By Technology, 2017 - 2030 (USD Million)

11.4.11.5. India 3D Printing Market Estimates and Forecasts, By Software, 2017 - 2030 (USD Million)

11.4.11.6. India 3D Printing Market Estimates and Forecasts, By Application, 2017 - 2030 (USD Million)

11.4.11.7. India 3D Printing Market Estimates and Forecasts, By Vertical, 2017 - 2030 (USD Million)

11.4.11.8. India 3D Printing Market Estimates and Forecasts, By Material, 2017 - 2030 (USD Million)

11.4.12. South Korea

11.4.12.1. South Korea 3D Printing Market Estimates and Forecasts, 2017 - 2030 (USD Million)

11.4.12.2. South Korea 3D Printing Market Estimates and Forecasts, by Component, 2017 - 2030 (USD Million)

11.4.12.3. South Korea 3D Printing Market Estimates and Forecasts, by Printer Type, 2017 - 2030 (USD Million)

11.4.12.4. South Korea 3D Printing Market Estimates and Forecasts, By Technology, 2017 - 2030 (USD Million)

11.4.12.5. South Korea 3D Printing Market Estimates and Forecasts, By Software, 2017 - 2030 (USD Million)

11.4.12.6. South Korea 3D Printing Market Estimates and Forecasts, By Application, 2017 - 2030 (USD Million)

11.4.12.7. South Korea 3D Printing Market Estimates and Forecasts, By Vertical, 2017 - 2030 (USD Million)

11.4.12.8. South Korea 3D Printing Market Estimates and Forecasts, By Material, 2017 - 2030 (USD Million)

11.4.13. Australia

11.4.13.1. Australia 3D Printing Market Estimates and Forecasts, 2017 - 2030 (USD Million)

11.4.13.2. Australia 3D Printing Market Estimates and Forecasts, by Component, 2017 - 2030 (USD Million)

11.4.13.3. Australia 3D Printing Market Estimates and Forecasts, by Printer Type, 2017 - 2030 (USD Million)

11.4.13.4. Australia 3D Printing Market Estimates and Forecasts, By Technology, 2017 - 2030 (USD Million)

11.4.13.5. Australia 3D Printing Market Estimates and Forecasts, By Software, 2017 - 2030 (USD Million)

11.4.13.6. Australia 3D Printing Market Estimates and Forecasts, By Application, 2017 - 2030 (USD Million)

11.4.13.7. Australia 3D Printing Market Estimates and Forecasts, By Vertical, 2017 - 2030 (USD Million)

11.4.13.8. Australia 3D Printing Market Estimates and Forecasts, By Material, 2017 - 2030 (USD Million)

11.4.14. Singapore

11.4.14.1. Singapore 3D Printing Market Estimates and Forecasts, 2017 - 2030 (USD Million)

11.4.14.2. Singapore 3D Printing Market Estimates and Forecasts, by Component, 2017 - 2030 (USD Million)

11.4.14.3. Singapore 3D Printing Market Estimates and Forecasts, by Printer Type, 2017 - 2030 (USD Million)

11.4.14.4. Singapore 3D Printing Market Estimates and Forecasts, By Technology, 2017 - 2030 (USD Million)

11.4.14.5. Singapore 3D Printing Market Estimates and Forecasts, By Software, 2017 - 2030 (USD Million)

11.4.14.6. Singapore 3D Printing Market Estimates and Forecasts, By Application, 2017 - 2030 (USD Million)

11.4.14.7. Singapore 3D Printing Market Estimates and Forecasts, By Vertical, 2017 - 2030 (USD Million)

11.4.14.8. Singapore 3D Printing Market Estimates and Forecasts, By Material, 2017 - 2030 (USD Million)

11.5. South America

11.5.1. South America 3D Printing Market Estimates and Forecasts, 2017 - 2030 (USD Million)

11.5.2. South America 3D Printing Market Estimates and Forecasts, by Component, 2017 - 2030 (USD Million)

11.5.3. South America 3D Printing Market Estimates and Forecasts, by Printer Type, 2017 - 2030 (USD Million)

11.5.4. South America 3D Printing Market Estimates and Forecasts, By Technology, 2017 - 2030 (USD Million)

11.5.5. South America 3D Printing Market Estimates and Forecasts, By Software, 2017 - 2030 (USD Million)

11.5.6. South America 3D Printing Market Estimates and Forecasts, By Application, 2017 - 2030 (USD Million)

11.5.7. South America 3D Printing Market Estimates and Forecasts, By Vertical, 2017 - 2030 (USD Million)

11.5.8. South America 3D Printing Market Estimates and Forecasts, By Material, 2017 - 2030 (USD Million)

11.5.9. Brazil

11.5.9.1. Brazil 3D Printing Market Estimates and Forecasts, 2017 - 2030 (USD Million)

11.5.9.2. Brazil 3D Printing Market Estimates and Forecasts, by Component, 2017 - 2030 (USD Million)

11.5.9.3. Brazil 3D Printing Market Estimates and Forecasts, by Printer Type, 2017 - 2030 (USD Million)

11.5.9.4. Brazil 3D Printing Market Estimates and Forecasts, By Technology, 2017 - 2030 (USD Million)

11.5.9.5. Brazil 3D Printing Market Estimates and Forecasts, By Software, 2017 - 2030 (USD Million)

11.5.9.6. Brazil 3D Printing Market Estimates and Forecasts, By Application, 2017 - 2030 (USD Million)

11.5.9.7. Brazil 3D Printing Market Estimates and Forecasts, By Vertical, 2017 - 2030 (USD Million)

11.5.9.8. Brazil 3D Printing Market Estimates and Forecasts, By Material, 2017 - 2030 (USD Million)

11.6. Middle East and Africa

11.6.1. Middle East and Africa 3D Printing Market Estimates and Forecasts, 2017 - 2030 (USD Million)

11.6.2. Middle East and Africa 3D Printing Market Estimates and Forecasts, by Component, 2017 - 2030 (USD Million)

11.6.3. Middle East and Africa 3D Printing Market Estimates and Forecasts, by Printer Type, 2017 - 2030 (USD Million)

11.6.4. Middle East and Africa 3D Printing Market Estimates and Forecasts, By Technology, 2017 - 2030 (USD Million)

11.6.5. Middle East and Africa 3D Printing Market Estimates and Forecasts, By Software, 2017 - 2030 (USD Million)

11.6.6. Middle East and Africa 3D Printing Market Estimates and Forecasts, By Application, 2017 - 2030 (USD Million)

11.6.7. Middle East and Africa 3D Printing Market Estimates and Forecasts, By Vertical, 2017 - 2030 (USD Million)

11.6.8. Middle East and Africa 3D Printing Market Estimates and Forecasts, By Material, 2017 - 2030 (USD Million)

11.6.9. KSA

11.6.9.1. KSA 3D Printing Market Estimates and Forecasts, 2017 - 2030 (USD Million)

11.6.9.2. KSA 3D Printing Market Estimates and Forecasts, by Component, 2017 - 2030 (USD Million)

11.6.9.3. KSA 3D Printing Market Estimates and Forecasts, by Printer Type, 2017 - 2030 (USD Million)

11.6.9.4. KSA 3D Printing Market Estimates and Forecasts, By Technology, 2017 - 2030 (USD Million)

11.6.9.5. KSA 3D Printing Market Estimates and Forecasts, By Software, 2017 - 2030 (USD Million)

11.6.9.6. KSA 3D Printing Market Estimates and Forecasts, By Application, 2017 - 2030 (USD Million)

11.6.9.7. KSA 3D Printing Market Estimates and Forecasts, By Vertical, 2017 - 2030 (USD Million)

11.6.9.8. KSA 3D Printing Market Estimates and Forecasts, By Material, 2017 - 2030 (USD Million)

11.6.10. UAE

11.6.10.1. UAE 3D Printing Market Estimates and Forecasts, 2017 - 2030 (USD Million)

11.6.10.2. UAE 3D Printing Market Estimates and Forecasts, by Component, 2017 - 2030 (USD Million)

11.6.10.3. UAE 3D Printing Market Estimates and Forecasts, by Printer Type, 2017 - 2030 (USD Million)

11.6.10.4. UAE 3D Printing Market Estimates and Forecasts, By Technology, 2017 - 2030 (USD Million)

11.6.10.5. UAE 3D Printing Market Estimates and Forecasts, By Software, 2017 - 2030 (USD Million)

11.6.10.6. UAE 3D Printing Market Estimates and Forecasts, By Application, 2017 - 2030 (USD Million)

11.6.10.7. UAE 3D Printing Market Estimates and Forecasts, By Vertical, 2017 - 2030 (USD Million)

11.6.10.8. UAE 3D Printing Market Estimates and Forecasts, By Material, 2017 - 2030 (USD Million)

11.6.11. South Africa

11.6.11.1. South Africa 3D Printing Market Estimates and Forecasts, 2017 - 2030 (USD Million)

11.6.11.2. South Africa 3D Printing Market Estimates and Forecasts, by Component, 2017 - 2030 (USD Million)

11.6.11.3. South Africa 3D Printing Market Estimates and Forecasts, by Printer Type, 2017 - 2030 (USD Million)

11.6.11.4. South Africa 3D Printing Market Estimates and Forecasts, By Technology, 2017 - 2030 (USD Million)

11.6.11.5. South Africa 3D Printing Market Estimates and Forecasts, By Software, 2017 - 2030 (USD Million)

11.6.11.6. South Africa 3D Printing Market Estimates and Forecasts, By Application, 2017 - 2030 (USD Million)

11.6.11.7. South Africa 3D Printing Market Estimates and Forecasts, By Vertical, 2017 - 2030 (USD Million)

11.6.11.8. South Africa 3D Printing Market Estimates and Forecasts, By Material, 2017 - 2030 (USD Million)

Chapter 12. Competitive Landscape

12.1. Recent Developments & Impact Analysis by Key Market Participants

12.2. Company Categorization

12.3. Company Market Positioning

12.4. Company Market Share Analysis

12.5. Strategy Mapping

12.5.1. Expansion

12.5.2. Mergers & Acquisition

12.5.3. Partnerships & Collaborations

12.5.4. New Product Launches

12.5.5. Research And Development

12.6. Company Profiles

12.6.1. 3D Systems, Inc.

12.6.1.1. Participant’s Overview

12.6.1.2. Financial Performance

12.6.1.3. Product Benchmarking

12.6.1.4. Recent Developments

12.6.2. 3DCeram

12.6.2.1. Participant’s Overview

12.6.2.2. Financial Performance

12.6.2.3. Product Benchmarking

12.6.2.4. Recent Developments

12.6.3. Arcam AB

12.6.3.1. Participant’s Overview

12.6.3.2. Financial Performance

12.6.3.3. Product Benchmarking

12.6.3.4. Recent Developments

12.6.4. Autodesk, Inc.

12.6.4.1. Participant’s Overview

12.6.4.2. Financial Performance

12.6.4.3. Product Benchmarking

12.6.4.4. Recent Developments

12.6.5. Canon, Inc.

12.6.5.1. Participant’s Overview

12.6.5.2. Financial Performance

12.6.5.3. Product Benchmarking

12.6.5.4. Recent Developments

12.6.6. Dassault Systemes

12.6.6.1. Participant’s Overview

12.6.6.2. Financial Performance

12.6.6.3. Product Benchmarking

12.6.6.4. Recent Developments

12.6.7. EnvisionTec, Inc.

12.6.7.1. Participant’s Overview

12.6.7.2. Financial Performance

12.6.7.3. Product Benchmarking

12.6.7.4. Recent Developments

12.6.8. EOS (Electro Optical Systems) GmbH

12.6.8.1. Participant’s Overview

12.6.8.2. Financial Performance

12.6.8.3. Product Benchmarking

12.6.8.4. Recent Developments

12.6.9. ExOne

12.6.9.1. Participant’s Overview

12.6.9.2. Financial Performance

12.6.9.3. Product Benchmarking

12.6.9.4. Recent Developments

12.6.10. GE Additive

12.6.10.1. Participant’s Overview

12.6.10.2. Financial Performance

12.6.10.3. Product Benchmarking

12.6.10.4. Recent Developments

12.6.11. HP Inc.

12.6.11.1. Participant’s Overview

12.6.11.2. Financial Performance

12.6.11.3. Product Benchmarking

12.6.11.4. Recent Developments

12.6.12. madeinspace.us

12.6.12.1. Participant’s Overview

12.6.12.2. Financial Performance

12.6.12.3. Product Benchmarking

12.6.12.4. Recent Developments

12.6.13. Materialise NV

12.6.13.1. Participant’s Overview

12.6.13.2. Financial Performance

12.6.13.3. Product Benchmarking

12.6.13.4. Recent Developments

12.6.14. Optomec, Inc.

12.6.14.1. Participant’s Overview

12.6.14.2. Financial Performance

12.6.14.3. Product Benchmarking

12.6.14.4. Recent Developments

12.6.15. Organovo Holdings Inc.

12.6.15.1. Participant’s Overview

12.6.15.2. Financial Performance

12.6.15.3. Product Benchmarking

12.6.15.4. Recent Developments

12.6.16. Proto Labs, Inc.

12.6.16.1. Participant’s Overview

12.6.16.2. Financial Performance

12.6.16.3. Product Benchmarking

12.6.16.4. Recent Developments

12.6.17. Shapeways, Inc.

12.6.17.1. Participant’s Overview

12.6.17.2. Financial Performance

12.6.17.3. Product Benchmarking

12.6.17.4. Recent Developments

12.6.18. Stratasys Ltd.

12.6.18.1. Participant’s Overview

12.6.18.2. Financial Performance

12.6.18.3. Product Benchmarking

12.6.18.4. Recent Developments

12.6.19. Tiertime

12.6.19.1. Participant’s Overview

12.6.19.2. Financial Performance

12.6.19.3. Product Benchmarking

12.6.19.4. Recent Developments

12.6.20. Voxeljet AG

12.6.20.1. Participant’s Overview

12.6.20.2. Financial Performance

12.6.20.3. Product Benchmarking

12.6.20.4. Recent Developments

List of Tables

Table 1 3D Printing- Industry snapshot & critical success factor, 2017 - 2030

Table 2 Global 3D printing market, 2017-2030 (USD Million)

Table 3 Global 3D printing market estimates and forecasts by component, (USD Million), 2017 - 2030

Table 4 Global 3D printing market estimates and forecasts by printer type, (USD Million), 2017 - 2030

Table 5 Global 3D printing market estimates and forecasts by technology, (USD Million), 2017 - 2030

Table 6 Global 3D printing market estimates and forecasts by software, (USD Million), 2017 - 2030

Table 7 Global 3D printing market estimates and forecasts by application, (USD Million), 2017 - 2030

Table 8 Global 3D printing market estimates and forecasts by vertical (desktop 3D printers), (USD Million), 2017 - 2030

Table 9 Global 3D printing market estimates and forecasts by vertical (industrial 3D printers), (USD Million), 2017 - 2030

Table 10 Global 3D printing market estimates and forecasts by material, (USD Million), 2017 - 2030

Table 11 Global 3D ASPs by technology, (USD Thousand), 2017 - 2030

Table 12 Global desktop 3D printer market shipment (Thousand Units), by technology, 2017 - 2030

Table 13 Key Company Analysis

Table 14 Key Company Analysis - New Entrants

Table 15 Global hardware market by region, 2017 - 2030 (USD Million)

Table 16 Global software market by region, 2017 - 2030 (USD Million)

Table 17 Global services market by region, 2017 - 2030 (USD Million)

Table 18 Global desktop 3D printer market by region, 2017 - 2030 (USD Million)

Table 19 Global industrial 3D printer market by region, 2017 - 2030 (USD Million)

Table 20 Global stereolithography market by region, 2017 - 2030 (USD Million)

Table 21 Global fuse deposition modelling market by region, 2017 - 2030 (USD Million)

Table 22 Global selective laser sintering market by region, 2017 - 2030 (USD Million)

Table 23 Global direct metal laser sintering market by region, 2017 - 2030 (USD Million)

Table 24 Global polyjet printing market by region, 2017 - 2030 (USD Million)

Table 25 Global inkjet printing market by region, 2017 - 2030 (USD Million)

Table 26 Global EBM market by region, 2017 - 2030 (USD Million)

Table 27 Global laser metal deposition market by region, 2017 - 2030 (USD Million)

Table 28 Global digital light processing market by region, 2017 - 2030 (USD Million)

Table 29 Global laminated object manufacturing market by region, 2017 - 2030 (USD Million)

Table 30 Global others market by region, 2017 - 2030 (USD Million)

Table 31 Global design software market by region, 2017 - 2030 (USD Million)

Table 32 Global inspection software market by region, 2017 - 2030 (USD Million)

Table 33 Global printer software market by region, 2017 - 2030 (USD Million)

Table 34 Global scanning software market by region, 2017 - 2030 (USD Million)

Table 35 Global prototyping market by region, 2017 - 2030 (USD Million)

Table 36 Global tooling market by region, 2017 - 2030 (USD Million)

Table 37 Global functional parts market by region, 2017 - 2030 (USD Million)

Table 38 Global automotive market by region, 2017 - 2030 (USD Million)

Table 39 Global aerospace & defense market by region, 2017 - 2030 (USD Million)

Table 40 Global healthcare market by region, 2017 - 2030 (USD Million)

Table 41 Global consumer electronics market by region, 2017 - 2030 (USD Million)

Table 42 Global power & energy market by region, 2017 - 2030 (USD Million)

Table 43 Others vertical market by region, 2017 - 2030 (USD Million)

Table 44 Global educational purpose market by region, 2017 - 2030 (USD Million)

Table 45 Global fashion & jewelry market by region, 2017 - 2030 (USD Million)

Table 46 Global objects market by region, 2017 - 2030 (USD Million)

Table 47 Global dental market by region, 2017 - 2030 (USD Million)

Table 48 Global food market by region, 2017 - 2030 (USD Million)

Table 49 Others vertical market by region, 2017 - 2030 (USD Million)

Table 50 Global polymer market by region, 2017 - 2030 (USD Million)

Table 51 Global metal market by region, 2017 - 2030 (USD Million)

Table 52 Global ceramic market by region, 2017 - 2030 (USD Million)

Table 53 North America 3D printing market by component, 2017 - 2030 (USD Million)

Table 54 North America 3D printing market by printer type, 2017 - 2030 (USD Million)

Table 55 North America 3D printing market by technology, 2017 - 2030 (USD Million)

Table 56 North America 3D printing market by software, 2017 - 2030 (USD Million)

Table 57 North America 3D printing market by application, 2017 - 2030 (USD Million)

Table 58 North America industrial 3D printing market by vertical, 2017 - 2030 (USD Million)

Table 59 North America desktop 3D printing market by vertical, 2017 - 2030 (USD Million)

Table 60 North America 3D printing market by material, 2017 - 2030 (USD Million)

Table 61 U.S. 3D printing market by component, 2017 - 2030 (USD Million)

Table 62 U.S. 3D printing market by printer type, 2017 - 2030 (USD Million)

Table 63 U.S. 3D printing market by technology, 2017 - 2030 (USD Million)

Table 64 U.S. 3D printing market by software, 2017 - 2030 (USD Million)

Table 65 U.S. 3D printing market by application, 2017 - 2030 (USD Million)

Table 66 U.S. industrial 3D printing market by vertical, 2017 - 2030 (USD Million)

Table 67 U.S. desktop 3D printing market by vertical, 2017 - 2030 (USD Million)

Table 68 U.S. 3D printing market by material, 2017 - 2030 (USD Million)

Table 69 Canada 3D printing market by component, 2017 - 2030 (USD Million)

Table 70 Canada 3D printing market by printer type, 2017 - 2030 (USD Million)

Table 71 Canada 3D printing market by technology, 2017 - 2030 (USD Million)

Table 72 Canada 3D printing market by software, 2017 - 2030 (USD Million)

Table 73 Canada 3D printing market by application, 2017 - 2030 (USD Million)

Table 74 Canada industrial 3D printing market by vertical, 2017 - 2030 (USD Million)

Table 75 Canada desktop 3D printing market by vertical, 2017 - 2030 (USD Million)

Table 76 Canada 3D printing market by material, 2017 - 2030 (USD Million)

Table 77 Mexico 3D printing market by component, 2017 - 2030 (USD Million)

Table 78 Mexico 3D printing market by printer type, 2017 - 2030 (USD Million)

Table 79 Mexico 3D printing market by technology, 2017 - 2030 (USD Million)

Table 80 Mexico 3D printing market by software, 2017 - 2030 (USD Million)

Table 81 Mexico 3D printing market by application, 2017 - 2030 (USD Million)

Table 82 Mexico industrial 3D printing market by vertical, 2017 - 2030 (USD Million)

Table 83 Mexico desktop 3D printing market by vertical, 2017 - 2030 (USD Million)

Table 84 Mexico 3D printing market by material, 2017 - 2030 (USD Million)

Table 85 Europe 3D printing market by component, 2017 - 2030 (USD Million)

Table 86 Europe 3D printing market by printer type, 2017 - 2030 (USD Million)

Table 87 Europe 3D printing market by technology, 2017 - 2030 (USD Million)

Table 88 Europe 3D printing market by software, 2017 - 2030 (USD Million)

Table 89 Europe 3D printing market by application, 2017 - 2030 (USD Million)

Table 90 Europe industrial 3D printing market by vertical, 2017 - 2030 (USD Million)

Table 91 Europe desktop 3D printing market by vertical, 2017 - 2030 (USD Million)

Table 92 Europe 3D printing market by material, 2017 - 2030 (USD Million)

Table 93 UK 3D printing market by component, 2017 - 2030 (USD Million)

Table 94 UK 3D printing market by printer type, 2017 - 2030 (USD Million)

Table 95 UK 3D printing market by technology, 2017 - 2030 (USD Million)

Table 96 UK 3D printing market by software, 2017 - 2030 (USD Million)

Table 97 UK 3D printing market by application, 2017 - 2030 (USD Million)

Table 98 UK industrial 3D printing market by vertical, 2017 - 2030 (USD Million)

Table 99 UK desktop 3D printing market by vertical, 2017 - 2030 (USD Million)

Table 100 UK 3D printing market by material, 2017 - 2030 (USD Million)

Table 101 Germany 3D printing market by component, 2017 - 2030 (USD Million)

Table 102 Germany 3D printing market by printer type, 2017 - 2030 (USD Million)

Table 103 Germany 3D printing market by technology, 2017 - 2030 (USD Million)

Table 104 Germany 3D printing market by software, 2017 - 2030 (USD Million)

Table 105 Germany 3D printing market by application, 2017 - 2030 (USD Million)

Table 106 Germany industrial 3D printing market by vertical, 2017 - 2030 (USD Million)

Table 107 Germany desktop 3D printing market by vertical, 2017 - 2030 (USD Million)

Table 108 Germany 3D printing market by material, 2017 - 2030 (USD Million)

Table 109 France 3D printing market by component, 2017 - 2030 (USD Million)

Table 110 France 3D printing market by printer type, 2017 - 2030 (USD Million)

Table 111 France 3D printing market by technology, 2017 - 2030 (USD Million)

Table 112 France 3D printing market by software, 2017 - 2030 (USD Million)

Table 113 France 3D printing market by application, 2017 - 2030 (USD Million)

Table 114 France industrial 3D printing market by vertical, 2017 - 2030 (USD Million)

Table 115 France desktop 3D printing market by vertical, 2017 - 2030 (USD Million)

Table 116 France 3D printing market by material, 2017 - 2030 (USD Million)

Table 117 Italy 3D printing market by component, 2017 - 2030 (USD Million)

Table 118 Italy 3D printing market by printer type, 2017 - 2030 (USD Million)

Table 119 Italy 3D printing market by technology, 2017 - 2030 (USD Million)

Table 120 Italy 3D printing market by software, 2017 - 2030 (USD Million)

Table 121 Italy 3D printing market by application, 2017 - 2030 (USD Million)

Table 122 Italy industrial 3D printing market by vertical, 2017 - 2030 (USD Million)

Table 123 Italy desktop 3D printing market by vertical, 2017 - 2030 (USD Million)

Table 124 Italy 3D printing market by material, 2017 - 2030 (USD Million)

Table 125 Spain 3D printing market by component, 2017 - 2030 (USD Million)

Table 126 Spain 3D printing market by printer type, 2017 - 2030 (USD Million)

Table 127 Spain 3D printing market by technology, 2017 - 2030 (USD Million)

Table 128 Spain 3D printing market by software, 2017 - 2030 (USD Million)

Table 129 Spain 3D printing market by application, 2017 - 2030 (USD Million)

Table 130 Spain industrial 3D printing market by vertical, 2017 - 2030 (USD Million)

Table 131 Spain desktop 3D printing market by vertical, 2017 - 2030 (USD Million)

Table 132 Spain 3D printing market by material, 2017 - 2030 (USD Million)

Table 133 Asia Pacific 3D printing market by component, 2017 - 2030 (USD Million)

Table 134 Asia Pacific 3D printing market by printer type, 2017 - 2030 (USD Million)

Table 135 Asia Pacific 3D printing market by technology, 2017 - 2030 (USD Million)

Table 136 Asia Pacific 3D printing market by software, 2017 - 2030 (USD Million)

Table 137 Asia Pacific 3D printing market by application, 2017 - 2030 (USD Million)

Table 138 Asia Pacific industrial 3D printing market by vertical, 2017 - 2030 (USD Million)

Table 139 Asia Pacific desktop 3D printing market by vertical, 2017 - 2030 (USD Million)

Table 140 Asia Pacific 3D printing market by material, 2017 - 2030 (USD Million)

Table 141 China 3D printing market by component, 2017 - 2030 (USD Million)

Table 142 China 3D printing market by printer type, 2017 - 2030 (USD Million)

Table 143 China 3D printing market by technology, 2017 - 2030 (USD Million)

Table 144 China 3D printing market by software, 2017 - 2030 (USD Million)

Table 145 China 3D printing market by application, 2017 - 2030 (USD Million)

Table 146 China industrial 3D printing market by vertical, 2017 - 2030 (USD Million)

Table 147 China desktop 3D printing market by vertical, 2017 - 2030 (USD Million)

Table 148 China 3D printing market by material, 2017 - 2030 (USD Million)

Table 149 Japan 3D printing market by component, 2017 - 2030 (USD Million)

Table 150 Japan 3D printing market by printer type, 2017 - 2030 (USD Million)

Table 151 Japan 3D printing market by technology, 2017 - 2030 (USD Million)

Table 152 Japan 3D printing market by software, 2017 - 2030 (USD Million)

Table 153 Japan 3D printing market by application, 2017 - 2030 (USD Million)

Table 154 Japan industrial 3D printing market by vertical, 2017 - 2030 (USD Million)

Table 155 Japan desktop 3D printing market by vertical, 2017 - 2030 (USD Million)

Table 156 Japan 3D printing market by material, 2017 - 2030 (USD Million)

Table 157 India 3D printing market by component, 2017 - 2030 (USD Million)

Table 158 India 3D printing market by printer type, 2017 - 2030 (USD Million)

Table 159 India 3D printing market by technology, 2017 - 2030 (USD Million)

Table 160 India 3D printing market by software, 2017 - 2030 (USD Million)

Table 161 India 3D printing market by application, 2017 - 2030 (USD Million)

Table 162 India industrial 3D printing market by vertical, 2017 - 2030 (USD Million)

Table 163 India desktop 3D printing market by vertical, 2017 - 2030 (USD Million)

Table 164 India 3D printing market by material, 2017 - 2030 (USD Million)

Table 165 South Korea 3D printing market by component, 2017 - 2030 (USD Million)

Table 166 South Korea 3D printing market by printer type, 2017 - 2030 (USD Million)

Table 167 South Korea 3D printing market by technology, 2017 - 2030 (USD Million)

Table 168 South Korea 3D printing market by software, 2017 - 2030 (USD Million)

Table 169 South Korea 3D printing market by application, 2017 - 2030 (USD Million)

Table 170 South Korea industrial 3D printing market by vertical, 2017 - 2030 (USD Million)

Table 171 South Korea desktop 3D printing market by vertical, 2017 - 2030 (USD Million)

Table 172 South Korea 3D printing market by material, 2017 - 2030 (USD Million)

Table 173 Australia 3D printing market by component, 2017 - 2030 (USD Million)

Table 174 Australia 3D printing market by printer type, 2017 - 2030 (USD Million)

Table 175 Australia 3D printing market by technology, 2017 - 2030 (USD Million)

Table 176 Australia 3D printing market by software, 2017 - 2030 (USD Million)

Table 177 Australia 3D printing market by application, 2017 - 2030 (USD Million)

Table 178 Australia industrial 3D printing market by vertical, 2017 - 2030 (USD Million)

Table 179 Australia desktop 3D printing market by vertical, 2017 - 2030 (USD Million)

Table 180 Australia 3D printing market by material, 2017 - 2030 (USD Million)

Table 181 Singapore 3D printing market by component, 2017 - 2030 (USD Million)

Table 182 Singapore 3D printing market by printer type, 2017 - 2030 (USD Million)

Table 183 Singapore 3D printing market by technology, 2017 - 2030 (USD Million)

Table 184 Singapore 3D printing market by software, 2017 - 2030 (USD Million)

Table 185 Singapore 3D printing market by application, 2017 - 2030 (USD Million)

Table 186 Singapore industrial 3D printing market by vertical, 2017 - 2030 (USD Million)

Table 187 Singapore desktop 3D printing market by vertical, 2017 - 2030 (USD Million)

Table 188 Singapore 3D printing market by material, 2017 - 2030 (USD Million)

Table 189 South America 3D printing market by component, 2017 - 2030 (USD Million)

Table 190 South America 3D printing market by printer type, 2017 - 2030 (USD Million)

Table 191 South America 3D printing market by technology, 2017 - 2030 (USD Million)

Table 192 South America 3D printing market by software, 2017 - 2030 (USD Million)

Table 193 South America 3D printing market by application, 2017 - 2030 (USD Million)

Table 194 South America industrial 3D printing market by vertical, 2017 - 2030 (USD Million)

Table 195 South America desktop 3D printing market by vertical, 2017 - 2030 (USD Million)

Table 196 South America 3D printing market by material, 2017 - 2030 (USD Million)

Table 197 Brazil 3D printing market by component, 2017 - 2030 (USD Million)

Table 198 Brazil 3D printing market by printer type, 2017 - 2030 (USD Million)

Table 199 Brazil 3D printing market by technology, 2017 - 2030 (USD Million)

Table 200 Brazil 3D printing market by software, 2017 - 2030 (USD Million)

Table 201 Brazil 3D printing market by application, 2017 - 2030 (USD Million)

Table 202 Brazil industrial 3D printing market by vertical, 2017 - 2030 (USD Million)

Table 203 Brazil desktop 3D printing market by vertical, 2017 - 2030 (USD Million)

Table 204 Brazil 3D printing market by material, 2017 - 2030 (USD Million)

Table 205 MEA 3D printing market by component, 2017 - 2030 (USD Million)

Table 206 MEA 3D printing market by printer type, 2017 - 2030 (USD Million)

Table 207 MEA 3D printing market by technology, 2017 - 2030 (USD Million)

Table 208 MEA 3D printing market by software, 2017 - 2030 (USD Million)

Table 209 MEA 3D printing market by application, 2017 - 2030 (USD Million)

Table 210 MEA industrial 3D printing market by vertical, 2017 - 2030 (USD Million)

Table 211 MEA desktop 3D printing market by vertical, 2017 - 2030 (USD Million)